MarianVejcik

By Gerald P. Dwyer

Anybody looking for a home can attest that mortgage charges stay excessive within the U.S. In June 2024, the 30-year mounted charge mortgage charge was round 6.9 p.c. For comparability, it was round 3.6 p.c in January 2019, simply previous to the pandemic. Will mortgage charges come down from their present excessive ranges? Whereas no forecast of the long run might be sure, decrease mortgage charges are in truth fairly possible.

Given current financial coverage, it’s affordable to suppose that inflation will finally return to 2 p.c per 12 months, or at the very least to the neighborhood of two p.c. Present short-term Treasury charges are about 5.25 p.c per 12 months. With inflation at 2 p.c, a 5.25 p.c nominal Treasury invoice charge would indicate a traditionally very excessive actual Treasury rate-that is, the Treasury charge web of inflation. Not that way back, the true charge on Treasury payments was damaging. The true charge on Treasury securities is quickly excessive because of the Federal Reserve’s coverage objective of decreasing the inflation charge.

Inflation is down considerably from two years in the past. The Private Consumption Expenditures Worth Index grew 2.6 p.c over the twelve-month interval ending Could 2024. It grew 6.7 p.c over the twelve-month interval ending Could 2022. There isn’t a indication that inflation will enhance and, given the Federal Reserve’s willpower thus far, it’s affordable to suppose that the inflation charge will quiet down someplace between 2 and three p.c per 12 months, if not at 2 p.c. Given a historic common actual charge on short-term Treasury payments close to zero, the short-term Treasury charge is more likely to be within the neighborhood of three p.c.

If short-term Treasury charges lower, why would housing mortgage charges lower? A part of the reason being as a result of long-term Treasury bond yields will lower. Lengthy-term Treasury charges mirror expectations of future short-term charges; decrease anticipated future short-term charges decrease long-term Treasury charges. Decrease long-term Treasury charges will lead to decrease long-term mortgage charges, however that’s nowhere close to all of the story.

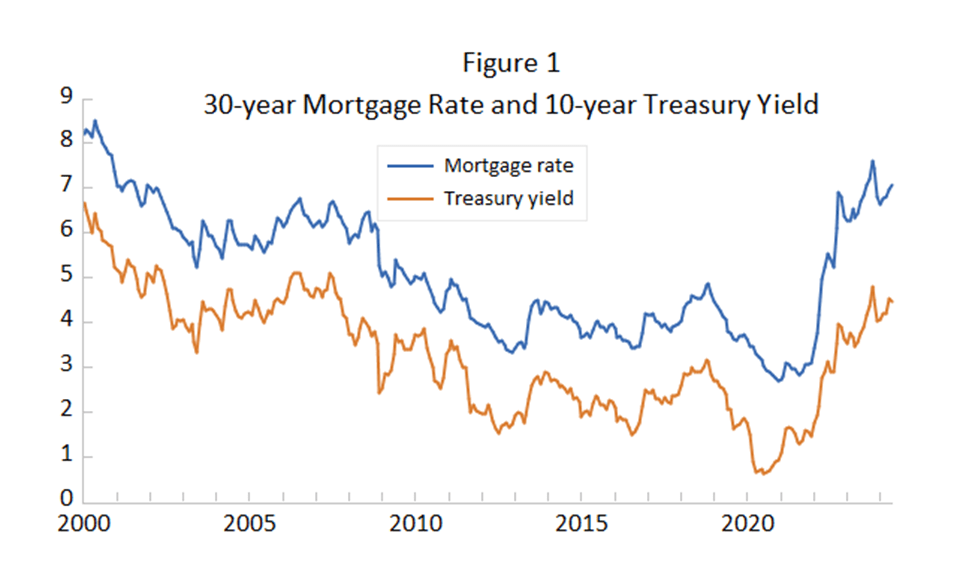

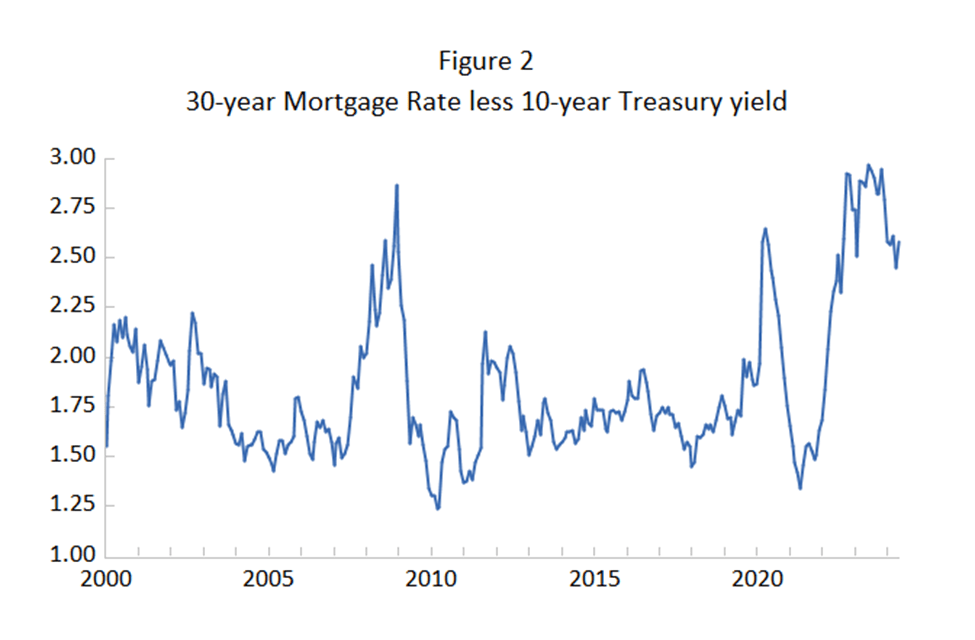

Determine 1 exhibits the 30-year mortgage charge and the 10-year Treasury yield individually. Determine 2 exhibits the unfold, or distinction, between the 2. The ten-year Treasury yield generally is used for comparisons to mortgage charges as a result of the precise phrases of mortgages are shorter than 30 years and since the 10-year Treasury safety is traded extra often than 30-year Treasury securities, making its value and yield extra informative.

The 30-year mortgage charge and the 10-year Treasury yield have each elevated since 2020, however the enhance within the unfold is kind of notable. The unfold might be interpreted as a danger unfold as a result of Treasury securities are risk-free when it comes to paying the promised variety of {dollars}. (They’re nominally risk-free however probably not risk-free.) Why has the danger unfold elevated?

A danger lenders face is the danger of prepayment of the mortgage. Prepayment of the mortgage is a danger as a result of it usually is related to the borrower purposefully refinancing the mortgage to acquire a decrease rate of interest. That decrease rate of interest for the borrower is also a decrease rate of interest for the lender if the lender replaces the refinanced mortgage with one other mortgage.

Prepayment danger is the biggest single danger for lenders. When, as now, rates of interest are quickly excessive, prepayment danger on new mortgages is excessive as a result of charges are more likely to be decrease sooner or later, which can make it worthwhile for debtors to refinance at these decrease charges. Successfully, the anticipated phrases of mortgages lower.

One other danger often talked about, foreclosures on account of a recession, truly does not create a danger for lenders. The big majority of mortgages in america are assured by the federal authorities businesses popularly referred to as Fannie Mae, Freddie Mac and Ginnie Mae. If a borrower defaults, the federal company guaranteeing the mortgage pays off the mortgage and absorbs the loss after the house is foreclosed and bought. Voila, default danger does not matter to lenders!

Foreclosures creates a unique danger, although, than default danger and loss. Foreclosures of a mortgage backed by the Federal authorities leads to prepayment. Default nonetheless is a danger however it’s not a danger of loss; it’s a danger of prepayment. Even when the foreclosures just isn’t motivated by a comparatively excessive rate of interest, the lender all the time has the danger that the speed shall be decrease on one other mortgage it’d purchase to interchange the foreclosed mortgage.

Prepayment just isn’t the one danger related to mortgages. The Federal Reserve acquired a really giant portfolio of mortgages as a part of its coverage of Quantitative Easing. Mortgages are bundled into securities referred to as Mortgage Backed Securities (MBSs) which might be traded after the mortgages are issued. For a while, the Federal Reserve was buying quantities of MBSs equal to the brand new problems with mortgages. The rationale of those purchases was to decrease mortgage charges. Whereas not unequivocal, statistical proof signifies that these purchases did decrease mortgage charges.

The Federal Reserve now could be promoting MBSs because it unwinds Quantitative Easing. These gross sales account for some a part of the rise within the mortgage charges and within the unfold between the mortgage charge and the yield on Treasury securities.

Decrease long-term Treasury charges and decrease spreads within the close to future will translate into decrease mortgage charges. A lower-inflation setting shall be related to decrease short-term curiosity Treasury charges if the Federal Reserve continues pursuing its present coverage of decreasing the inflation charge. Decrease short-term rates of interest will translate into decrease long-term charges as a result of long-term charges will mirror expectations of those decrease short-term rates of interest. These decrease rates of interest will create prepayments however will decrease the danger of future prepayments, inflicting the unfold between mortgage and Treasury charges to say no. As well as, the Federal Reserve finally will cease promoting MBSs, which additionally will decrease the unfold. In sum, mortgage charges will lower due to decrease inflation and decrease risk-free rates of interest, much less prepayment danger and fewer gross sales of MBSs by the Federal Reserve.

Authentic Submit

Editor’s Word: The abstract bullets for this text have been chosen by Searching for Alpha editors.