Pgiam/iStock by way of Getty Pictures

Funding thesis

Based mostly in Hilliard, Ohio, Superior Drainage Techniques, Inc. (NYSE:WMS) is a worldwide producer of progressive water administration options. It predominantly operates within the stormwater and septic wastewater markets, however the firm’s full suite of merchandise can also be pivotal throughout development and agricultural purposes globally. WMS is additional distinguished by its intensive patent portfolio, which offers aggressive benefits by way of capital-light enterprise returns within the area of water administration applied sciences.

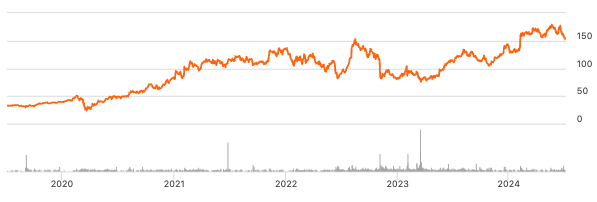

Determine 1. WMS share value evolution, final 5-years

Searching for Alpha

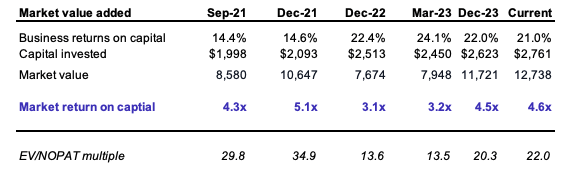

The inventory is +20% within the final 6 months, however shopping for began to exhaust following WMS’ FY’24 leads to Might. Key takeouts have been (i) the +14% dividend enhance to $0.16/share, and (ii) the +22% returns on capital employed within the enterprise. Given this, my observations are the market has absolutely captured this worth at its present multiples – to commerce larger than the present 22x EV/NOPAT and 4.6x EV/IC multiples is simply too far a stretch for my part.

The valuation baton should be handed to fundamentals and my opinion is administration can drive worth by 1) margin progress [post-tax margins are +8 percentage points to ~20% from FY’21-24], 2) administration committing additional assets to progress, competitiveness + efficiencies [i.e. further margin growth], and three) utilization of surplus money flows [the average FCF is ~$435 million every rolling 12 months].

Nevertheless, as a result of sensitivity to working margin vs. further worth drivers, I’m maintain on WMS, in search of a extra engaging beginning valuation. Internet-net, fee maintain.

Why WMS is a good enterprise

Credit score should be served the place credit score is due. WMS is a good enterprise for a number of causes, beginning with its certified progress report. Progress is meaningless except listed towards the capital used to engender it.

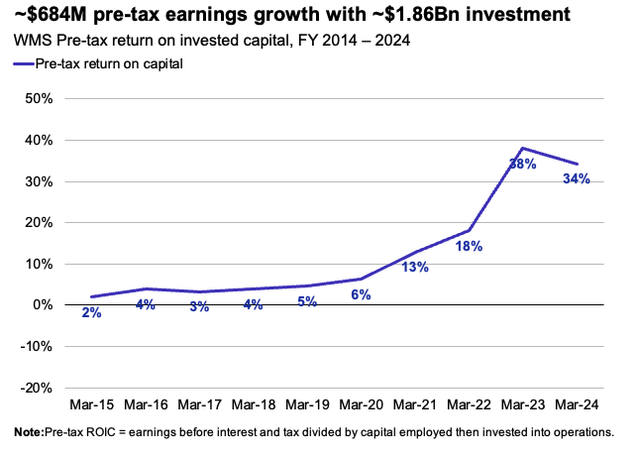

In that vein, the worth of earnings per $1 of capital invested into WMS’ operations has compounded exceptionally: Working earnings of ~$39mm in FY’14 grew to $723mm in FY’24, thus WMS’ administration compounded earnings at CAGR +33% per yr for 10 years producing $684mm in incremental earnings progress (pre-tax), That is towards a $1.86Bn enhance in capital required to keep up these earnings – solely 15.8% CAGR, Thus we see +$684mm earnings progress on +$1.86Bn incremental funding, tallying ~36% marginal return on funding. Though, it’s extra nuanced than this – from FY’15-’20, the incremental return on WMS’ new belongings was ~21%. However from FY-20-’24, it shed ~$584mm of capital from its base [inc. through dividends], but working earnings elevated by $554mm, totalling ~5.4x return on its current belongings. This was all margin-related, as capital effectivity remained roughly the identical.

Discovering funding managers that may compound capital at +35% over an prolonged interval is difficult. Not to mention by numerous market cycles and so on.

Determine 2.

Firm filings, writer

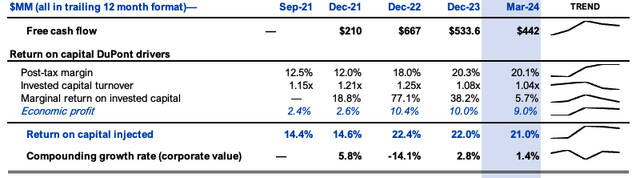

Returns are pushed by 1) growing post-tax margins [management added 750-800bps to NOPAT margin since FY’21], and a pair of) moderately environment friendly turnover on its investments. Critically, the financial leverage on WMS’ investments is excessive – administration methodically produced double-digit returns on its new investments from FY’21-’23 (Determine 3). This follows intensive reinvestments into working effectivity for automation, manufacturing + recycling capability and elevated productiveness. They have been additionally >12%, indicating substantial financial worth add – however the development waned in FY’24, corroborating the exhausted development. Subsequent freely obtainable money greater than doubled, and administration appears to comfortably produce ~$450mm in FCF at this tempo of enterprise each 12 months. The questions now are 1) what alternatives do administration have in entrance of itself now, 2) the place can the funds be redeployed [outside of dividends + buybacks], and three) how lengthy will this benefit interval final?

Determine 3.

Firm filings, writer

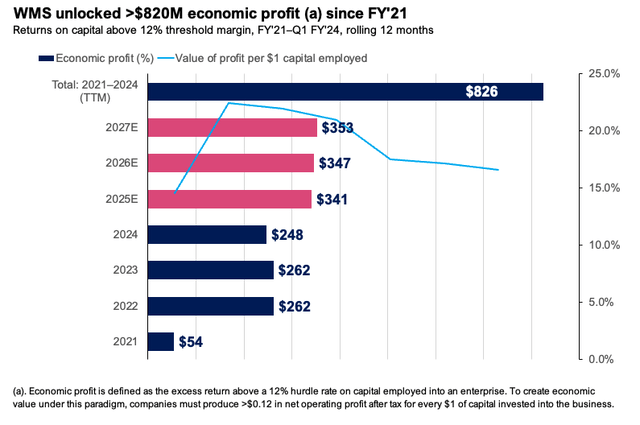

The magnitude of financial worth has totalled ~$830mm since FY’21 for my part – judged by the cumulative financial earnings (“EPs”) administration produced since 2021 [EP is the surplus return above a 12% hurdle rate. This figure represents the LT market averages, and thus the opportunity cost of holding the indices. It is also a reasonably high watermark to pass]. Buyers have paid a 3.5x a number of on this, including ~$2.9Bn in enterprise worth because the finish of 2021. This a number of is consistent with its historic EV/IC ranges of 3-4.5x. Based mostly on my FY’24-’27E estimates, it may produce a cumulative c.$1Bn in EP over the following 3-years. Assuming the 3x a number of, that is +$3Bn incremental market worth, getting us to ~$15.9Bn implied EV by 2027.

Determine 4.

Firm filings

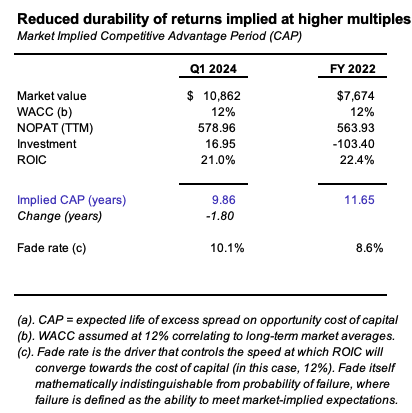

Administration tasks ~$250-$300mm capital spend in FY’25 which is >2x the historic vary of FY’21-’24. This equals ~30% of est. EBITDA of $980mm on the higher finish of the vary, on gross sales of ~$3Bn. Crucially, this suggests ~32% adj. EBITDA margin, equal to this yr’s consequence. My assumptions are in keeping with these estimates [see: Appendix 1]. My estimate is the anticipated lifetime of WMS printing >12% ROICs is ~9-10 years, with a fade fee of ~10% to the company common return of 6-7% (Determine 4). Notably, that is down from FY’22, and suits with the sideways motion in inventory value. The embedded threat to the thesis is a a number of contraction of ~0.5x in my worst-case situation. Why? As a result of the expectations on its ahead progress is larger than in FY’22, for example. This implies the margin for error is larger – a 26% EBIT margin is required to commerce larger from right here, for my part. Administration can do that, for my part, however ought to it fail [due to any litany of factors] – WMS’ valuation is extremely delicate to this.

Determine 5.

Writer estimates

Determine 6.

Writer estimates

Valuation extremely delicate to pre-tax margins

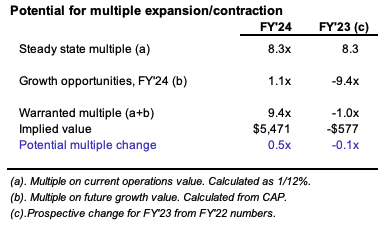

Buyers have captured a number of issues nicely in WMS’ present market worth – 1) current margin progress, 2) administration’s capital allocation + the outcomes of, 3) the upper dividend [indicative of earnings quality] and 4) the long run worth of its progress alternatives.

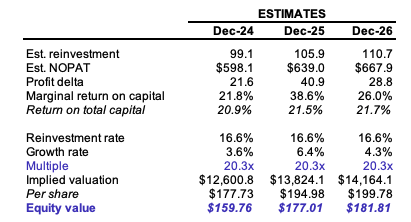

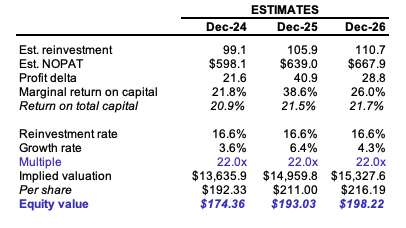

The place WMS trades from right here is most delicate to working margin vs. capital effectivity. Assuming 1) 2.2% compounding gross sales progress to FY’26, 2) 26% pre-tax margins with 23% tax fee, and three) a capital reinvestment fee of ~$1.50 per $1 of revenues [due to management’s planned investment ramp], I get to an implied worth of $181-$188/share by FY’26E, with the inventory buying and selling at a lowered a number of of 20.3x EV/NOPAT and 4.4x EV/IC. That is simply ~6% CAGR and never sufficient flesh to placed on the skeleton.

Valuation insights

Valuations are supported to ~$180-$188/share by FY’26E at ~20x my FY’24 estimates of NOPAT. Notably, the essential issue is the margin progress shifting ahead. The essential elements are that my estimates bake in: ~26% pre-tax margins, +300bps on the FY’21-’24 common, ~1.0x turnover on capital invested into WMS’ enterprise operations. As such, the important thing threat is that margins do not maintain this stage [they are 26% in the TTM, consensus expects similar in FY’24 too]. If WMS prints working margins of, say, 22% to FY’26 as a substitute, the inventory appears overvalued to me. Thus, all of it hinges on the marginal evaluation shifting ahead. Relating to WMS holding >25% margins pre-tax, that is supported by 1) strengthening fundamentals within the infrastructure, constructing and agricultural sectors, and a pair of) administration’s strengthening the corporate’s ROICs [I see a competitive advantage period (“CAP”) of ~9-10 years, below FY’22, but still high], with 3) a fade fee of ~10% to the long-term company common 6-7% return on capital, and 4) administration’s clear efforts in investing for effectivity. Right here is the CEO’s language from the FY’24 name:

In fiscal 2025, we’ll obtain our steerage by quantity progress and glued price absorption in addition to operational effectivity as we reap the profit from capital investments we now have made in manufacturing and transportation during the last a number of years…

…As you’ll recall from earlier quarters, we now have talked about investing in our enterprise to strengthen our aggressive place when the market recovers and that’s precisely what we’re doing at this time

Buyers have re-rated the inventory sharply off FY’22 lows as fundamentals improved considerably. We now pay ~22x NOPAT and 4.6x invested capital to purchase WMS at this time. Administration invested ~$763mm incrementally from FY’21, and traders elevated the EV by $4.15Bn. Thus, every $1 funding created $5.45 in new market worth. My statement is the market values the earnings produced by each new $1 of capital WMS invests at ~4.5-5.5x. The danger, for my part, is a contraction again to ~20x NOPAT or much less, that means fundamentals want to choose up the slack.

Determine 7.

Writer, Searching for Alpha

If traders keep the present 22x a number of, I get to $15.3Bn in EV, or $198/share – however WMS has to provide the extent of EP described earlier for my part. It relies on whether or not traders proceed paying the excessive premium or not – backing the multiples off, fundamentals aren’t there to do the heavy lifting. Extra so if the margin compresses – if it does 23% pre-tax margin as a substitute, even on the 22x, the valuation is ~$175 by FY’26E, and the inventory appears overvalued by ~$25/share at this time.

Determine 8.

Writer

Determine 9.

Writer

Critically, I’m operating very conservative assumptions to see if WMS can nonetheless surpass extra pessimistic markets. On the enterprise aspect, it could [+20% returns on its operating capital, high and stable FCF, increased reinvestment at these high rates]. To point out how delicate the valuation is to its pre-tax margins, ran the situation of ~23% working margins, however elevated the implied reinvestment fee to ~30% of NOPAT [roughly in line with management’s plans]. Right here we get to ~$198/share by FY’26, however we nonetheless want the 22x a number of.

Dangers

Draw back dangers to the thesis embody 1) WMS not hitting a pre-tax margin vary >25%, 2) substantial enhance in OpEx for a similar purpose, and three) sharp contraction in multiples in direction of 22x NOPAT.

Upside dangers embody the very fact it may hit the 26% margin, which justifies the next valuation, the very fact administration are reinvesting larger sums within the enterprise, which may produce outsized outcomes, and the potential for charges to decrease sooner than anticipated, making a tailwind for fairness valuations.

In brief

Given the valuation calculus’ sensitivity is most skewed to the upside from a single variable [operating margins] versus a mixture of drivers [sales growth, margins, capital turnover, reinvestment, and so forth] my confidence in gauging the valuation is diminished. While I’m bullish on the inventory, my conviction is lowered by the very fact 1) traders have captured a lot of the corporate’s progress alternatives within the present valuation, and a pair of) the expectations are exquisitely excessive on it hitting desired efficiencies. Small adjustments within the estimates of margin have an outsized influence on my estimates of worth simply 3 years out – one can solely think about the asymmetries in longer forecast intervals for DCF functions. As such, my views are that (i) WMS is a good enterprise, however (ii) the potential for outsized funding returns is small at present valuations.