Oselote

Introduction

Catching the synthetic intelligence wave felt unattainable after lacking the preliminary surge. Inventory costs surged virtually an excessive amount of, and valuations appeared excessive.

Nevertheless, high quality shares with respectable AI publicity saved going up and buyers saved investing with out caring for the worth. A well known instance is NVIDIA Company (NVDA) which is up 161% year-to-date on the time of this text’s writing, after the 236% improve in 2023. The inventory appeared untouchable in January and nonetheless appears so now.

Nevertheless, this isn’t a great way of evaluating shares. So long as corporations will not be priced precisely primarily based on their projected earnings, there could also be room to run for them. The explanation all these corporations surged a lot in worth was not purely hype, fundamentals have been considerably enhancing as nicely.

That’s the reason I began taking a look at these corporations once more. Amazon.com, Inc. (AMZN) was my first purchase article within the AI area, and I highlighted my curiosity in corporations constructing synthetic intelligence infrastructure.

As we speak, we’re discussing one in every of them. Tremendous Micro Laptop, Inc. (NASDAQ:SMCI) (NEOE:SMCI:CA) gives important merchandise to allow knowledge facilities and new, superior applied sciences. Its inventory has been on a strongly growing pattern since January 2023. With this text, we’ll uncover if this pattern could proceed.

The corporate nonetheless advantages from robust tailwinds and is more likely to proceed to take action for the foreseeable future. Demand for knowledge facilities continues to be growing, and the corporate stays a pacesetter with progressive options.

Nevertheless, primarily based on my DCF valuation, I imagine the corporate is priced for perfection and it’s robust to search out an upside with a snug margin of error. That’s the reason it receives a “Maintain” ranking till a extra snug entry level.

Understanding The Enterprise

Though Tremendous Micro Laptop is a widely known identify, I imagine you will need to have understanding of the enterprise and its drivers.

The corporate calls itself a “supplier of accelerated compute platforms”. Beneath these phrases, there’s a firm promoting server and storage methods for knowledge facilities, cloud computing, edge computing, 5G, and synthetic intelligence (“AI”).

These merchandise embrace servers, storage methods, blades, workstations, full rack scale options, networking gadgets, server sub-systems, server administration, and safety software program. These options might be custom-made primarily based on the shoppers’ wants.

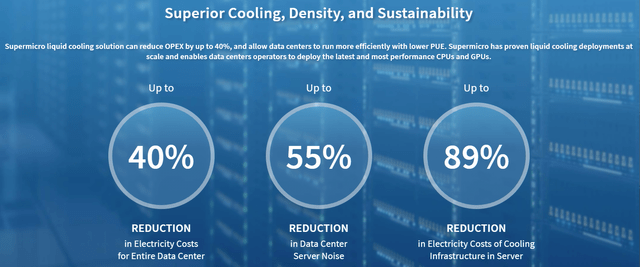

We’ll talk about this in additional element within the “long-term drivers” part, however one of many largest enterprise propositions SMCI has is lowering the price of working knowledge facilities by cost- and energy-efficient merchandise. It is a huge motivator for knowledge facilities to decide on SMCI’s merchandise.

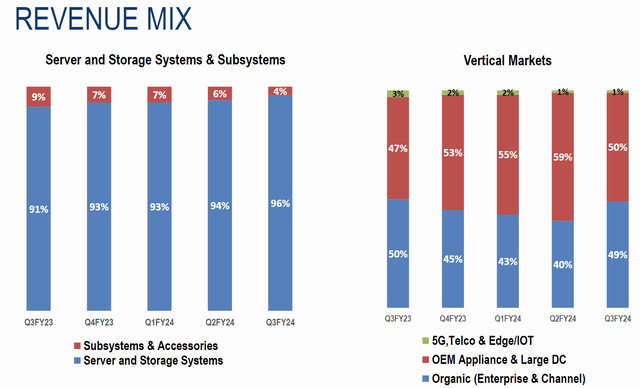

As of Q3 2024, 96% of the corporate’s income was generated by server and storage methods gross sales. Moreover, whereas gross sales to the communications sector weren’t important, half of gross sales had been to knowledge facilities and OEMs, and the opposite half had been to corporations investing of their IT capabilities, and different distributors and companions.

SMCI Q3 2023 Presentation

With the necessity for extra knowledge facilities, SMCI has seen robust demand for its merchandise. With this demand, its income jumped from $3.5 billion in 2021 to $7.1 billion in 2023, and its gross revenue jumped from $530 million to $1.3 billion in the identical interval.

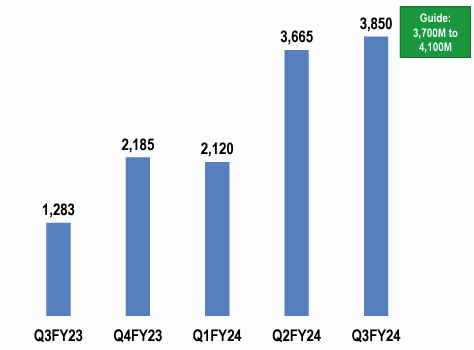

This pattern continued this yr. The corporate reached a formidable $3.85 billion in gross sales in Q3 2024, growing 200% year-over-year.

SMCI Q3 2023 Presentation

Competitors

SMCI goals to be the world’s main supplier of options utilizing accelerated, application-optimized compute platforms providing servers, storage, and networking. To say the least, this can be a crowded area with many established gamers.

The corporate calls corporations like Cisco Programs, Inc. (CSCO), Dell Applied sciences Inc. (DELL), Hewlett Packard Enterprise Firm (HPE), and Lenovo Group Restricted (OTCPK:LNVGY) rivals. Nevertheless, SMCI has sure aggressive benefits over these corporations.

The biggest benefit is the area of interest that SMCI focuses on. Cisco, for instance, has lacked innovation and now finds itself overconcentrated on conventional IT spending, as I mentioned in a current article. Dell and HPE additionally undergo from the identical drawback.

SMCI, alternatively, has proven its means to innovate and supply main options particular to knowledge facilities. Income combine from OEMs and knowledge facilities reached 59% in Q2 and fell again right down to 50% in the newest quarter. Its gross sales channels to knowledge facilities are energetic and producing large earnings, in contrast to its rivals.

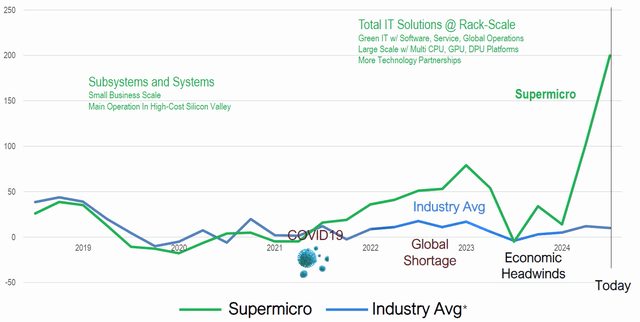

Due to this, the corporate managed to outperform its friends by an enormous margin, particularly in 2024.

SMCI Q3 2023 Presentation

SMCI’s give attention to inner R&D and manufacturing is one other benefit. All servers are examined and assembled in-house, and greater than half of the ultimate server and storage manufacturing is accomplished in SMCI’s services in California. The corporate continues to give attention to innovating, which is essential for industries supplying merchandise for superior applied sciences.

As well as, the corporate’s world footprint with workplaces and manufacturing capability within the US, Taiwan, and the Netherlands gives a price benefit, in addition to proximity to potential patrons.

Lengthy-Time period Drivers Are Sturdy

With this robust aggressive place, SMCI is poised to learn from longer-term developments probably the most. I’ll talk about developments round knowledge facilities first, because the demand from them retains growing.

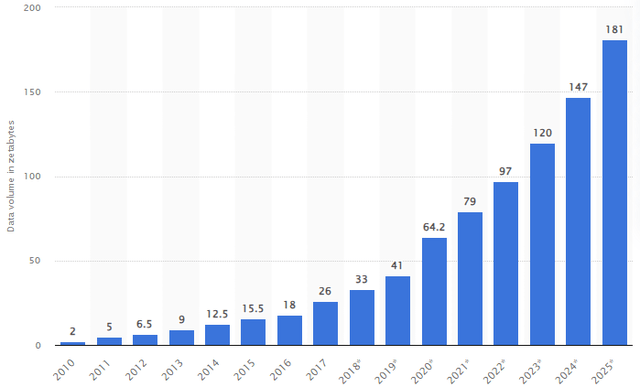

Merely put – the world wants extra knowledge facilities. Technological developments are pushing the present capability to its limits. Synthetic intelligence fashions are skilled on large knowledge units that require more room to be saved and processed. As these fashions enhance and customers construct extra fashions, this area requirement will solely get greater.

This knowledge era pattern isn’t solely pushed by synthetic intelligence. Utilizing the web, creating content material, texting a pal, and sending an electronic mail all generate knowledge that must be saved someplace. The “cloud” is basically a bodily server working in a knowledge heart. Even with out technological developments, it’s sure that we’d like extra knowledge storage capability. In accordance with the newest estimates, we create 402.74 million terabytes of knowledge each single day.

The annual knowledge volumes and how briskly it’s rising might be discovered beneath.

Statista

SMCI is changing into much more important for knowledge facilities due to its innovation. The corporate’s direct liquid cooling options can minimize electrical energy prices and scale back server noise considerably. It’s presently the one server firm that may present this resolution, which is a big short-term driver of development.

supermicro.com

Past knowledge facilities, SMCI’s merchandise are important for high-growth applied sciences like cloud computing, 5G, and edge computing. For instance, edge computing is critical to construct more practical metropolis site visitors administration. This may occasionally take years, however as we finally transition to autonomous automobiles, edge computing will probably be a part of our every day lives.

SMCI will nonetheless be there to allow all these applied sciences.

Bearish Situation

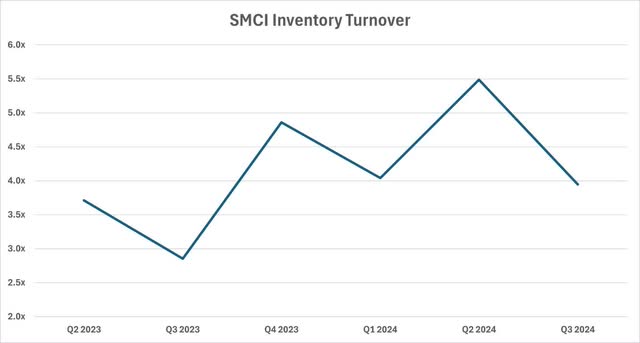

Most consumer-exposed corporations confronted a typical drawback after the preliminary surge in demand post-pandemic. They constructed up stock to produce the demand, however when stock was prepared, demand disappeared.

Though this will appear to be poor demand planning, it is vitally tough to keep away from overproduction when demand is skyrocketing. I concern SMCI would possibly face an identical drawback.

Though gross sales are up, stock elevated disproportionally. It jumped from $1.4 billion in Q3 2023 to $4.1 in Q3 2024. Though the stock turnover is up year-over-year due to considerably greater gross sales, it fell beneath 4x in Q3 2024.

S&P Capital IQ

I do suppose that demand will probably be robust within the brief time period as investments in knowledge facilities and different superior applied sciences proceed. Nevertheless, when demand slows down, I battle to see a state of affairs the place SMCI isn’t left with extra stock at hand.

Moreover, expectations at the moment are too excessive for the enterprise. SMCI tripled its quarterly income and raised full-year steering in Q3 2024, however even this spectacular income was barely beneath expectations. My second concern is that the corporate is priced for perfection, wherein case it will likely be difficult for the corporate to beat estimates.

To grasp market expectations, we have to dive deeper into valuation.

Valuation

We’ll use a Discounted Money Circulate (“DCF”) mannequin for the honest worth calculation.

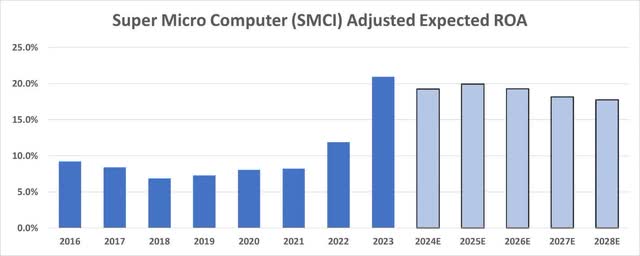

My method to forecasting earnings includes attempting to estimate how worthwhile the corporate can change into and how briskly it will possibly develop. The corporate managed to extend its profitability considerably in 2023. I imagine with present tailwinds, assuming that it’ll preserve these ranges of ROA is cheap. As well as, I mannequin robust development for the subsequent 5 years.

S&P Capital IQ – Writer

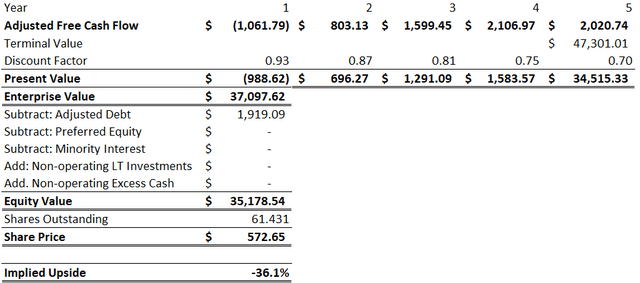

I’m utilizing a terminal development fee of three%, barely above long-term inflation targets attributable to robust development tailwinds, a long-term risk-free fee of two%, a market threat premium of 5.7%, and the inventory’s 5-year fairness beta.

I deal with extra money in another way. Please consult with one in every of my older articles for an in depth description.

Utilizing these earnings assumptions, we discover an fairness worth of $35.2 billion, translating to a goal share worth of $572.65. This suggests a draw back potential of -36% on the time of this text’s writing.

SMCI – DCF Valuation

Conclusion

SMCI is a number one supplier of servers and different networking tools to enterprises, authentic tools producers, and knowledge facilities. It differentiates itself from its friends due to its progressive expertise and powerful gross sales channels to knowledge facilities.

As we generate extra knowledge and wish extra knowledge facilities due to developments in AI and different applied sciences, demand for SMCI’s merchandise is poised to surge. Moreover, SMCI would possibly take a bigger share of this rising market by its newer choices equivalent to direct liquid cooling options.

I feel the corporate will probably be extra worthwhile and see greater development going ahead. Nevertheless, present valuations make me pause. Even when pricing in robust development and excessive profitability, the present inventory worth is considerably greater than my honest worth calculation.

As well as, as excessive stock grew to become an issue for consumer-exposed corporations after demand slowed down, I concern the identical would possibly occur to SMCI as soon as knowledge heart investments decelerate.

That’s the reason SMCI receives a “Maintain” ranking. I wish to revisit this firm as soon as the worth is inside affordable ranges.