John Phillips

Adyen (OTCPK:ADYEY) is one in every of my highest conviction identify and I’ve carried out a deep dive into the identify for members of Outperforming the Market, which features a abstract of my 5-year monetary forecast and my intrinsic worth and entry value estimate for Adyen.

I like Adyen as an organization given the robust trade tailwinds, its strong aggressive place, and long-term compounding and free money movement era capabilities.

Temporary introduction into Adyen

Adyen is likely one of the main funds firms globally, and thru its unified know-how stack, presents prospects with the distinctive means to combine each on-line and in-store cost processing and value-added companies.

The corporate has led an natural development technique, which I’ll elaborate intimately later, and is led by Pieter van der Does, who can also be the co-founder of Adyen.

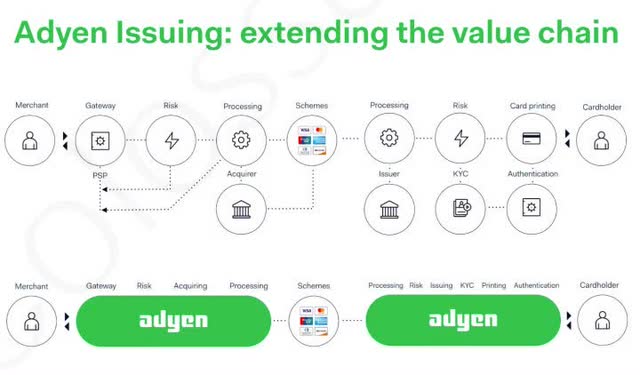

Considered one of Adyen’s key worth proposition is that it is ready to deal with the complete funds lifecycle and supply an end-to-end answer for its prospects. This contains every thing from gateway, danger administration, processing, buying and settlement.

As well as, one other key worth proposition is to scale back friction for companies and to supply a funds platform that’s constructed for pace, efficiency, safety and innovation as Adyen has an end-to-end in-house tech stack.

Lastly, Adyen doesn’t simply deal with on-line funds but additionally on different segments like in-store funds and platforms, thereby giving the corporate the power to assist prospects combine their knowledge throughout on-line and in-store codecs to generate insights on engagement and loyalty.

Adyen enterprise mannequin and worth proposition (Adyen IR)

Adyen income combine

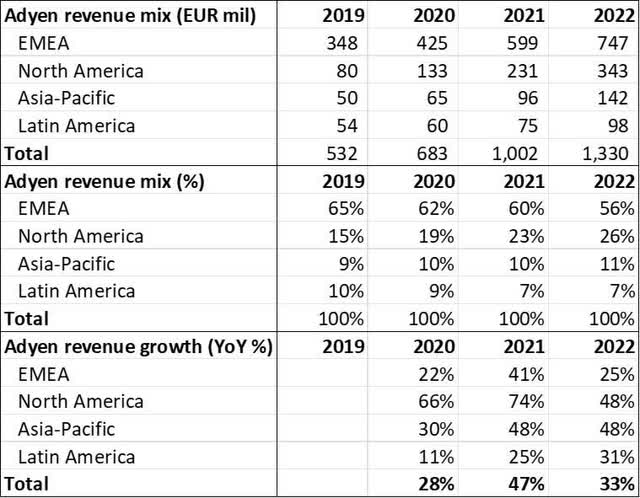

I put collectively the income break down by geographical areas of Adyen within the final 4 years to raised perceive the enterprise.

We now have seen EMEA contribution to revenues steadily fall from 65% of whole income in 2019 to 56% of whole income in 2022.

Revenues from North America was the quickest, with a median development of 63% over the four-year interval, whereas Asia-Pacific was the second quickest rising area with a median 42% development over the four-year interval. The EMEA area noticed a median development of 29% over the four-year interval whereas the Latin America area noticed a median development of twenty-two% over the four-year interval.

Adyen Income Contribution and Development (Creator generated)

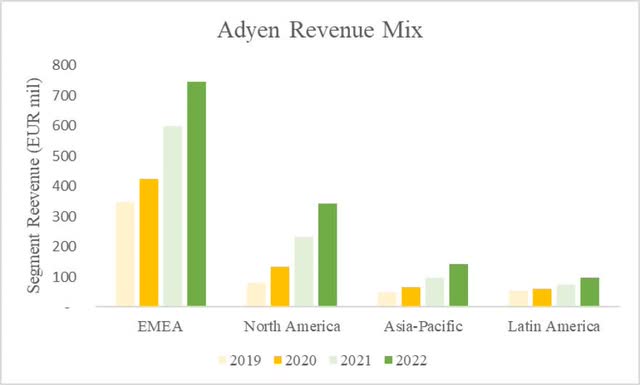

The graph illustrates the geographical mixture of Adyen, with the EMEA area making up the vast majority of its revenues, whereas North America being the second largest contributor of revenues and rising quickly.

Adyen Income Combine (Creator generated)

I wish to monitor Adyen’s development within the North America and Asia-Pacific areas over time as these are robust drivers for development for Adyen, on prime of its constant, core development driver, the EMEA area.

Favorable tailwinds within the world funds market

Now, we’ll take a look at the trade tailwinds for Adyen. This comes not solely from a rising funds market, but additionally from its persevering with market share achieve from incumbents within the section.

Development of the funds market

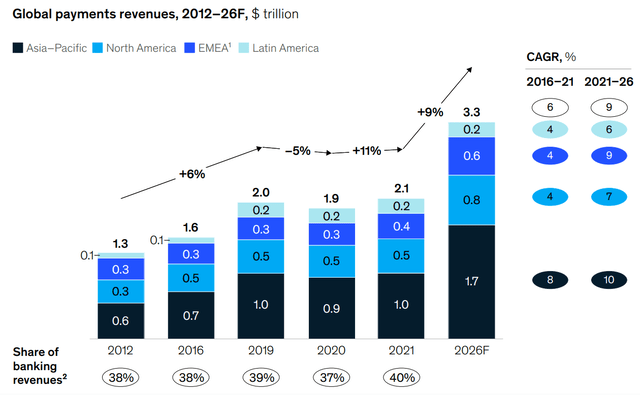

The funds market is anticipated to proceed to develop within the subsequent few years.

By 2026, the worldwide funds income is anticipated to achieve $3.3 trillion, rising 9% CAGR over the interval. Areas poised for outsized development embody Asia-Pacific and EMEA, which is anticipated to develop at 10% CAGR and 9% CAGR respectively.

International Funds Income (McKinsey 2022 International Funds Report)

This development within the world funds income is pushed by the continued development in digital funds, each on-line and offline.

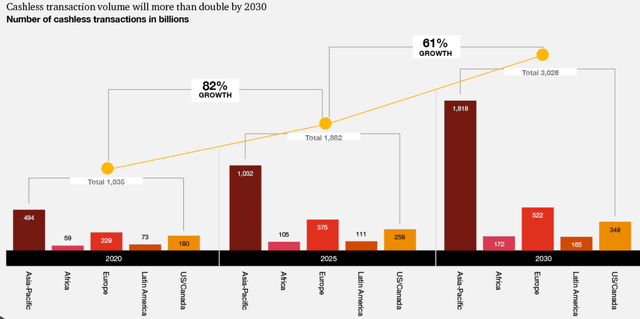

As will be seen beneath, cashless transaction quantity is anticipated to greater than double by 2030 throughout all geographies.

Cashless transaction volumes (PwC)

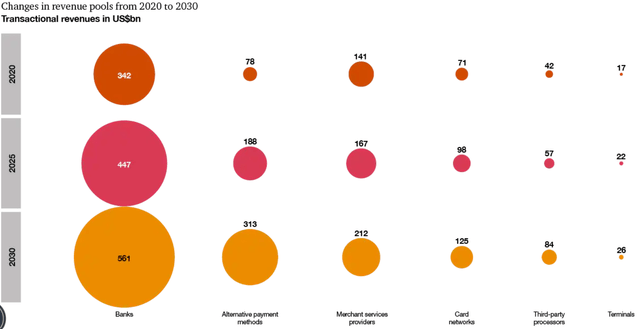

Alternate options cost strategies and service provider service suppliers, two segments which Adyen is uncovered to, proceed to develop in revenues till 2030.

Change in income swimming pools (PwC )

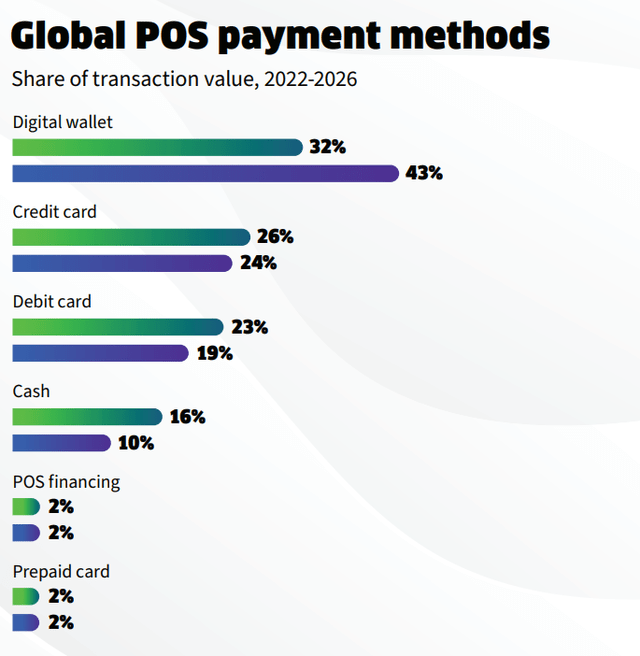

For Level of Sale (“POS”) transactions, there’s a development transferring away from money and playing cards in the direction of digital wallets, which Adyen is uncovered to.

International POS cost strategies (FIS International Funds Report)

Enterprise technique

Adyen employs a land-and-expand technique, and it primarily grows together with its prospects.

Since its IPO, Adyen has discovered that a big majority of development annually comes from the companies which are already on its platform. On prime of that, Adyen has seen constantly low quantity churn of lower than 1%.

Thus, Adyen’s means to proceed to realize pockets share from present prospects is its most important development engine to continues to drive future development.

The purpose firstly when onboarding new prospects into its platform is to indicate the robust worth proposition that Adyen can ship and from there, increase its scope of labor as belief is constructed and a partnership is born.

This means comes from the highest tier gross sales groups at Adyen that appears to safe potential prospects, advance them and drive penetration after.

The gross sales groups are there to supply this collaboration between Adyen and present prospects to find out what their challenges are and methods to overcome them. As well as, Adyen is structured into options like Funds, Information, Platform Engineering and Platforms & Monetary Providers. Because of this there are technical and product groups that may work to satisfy the calls for and clear up challenges that Adyen faces.

One other a part of Adyen’s enterprise technique contains its three business pillars.

Adyen has three business pillars, that are Digital, United Commerce and Platforms. I feel that this can be a smart way for Adyen to proceed to innovate in every pillar and proceed to evolve with the instances in every pillar and supply the very best options.

Adyen began off in Digital, with its origins in on-line funds. The concept right here is for Adyen to scale back friction in on-line funds to make sure that prospects expertise a cost platform that’s engineered for pace and an end-to-end in-house constructed tech stack that permits Adyen to have full management and agility. This provides Adyen full management over the know-how, which might then result in Adyen releasing new merchandise to allow a buyer’s development, change performance or implement new cost strategies.

Adyen’s Unified Commerce providing ensures that its platform is ready to allow companies of as we speak function each on-line and in-store, thereby enabling prospects to make use of Adyen as a single multi-channel answer and one the place prospects can have a built-in view of all transactions occurring. This helps prospects perceive buyer conduct higher on a blended perspective, together with each on-line and in-store, enabling prospects to have higher engagement and loyalty with their very own prospects.

Final however not least, Adyen’s Platform providing was created from its present product providing because the wants of enterprises began changing into extra advanced. The enterprise platforms that Adyen work hosts small and medium measurement companies, which Adyen also can work with by these enterprise platforms.

To proceed to innovate on its choices, Adyen launched its embedded monetary product suite. This product providing is supposed to supply Adyen’s platform companies the power to convey to their customers a superior monetary expertise. A few of its modern merchandise within the product suite contains card issuing, enterprise financial institution accounts and money advances.

Market share

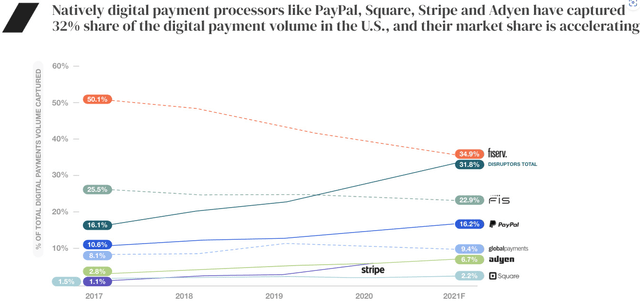

Adyen is likely one of the tech-enabled disruptors within the world funds market.

As will be seen beneath, conventional incumbents like Fiserv (FI), FIS and International Funds (GPN) are dropping market share, with a mixed market share of 84% in 2017 falling to a mixed market share of 67% in 2021. This comes because the disruptors market share grew from 16% in 2017 to 32%. Through the interval, Adyen’s market share greater than doubled.

Disrupters in digital cost processing (F-Prime State of Fintech)

It’s anticipated that the incumbent market share will proceed to fall because the disruptors proceed to innovate on know-how and convey improved choices, decreased friction and complexity and higher integration.

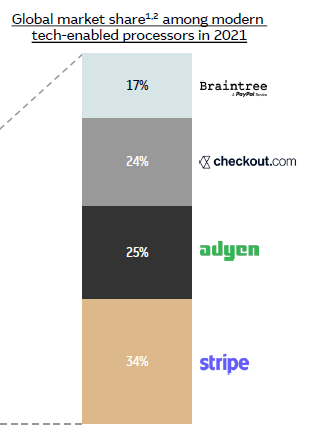

As will be seen beneath, the tech-enabled gamers are consolidated by 4 key gamers, with Adyen and Stripe being probably the most aggressive out of the 4. On prime of that, Adyen focuses on the Europe market and enterprises whereas Stripe focuses on the North American market and small, medium companies.

Market share of disruptors within the world funds market (CB Insights)

I feel the truth for Adyen is as such: Stripe will proceed to be a competitor within the long-term, however the world funds market continues to develop, as proven above, and in addition, these disruptors will proceed to realize share from the incumbents on account of their aggressive positioning.

Administration crew

Pieter van der Does is Adyen’s co-founder and CEO. He presently has 922k shares in Adyen, which quantities to $1.5 billion as we speak. His base wage and remuneration obtained in 20221 and 2022 quantity to $629k and $692k, and this makes up lower than 1% of his shareholding in Adyen. This makes him inclined to be aligned to shareholders to Adyen.

Ingo Jeroen Uytdehaage is the CFO of Adyen and been with the corporate for the previous 12 years. In 2023, he was appointed as co-CEO of Adyen and he’ll oversee the Product and Operations groups. His CFO position will probably be taken over by Ethan Tandowsky whereas Roelant Prins, the present CCO, whereas oversee the Account Administration groups. These adjustments come as Adyen’s present COO is stepping down in 2023.

Free money movement machine and long-term compounder

Adyen has a web money steadiness of 6.3 billion euros, which makes up about 14% of its market capitalization as we speak.

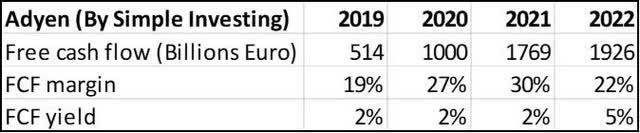

On prime of that, Adyen has robust free money movement era skills.

As will be seen beneath, Adyen’s free money movement margins are strong between 19% to 30% whereas free money movement yields have ranged between 2% and 5%.

Adyen free money movement era (Creator generated)

The Adyen enterprise mannequin is a extremely worthwhile one, with ROE up to now 4 years being between 24% and 31% and its ROIC being within the vary of 23% and 30%. What this implies is that the capital being reinvested into the enterprise continues to develop at a fast clip and companies like these are long-term compounders.

Adyen ROE and ROIC (Creator generated)

What this implies for Adyen is that its free money movement era permits it to proceed to develop its surplus of money movement, which might then be both re-invested into the corporate, and even used to amass different firms. On prime of that, its excessive return on fairness implies that for every greenback reinvested into the enterprise, this helps develop the returns of the enterprise additional as compounding takes place.

Stable monetary targets

Adyen has three most important monetary targets that it hopes to realize both within the medium time period or the long-term.

Firstly, web income development is anticipated to develop at a CAGR vary of mid-twenties and low thirties within the medium time period.

Secondly, Adyen expects to enhance EBITDA margin by enhancements in working leverage. The long-term aim for EBITDA margin is 65%.

Thirdly and lastly, Adyen expects to keep up a sustainable capital expenditure price of as much as 5% of its web income.

I feel that these targets will be met, as proven by the robust trade tailwinds for Adyen, the capital environment friendly enterprise mannequin and continued EBITDA margin.

Valuation

I forecasted Adyen to realize a 28% CAGR for its revenues, which is in-line with its targets, whereas I count on EBITDA to enhance to 60 with bettering working leverage. The detailed 5-year monetary mannequin will be present in my Adyen deep dive article.

Based mostly on that 5-year monetary mannequin, I additionally reiterate my intrinsic worth derived for Adyen that can also be discovered within the deep dive, which relies on the discounted money movement mannequin for the 5-year interval.

My 1-year value goal for Adyen is $20.40, implying 21% upside from present ranges. The 1-year value goal suggest 60x 2024 P/E. I feel that this valuation a number of is justified for Adyen given its robust trade tailwinds, high quality administration crew, resilient and worthwhile enterprise mannequin and strong enterprise technique.

Conclusion

There are favorable trade tailwinds within the world funds market that favors Adyen because the development continues to maneuver in the direction of cashless transactions.

Adyen’s land-and-expand technique has confirmed to be efficient in rising the enterprise organically and affordably, whereas it continues to innovate throughout totally different business pillars like digital, unified commerce and platforms section.

Adyen, as a disruptor within the world funds market, won’t solely proceed to realize share from incumbents, but additionally develop together with the worldwide funds market.

On prime of that, Adyen is run by its co-founder who has a number of pores and skin within the sport and it has a extremely worthwhile enterprise mannequin that has strong free money movement era and excessive returns on fairness.

My 1-year value goal for Adyen is $20.40, implying 21% upside from present ranges.

Editor’s Be aware: This text discusses a number of securities that don’t commerce on a serious U.S. alternate. Please pay attention to the dangers related to these shares.