FG Commerce/E+ by way of Getty Photos

Funding Abstract

When wanting over the transportation trade there appears to have been a whole lot of disappointing earnings throughout many corporations, however XPO Inc (NYSE:XPO) is a shining mild that showcases its resilience and skill to hedge downturns in the cycle and outperform. Although the YoY income development might need been small, the EPS grew by 22% which could be very spectacular as gasoline costs have elevated and margins squeezed for a lot of corporations. However with the worldwide presence that XPO holds they appear to have managed very wonderful nonetheless.

After the report got here out on Might 4 the share value has been in a powerful uptrend and XPO now boasts a FWD P/E of 25. The shares are up practically 100% within the final 12 months and I feel there’s a sturdy chance of a correction as XPO is buying and selling 47% above the sector and its 5-year common p/e of 16. Regardless of development being spectacular and XPO noting they’re gaining extra market share I may also help however to assume we would see higher entry costs within the brief time period for buyers in search of to begin a place. Proper now I’m ranking XPO inventory a maintain.

Firm Overview

XPO has its historical past relationship again to 2000 when it was based. Since then the corporate has grown into a serious participant within the floor cargo transportation trade and boasts a big market share.

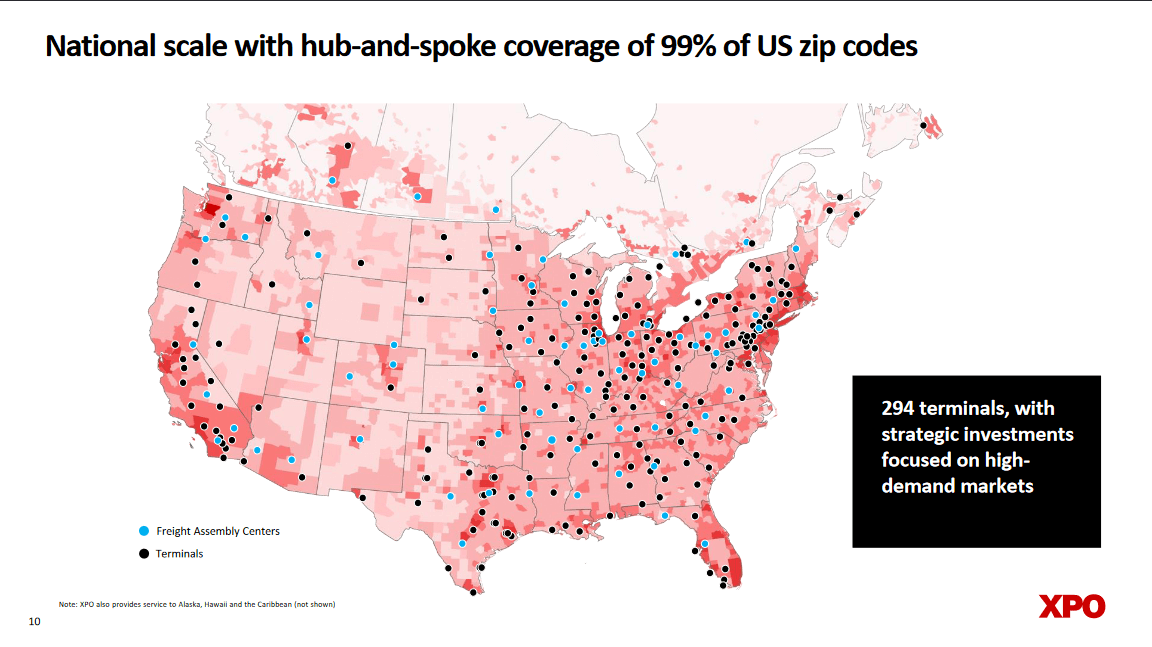

Market Footprint (Investor Presentation)

With 294 terminals throughout the US, XPO can cowl 99% of all US zip codes which presents them as a really intriguing possibility for purchasers in my view. The place XPO has been very profitable is in establishing sturdy and lasting relationships with corporations that want constant transportation and ones that make deliveries often. A number of the main names embody Caterpillar Inc (CAT) and Deere & Firm (DE).

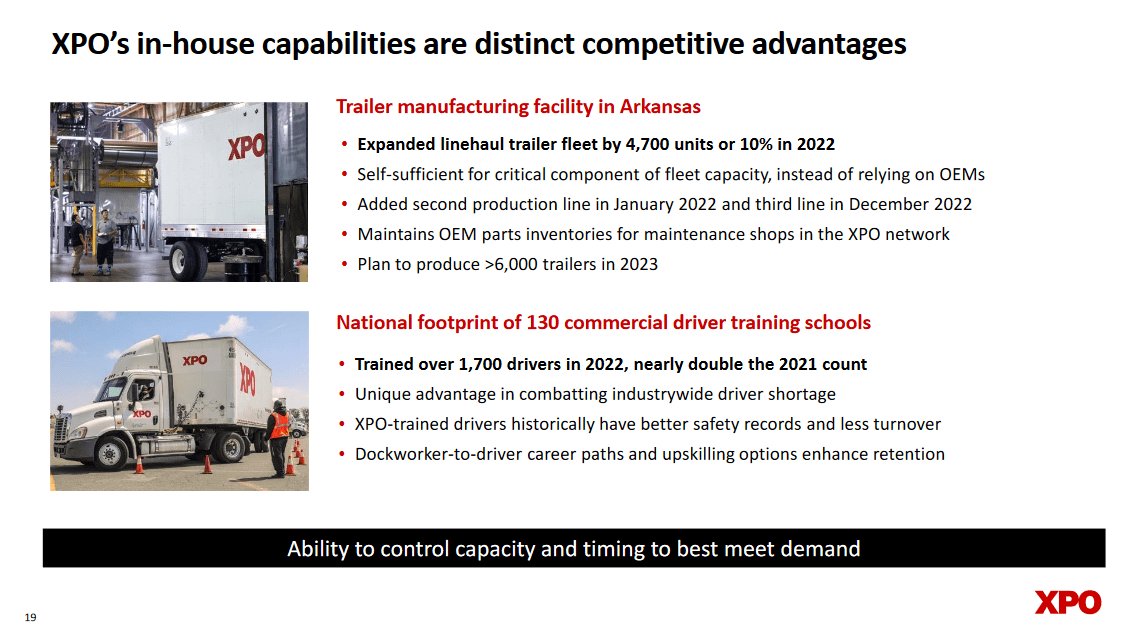

XPO Overview (Investor Presentation)

As the workers of the corporate are the driving pressure behind enlargement XPO prioritizes sustaining a powerful retention fee and conserving them joyful. They’ve pushed closely in rising their workers and in 2022 alone they educated over 1.700 drivers and expanded the fleet by 4.700 models. The corporate constructions its enterprise into two major segments, the North American LTL and European Transportation. The North American section makes up nearly all of the revenues, round 70% within the final quarter. The North American section supplies prospects with less-then-truckload shipments but in addition cross-border deliveries to Mexico, Canada, and the Caribbean.

Market Footprint

The transportation and freight market is a tough one to function in as it’s closely depending on sturdy financial exercise which will increase demand for deliveries and shipments. However additionally they have to effectively battle larger gasoline bills in sure intervals. At the moment, the outlook appears to be that demand shall be considerably constant within the US as manufacturing and gross sales stay steady, however decrease freight charges are putting stress on margins for corporations like XPO and others.

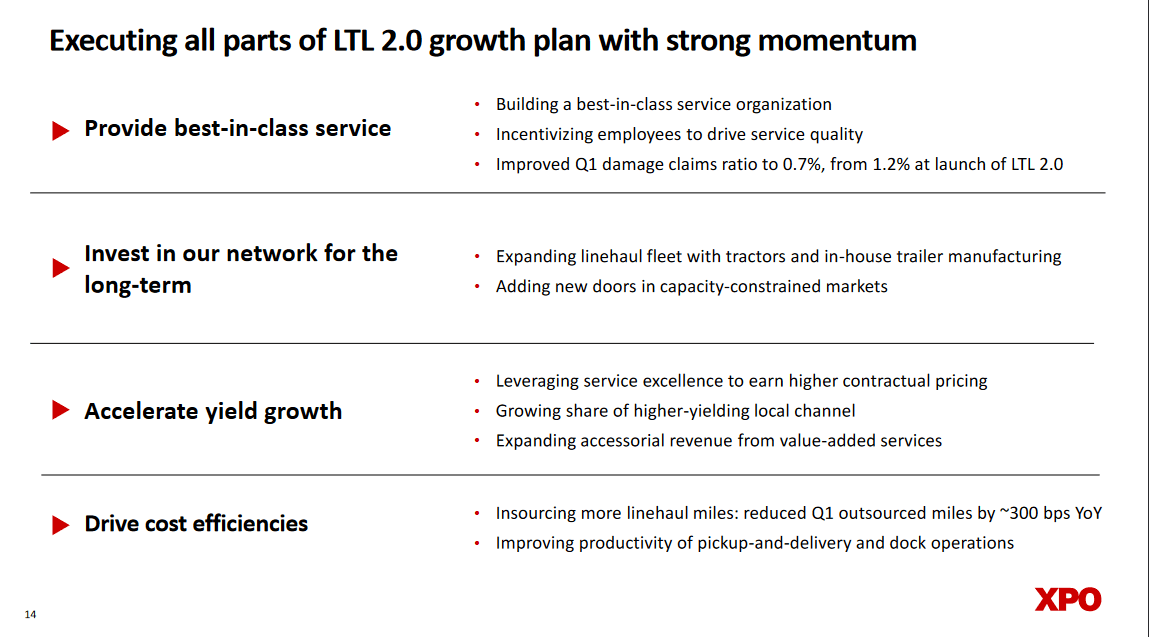

Development Plan (Earnings Presentation)

To speed up the expansion of the enterprise XPO is guaranteeing they’re in a powerful place when the cycle comes round once more. Proper now I feel we’re within the backside a part of the cycle as some essential key notifications of which might be tools orders rising and charges starting to rise considerably. Proper now the charges aren’t the place they have been in 2022 once we skilled the late a part of the cycle or the euphoric state. What XPO is doing to set itself up is increasing the fleet to seize much more income development and safe market share.

Quarterly Outcomes

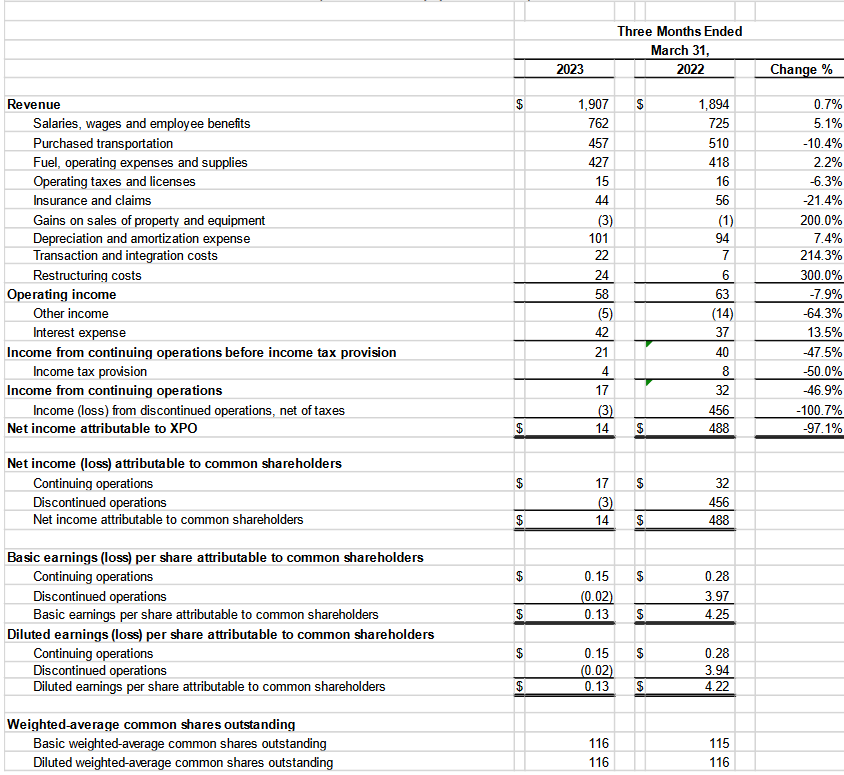

Trying on the final earnings report from XPO it was an actual success in my view. They have been regardless of the higher charges final 12 months capable of improve the EPS by 22% YoY, and the revenues additionally.

Revenue Assertion (Q1 Report)

The corporate remains to be spending capital on bought transportation, however it’s down 10% YoY, which helped offset some extra bottom-line development. What makes me optimistic concerning the coming quarters is the truth that XPO has hedged very properly in opposition to gasoline bills and the Q1 FY2023 report solely confirmed this half rising 2.2% YoY. The administration feedback on the quarter have been attention-grabbing to learn, CEO Mario Harik mentioned the next, “Demand stays gentle, with a detrimental influence on tonnage, however we’re actively decreasing our working prices whereas persevering with to speculate capital to satisfy the long-term wants of our prospects. Importantly, we’re gaining worthwhile market share, propelled by our highest service high quality in over a decade.” This remark speaks volumes about what the present trade state of affairs is, a time to ascertain extra income streams and construct out what’s working, and spend money on that. Seeing XPO capable of effectively mitigate excessive working prices can be reassuring and a motive for a maybe barely richer valuation than the sectors.

Dangers

The first dangers dealing with any firm within the transportation trade appear to be about managing excessive gasoline prices and hedging in opposition to that effectively. As seen with XPO they’ve been capable of drag down working bills and publish a 22% YoY development of EPS regardless of many different corporations like Werner Enterprises (WERN) for instance seeing each the highest and backside line lowering because the market softens. A number of the worries I’ve simply concerning the share value is {that a} pullback appears fairly seemingly seeing as the value has run up so rapidly just lately. XPO is buying and selling above its 5-year historic p/e of 16 – 17 and nothing elementary has modified across the enterprise mannequin. They have been simply superb at managing low working prices regardless of decrease charges and excessive gasoline costs. That appears to have equated to a share value improve of over 30%.

Valuation & Wrap Up

XPO is a serious firm within the transportation sector within the US, notably with floor transportation. The final quarter confirmed the corporate’s capacity to develop by downturns and a softer market surroundings. This has brought on the share value to extend at a really quick fee in simply the previous couple of months, and it is now buying and selling above historic averages.

Inventory Chart (In search of Alpha)

I feel the monetary state of the enterprise is robust and debt would not appear to be a serious job for them to deal with. The market appears to be within the backside a part of the cycle however on the rise. When that occurs development may come rapidly and will probably justify the present valuation of the enterprise. However for me, I feel it’s miles extra seemingly we see a short-term pullback, and maybe an entry level round $50 per share opens up. Within the meantime, I’m ranking XPO a maintain.