Not too long ago, just a few media retailers have warned of the upcoming demise of the petrodollar settlement, generally referred to as the petrodollar. With such narratives comes investor anxiousness. Contemplate the next headlines on the subject.

OPEC Will Sever Hyperlink With Greenback For Pricing Oil- The New York Occasions

The Petrodollar Is Useless and that’s a giant deal- FX Road

After 50 Years, Demise of the Petrodollar Sign Finish of U.S. Hegemony- The Road Professional

Earlier than leaping to conclusions, let’s focus on what the petrodollar is and isn’t. With that data, we are able to deal with issues in regards to the loss of life of the petrodollar. Moreover, we are able to discredit menacing headlines like- Petrodollar Deal Expires; Why This Might Set off ‘Collapse of All the pieces.’

Earlier than beginning, we have to make a disclaimer. The New York Occasions article we bullet level above will not be current. We added it to indicate this isn’t a brand new story. The article dated June 1975 begins as follows:

LIBREVILLE, Gabon, June 9 — The oil‐producing nations agreed in the present day to sever the hyperlink between oil costs and the greenback and to start out quoting costs in Particular Drawing Rights, the governor of the Iranian nationwide financial institution, Mohammed Yeganeh, stated.

What Is The Petrodollar?

In 1974, following the economically devastating oil embargo through which the value of per barrel rose four-fold, sparking a surge in inflation and weakening the financial system, the U.S. desperately sought to keep away from one other embargo in any respect prices. U.S. politicians theorized {that a} stronger relationship with Saudi Arabia would go a good distance towards reaching its objective.

Thankfully, the Saudis additionally hoped for a helpful relationship with the U.S., they usually wanted a reliable funding dwelling for his or her new oil riches. Additionally they desired higher army tools. On the time, Saudi Arabia was operating an enormous price range surplus due to its windfall from excessive oil costs and comparatively minor spending wants from throughout the nation.

Whereas there was by no means a proper petrodollar pact, it’s extensively believed that the U.S. and Saudi Arabia had a handshake settlement to fulfill one another’s wants. Saudi Arabia was inspired to speculate its surplus in protected, high-yielding U.S. Treasury securities. In trade, the U.S. would promote Saudi Arabia’s army tools. Each hoped a greater relationship could be a productive byproduct. Such is the petrodollar settlement.

The Petrodollar Was Not Actually About The Greenback

We expect the petrodollar discussions have been principally about Saudi Arabia needing a protected dwelling for his or her surpluses and the U.S. in search of {dollars} to fund her massive fiscal deficits. Whereas the greenback could be the foreign money for stated transactions, it was not going the main target of the talks.

In coping with the immense prices of the Vietnam Warfare and impressive social spending to pacify social unrest, America sought deficit funding. Saudi Arabia wanted to put money into its surpluses. Given the unprecedented liquidity and security of the U.S. Treasury market in comparison with different choices, the “settlement” made a variety of sense for each events. Moreover, as a result of Saudi oil income could be used to purchase dollar-based U.S. Treasury bonds, it made sense for Saudi Arabia to require different oil consumers to pay in U.S. {dollars}.

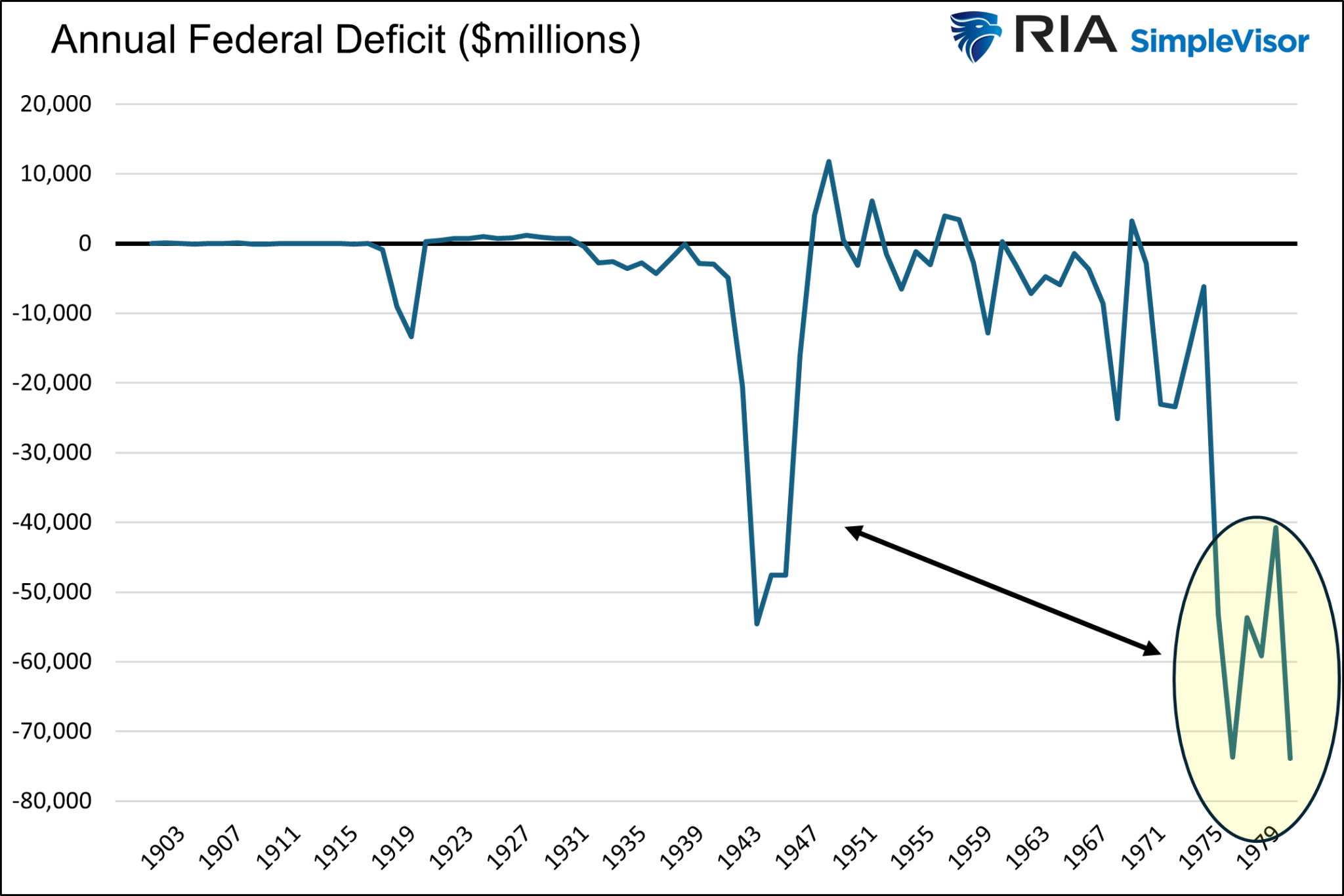

We share two graphs to higher respect the deteriorating U.S. fiscal place on the time. The primary graph under highlights the deficits throughout the mid-Seventies. As we speak, many would think about a $50—or $60 billion deficit minimal. However then, the deficits incurred have been a pointy departure from the norm.

The second graph supplies correct context. The nation was experiencing extra vital federal deficits within the mid-to late Seventies than it confronted throughout World Warfare II. Given the immense spending on World Warfare II, that truth was beautiful to many individuals on the time.

Saudi Arabia Doesn’t Have Investible {Dollars}

As we speak, the scenario is totally different. America nonetheless desperately wants funding, however Saudi Arabia doesn’t have price range surpluses to speculate. Per a Bloomberg article entitled The Petrodollar Is Useless, Lengthy Dwell The Petrodollar:

Quick ahead to in the present day, and Saudi Arabia doesn’t have a surplus to recycle in any respect. As a substitute, the nation is borrowing closely within the sovereign debt market and promoting property, together with chunks of its nationwide oil firm, to finance its grand financial plans.

True, Riyadh nonetheless holds vital onerous foreign money reserves, a few of them invested in US Treasuries. Nevertheless it’s not accumulating them anymore. China and Japan have vital extra money tied up on the American debt market than the Saudis do.

The Reserves Monopoly

Many consider the U.S. authorities bullies international nations into utilizing the greenback, thus forcing them to have greenback reserves. Such appears logical because the reserves have to be invested and will help fund our deficits.

We have no idea what our legislators say to different nations behind closed doorways. However we presume some “persuasion” presses different nations to make use of the greenback. Regardless, there aren’t many choices for the greenback.

The U.S. affords different nations one of the best place to speculate for 4 major causes. As we define in :

The 4 causes, the rule of regulation, liquid monetary markets, and financial and army may, all however assure the loss of life of the greenback is not going to happen anytime quickly.

No different nation has all 4 of these traits. China and Russia lack the rule of regulation and liquid monetary markets. Russia additionally has a small and fragile financial system. Europe doesn’t have liquid sufficient capital markets or army may.

and are sometimes rumored candidates to usurp the greenback. For starters, they don’t earn a return on funding. Probably extra problematic, their costs are extremely risky. There are a lot of different difficulties precluding them from full-fledged foreign money standing, which we are going to save for one more article.

Abstract

However whether or not there was a proper settlement, the petrodollar will not be going anyplace. Even when Saudi Arabia accepts , , , or gold for its oil, it might want to convert these currencies into {dollars} in nearly all situations.

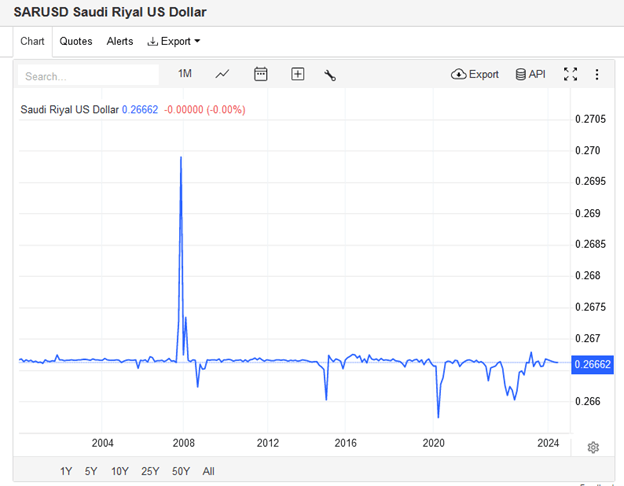

Contemplate that Saudi Arabia retains its foreign money worth pegged to the greenback, as proven within the graph under, courtesy of Buying and selling Economics. Additionally they maintain roughly $135 billion of U.S. Treasury securities, a three-year excessive. Does it appear to be Saudi Arabia is attempting to disassociate from the U.S. greenback and U.S. monetary markets?

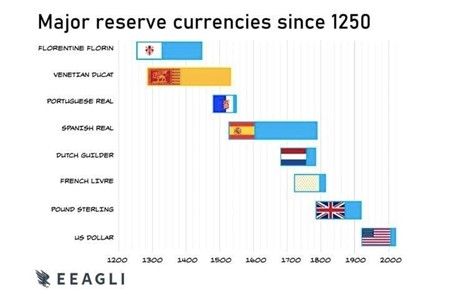

Tales like these on the petrodollar and others on the “imminent” loss of life of the greenback have been round for many years. Sometime they are going to be proper, and the greenback will observe the best way of prior international reserve currencies. However for that to occur there must be a greater different, and in the present day, nothing even shut exists.