Obtain free World updates

We’ll ship you a myFT Day by day Digest e-mail rounding up the newest World information each morning.

Our prime scoop right now is on SoftBank-owned Arm, which is in talks to herald Nvidia as an anchor investor as a part of the UK chip designer’s plans to checklist in New York as quickly as September.

Nvidia is one in every of a number of present Arm companions, together with Intel, that the UK-based firm is hoping will take a long-term stake on the preliminary public providing stage, in response to a number of individuals briefed on the talks.

The potential buyers are nonetheless negotiating with Arm over its valuation. One individual conversant in the discussions stated Nvidia needed to come back in at a share worth that may put Arm’s complete worth at $35bn to $40bn, whereas Arm needs to be nearer to $80bn.

Nvidia, the world’s most useful semiconductor firm, was pressured final 12 months to desert its deliberate $66bn acquisition of Arm after the deal was challenged by regulators.

Arm and Nvidia declined to remark. An individual near the scenario stated the talks had not been concluded and may not result in an funding.

Right here’s what else I’m conserving tabs on right now:

Central banks: The US Federal Reserve publishes its Beige Guide on financial situations, the Financial institution of England releases its monetary stability report and the Financial institution of Canada is anticipated to lift rates of interest once more in its choice right now.

Inflation knowledge: Russia, Spain and the US have their client worth indices for final month.

Nato: On the navy alliance summit’s second day, the G7 plans to announce a multilateral safety settlement for Ukraine and US president Joe Biden travels to Finland.

UK water disaster: A parliamentary choose committee is ready to query water trade executives this morning.

5 extra prime tales

1. Unique: JPMorgan is hiring dozens of bankers globally to capitalise on Silicon Valley Financial institution’s collapse, including to its groups catering to start-ups and enterprise capital-backed firms. Hires within the UK and the US embrace three former SVB executives, with the financial institution additionally planning to develop in its Asia places of work. Learn extra on how JPMorgan is filling the hole left by SVB.

2. A US federal court docket ruling has helped Microsoft transfer nearer to its buy of Activision Blizzard after a choose dismissed the Federal Commerce Fee’s try to dam the $75bn deal. The UK’s competitors watchdog, which initially rejected the acquisition, signalled it was open to discussing adjustments to the deal that may deal with its issues.

3. Unique: EY China has refused to pay charges owed to its international headquarters for greater than a 12 months in a dispute over IT providers. The Chinese language arm says the providers can’t be absolutely used after Beijing tightened knowledge safety guidelines, in response to individuals conversant in the matter. Learn extra on the tussle between EY’s international bosses and its semi-independent member companies in China.

4. New York-listed Assured Warranty has greater than $10bn of publicity to distressed UK water utilities that are labouring underneath £60bn of debt. If firms similar to Thames Water and Southern Water default or fail to make curiosity repayments, the US insurance coverage firm may find yourself having to pay out to lenders.

5. UK chancellor Jeremy Hunt has ordered ministers to seek out greater than £2bn of financial savings to fund 6 per cent public sector pay rises this 12 months, arguing that borrowing extra money to fund the rises will gasoline inflation. Hunt is anticipated to agree on a method with Prime Minister Rishi Sunak this week. Right here’s why some in Whitehall are already warning in opposition to the spending cuts.

The Large Learn

4 a long time after Ronald Reagan rejected large-scale US authorities intervention within the economic system, Joe Biden is embracing it wholeheartedly with a raft of subsidies for home producers in strategic sectors, within the hope of making lots of of hundreds of recent jobs. Will the president’s insurance policies remodel the American economic system in a means that’s sturdy and have a tangible impression that resonates with voters?

We’re additionally studying . . .

UK pensions: The flurry of consultations after the chancellor’s Mansion Home speech doesn’t encourage confidence within the pension system’s future, writes Helen Thomas.

Turkey appears west: Backing Sweden’s Nato bid was a strategic transfer by President Recep Tayyip Erdoğan to ease tensions and unblock commerce.

Ukraine and Nato: The navy alliance’s warning over admitting Kyiv dangers emboldening Moscow, writes the FT’s editorial board.

‘Gender-washing’: Japan’s monetary regulators warn that regional banks are vulnerable to inflating variety figures attributable to authorized ambiguity over ladies’s management roles.

Chart of the day

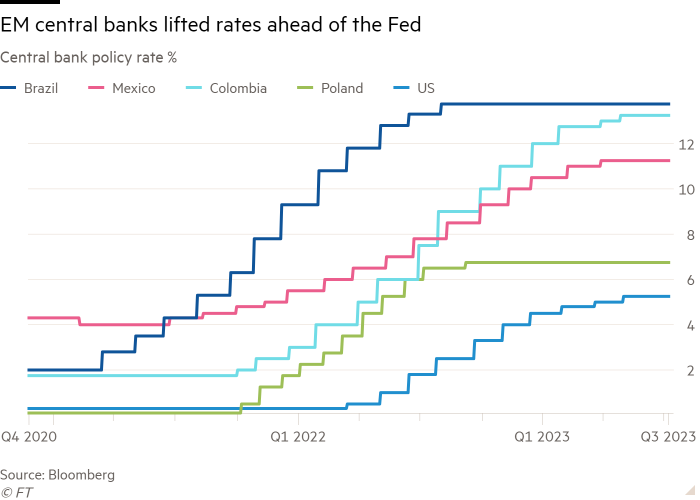

Buyers have been shopping for up native forex bonds issued by rising economies in a wager that policymakers there have finished a greater job of battling inflation than their developed market counterparts, with the hole in authorities borrowing prices between the 2 markets falling to its lowest stage in 16 years.

Take a break from the information

After an extended and vexed rebirth, the once-legendary London seafood restaurant Manzi’s is again. The FT’s Ajesh Patalay acquired a primary style of the in depth menu, which incorporates a big number of crustacea among the many starters.

Extra contributions by Emily Goldberg, Gordon Smith and Benjamin Wilhelm

Really useful newsletters for you

Asset Administration — Discover out the within story of the movers and shakers behind a multitrillion-dollar trade. Join right here

The Week Forward — Begin each week with a preview of what’s on the agenda. Join right here