Kativ

It is uncommon that I come throughout shares with a 7% yield plus that I might really think about including to my portfolio. I think about myself a dividend development investor greater than something, in search of alternatives to purchase shares which have a historical past of sustainably rising dividend funds which can be buying and selling at a very good worth. For instance, I personal Altria Group (MO) in my portfolio. As I’ve talked about earlier than in a earlier article, Altria has a uncommon mixture of excessive beginning yield, a historical past of dividend development, and it seems the dividend is sustainable shifting ahead.

Alternatives like which can be few and much between. However EPR Properties (NYSE:EPR) seems to be a type of uncommon alternatives. And to not point out, they pay out dividends each single month. EPR at the moment has a excessive beginning yield of seven.93%, has a historical past of dividend will increase, and the dividend at the moment seems to be sustainable. And to high it off, like many REITs, this firm seems to be buying and selling at its finest valuation in years.

As I’ve said earlier than, you possibly can inform quite a bit about an investor by whether or not or not they attempt to predict an organization’s inventory value actions, versus the corporate’s money flows. And in 2019, EPR was buying and selling round $70 a share, whereas AFFO per share was sitting at $5.51. In the course of the 2020 crash, AFFO per share dropped significantly for EPR, however has since recovered to close pre-2020 ranges. Regardless of this, we are able to see the share value is close to a 52-week low at $42.49. I imagine this creates a chance for sure sorts of buyers, as we’ll talk about beneath.

Overview

EPR Properties is an actual property funding belief that at the moment focuses on proudly owning three completely different property types-

Leisure Recreation Schooling

In line with the EPR Properties investor presentation, the corporate is the main diversified experiential REIT, specializing in distinctive experiential properties varieties that they imagine enduring traits. The rationale behind this? EPR has discovered that millennials, the biggest inhabitants section, prioritizes experiences over merchandise.

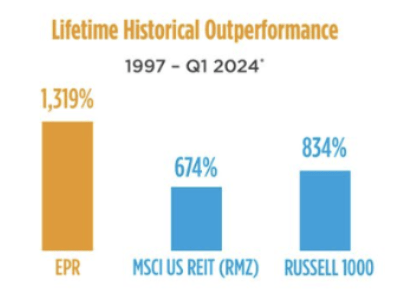

Lifetime EPR Efficiency (EPR Buyers Presentation)

If we take a look at the lifetime efficiency of this REIT, we are able to see they’ve enormously outperformed the Russell 1000 since their IPO. If we dig deeper into the actual property portfolio of EPR, we are able to see their present allocation in addition to their strategic give attention to these properties shifting ahead.

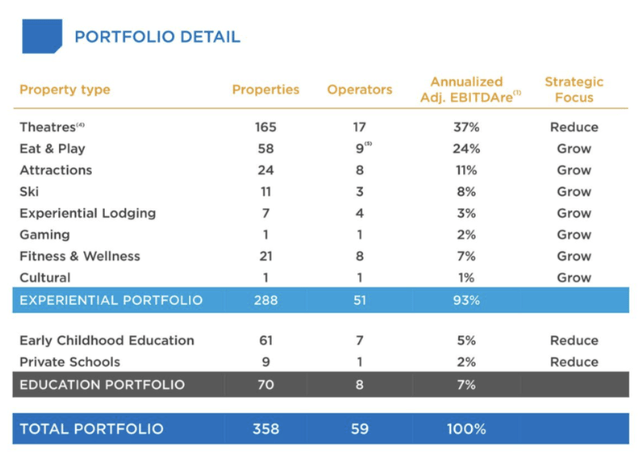

EPR Portfolio (EPR Buyers Presentation)

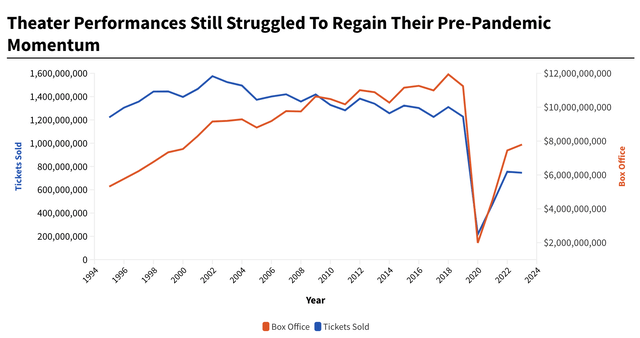

Theaters at the moment make up a big portion of their adjusted EBITDA at 37%. Regardless of this, we are able to additionally see that they’re at the moment search for alternatives to cut back the scale of this place. The explanations behind this are clear when how this REIT carried out throughout 2020. AFFO in 2019 was sitting at 422.7, and in 2020, this dropped all the way in which right down to 143.4. Having massive publicity to theaters throughout this time proved to be a big burden for EPR. Whereas site visitors to theaters has since recovered fairly a bit, it’s nonetheless not close to their pre-2020 ranges.

Theater Gross sales (Costar.com)

A lot of the remainder of their portfolio is at the moment allotted to properties which can be thought of ‘eat and play’ (for instance, Prime Golf) and sights. In Q1 of 2024, EPR invested a complete of 85.7M in two properties together with a 33.4M acquisition of Water Safari Resort in New York, and a 14.7M acquisition of land in Kansas Metropolis and Schaumburg, Illinois for the event of two Andretti Karting services. EPR additionally at the moment has 7% of their actual property portfolio allotted to schooling, however it is a sector they want to scale back over time.

Considerations

I might think about EPR an attention-grabbing alternative for extra aggressive revenue buyers. The priority most have with EPR is its sensitivity to the financial system. As we noticed throughout 2020, the tenants for EPR struggled. AFFO for EPR dropped considerably in 2020, and has not but fairly recovered to pre-2020 ranges. In 2019, AFFO was 422.7, and dropped to 143.4 in 2020. This was a staggering 66% lower. AFFO was above 400.6 in 2023, which is near a full restoration, however this restoration did take practically 4 years, and has led EPR to the conclusion that they’re overexposed to theaters (and as we now know, they want to scale back their publicity to theaters). Different sectors, resembling sights and eat play, do seem like stronger, however are nonetheless simply affected by financial situations. A wager on EPR, is a wager that the US financial system will stay sturdy. Evaluate this to a ‘greater high quality’ REIT like Realty Revenue (O), who continued to develop AFFO yearly by means of 2020.

The Dividend

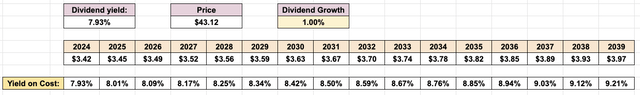

EPR has dividend funds which can be very simple to get enthusiastic about. The beginning yield is sitting at 7.93%, they pay out dividends each single month, they’ve been rising their dividend fee over the previous few years. As of proper now, the dividend seems to be secure, with EPR having a forward-looking AFFO payout ratio of 70.38%. Under, we are able to take a look at the EPR dividend over time from a yield on value perspective. Assuming only a 1% annual dividend development price over the subsequent 15% years, EPR might obtain a yield on value of 9.21%.

EPR Yield on Value (Tickerdata)

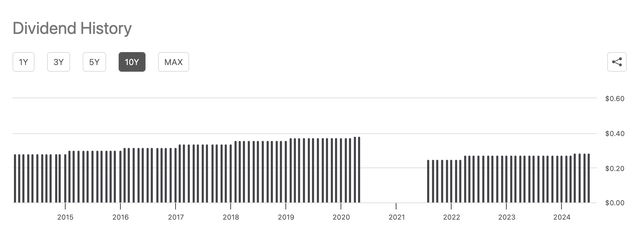

That is a powerful yield and a powerful yield on value. However right here is one thing else we now have to grasp about EPR that could be a enormous turnoff for a lot of revenue oriented buyers. Throughout 2020, EPR made the troublesome choice to chop their dividend fee, which was crucial resulting from their low AFFO throughout the time.

EPR Dividend Historical past (In search of Alpha)

As we are able to see above, this dividend was lower from early 2020, all the way in which to mid-2021. When the dividend returned, it was not as excessive because it was pre-2020 and has nonetheless not but returned to pre-2020 ranges. A dividend lower is little doubt a blemish on an organization’s historical past, and it’s one thing buyers want to pay attention to. With that being mentioned, for buyers who did not maintain EPR earlier than the dividend lower, this has created a extra engaging alternative because the dividend yield is close to 8% and seems to be way more sustainable.

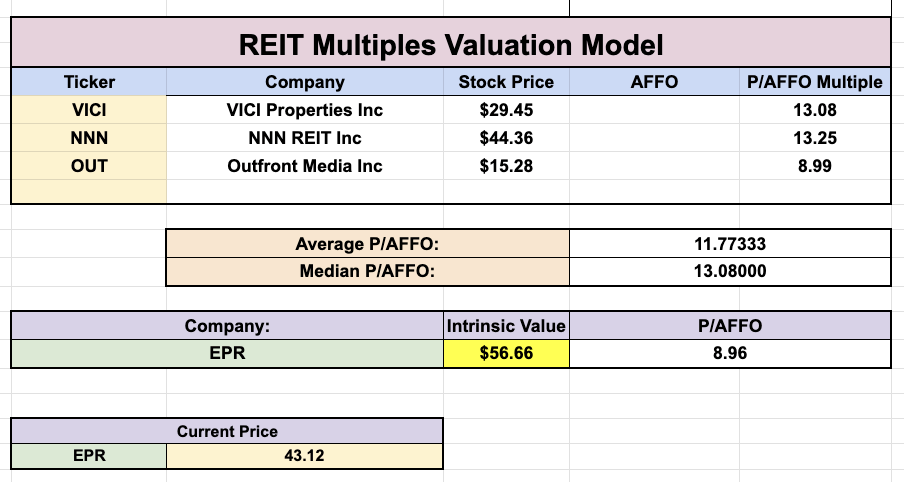

Valuation

If we take a look at EPR from a multiples’ valuation perspective, it seems that EPR is undervalued in comparison with how their friends are at the moment buying and selling. The common P/AFFO a number of for these comparable corporations is at the moment 11.77, whereas EPR is sitting at 8.96. If we utilized that very same common P/AFFO a number of to EPR, we’d come to a valuation of $56.66. Remember, for an organization like EPR, there is no such thing as a excellent comparable.

Multiples Valuation (Tickerdata)

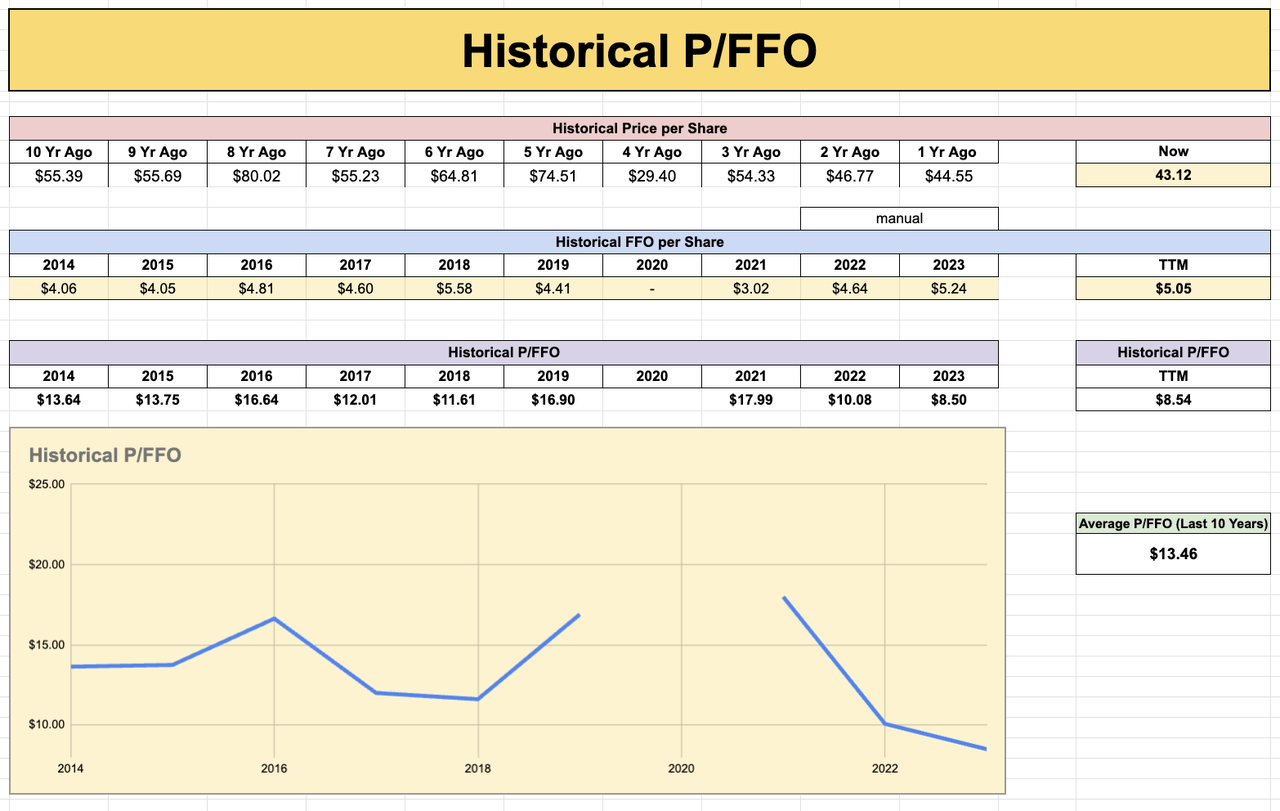

If we take a look at how EPR has traded traditionally utilizing a P/FFO a number of, we are able to see that over the previous 10 years, the common P/FFO a number of has been 13.46. As of proper now, their P/FFO is 8.54, which is considerably decrease than it has been traditionally. One other indication that this firm seems to be undervalued.

P/FFO Valuation (Tickerdata)

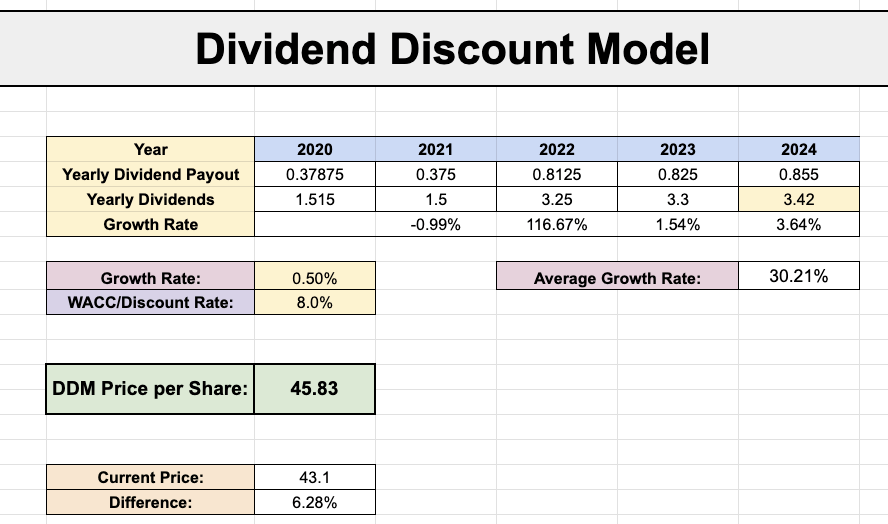

Lastly, if we take a look at EPR utilizing a dividend low cost mannequin, assuming simply 0.50% dividend development and a reduction price of 8%, we come to a good worth of $45.83.

Dividend Low cost Mannequin (Tickerdata)

Primarily based off all 3 of those valuations, EPR seems to be barely undervalued. And with price cuts reportedly on the way in which, we might see REITs make a bounce up ahead of anticipated.

Conclusion

For aggressive revenue buyers, EPR presents a singular alternative. EPR is little doubt delicate to the financial surroundings they function in, and certain wants to cut back their publicity to theaters, however additionally they seem to have a valuation that reveals the market has mispriced this REIT. They’ve an awesome mixture of excessive beginning yield, month-to-month dividends, and rising dividends that at the moment seem like secure. For buyers who’re assured in US markets long run and are looking for high-yield dividend alternatives, EPR ought to be a REIT that’s thought of.