lersan8910/iStock by way of Getty Photographs

Background

ESS Tech Inc. (NYSE:GWH) went public by way of a SPAC merger in late 2021. The corporate produces a grid scale battery with 4-12 hour length that may stabilize energy technology and be extra accommodating for intermittent renewables. Not like different grid battery choices, these from ESS depend on iron and salt. Its chemistry avoids poisonous electrolytes, flammable lithium, and costly uncommon metals which might be included in competing choices. The battery is made within the USA, and this can be crucial in qualifying for the home content material within the Inflation Discount Act of 2022. The corporate has an all-star forged of traders together with Softbank and Invoice Gates’ Breakthrough Vitality Ventures. Three way partnership and gross sales bulletins have been super however this hasn’t translated to GAAP acknowledged income for causes that are not solely clear.

A spreadsheet detailing ESS’s introduced wins

The abbreviated spreadsheet beneath (full sheet and footnotes out there) particulars ESS Applied sciences Inc (“GWH”) public bulletins on gross sales wins up to now, for the reason that firm’s SPAC merger. Only a few firm updates have been offered on beforehand introduced wins and shipments.

ESS Buyer Bulletins

Max # of Mission Buyer Location Product models Dimension MWH Softbank Davis, CA EW 1 Utilized Medical EW 2 Terrasol/Sycamore West Grove, PA EW 1 Terrasol/Sycamore West Grove, PA EW 1 Turlock California EW 2 3000 Schipol Amsterdam EW 75kw/500kwh 1 Coldwell Photo voltaic Mendicino, CA EW 3 QUT Australia EW 75kw/400kwh 1 Stanwell? Tarong? EW 75kw/500kwh 10 Stanwell? Rockhampton? EW 75kw/500kwh 9 Stanwell? EW 75kw/500kwh 35 SMUD Sacramento EW 6 2000 LEAG Boxberg 50 MW/500 MWh 3000 Customers Vitality Michigan EW 1 4000 Burbank Water Eco Campus EW 75kw/500kwh 1 Portland Basic adj to ESS EC 3MWH 1 3 SDG&E Cameron Corners EW 400kwh 6 2.4 46 12040.4 Click on to enlarge

This spreadsheet was put collectively by extracting information from firm bulletins in 2022 and 2023. The 2022 begin date is simply a bit after the SPAC merger. However information from 2021, whereas a special company period, offers additional alarming information on models which have been introduced however by no means up to date. For example 2GWH to the corporate’s largest shareholder: ESS and SB Vitality Signal Settlement to Deploy Two Gigawatt-hours of Lengthy-Length Storage, 17 EW or 8.5MWH to Enel Inexperienced Energy Espana, and 4 EW to Patagonia.

What kind of info may ESS present on every introduced set up?

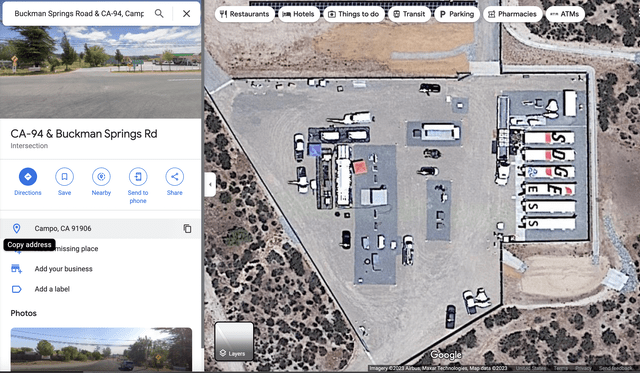

Here is an overhead shot of one of many earliest installs within the spreadsheet above, Cameron Corners:

Cameron Corners Microgrid (google maps)

The six EW models are pictured on the proper hand facet of the shot above. A name to one of many institutions, related to this microgrid, confirmed that they do have energy when the grid is down so the EW’s should be working. Some replace from SDG&E or ESS on the variety of outages the place the unit has served as backup and the variety of kwh equipped could be useful. Notably since this venture was achieved by ESS chairman Michael Niggli’s alma mater Sempra Vitality/SDG&E, it should be cheap for shareholders and analysts to request an replace and for Mr. Niggli to facilitate SDG&E offering one which would not give away any proprietary info.

Concerning all the opposite ESS installations, I invite SA readers to dig out and put up any comparable pictures and testimonials/refutations within the feedback beneath.

The corporate’s supply to “take a look at the spreadsheet”

This supply was made after my description of the spreadsheet derived from publicly out there info in ESS press releases and the lacking objects. I’ve defined that “trying on the spreadsheet” isn’t an enterprise to fill within the blanks. In any occasion we’re past “trying” and “clean filling”. Here’s a verbatim listing of things I referred to as out which might be amongst those who want dialogue:

“On a social media posting concerning the QUT battery, one in every of your workers mentioned he was trying ahead to working with Stanwell on its set up. Cannot discover a press launch that ever talked about Stanwell was the final word buyer for all these Australia models in limbo. Ought to your shareholders imagine firm press releases or social media posts by your workers? Or, fairly presumably and the necessity for a dialog on these kind of points, did I miss one thing?

on a social media posting one in every of your workers posted he was trying ahead to working with SMUD once more. Was your worker pulled off of SMUD and put again on? Or was this a company hiatus of some kind, and if that’s the case why and when? Why is that this all being unrolled on social media and never in firm releases in your many shareholders who do not comb by social media posts?

The place’s an replace on Patagonia, Enel Espana, or Softbank or did I miss these as nicely. An replace on Softbank could be notably useful since they’re your largest shareholder, are represented in your board and you’ve got apparently reserved manufacturing capability for them. If that deal is lifeless you, and so they, ought to disclose it. Reserved capability for an outfit that is purchased 1 Vitality Warehouse is probably going a deterrent to the Customers, SMUD’s and LEAG’s which may wish to have your complete 800MWH of annual capability, or no matter you might be keen to provide them. Is there a daily board assessment that firm info Softbank Vitality has acquired from the corporate isn’t being misused? Is there the reverse: that info ESS could have acquired from Softbank is correctly used and partitioned ?

The discharge on an Vitality Middle to be constructed by Portland Basic Electrical has by no means been up to date, that I’ve seen in your web site or theirs. The discharge said it was going to be constructed on land adjoining to ESS. I now have the tax plot house owners of the one two vacant parcels adjoining to you and PGE isn’t a kind of house owners. I do not see both of the 2 vacant parcel house owners leasing to PGE for this operate.

Although you are not involved with filling in these blanks I’ll proceed to take action and write about them as I obtain FOIA responses, drone footage, zoning board responses, and different responses to inquiries. This info shouldn’t move to shareholders from me, or different weblog writers, or from rivals, or from Wall St analysts, or from clients, or from commerce journals. It needs to be coming from you.”

[Author’s note: the reference to “Stanwell” in the first paragraph above refers to Queensland, Australia’s government owned power generator. “Patagonia, Enel Espana, or Softbank Energy in the second paragraph are all customers or prospective customers where releases have been put out by the company. For a full list of releases referred to here, click on the link to the full spreadsheet that appears right above the spreadsheet.]

And right here is ESS’s response to the objects raised above

“I’m sorry you’re feeling that this can be a lack of transparency on our half, however please know that we’ve tried to share what we are able to, the place we are able to, in line with the shopper’s needs. A few of these of us change plans/areas/timing/and so forth. and easily don’t selected to share that till they’re prepared.

A number of issues that I can say about your factors beneath, both as a result of they’re already on the market, or as a result of they don’t seem to be materials.

The SBE settlement remains to be in place – definitely any cancellation would have been a disclosure. That mentioned, as beforehand disclosed, there is no such thing as a ‘loss’ of capability as a consequence of that settlement. With SBE and all clients, our promise of reserved capability is topic to their well timed orders – successfully all we promise is that in the event that they place the orders per the settlement, we’ll construct their product on that schedule. SBE’s settlement has zero affect on LEAG or another buyer till such time as orders are positioned and we settle for them. Aspect word, with planning cycles so prolonged as of late, we’d have the ability to construct extra capability inside the timeframes of most bigger orders. Respect your telling me that Stanwell was ‘leaked’ by somebody on our facet. I’ll look into that, as it’s a clear violation of confidentiality. I do know ESI has posted about Stanwell, however that’s sort of the purpose, that is Stanwell and ESI’s announcement to make (or disclosure to provide, in case you desire), not ESS’s. We now have no contractual relationship with ESI’s clients. As to SMUD, this can be a nice instance of searching for one thing that isn’t there. We now have plenty of folks on our workforce, together with our head of supply, who’ve labored with SMUD up to now, for various corporations. That features me. “Trying ahead to working with you once more’ means precisely that – however there is no such thing as a earlier ESS relationship – that is the primary settlement we’ve ever achieved with them.

As to the others the place you point out ‘no replace’, all I can say is that when there may be an replace, we’ll replace. If we haven’t up to date, you may assume that there is no such thing as a replace to provide.”

And listed here are some additional feedback on that change.

Administration is no less than attempting to have interaction in a dialog on my transparency issues. I thank them for considerate and well timed responses. We seem to disagree on whether or not the transparency subject has been solved. There was no replace on the 2021 bulletins for a sale to Patagonia or ENEL Espana. Administration did not reply to my questions on Portland Basic Electrical. I simply acquired this response from PG&E on the state of the venture, “Hello Fred, Sure, the replace is that this venture is additional delayed. Building of the models has not but began, and the deliberate energize date has been moved out to summer season of 2024.” Since ESS press launched this venture on 12/20/21, I might prefer to know when the venture was delayed, and what precipitated the delay. Since PG&E is keen to answer an e-mail inquiry it should be public info. Ask your self whether or not its cheap that the corporate ought to have up to date this venture with the delay info. Lastly on the “reserved capability” for Softbank Vitality, is it cheap to count on the shopper or potential ESS investor to parse this language on a reserve that is not a reserve until orders are place? I do know the place to look and may’t discover a detailed 8K reference to this very materials 2GWH contract.

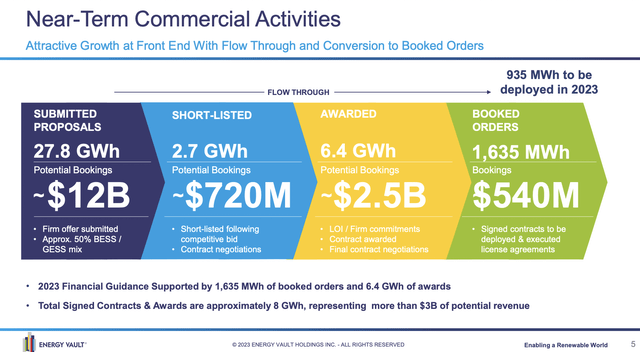

What do rivals disclose on key metrics? Is it cheap to count on extra transparency given what firm friends are disclosing? What would ESS’s disclosure seem like in that format?

Under discover a slide from the primary quarter presentation from peer Vitality Vault:

Vitality Vault Metrics (Vitality Vault)

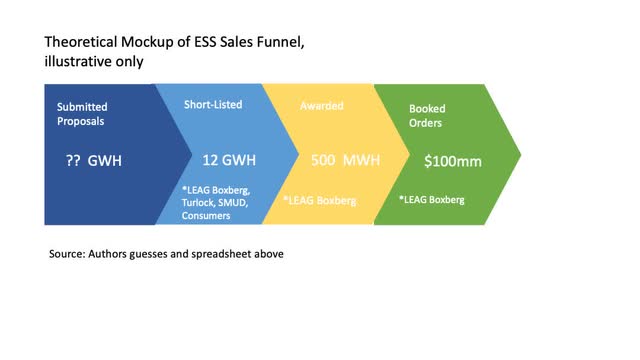

And here is what the ESS info may seem like even with simply the paucity of data that is been given to shareholders:

Supply: Writer

Promoting to the suitable kind of buyer

ESS must prioritize its gross sales and understand that markets that look nice now could not look so good over the 20-25 12 months lifetime of their batteries. I imagine an incredible lots of the introduced wins do not fall in these classes listed beneath. I imagine there are three market sorts on which ESS needs to be concentrating now that ought to stand the take a look at of time with this lengthy lived expertise:

Balancing assets and assembly carbon discount targets for base load mills. Examples from ESS’s spreadsheet of introduced initiatives embrace LEAG, Stanwell, Customers Vitality and Portland Basic Diurnal storage. It is a fancy time period for saving energy generated within the afternoon solar from Photovoltaics for use within the night demand peak. Closest instance from ESS’s spreadsheet of introduced initiatives is the Cameron Corners microgrid of SDG&E. Curtailment for wind and photo voltaic producers. Wikipedia defines curtailment as follows: “In electrical grid energy mills, curtailment is the deliberate discount in output beneath what may have been produced as a way to steadiness power provide and demand or as a consequence of transmission constraints.” There are not any pure examples of this in ESS’s spreadsheet of introduced initiatives.

After all every of those focus areas mix collectively in sure cases.

Base Load Operators

Except for simply attempting to function profitably, base load operators within the US are actually dealing with an array of suggestions and laws on battery storage and carbon discount. Movement batteries make nice sense on this software: it saves an operator from spinning up its costliest resource– peaking fuel turbines– to fulfill a requirement spike which might’t be dealt with by the bottom load facility. Versus generators, battery storage will be dispatched instantaneously and emits no carbon. One of the best instance from the spreadsheet, on which ESS has not offered any updates, is Customers Vitality. Primarily based on the hyperlink above, utilities in Michigan “…must deploy 2,500 MW of power storage by 2030 and 4,000 MW by 2040 to make sure grid reliability as fossil gas technology retires.”

Diurnal storage

Sadly peak photo voltaic manufacturing would not happen through the morning or night demand peaks. Longer length move batteries like these from ESS are a key device to resolve this. There are some wonderful papers on the subject, together with nice pronouncements: “..diurnal storage can probably be enough to fulfill the mixing wants of excessive renewable power penetrations as much as no less than 80%.” That paper included modeling outcomes on their 2050 storage forecast: “…deployment for power storage exceeds 125 GW by 2050, greater than a five-fold improve from the present put in storage capability … . For battery storage, there may be no less than 3,000 occasions extra battery capability in 2050 than exists at this time”

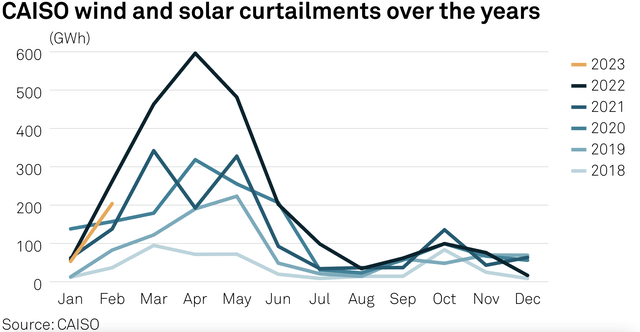

The curtailment alternative for move battery storage is large

With rising installations of wind and photo voltaic the quantity of curtailments will proceed to climb. Listed below are some latest numbers for California:

In accordance with the California Unbiased System Operator (CAISO), roughly 1,400 GWh of utility-scale photo voltaic and almost 80 GWh of wind had been curtailed in California in 2021. This is sufficient to energy almost 220,000 properties for a 12 months.

The quantity of photo voltaic curtailment in California has been rising lately, because the state has added extra photo voltaic capability to its grid. In 2019, solely 600 GWh of photo voltaic had been curtailed. [Source: Google Bard]

California Curtailments over time (CAISO by way of S&P International)

And here is some info on curtailment within the Texas market:

-The quantity of wind and photo voltaic technology that’s curtailed in Texas varies from 12 months to 12 months, however it’s sometimes round 4% of whole technology. In 2021, for instance, ERCOT curtailed 109,924 GWh of wind technology, which represents 4.2% of whole wind technology within the state.

One approach to mitigate the price of curtailment is with longer length batteries similar to ESS’s 12 hour iron move providing. After all this may not alleviate the consequences of over manufacturing of wind in every week lengthy storm, however it could permit storing manufacturing and turning it into income in intervals the place the solar is down or the wind is diminished.

“Crucial choices you make aren’t the stuff you do, however the stuff you resolve to not do.” This quote is attributed to Steve Jobs. I’ve been a fan of international gross sales since a few of these markets are monumental and transferring shortly. The Boxberg, Germany order is the largest the corporate has booked. Australia and East Germany seem like nice markets however gross sales and repair there contain 2 days of aircraft journey vs. the superb alternatives a automobile trip away from Wilsonville, OR. These international operations would require choice of companions, the place the corporate has not carried out nicely, and understanding and lobbying on laws that is tough to remain on high of with out deep native data and connections. Given the corporate’s demonstrably poor document of choosing companions and executing in Australia, I’m cooling on international gross sales.

I’ve additionally been a fan of promoting batteries into the Time Of Use arbitrage which regularly exists in states like Hawaii and California with monumental spreads between peak and off peak energy prices. I acquired an incredible fable on pursuing the fickle arbitrage market, which, together with a compression of the out there arbitrage as a consequence of a narrowing of spreads between peak and off-peak charges, has cooled my enthusiasm for this phase:

The Arbitrary Arbitrage Fairy. Let’s say you’re approached and provided a $1M wall secure. The thought being pitched is that each single day you may put $1,000 into the wall secure within the morning, go about your day, and whenever you return, you may withdraw $1,500 from the wall secure. A magic Arbitrage Fairy has turned your $1,000 into $1,500. However there are caveats. The Arbitrage Fairy isn’t included within the buy worth, it isn’t even a part of the secure, it exists and acts independently of the secure and the secure’s producer. The producer has no contact with, or management over the actions and whims of, the Arbitrage Fairy. Whether or not the at present favorable economics of this wall secure will proceed to be favorable is unknown.

It’s solely potential that within the foreseeable future chances are you’ll deposit $1,000 into the wall secure and withdraw $1,300, or $1,200, or $1,100 as an alternative of $1,500. Worst case state of affairs is that if the Arbitrage Fairy merely stops exhibiting up and performing its day by day magic, each time you deposit $1,000 within the morning, it’ll develop into $600 by the afternoon. In any case, that is an Arbitrary Arbitrage Fairy. Would you continue to like to purchase a $1M wall secure?

I imagine a number of of the introduced wins within the spreadsheet above are pursuing this Time of Use arbitrage market, which can look good now however could not show a dependable sufficient issue for patrons to afford the ESS battery sooner or later. My ardor has additionally cooled on the arbitrage market because of the astonishing admission that ESS’s roundtrip effectivity is simply 60% (see query from Colin Rusch) This is a gigantic drawback to lithium at 70%+ and pumped hydro at ~80%. Because of this, for each 1MWH hour put into the ESS battery, it’s producing 400kwh of warmth. Think about your little toe hotter 1000watt heater below your desk plugged in for 400 hours! That is a number of warmth and calls into query the corporate’s assertion that no cooling is required. Or within the parlance of the fairy and the wall secure, $400 of each $1000 you place into the secure is straight away burned up. Maybe nonetheless an attention-grabbing proposition so long as the fairy stays wholesome and visits the secure commonly; a giant “if”. Whereas PG&E’s TOU charges as soon as allowed the $1000-in and $1500-out economics within the first paragraph of the wall secure fable, now the diminished fairy is simply delivering about $1200 in peak price income for each $1000 off peak battery cost price (and that is earlier than cranking within the 60% spherical journey effectivity which eliminates the desirability of the secure and the attractive fairy, at this unfold.)

Why am I nonetheless at a purchase on GWH with all these cautions?

I moved to a really speculative “Purchase” primarily based on the information of the 50MW/500MWH order ESS acquired from LEAG for its Boxberg, Germany plant. If ESS is starting to e-book grid scale batteries like this, which can pull in $100 million of income, then its inventory may get well shortly past post-SPAC heights.

However I’ll transfer shortly again to a “maintain” or perhaps a “promote” if the next issues do not occur both earlier than or on the subsequent earnings name, anticipated in mid August:

I might prefer to see administration clarify, intimately, this recurring income recognition drawback. They need to fill within the clean cells within the spreadsheet above. Shareholders and perspective clients probably have the identical questions on these introduced initiatives: are they commissioned? are they producing MWH of storage? are they working on spec? Some specificity on the LEAG contract could be nice; it is because of be signed within the third quarter. Oddly this was introduced earlier than it has been fully inked. Ideally it’ll embrace a money deposit and progress funds. I imagine administration ought to commonly replace shareholders on the efficiency and adequacy of the inevitable international companions they might want to assist international gross sales. ESI Asia doesn’t seem like performing in Australia. As of the final earnings name they’d 10 Vitality Warehouse models in nation however caught within the port; no income has been acknowledged on these models. ESI Asia has promised a $70 million facility in Queensland the place it’ll assemble ESS batteries. ESI Asia has handed alongside the information of their floor breaking on two separate events, odd for a single capital venture. Alas, the pictured floor breakings weren’t on land that they personal or suggest to purchase. Not a twig has been disturbed, or a spoonful of grime moved on that land. As companions are chosen to assist the LEAG battery we have to know who they’re, what their deliverables and dates are, and the way they’re performing.

Conclusion

Please ask your self whether or not the income recognition drawback has been correctly addressed. I used to suppose the issues had been associated solely to our previous accounting agency and being caught in R&D accounting, which apparently has completely different necessities for income recognition. And maybe our issues needed to do with legacy gross sales contracts which required ESS to attend on income for venture deliverables out our its management. The longer the dearth of income recognition continues– greater than two years within the case of some introduced sales– the extra I feat there’s a specification over-promise or some tough flaw in these batteries. Different traders could have extra success sourcing such a info from administration or elsewhere; maybe delay your personal inventory purchases till you’ve solutions. A very miserable hand waving dialogue is CFO Tony Rabb’s remarks in the newest earnings name. This is not rocket science. The gaps within the spreadsheet needs to be crammed in by the corporate, its clients, analysts and even Searching for Alpha writers and commenters. Inform us whether or not every unit is connected and what number of MWH are being saved, day by day, in ESS move batteries.

A clear ESS, that isn’t solely saying wins, however commonly updating them will be an especially nicely valued entity. Clients wish to see outcomes as a way to make a purchase order determination and so do shareholders.

.jpeg?itok=EJhTOXAj'%20%20%20og_image:%20'https://cdn.mises.org/styles/social_media/s3/images/2025-03/AdobeStock_Supreme%20Court%20(2).jpeg?itok=EJhTOXAj)