BrianAJackson/iStock by way of Getty Pictures

Funding Thesis

Nationwide Nasdaq-100 Threat-Managed Earnings ETF (NYSEARCA:NYSEARCA:NUSI) warrants a maintain ranking on account of its sub-optimal qualities in comparison with peer earnings funds. In comparison with main rivals, NUSI has one of many highest expense ratios and lowest dividend yields. In trade for comparatively excessive charges, the fund has supplied comparatively mediocre efficiency when contemplating capital appreciation, dividend yield, and expense ratio elements. Moreover, the fund traditionally has demonstrated solely restricted draw back safety and has a comparatively unattractive valuation at present on account of its weight on mega-cap, large tech corporations.

NUSI Overview and In contrast ETFs

NUSI is an ETF that seeks to supply buyers with excessive month-to-month earnings by way of an options-based technique with holdings from the Nasdaq-100 Index. Consequently, the fund advertises a hard and fast earnings high quality with lowered volatility. Competing earnings ETFs have gained reputation lately by providing a excessive dividend yield by way of choices, coated calls, or different difficult devices whereas limiting draw back. NUSI was created in 2019 and has 105 holdings with $383M in AUM.

For comparability functions, different funds examined are S&P 500 Threat Managed Earnings ETF (XRMI), SPDR Blackstone Excessive Earnings ETF (HYBL), and JPMorgan Fairness Premium Earnings ETF (JEPI). XRMI owns shares within the S&P 500 Index however achieves a risk-managed earnings technique by utilizing a net-credit collar technique with a mixture of put and name choices on the identical index. HYBL differs from the opposite ETFs in that its earnings era comes from its asset allocation of greater than 96% in bonds, loans, and different debt devices. JEPI is a by-product earnings ETF and makes use of fairness linked notes to supply a powerful dividend with restricted draw back. JEPI, like NUSI, is heavier on IT with a 15.5% weight on data expertise.

Funds In contrast: Efficiency, Expense Ratio, and Dividend Yield

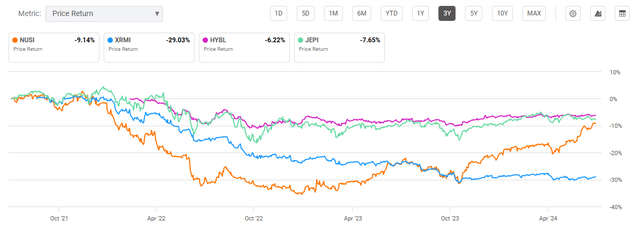

NUSI has seen a 3-year compound annual progress price of 4.23%. The fund’s worst latest 12 months was 2022 with a -28.26% decline, whereas its finest 12 months was 2023 with a 31.51% rise. XRMI has seen the worst latest efficiency, with a mean annualized worth return of -1.03% since its inception in 2021. Since HYBL’s 2022 inception, the fund has seen a mean annual return of 4.3%. Lastly, JEPI has seen the perfect annualized 3-year return of 6.98%.

3-Yr Complete Worth Return: NUSI and In contrast Threat-Managed Funds (In search of Alpha)

A key downside for NUSI is its charges. At 0.68%, solely HYBL has a better expense ratio. As proven within the efficiency comparability earlier, buyers might obtain comparable worth return with JEPI at a a lot decrease 0.35% expense ratio. A major goal for every fund is earnings, measured by dividend yield. These vary from 6.8% to 12.2% for the in contrast ETFs. NUSI presents the bottom yield, which has seen a unfavourable dividend progress CAGR over the previous three years.

Expense Ratio, AUM, and Dividend Yield Comparability

NUSI

XRMI

HYBL

JEPI

Expense Ratio

0.68%

0.60%

0.70%

0.35%

AUM

$383.17M

$35.66M

$148.99M

$33.65B

Dividend Yield TTM

6.80%

12.19%

8.24%

7.35%

Dividend Progress 3 YR CAGR

-6.22%

N/A

N/A

-4.54%

Click on to enlarge

Supply: In search of Alpha, 9 Jul 24

NUSI Holdings and Key Concerns

As a result of it tracks corporations inside the Nasdaq-100, NUSI is unsurprisingly heavy on data expertise at 49.9% weight. NUSI’s high 10 holdings weight additionally stands at a comparatively heavy 51.55%. With 105 holdings, NUSI is the least diversified fund in contrast.

Prime 10 Holdings for NUSI and Peer Earnings ETFs

NUSI – 105 holdings

XRMI – 507 holdings

HYBL – 538 holdings

JEPI – 131 holdings

AAPL – 8.81%

MSFT – 7.55%

SRLN – 3.58%

AMZN – 1.74%

MSFT – 8.66%

AAPL – 7.16%

PARPK 2021 – 0.99%

MSFT – 1.72%

NVDA – 8.04%

NVDA – 6.87%

ALSN 3.75 – 0.64%

META – 1.70%

AVGO – 5.27%

AMZN – 3.98%

ADVGRO – 0.59%

TT – 1.65%

AMZN – 5.13%

META – 2.53%

DVA 4.625 – 0.57%

PGR – 1.64%

META – 4.66%

GOOGL – 2.42%

ALLY 6.7 – 0.57%

GOOGL – 1.60%

TSLA – 3.05%

GOOG – 2.03%

NUGGET – 0.54%

INTU – 1.55%

GOOGL – 2.78%

AVGO – 1.66%

ARES – 0.54%

MA – 1.48%

GOOG – 2.70%

BRK.B – 1.61%

GARDA – 0.53%

SO – 1.46%

COST – 2.52%

LLY – 1.59%

SUN 4.5 – 0.52%

NOW – 1.44%

Click on to enlarge

Supply: A number of, compiled by creator on 9 Jul 24

Wanting ahead, there are a number of unfavourable outlook elements for NUSI in comparison with peer risk-managed earnings ETFs. The primary issue is its general efficiency when contemplating share worth change, dividend yield, and expense ratio. As I’ll focus on, this general efficiency has been sub-optimal in comparison with friends, which reveals no indicators of fixing considerably. The second and third key elements are the fund’s capacity to restrict draw back and maximize upside. As I’ll present, NUSI has not supplied the identical draw back safety as different funds and but has restricted upside potential contemplating its holdings combine.

Total Efficiency: All Issues Thought-about

The primary key issue that have to be examined is the general efficiency of NUSI when together with its change in share worth, dividend yield, and costs. Earnings funds can lure buyers with an attractive dividend yield solely to see depreciating returns by way of share worth decline and excessive charges. NUSI, we see a 3-year share worth compound annual progress price of 4.23%. Assuming a relentless dividend yield of 6.80% and expense ratio of 0.68% over the previous three years for simplicity, we are able to then have a look at the fund holistically. Primarily based on all these elements and assumptions, the true whole 3-year common annual return for NUSI was 10.35%.

NUSI

XRMI

HYBL

JEPI

3-Yr Share Worth CAGR

4.23%

-1.03%

4.30%

6.98%

+ Dividend Yield

6.80%

12.19%

8.24%

7.35%

– Expense Ratio

0.68%

0.60%

0.70%

0.35%

Complete Efficiency

10.35%

10.56%

11.84%

13.98%

Click on to enlarge

Supply: A number of, compiled by creator on 9 Jul 24

Using this similar methodology for the peer funds, we see that NUSI noticed the bottom efficiency from a holistic standpoint. Though XRMI noticed unfavourable worth return over the previous three years, its increased dividend yield and decrease expense ratio compensated for these downsides. Lastly, each HYBL and JEPI noticed stronger worth returns and dividend yields, leading to stronger general efficiency in comparison with NUSI.

Threat Administration Technique

The second key issue that NUSI boasts is threat administration by limiting draw back potential. A key latest timeframe to measure this safety is 2022, which noticed almost a -19% drawdown within the general market, as measured by the S&P 500 Index. By comparability, in 2022, NUSI noticed a -28.26% return.

NUSI

XRMI

HYBL

JEPI

SPY

2022 Share Worth Change

-28.26%

-23.35%

-9.30%

-13.60%

-18.73%

Click on to enlarge

Supply: A number of, compiled by creator on 9 Jul 24

HYBL, on account of its lack of equities and concentrate on bonds and debt devices, noticed a decline in 2022 however not as extreme as the opposite in contrast funds. A lot of NUSI’s decline in 2022 will be defined by its weight within the IT sector. Wanting ahead, the IT sector reveals indicators of excessive valuations once more. Due to this fact, one can fairly count on that the following tech correction may have an outsized influence on NUSI in comparison with peer earnings funds. Whereas NUSI is much less risky than the market general, as I’ll focus on later, it demonstrated the weakest capacity to handle draw back safety in 2022.

Restricted Upside Potential

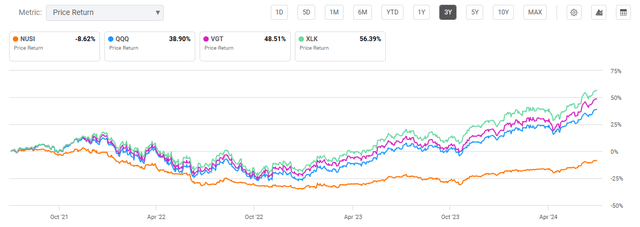

Regardless of NUSI’s draw back potential, the fund arguably has restricted upside potential given its high holdings. In 2023, NUSI noticed a share worth enhance of 18.69%. That is stunning provided that NUSI’s high 10 holdings are nearly similar in choice and weight to Invesco QQQ ETF (QQQ). Nevertheless, QQQ noticed a return in 2023 of over 52%. Moreover, different tech-heavy funds akin to Vanguard’s Data Know-how Fund (VGT) and Know-how Choose Sector SPDR Fund (XLK) additionally noticed huge returns in 2023.

NUSI and Tech-Centered ETFs: 3 Yr Complete Worth Return (In search of Alpha)

Even the broader S&P 500 Index noticed a greater 2023 return at about 23.8%. As clearly witnessed within the determine above, NUSI does supply considerably much less volatility than tech funds and the broader market. I’ll cowl extra on this after we tackle dangers to buyers.

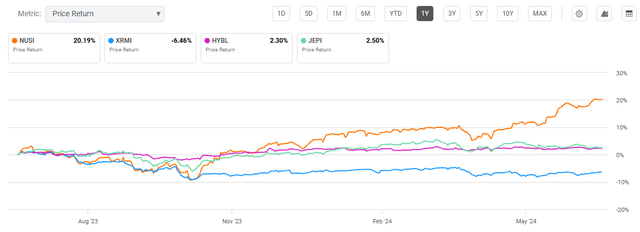

Present Valuation

Because of robust returns for the IT sector not too long ago, NUSI has seen a stable 20% worth return over the previous 12 months. Nevertheless, on account of its restricted upside potential beforehand mentioned, this nonetheless lagged the market general, as measured by the S&P 500’s 26% one-year return.

One-Yr Complete Worth Return: NUSI and Peer Earnings ETFs (In search of Alpha)

NUSI has the least fascinating valuation metrics, as measured by its worth/earnings and worth/e-book multiples. HYBL’s P/E and P/B ratios are usually not relevant, because it predominantly consists of bonds and debt versus equities. I’ve written beforehand that mega-cap large tech corporations have very excessive valuations at present, in contrast in opposition to each friends and their very own averages. Due to this fact, I imagine the IT sector is prone to correction. As historical past suggests, NUSI has very restricted capacity to guard buyers from draw back.

Valuation Metrics for NUSI and Peer Opponents

NUSI

XRMI

HYBL

JEPI

P/E ratio

37.07

22.24

N/A

21.04

P/B ratio

3.78

4.09

N/A

4.00

Click on to enlarge

Supply: Compiled by Creator from A number of Sources, 9 Jul 24

Dangers to Buyers

Regardless of my dialogue of restricted upside potential, a key profit to NUSI is that it does present buyers with decrease volatility. This volatility will be measured by analyzing beta and customary deviation values for every fund. NUSI’s beta worth stands at 0.94 indicating that it’s barely much less risky than the market general. Moreover, the fund has a normal deviation of 14.63%, indicating much less volatility than the market general however on the upper finish for a risk-managed earnings ETF. By comparability, JEPI, which noticed the perfect general efficiency mentioned beforehand, has a beta worth of 0.52 and a one-year customary deviation of 8.09%. This additional reinforces to me that NUSI is sub-optimal in its threat administration.

Concluding Abstract

Whereas NUSI presents a major dividend yield, different earnings funds outperform when holistically examined together with share worth change, dividend yield, and expense ratio. Whereas NUSI advertises a technique that protects buyers throughout declines, it isn’t impervious to steep drops as seen in 2022. Because of its tech-heavy focus, the fund additionally has a comparatively excessive valuation in comparison with friends. Given excessive P/E ratios for a number of high holdings, the fund is prone to one other decline in share worth. Contemplating its lack of ability to considerably shield buyers from corrections prior to now, the fund subsequently dangers underperforming peer earnings funds. These alternate options embody JPMorgan’s JEPI which has extra aptly supplied buyers with earnings together with higher draw back safety.