General, customers are financially higher off in 2024 in comparison with final 12 months. This is because of a mixture of a resilient labour market, stable wage progress, and cooling inflationary pressures, all of which have supplied reduction to households’ budgets. Nonetheless, regardless of a extra optimistic future financial outlook, customers throughout completely different areas stay sceptical and proceed to stick to cautious spending behaviours.

On this two-part collection, we’ll dive into how customers’ spending behaviours have modified since COVID-19 and the way they proceed to be influenced by financial nervousness. Half one will give attention to how client spending habits throughout the globe have modified to suit a smaller purse as their funds have taken a tumble following a number of lockdowns and a price of dwelling disaster. Proceed studying this text for the primary instalment within the two-part collection to learn the way your corporation and your model can keep related by supporting prospects of their quest to make their cash stretch so far as potential.

How Has the Pressure on Budgets Altered the Manner Individuals Store?

UK spending habits

UK households have lengthy since made modifications to their spending priorities to counteract the challenges the price of dwelling disaster has thrown at them. Whereas client sentiment has improved considerably in current months as a result of falling inflation ranges, most Brits reject the notion that the price of dwelling disaster is over. Subsequently, enhancing macroeconomic situations takes time to be mirrored in client attitudes. That is partly a mirrored image of ongoing difficulties attributable to elevated rates of interest and rents, nevertheless it additionally factors to the lasting emotional affect of the crises individuals have confronted lately. In consequence, greater than ever, customers are taking a cautious method, are placing in additional time to make their cash go so far as potential, and are going to the retailers extra ready:

General, customers within the UK are adapting their day-to-day spending habits somewhat than making main shifts of their use of services. Their focus lies on extracting most worth from their present spending, with a reluctance to chop out whole areas of expenditure. Whereas most individuals spend the identical in important classes, many lowered their spending in discretionary areas comparable to leisure and premium meals final 12 months.

Shopping for habits of American customers

Throughout the pond, US customers’ spending urge for food continues to be elevated even after a number of years of crises. Client optimism has steadily risen since Could 2023, with half of customers anticipating to be financially higher off over the course of the 12 months. This has resulted in a notable improve in spend throughout classes like journey, dwelling enhancements, and big-ticket gadgets on the tail-end of 2023. This swell of spend is anticipated provided that this era coincides with the vacations, because the buying season tends to be full steam forward amid the plethora of offers and reductions to spice up retail gross sales. Nonetheless, as US customers depart the buying season behind, altering spending habits could be noticed: Cheaper grocery options and scaling again on spending on garments and eating out are methods US Individuals are attempting to stretch their {dollars}.

Furthermore, the second half of 2024 may trigger confidence to be unstable once more with the US presidential election. Regardless of enchancment, it’s price noting that confidence nonetheless stays effectively under ranges seen proper earlier than the pandemic. Subsequently, retailers shouldn’t anticipate spending to rebound on the similar charge as confidence – there will probably be a little bit of a lag impact as many customers cautiously develop their buying repertoires.

Savvy modifications US customers have made or would make to their spending habits:

German client spending behaviour

Much like the UK, German customers have gloomy expectations for the financial system. Navigating from disaster to disaster has created fatigue amongst customers, dampening their monetary outlook. In consequence, Germans stay ready to make intensive cutbacks on their most respected actions, with. savvy buying habits picked up through the peak of inflation right here to remain. These embrace lowered power use at dwelling, elevated purchases of personal label merchandise and low-cost retailers, and a reevaluation of their priorities and long-term targets, comparable to dwelling possession. . Manufacturers can faucet into the rise of personal labels by persevering with to innovate in their very own label product traces. Foods and drinks manufacturers in Germany responded to this, with personal labels gaining a major share of latest launches in 2022.

Furthermore, customers in Germany look to second-hand clothes to save cash and the setting. Though style stays amongst German customers’ prime spending classes, many will select to chop again in the event that they should. Two-fifths of Germans report that cash considerations have brought about them to search for options to purchasing new gadgets. In consequence, second-hand buying is rising in recognition as a extra reasonably priced and sustainable technique to store. This has opened up new alternatives for manufacturers to faucet into resale packages, and plenty of corresponding initiatives within the German style retail market over the past 12 months have emerged. Since practically three in 4 Germans suppose that purchasing second-hand is an effective technique to cut back environmental affect, style manufacturers that embrace resale and place their worth with regard to sustainability could have a bonus over rivals.

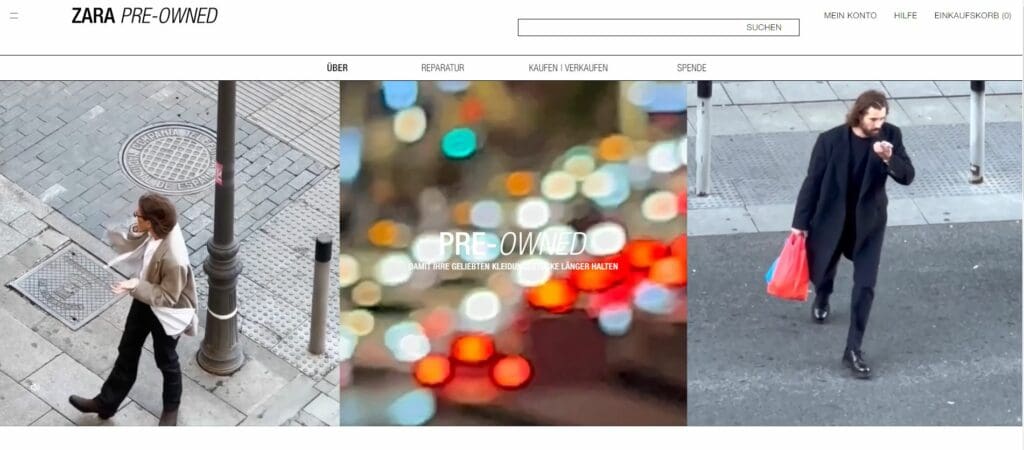

For instance, Zara has launched its personal resale platform the place prospects are inspired to purchase and resell their pre-loved Zara gadgets, and likewise presents restore companies and an area to donate clothes. Supply: zara.com/de/

Client spending habits in APAC

The Asia Pacific area has seen important modifications as a result of monetary affect of the COVID-19 pandemic. Many customers within the area have skilled monetary nervousness, which has led to widespread cost-cutting and lack of jobs, with unemployment charges in APAC estimated to develop even additional. In consequence, Chinese language customers have made reducing discretionary spending their first precedence to enhance their monetary scenario. In the meantime, in Thailand, customers are selecting private-label merchandise over branded equivalents. The fixed hunt for the bottom worth has brought about client loyalty to decrease within the APAC area.

In India personal labels have the chance to entice budget-driven buyers to loosen their purse strings: 4 in 10 customers prioritise low costs when shopping for merchandise and 34% search premium private-label merchandise. Retailers can provide worth packs for private-label merchandise to ease budget-stricken customers, and additional enhance high quality perceptions of their model to boost worth.

Moreover, over half of Indian customers with a decent finances are dwelling cooking extra usually as an alternative of getting meals delivered, with a lot of them switching to cheaper components. Retailers can help their altering client behaviour by making cooking enjoyable and fulfilling, as an alternative of only a technique to cut back prices. Meals manufacturers comparable to CooX Asia purpose to foster significant connections with customers by cultivating a vibrant neighborhood of dwelling cooks and meals lovers.

Saving For A Wet Day

Though financial savings exercise was considerably lowered in comparison with the degrees seen over the previous few years and regardless of the challenges posed by the rising value of dwelling, family financial savings deposits within the UK continued to rise by 4% in 2022. In actual fact, common financial savings stays among the many prime three client spending priorities with over half of Brits placing cash apart for a wet day: Solely a fraction of customers have lowered their financial savings or pension contributions.

Much like the UK, customers within the US have lowered their discretionary spending and began to prioritise their financial savings as they return from the Christmas holidays. The intention being to be ready to spend extra once more in the summertime: Over two-fifths of US customers added to their financial savings on the finish of 2023. Whereas the high-rate setting has been a thorn within the facet of debtors, the brilliant facet is that the rise in Annual Proportion Yield throughout high-yield financial savings accounts, with some monetary establishments even providing an APY of over 5% – presents a good-looking return for customers trying to be actionable about their financial savings intentions.

Many German households stay cautious in spending as a result of they worry, amongst different issues, excessive subsequent funds for utility and customary prices, comparable to gasoline and electrical energy. Consequently, and regardless of rising prices, German customers proceed to avoid wasting and the financial savings ratio remained excessive within the first half of 2023. Nonetheless, with much less disposable revenue out there, customers in a worse monetary scenario are much less more likely to prioritise common financial savings. Since lower-income households are hit hardest by the price of dwelling disaster and its aftermath, they are going to want extra time to get well than better-off households. Manufacturers are inspired to bolster help for these customers in enhancing their monetary resilience and reaching their financial savings targets. For instance, by cooperating with “save now, purchase later” suppliers like SaveStrike. This can improve model repute, as customers will understand financially accountable manufacturers as being respected and reliable.

One Measurement Does Not Match All

Inflation highlights persisting gender inequalities

There are clear gender variations in client responses to budgeting with girls making extra decisive modifications to their spending habits, which ends up in a gender spending hole. Over half of girls within the UK have used stricter buying lists to stick to. Girls are additionally considerably extra more likely to have made their lunch somewhat than purchased from a meals outlet, selected lowered gadgets, and substituted for cheaper components. This development is indicative of continued gender inequalities in lots of households that, historically, see girls extra usually chargeable for family buying. The gender pay hole is one other situation impacting how girls deal with the excessive value of dwelling. Girls proceed to earn lower than males on common, making them extra susceptible to the results of excessive inflation. This in flip is more likely to immediate better nervousness amongst girls, which once more will immediate a much bigger behavioural response.

Assist younger adults through the revenue squeeze

Aside from behavioural variations based mostly on gender, Mintel consultants are additionally observing variations based mostly on age. The older cohorts of Millennials and Gen Z are considerably extra more likely to make their very own lunch somewhat than shopping for it. Nonetheless, the youthful cohorts throughout the Millennial and Gen Z goal group are falling behind. An absence of abilities or consciousness of the financial savings that may be made by savvier buying and meals preparation are the explanation why the youngest adults aren’t making the identical money-saving modifications to their meal habits as their barely older friends. This is a chance for manufacturers, notably supermarkets, to interact with the youngest adults by means of reasonably priced meal plans and to tell them of the financial savings they may make by meal prepping.

The wealth hole

The extent to which client spending habits are altering within the US is determined by US households’ monetary scenario. Increased-earners’ monetary outlooks are naturally extra optimistic as a result of them already being in a steady place. Quite the opposite, the lower-end revenue brackets displayed the best quantity of pessimism round their monetary futures. The challenges for these households are aplenty, comparable to dwelling on a paycheck-to-paycheck cadence, contending with larger ranges of debt, and better bank card dependency. All of those components contribute to lower-earners having thinner monetary margins, which additionally results in a just about nonexistent monetary cushion to fall again on ought to unexpected circumstances come up. The excessive charge setting of the previous two years has solely amplified this section’s monetary hardships, primarily as a result of rise throughout bank card APRs. On condition that low-earners have a better probability of revolving their bank cards, the curiosity they accrue on their month-to-month balances has solely grown bigger, piling on to the mountain of monetary challenges they’re wrestling with. Monetary establishments, particularly those who serve subprime credit score bands, ought to set up contact with these struggling prospects and provide debt reduction options and money-management counselling to place them on the street in direction of monetary restoration.

Finest Egg has printed an informational piece on organising a profitable debt discount plan for customers in financially strained circumstances and is providing them a instrument to regain management over their funds. Supply: bestegg.com

Trying Forward with Mintel

General, customers’ monetary outlook is anticipated to be extra optimistic, nonetheless, years of uncertainties and crises have left customers throughout the globe feeling deflated and sceptical. The extra optimistic monetary outlook, due to this fact, might not be mirrored in client buying habits.

However, there are alternatives for companies to encourage client spending in the event that they give attention to the messaging round their merchandise. Added worth, comparable to sustainability claims, longevity, and extra, are key to attractive customers to half with their hard-earned cash. To search out out what you are able to do to make your model and merchandise stand out keep tuned for half two of Mintel’s article on how client spending behaviour has modified.

For all of our Shoppers and Traits Market Analysis go to our Mintel Retailer right here. Or signal as much as Mintel Highlight under to obtain contemporary and free market insights, delivered on to your inbox.

Signal as much as Highlight