Natallia Saksonova/iStock by way of Getty Photographs

Thesis

On this article, I delve into the monetary well being, enterprise technique, and future prospects of Titan Equipment (NASDAQ:TITN), a pacesetter within the agricultural and development tools markets. With the corporate experiencing a burst of monetary development, surging by a outstanding 23.6% in complete income for the primary fiscal quarter of 2024, I discover what’s driving this upward pattern, together with vital income leaps in elements, providers, and rental sectors and in addition study the perplexing undervaluation of Titan’s shares relative to its strong development and efficiency.

Firm Overview

Titan Equipment was established in 1980 and presently maintains their headquarters in West Fargo, North Dakota. They’re acknowledged domestically and globally as leaders in agricultural and development tools markets.

Titan’s tools aids meals, fiber, feed grain, and renewable power manufacturing whereas assembly house, backyard, business, residential, and authorities property upkeep wants. Inside their development phase, their tools combine consists of heavy equipment for giant tasks in addition to mild industrial machines that assist facilitate smaller residential development duties, highway/freeway development duties in addition to power/forestry operations.

Titan additionally goes past conventional gross sales fashions by renting tools and providing ancillary providers akin to tools transportation, farm knowledge administration merchandise, GPS sign subscriptions and CNH Industrial finance and insurance coverage merchandise.

A Titan Amongst the Crops

With a burst of strong monetary development, Titan Equipment lately posted a placing 23.6% surge in complete income for its fiscal first quarter of 2024, amassing a grand complete of $569.6 million. Driving this surge had been some deftly dealt with acquisitions and a powerful efficiency in same-store gross sales, primarily inside their Agriculture and Building departments. It is price highlighting that elements income leaped by a considerable 40.9%, whereas service income and rental and different income adopted swimsuit with an uptick of 18.3% and 32.9% respectively.

As for income, Titan Equipment did not disappoint. Gross revenue for Q1 swelled by a powerful 33.7% to succeed in $119 million. In the meantime, the gross revenue margin escalated by 160 foundation factors, a development fueled primarily by strengthened tools margins, the results of surging demand and a fortuitous product combine.

Let’s break it down by segments. Within the Agriculture realm, Titan Equipment’s gross sales blossomed by 32.9%, fertilized by current acquisitions and natural development. However the income development story was considerably marred by a scarcity of high-demand money crop tools. Over within the Building division, a constructive 7.5% gross sales enhance was famous, underpinned by a strong 9.9% same-store gross sales development. On the worldwide entrance, gross sales receded by 1.4% on account of a weakening euro (which has since appreciated). Nonetheless, after adjusting for these foreign money headwinds, the phase noticed a gross sales development of two.8%.

By way of web revenue, Titan Equipment managed to raise it to $27 million, an increase from the prior yr’s first quarter web revenue of $17.5 million.

Shifting onto the stability sheet, Titan Equipment boasts a powerful complete stock stability of $854.2 million whereas conserving $38 million in money available.

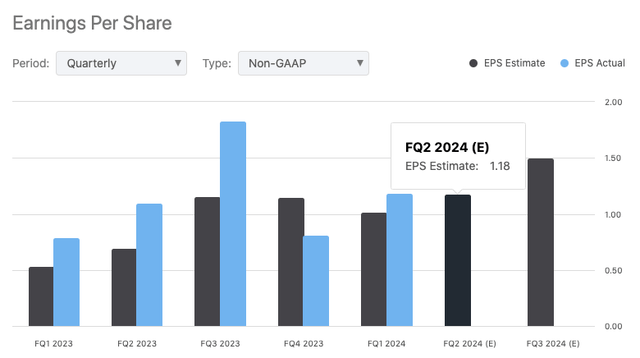

Looking for Alpha

Lastly, wanting forward, which we’ll get extra coloration on come August 23, Titan’s administration doubled down on their bullish outlook for the fiscal yr 2024, anticipating to experience a wave of demand and favorable market circumstances, even within the face of some high-demand product provide constraints.

Expectations

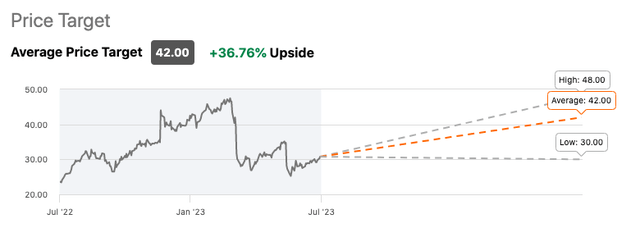

Titan presently instructions a “Sturdy Purchase” common ranking amongst 5 Wall Road analysts who forecast a +36% upside worth goal.

Looking for Alpha

Efficiency

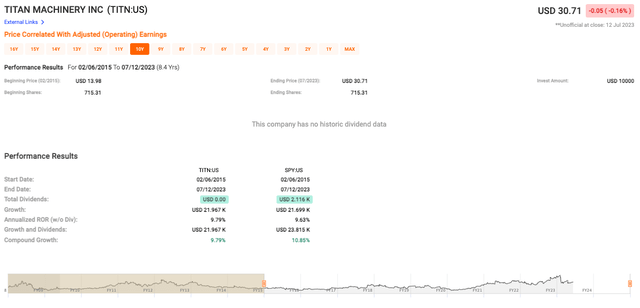

Regardless of no dividends to talk of, Titan Equipment has generated some spectacular returns by almost doubling within the worth from USD 13.98 to USD 30.71 over the past 8.4 years (see knowledge beneath).

Nonetheless, it is essential to remember that it is a purely growth-driven story. The truth that TITN doesn’t present dividends signifies that traders counting on revenue from their portfolio would possibly wish to look elsewhere.

Quick Graphs

With that famous, it is once we consider dividends that issues change into a little bit extra advanced. The overall development, together with dividends for the S&P 500 Index (based mostly on a hypothetical preliminary funding of $10K) is USD 23.815K, which takes the S&P’s compound development fee to 10.85%. This outperforms TITN’s 9.79%, displaying that the S&P has a slight holistic benefit once we take into account the whole returns, i.e., development plus dividends.

Valuation

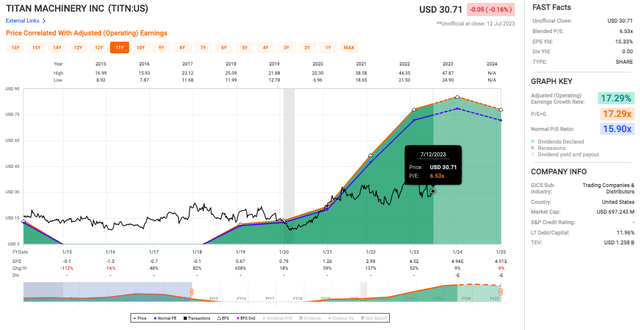

Titan’s Blended P/E of 6.53x seems notably low for a corporation that appears to be performing fairly properly, with an adjusted working earnings development fee of 17.29%. In different phrases, an organization that’s rising its earnings at over 17% per yr, but buying and selling at solely 6.53 instances earnings, screams undervalued to me.

Quick Graphs

Additionally, the P/E ratio is properly beneath the “regular” P/E ratio of 15.90x which additional helps my undervaluation speculation. That mentioned, the EPS yield is kind of excessive at 15.33%. Coupled with a non-existent dividend yield, this means that Titan Equipment is prioritizing reinvestment in its enterprise as an alternative of returning money to shareholders.

Sector Valuation

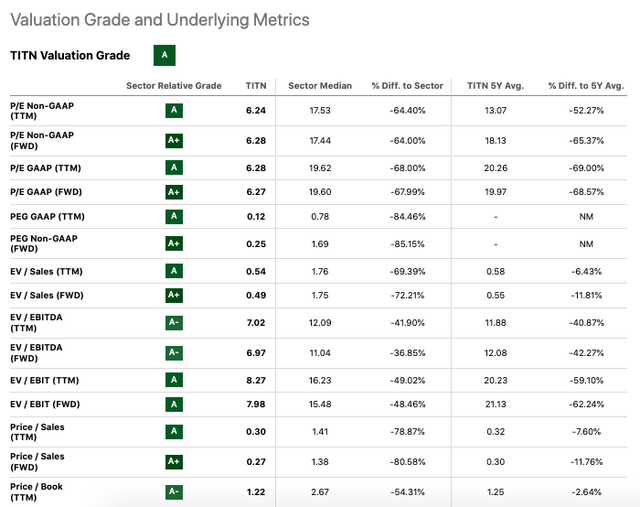

My preliminary look just about reveals that the foremost conclusion to attract from these numbers is that TITN is considerably undervalued in comparison with each its sector and its five-year common throughout a number of key valuation metrics.

Looking for Alpha

A placing illustration of that is TITN’s P/E Non-GAAP (TTM and FWD) scores. With TTM at 6.24 and FWD at 6.28, TITN’s P/E is sharply beneath each the sector median and its 5-year common, by greater than 50% in each circumstances.

This pattern is equally pronounced in GAAP P/E and PEG ratios. With PEG GAAP (TTM) at 0.12 and PEG Non-GAAP (FWD) at 0.25, TITN’s development is priced extremely cheaply in comparison with the sector, suggesting the market is doubtlessly overlooking the corporate’s development prospects.

It is also price noting the corporate’s EV/Gross sales, EV/EBITDA, and EV/EBIT metrics. As soon as once more, TITN outperforms the sector and its historic averages in all these regards. These ratios, notably when in comparison with the sector median, counsel that TITN’s enterprise worth is undervalued relative to its income and earnings earlier than curiosity and taxes.

Looking for Alpha

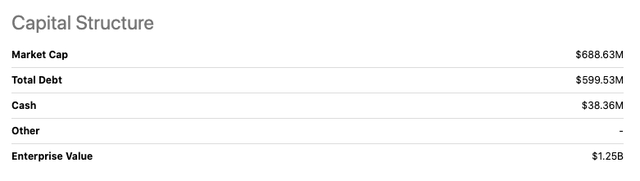

Lastly, TITN’s capital construction reveals just a few potential issues. The corporate has a large debt load of $599.53M versus a market cap of $688.63M, indicating vital leverage.

Dangers & Headwinds

First, the bounce in working bills throughout Q1, growing by a major 26.8%. This spike, pushed primarily by prices associated to current acquisitions and escalated variable bills in step with rising revenues, is noteworthy. I have to warning that, whereas buying new companies and increasing market share are commendable development methods, the associated prices can doubtlessly impinge on profitability if they are not managed meticulously.

One other yellow flag that warrants my consideration is the escalating curiosity bills, up from $1.5 million to $2.5 million year-over-year. This rise is primarily because of larger interest-bearing flooring plan borrowings. From a monetary threat perspective, a persistently rising curiosity expense can result in larger monetary burden and better leverage, doubtlessly lowering free money circulate and risking future monetary stability.

The worldwide gross sales efficiency paints an image of potential concern too. Worldwide phase gross sales have dipped by 1.4%, influenced by a mixture of geopolitical uncertainties in Ukraine and, on the time of their final earnings report, a depreciating euro which has steadily risen because it dipped beneath USD1 final fall. The problem right here is twofold – foreign money threat and geopolitical threat. An ongoing battle in Ukraine (with no peace negotiations in sight) will most definitely proceed to hamper gross sales within the area, whereas a euro that would weaken once more, diminish the worth of abroad income.

Lastly, shifting focus to stock administration, Titan reported a major build-up in the course of the quarter, primarily attributable to the aforementioned acquisitions. Whereas a well-stocked stock generally is a boon in instances of excessive demand, overstocking can tie up substantial capital, add carrying prices and inflate threat ranges within the occasion of a sudden market downturn. Concurrently, persistent provide constraints in high-demand tools classes may inhibit Titan’s capacity to fulfill buyer demand and drive development.

Closing Takeaway

Given Titan Equipment’s sturdy development, undervalued standing in comparison with its sector, and future constructive outlook regardless of some manageable dangers, I fee TITN inventory a “Purchase”. The corporate’s current monetary efficiency exhibits a powerful trajectory when it comes to income and profitability. Whereas they do have a excessive leverage ratio and a few operational dangers, the general monetary and sector efficiency coupled with a P/E ratio that implies undervaluation present a positive funding alternative. Nonetheless, I would beneficial it for growth-oriented traders because of its non-existent dividend yield.