Maks_Lab

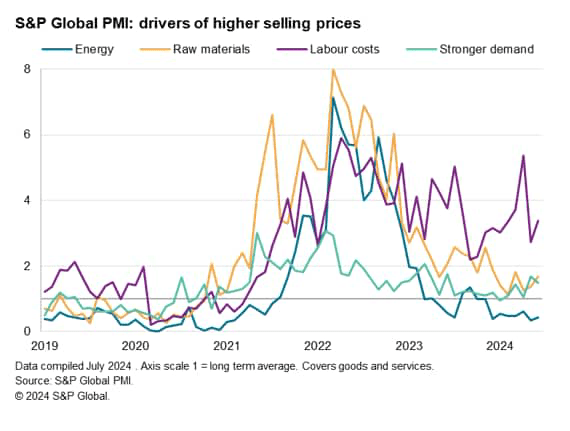

Value pressures remained elevated globally, in keeping with PMI survey knowledge, as additional indicators of cooling within the service sectors of most main economies had been partly countered by reviving value pressures within the manufacturing sector. The latter poses a possible menace to efforts to tame inflation, which in lots of economies stays elevated relative to central financial institution targets.

International PMI promoting worth inflation edges all the way down to second-lowest since pandemic

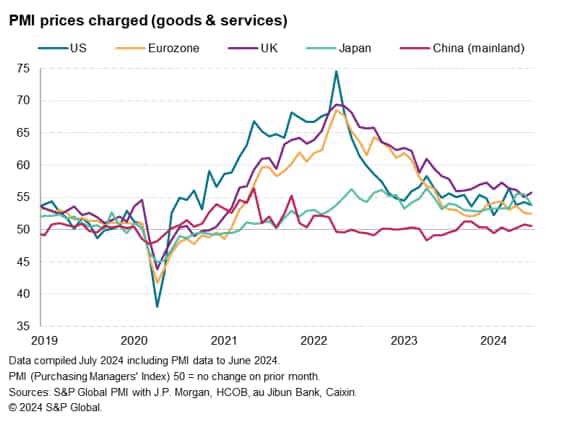

Worldwide PMI survey knowledge compiled by S&P International for J.P. Morgan confirmed common costs charged for items and providers rose globally on the slowest fee since January, registering the second-weakest month-to-month rise since October 2020. The speed of improve however remained elevated by pre-pandemic requirements, as slower service sector inflation was offset by resurgent worth strain within the manufacturing sector.

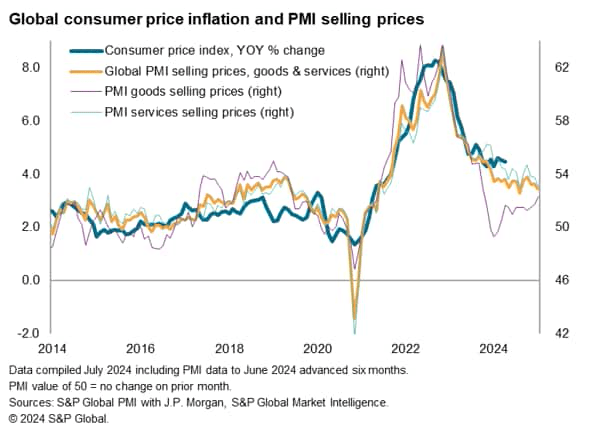

The composite PMI Costs Charged Index fell from 53.2 in Could to 52.8 in June, nonetheless working significantly above the pre-pandemic decade common of 51.2 however hinting at slower inflation in coming months. The current PMI readings are per international CPI inflation of roughly 3.5%, down from the newest estimate of 4.5%.

Rising manufacturing prices pose new menace in struggle towards international inflation

The June PMI knowledge had been characterised by cooling service sector worth developments however a revival of upward inflation momentum in manufacturing, the latter thereby presenting a rising menace to the worldwide struggle towards cussed international shopper inflation.

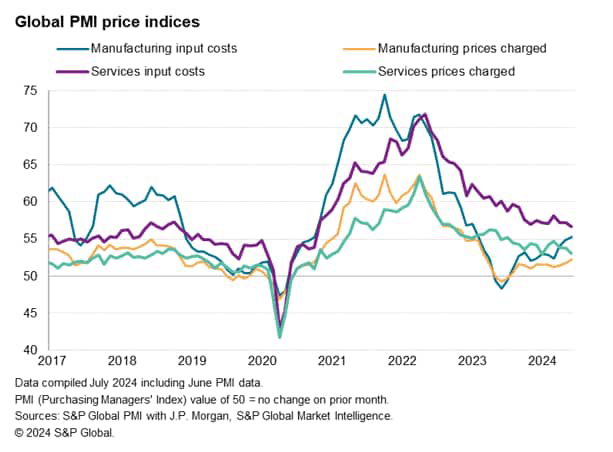

Service sector enter prices rose globally in June on the slowest fee since October 2020, although the speed of improve remained above the pre-pandemic decade common. Promoting worth inflation within the service sector likewise cooled however remained elevated by historic requirements. A steep cooling of providers inflation in 2022 has since been changed with a way more gradual moderation.

Manufacturing sector enter prices confirmed the most important month-to-month rise for 16 months in June, the speed of inflation having trended greater for the reason that center of final 12 months. Larger prices had been handed on to prospects, ensuing within the largest rise in common costs charged for items since March 2023.

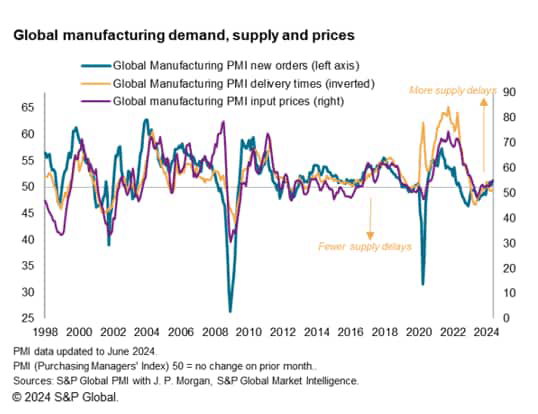

Accelerating progress of producing enter prices will be largely traced to reviews of upper uncooked materials costs and rising wage prices, with provide chain pressures – in distinction – remaining subdued.

Measured general, international provider supply occasions lengthened solely marginally in June after 4 months of marginal enhancements, pointing to few provide chain pressures on common globally regardless of ongoing disruptions to delivery in each the Pink Sea and Panama Canal. The information due to this fact counsel that suppliers proceed to function with enough capability to satisfy demand on a well timed foundation.

Nonetheless, the current upturn in manufacturing orders, which rose for a fifth successive month in June, has led to reviews of some demand-pull worth pressures growing.

Underlying inflation stubbornness extra evident in UK than US and Eurozone

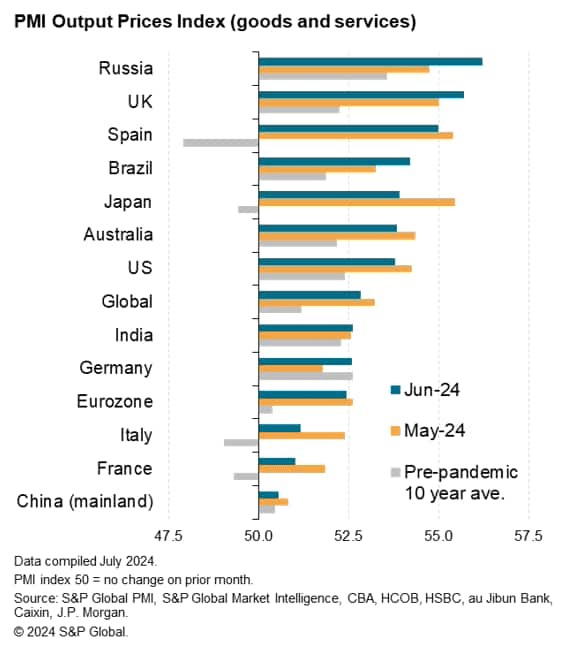

Of the most important economies tracked by the PMI surveys, promoting worth inflation rose most sharply in Russia adopted by the UK, with inflation ticking greater in each circumstances in comparison with Could and rising additional above pre-pandemic decade averages.

Whereas a robust worth achieve was additionally seen in Spain, the speed of improve was beneath the pre-pandemic long term common – as was additionally notably the case in Japan, France and Italy. The latter two noticed particularly modest worth will increase – in France, the rise was the smallest for 40 months – to assist deliver eurozone promoting worth inflation all the way down to its lowest for eight months and near the pre-pandemic common.

Promoting worth inflation in Japan slowed to a three-month low, and within the US, the rise was among the many smallest seen over the previous three years.

The smallest worth improve was once more recorded in mainland China, although costs have now risen right here (albeit marginally) for 3 successive months.

Authentic Submit

Editor’s Word: The abstract bullets for this text had been chosen by In search of Alpha editors.