Olivier Le Moal

By Zain Vawda

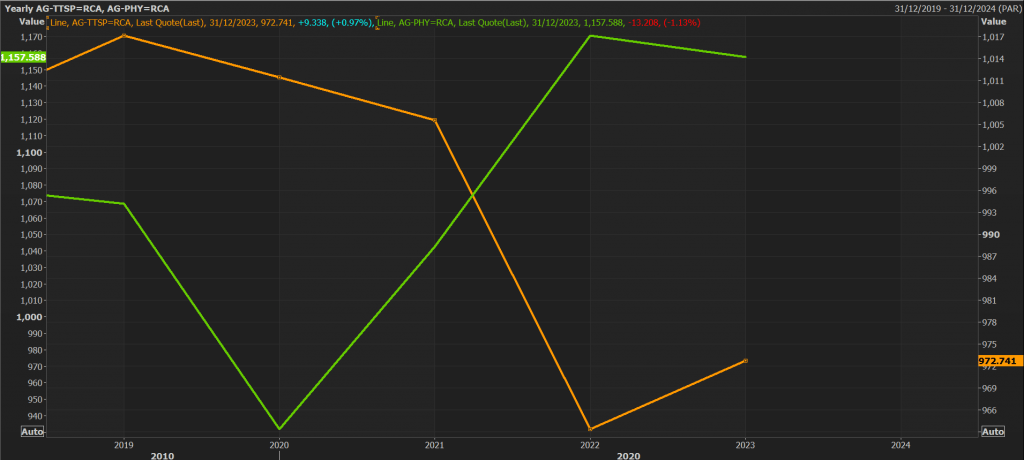

Silver costs have seen a exceptional rise this 12 months, and with six months nonetheless to go, many are questioning simply how excessive they might climb. One key issue to look at is the provision and demand dynamics, as demand for silver continues to outstrip provide.

In line with the World Silver Survey, 2024 is the fifth 12 months in a row with a silver scarcity. In 2023, silver demand was greater than provide, resulting in a market deficit of over 142 million ounces. By the tip of 2024, this shortfall is anticipated to just about double to 265 million ounces due to growing industrial demand.

Silver Provide (Orange Line) and Demand (Inexperienced Line), 2019-2024

Supply: LSEG

Traditionally, half of the demand for silver was for industrial use and the opposite half for funding. Not too long ago, industrial demand has grown considerably, now making up 64% of worldwide silver demand, up 19% from final 12 months.

This development exhibits no indicators of slowing. The first drivers of the silver provide squeeze are the Inexperienced Power Transition, notably photo voltaic vitality, and the excessive demand from the Synthetic Intelligence and electrical car (EV) sectors. These industries are among the many fastest-growing on the planet at the moment.

The one fear has been a latest dip in demand from China and the potential of a slowdown within the Chinese language financial system. This might assist stability the demand and provide hole. Extended greater rates of interest from Central Banks may additionally dampen silver costs and probably cease the rally. The earlier the US Federal Reserve cuts charges, the higher it will be for silver costs.

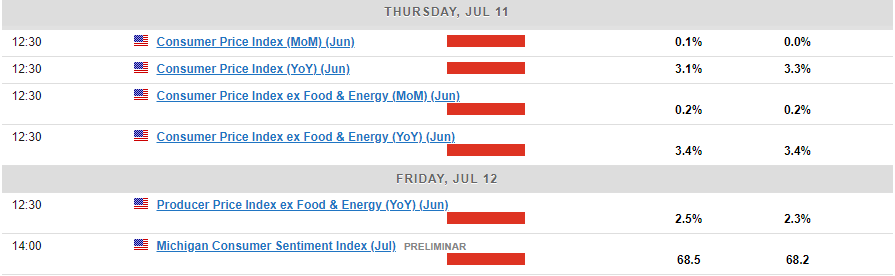

The Week Forward

The US CPI knowledge has the potential to offer silver a shot within the arm and supply some impetus from a transfer away from the psychological 30.00 deal with. A scorching inflation print tomorrow may have the other affect and push Silver under the 30.00 deal with within the brief time period, however the general bullish development is prone to stay intact.

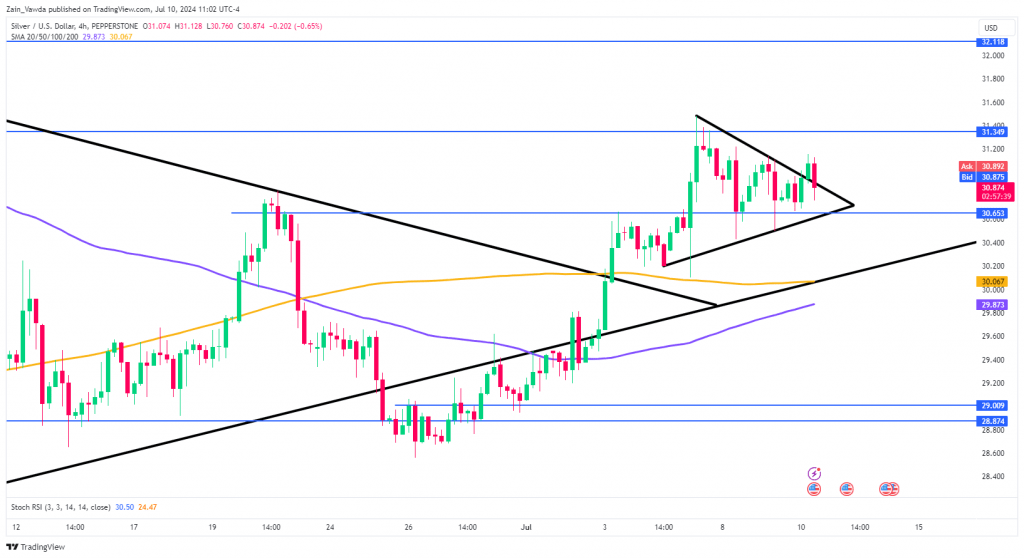

Technical Evaluation

From a technical standpoint, silver broke out of a bullish pennant sample on the day by day chart on July 3, which led to a rally as much as round 31.50 earlier than getting into a pullback and consolidation part.

Since then, silver has been forming decrease highs and better lows, creating a brand new bullish pennant sample. One other vital issue to look at is the shifting averages; the 100-day MA is nearing a golden cross with the 200-day MA, suggesting additional upside and bullish momentum.

Nonetheless, if a 4-hour candle closes under the 30.600 stage, it will sign a change in construction, invalidating the present bullish setup.

Assist

30.60 30.20 30.00 (psychological stage)

Resistance

Silver (XAG/USD) Day by day Chart, July 10, 2024

Supply: TradingView.com

Authentic Publish