Boy Wirat

Overview

Eagle Level Credit score (NYSE:ECC) is a closed finish fund that invests in fairness and junior debt tranches of Collateralized Mortgage Obligations. CLOs might current an elevated degree of threat however shareholders are rewarded for taking up this increased degree of threat by way of a better distribution fee. I mentioned the precise dangers of CLOs in my earlier article titled: ‘Earn A Excessive Yield From CLOs‘ that I like to recommend studying by way of for extra context across the construction this fund follows. The fund’s goal is to generate excessive ranges of present earnings and this makes it a lovely fund for buyers that want to construct a large earnings stream from their portfolio.

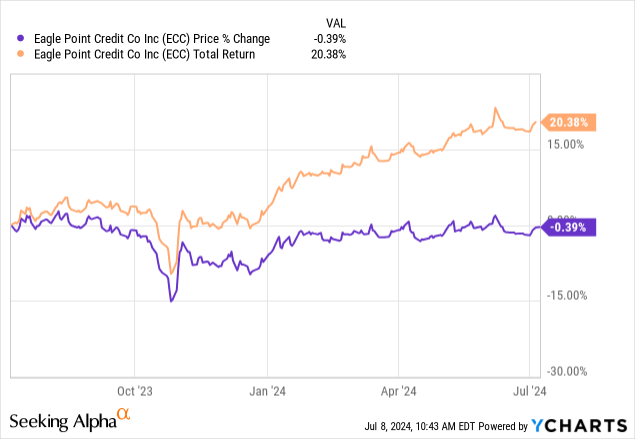

We are able to see that the worth has remained comparatively flat during the last twelve months. Nevertheless, the excessive distribution yield of 16.5% has helped ship a complete return better than 20% over the identical timeframe. The truth that the distribution is paid out on a month-to-month foundation additionally provides to this enchantment. I might be looking at the newest earnings knowledge to evaluate how steady and protected the present distribution fee is in the meanwhile.

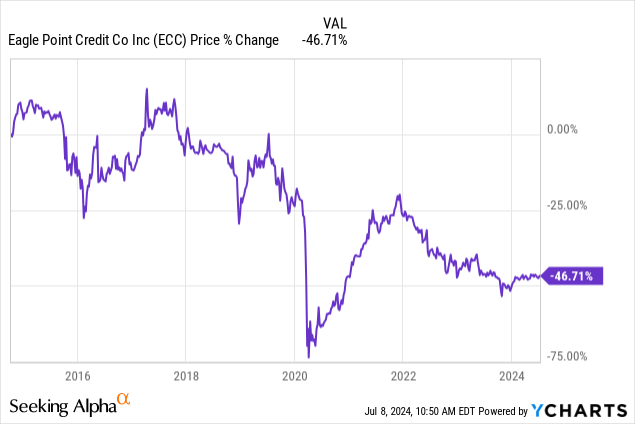

Relating to valuation, it may be a bit difficult to know when the suitable time for entry is. In spite of everything, some buyers might get a bit nervous when trying on the value chart alone and seeing ECC down nearly 50% since inception. I would not blame a number of the much less risk-averse buyers for staying away out of worry, however I needed to additionally talk about my present ideas on valuation and what makes this a good time for entry. There are a number of totally different macroeconomic components right here at play which have the potential to function a value catalyst over the subsequent twelve months as effectively.

I needed to first present a short overview of what ECC’s portfolio contains in addition to the methods applied. I consider that their present portfolio would see a variety of aid and potential progress from future rate of interest cuts which are on the horizon. Only for some added context, ECC has an inception relationship again to 2014 and is externally managed by Eagle Level Credit score Administration.

Portfolio Catalyst & Dangers – Curiosity Charge Cuts

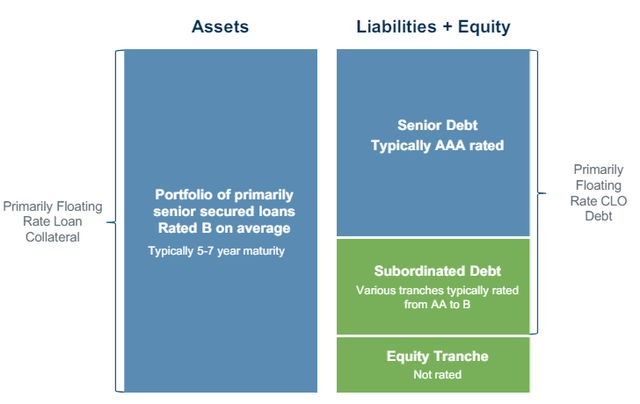

Collateralized mortgage obligations are a credit score product that consists of a structured pool of loans which were bundled collectively. Consider this construction as a totem pole, as illustrated under. The highest of the totem pole is taken into account the least dangerous as a consequence of its increased degree of compensation precedence. Conversely, the underside of the totem pole is essentially the most dangerous since this tranche is usually paid out final. ECC operates within the riskiest tranche, which is the fairness degree.

Though the riskiest degree, CLO fairness is finally a lovely asset class when noticed over a protracted time frame. As an illustration, the Credit score Suisse Leveraged Mortgage index has recorded optimistic whole returns every calendar yr relationship again to 1992, aside from the disaster in 2008. This can be a degree of threat that buyers have to be comfy with earlier than contemplating an funding into ECC.

ECC Presentation

One other vital facet of CLOs is that these swimming pools of debt are usually associated to firms which are under funding grade rated. Referring to the identical illustration above, we are able to see that ECC’s portfolio focuses on main publicity to floating fee CLO debt as effectively. There are 1,793 underlying mortgage obligors as a part of their portfolio, in addition to 152 totally different fairness securities inside. Their present publicity to floating fee senior secured loans sits at 97.4%. A floating fee based mostly portfolio can effectively capitalize on this increased rate of interest setting that we’re in by accumulating increased curiosity from debtors. Whereas this idea is nice for earnings era, there additionally lies a vulnerability for the obligors and securities held inside.

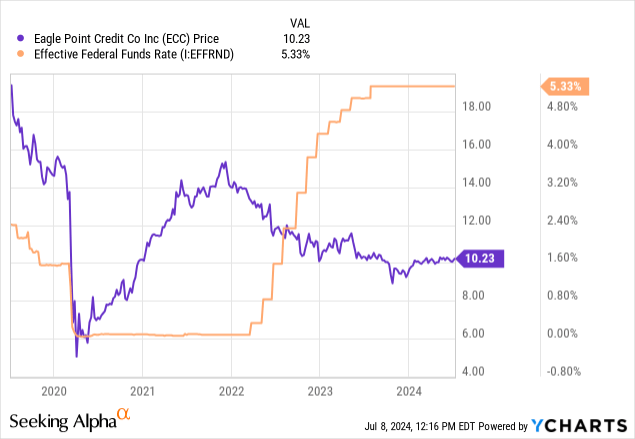

Greater rates of interest can concurrently put extra pressure on borrowing firms because the required value of debt upkeep will increase. The federal funds fee has sat at a decade excessive for nearly a yr now and consequently, we are able to see a better quantity of defaults throughout the CLO construction. Because the fairness tranche makes up a big portion of ECC’s portfolio, this might result in a falling share value or internet asset worth over time for the reason that fairness tranche is the primary to soak up the losses.

It is no coincidence that the worth of ECC has just lately shared an inverse relationship with the federal funds fee. We are able to see that when charges have been reduce to close zero ranges in 2020, the market noticed an elevated quantity of debtors since buying debt capital was low-cost. Conversely, when charges quickly rose beginning in 2022, ECC’s value began to lower.

This similar idea might be utilized when trying ahead as effectively. I consider that there are a number of indicators that might sign that the beginning of rate of interest cuts could also be on the horizon. The Fed has constantly saved rates of interest unchanged during the last a number of conferences and defined that they’re awaiting extra financial knowledge to roll in round inflation, the labor market, and shopper spending. The present inflation degree has slowly ticked down during the last two months and we will see if this pattern continues when the newest report is launched on July eleventh. As well as, the newest unemployment fee now sits at 4.1% and has steadily elevated for a couple of yr straight now. Lastly, the US Presidential election is occurring on the finish of 2024 and this could create elevated ranges of uncertainty available in the market. The mixture of this stuff might be superb circumstances to incentivize the Fed to start chopping charges as a strategy to stimulate the financial system.

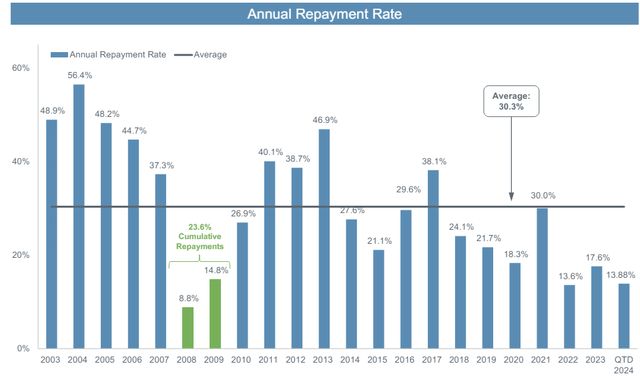

Rate of interest cuts may function a catalyst for value and NAV progress. Because the setting for borrowing turns into extra engaging, we may probably see excessive volumes of debtors. This could doubtlessly unlock much more offers for ECC that administration can use to proceed rising their general portfolio. Just like the worth motion talked about earlier than, we may additionally see ECC’s value begin to admire as they benefit from this elevated borrower quantity. This concept can be conceptualized when trying on the annual compensation charges. Discover how the annual compensation charges rose considerably in 2021 as charges have been at close to zero ranges but additionally began to lower over 2022 as charges started rising.

ECC Presentation

This exhibits that rate of interest cuts can even present a ample degree of aid for present debtors inside ECC’s portfolio. As rates of interest get reduce, the required amount of money allotted in the direction of debt upkeep would lower, assuming the borrower was on a floating fee foundation. Because of this ECC’s portfolio high quality may find yourself yielding higher outcomes and quicker repayments in a decrease fee setting. Sooner repayments signifies that ECC would acquire entry to extra capital to then put in the direction of new investments that might gasoline progress going ahead.

Financials

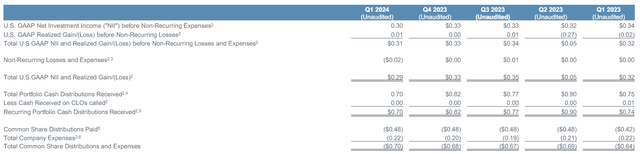

Referencing the newest Q1 earnings report, recurring money amounted to $0.70 per share whereas whole NII and realized beneficial properties amounted to $0.29 per share. These have been decreases over This autumn totals of each recurring money and NII and realized beneficial properties, totaling $0.82 and $0.33 per share respectively. Nevertheless, the lower was attributed to the actual fact that there have been increased mortgage prepayments in This autumn of the prior yr. This implies that there have been fewer energetic loans of their portfolio that have been contributing to the web funding earnings by way of curiosity funds.

ECC Presentation

Nevertheless, this was offset by roughly $131M that was deployed into new capital investments that may contribute to general portfolio progress. I consider that ECC will proceed to prioritize new investments as they proceed to unload positions that have been bought at engaging ranges during the last two years. Moreover, regardless of there being a drop in NII realized beneficial properties and recurring money, ECC noticed a rise in whole gross earnings from a mixture of its publicity to CLO fairness and CLO debt.

CLO fairness introduced in funding earnings totaling $30.84M for the quarter and earnings from CLO debt introduced in $4.89M. Together with all different avenues, Whole gross earnings landed at $40.80M, which was a big enhance over the $31.92M for Q1 of 2023. I anticipate these numbers to extend as rates of interest are reduce. Rate of interest cuts might introduce a bunch of latest alternatives and offers that may hit the market as borrowing circumstances finally turn out to be extra engaging and reasonably priced.

As the quantity of alternatives will increase, this might enhance the chance that the present distribution fee might be sustained. The web funding earnings, realized beneficial properties, and recurring money ranges may actually be negatively impacted from decrease charges, as ECC would finally usher in much less earnings by way of its publicity to floating fee loans. In the meanwhile although, the distribution is effectively maintained and long run shareholders proceed to be rewarded by way of supplementals.

Dividend

As of the newest declared month-to-month dividend of $0.14 per share, the present dividend yield sits at 16.5%. Money stream has been so robust that ECC has additionally introduced month-to-month supplementals by way of September of this yr, totaling $0.02 per share for every month between every now and then. If we break the bottom distribution out to a quarterly view, we get a quarterly base distribution whole of $0.42 per share. Including within the supplemental distributions takes the entire quarterly payout to $0.48 per share. Recurring money flows of $0.70 per share for the quarter covers this distribution, which signifies that the distribution is roofed by about 145%.

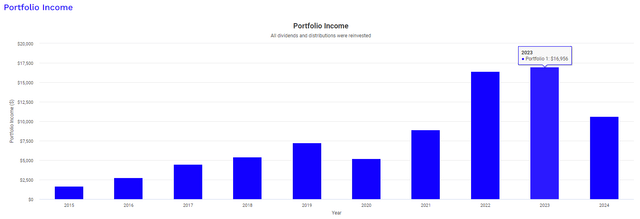

The annual payout quantities for ECC can fluctuate based mostly on efficiency however that does not imply that this is not a terrific alternative for earnings compounding. That is assisted by ECC’s dividend reinvestment coverage that helps reinvest distributions at a slight low cost to NAV. The newest annual report explains how the corporate permits distributions to be reinvested at a reduction as much as 5 p.c of the market value, if the market value exceeds the NAV per share. I can not affirm if all brokerages enable for this however I do know for certain that Constancy is able to reinvesting distributions on the acknowledged low cost.

To assist visualize the earnings progress right here, I ran a again check with Portfolio Visualizer. This graph assumes an unique funding of $10,000 at the beginning of 2015 and likewise assumes a set month-to-month contribution of $500 monthly. This calculation additionally contains all dividends being reinvested at market value all through all the holding interval. In 2015 your dividend earnings would have totaled $1,645. This whole would have grown to $16.956 in 2023 and we are able to actually see the massive spike in earnings as soon as charges began to get hiked in 2022. We are able to additionally see the alternative occur in 2020, as charges have been reduce to close zero ranges and ECC’s distribution took a slight dip.

Portfolio Visualizer

One thing price mentioning right here is that almost all of the distribution acquired right here is classed as bizarre dividends. Atypical dividends have much less favorable tax penalties in comparison with the certified dividends you’d obtain from conventional dividend progress shares. Subsequently, ECC could also be greatest utilized in a tax advantaged account based mostly in your private scenario.

Valuation

By way of valuation, ECC does at present commerce at a premium to NAV of about 12.7%. Because of this the beforehand talked about dividend reinvestment low cost applies in the meanwhile. For reference, this can be a bit of a better premium than the ten.7% the worth traded at after I final lined ECC. Nevertheless, we are able to see that the worth traded at a a lot bigger 30% premium to NAV earlier within the yr across the begin of Could. Moreover, this present premium sits above the typical three yr premium to NAV of about 9.3% which signifies that ECC is comparatively costly right here.

CEF Information

Nevertheless, I preserve my purchase score as a result of I do consider rate of interest cuts will finally increase valuations inside their portfolio and enhance the quantity of offers that ECC can pursue to develop their portfolio. As acknowledged from their newest earnings name, the upper charges have induced some extra loans to default. Consequently, decrease rates of interest can present their portfolio a little bit of aid and finally enhance the standard of investments inside, because it offers debtors a bit extra respiratory room.

Through the first quarter, we noticed solely six leverage mortgage defaults. As of quarter finish, the trailing 12 month default fee declined to 1.14%, which is effectively under the historic common of two.7%. Whereas the default fee might enhance from these ranges because the yr progresses, we additionally proceed to consider analysis desks are considerably overestimating the near-term default threat as lots of the underlying mortgage debtors in our CLOs have continued to see income and EBITDA progress, which helps to offset the affect of upper charges. – Tom Majewski, CEO

Subsequently, I plan to proceed reinvesting my distributions and will probably add on any value drop alternatives. The premium may enhance because the portfolio continues to develop. Even when the premium would not enhance, I plan so as to add on any drops in premium to NAV to proceed rising my distribution earnings.

Takeaway

In conclusion, I preserve my purchase score on ECC as administration continues to spend money on the expansion of their portfolio. As prepayments begin to enhance, this might point out the top quality underwriting skills of the administration. Although the worth at present trades at a premium to NAV, I nonetheless see worth right here as ECC could be a robust compounder of earnings. The dividend reinvestment low cost profit is a big plus for long run holders for the reason that value at present trades at a premium. Future rate of interest cuts might function a catalyst for progress as they enhance the quantity of debtors searching for debt capital. On the similar time, rate of interest cuts may additionally present aid for his or her portfolio of investments and enhance the general high quality. Regardless of CLOs sustaining a better degree of threat, the efficiency over lengthy durations of time nonetheless stays a lovely asset class.