onebluelight/iStock Unreleased by way of Getty Pictures

I’ve not written to you about Visa Inc. (NYSE:V) beforehand, however the inventory has been a long-term mainstay in my portfolio. Current occasions and softer share costs prompted me to share my present evaluation.

As well as, throughout the final week I famous two In search of Alpha impartial / damaging articles about Visa. These additional spurred me to consider the inventory. These articles are discovered right here and right here. You could want to reference these various viewpoints.

Background

Visa runs the world’s largest retail digital funds community, working in additional than 200 nations and territories. Visa’s core merchandise embrace credit score, debit, pay as you go, and money entry applications. The corporate processes roughly 750 million transactions per day. There are over 4.4 billion Visa playing cards at the moment in circulation. Importantly, Visa isn’t a monetary establishment. Visa doesn’t problem playing cards, prolong credit score, or set charges and charges for account holders of Visa merchandise, nor does Visa earn revenues from or bear credit score threat.

Successfully, Visa and peer Mastercard Inc (MA) personal an digital funds duopoly. Nonetheless, Visa processes about double the variety of transactions as Mastercard. American Categorical (AXP), Uncover Monetary Companies (DFS), and a a number of different entities additionally deal with digital funds; nonetheless, these are dwarfed by Visa and Mastercard.

Funding Thesis

Through my private Funding Technique Assertion, I define the traits for what I consider constitutes a very good funding buy. Visa inventory ticks all of the packing containers:

sound stability sheet

earns earnings in money

robust franchise

well-managed

shareholder-friendly

the inventory trades meaningfully under Truthful Worth

Hardly ever are V shares a screaming purchase. At the moment, newsfeed objects seem like contributing to considerably softer share costs. This may occasionally current a possibility for traders to start to construct a brand new place or accumulate shares.

A Temporary Basic Rundown

Word: monetary knowledge offered by way of the “Visa Quarterly Earnings” hyperlink on the corporate web site.

Steadiness Sheet

Visa owns a sound stability sheet as exhibited by its liquidity, manageable debt, and fairness construct.

The present ratio is 1.4x, nicely above the everyday 1.0x threshold indicating ample liquidity. Visa retains between $17 billion and $20 billion money and marketable property on its stability sheet. The corporate may pay about 5 quarters’ complete working bills from cash-on-hand.

Debt-to-Fairness runs about 50 p.c. It is simply managed. The Curiosity Protection Ratio (EBIT / Curiosity Expense) is ~30x. For many companies, a determine above 5x is taken into account enough.

Visa administration has a nice long-term document of making shareholder worth as measured by growing complete fairness as a perform of complete shares excellent (guide worth).

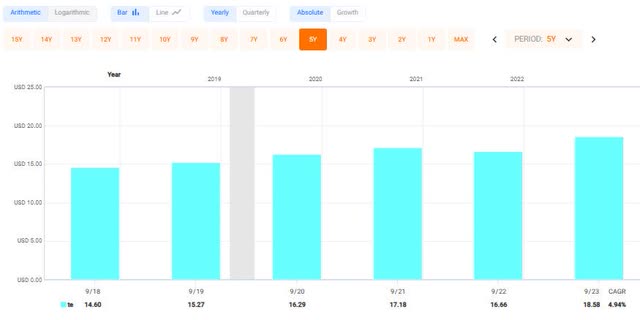

fastgraphs.com

Over the previous 5 fiscal years, share fairness construct elevated by about 5 p.c a yr. The development continues unabated into FY2024.

Earnings Earned in Money

Visa is a kind of premier corporations that generates larger working money movement than web revenue.

Visa Inc – Annual Web Revenue and Money Stream ($B)

FY2023

FY2022

FY2021

Web Revenue

17.3

15.0

12.3

Working Money Stream

20.8

18.8

15.2

Free Money Stream

19.7

17.9

14.5

Click on to enlarge

Certainly, Visa generates extra free money movement (working money movement much less capital expenditures) than web revenue.

The corporate’s fiscal yr ends September 30. There’s little query FY2024 money movement will eclipse web revenue once more.

Sturdy Franchise

The Visa franchise is unassailable. It is the world’s largest digital cost processor. Visa and Mastercard epitomize “large moat” companies.

Proof of a robust franchise is exhibited by a measure of pricing energy. Visa and MC have such functionality. The long-term potential of those two corporations to cost their merchandise is a driver for a few of the present market hubbub surrounding these enterprises.

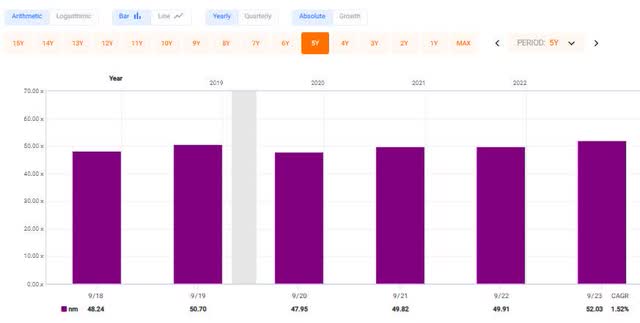

Maybe ancillary to the franchise dialogue, Visa routinely generates web margins between 53 p.c and 57 p.c. That is outstanding.

fastgraphs.com

Only a few massive firms generate such large margins constantly.

Peer Mastercard additionally enjoys excessive web margins, too, although usually a number of hundred foundation factors lower than Visa Inc.

fastgraphs.com

Visa is Properly-Managed

Whereas evaluating administration effectiveness contains parts of subjectivity, there are a number of quantitative / qualitative measures to help traders. Listed here are a number of:

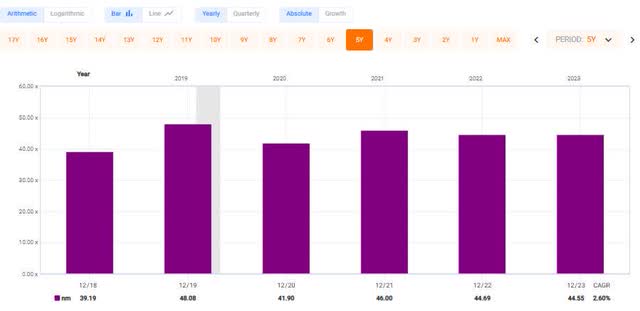

Administration produces excessive and constant long-term return on capital and return on fairness.

fastgraphs.com

These figures are glossed by the truth that Visa’s WACC is about 9 p.c.

Administration creates long-term shareholder worth as evidenced by guide worth per share. (See earlier part of this text.)

The present board of administrators’ tenure is about 5 years. (See Web page 37 of the 2024 proxy assertion). I dislike boards with entrenched administrators. An orderly rotation is wholesome.

There’s an impartial Chairman of the Board. I desire to see an impartial Chair versus a mixed CEO / Chairman position.

Usually, administration retains Visa out of the highlight.

Administration supplies clear, unambiguous steering; units Road expectations; then proceeds to satisfy or exceed such steering.

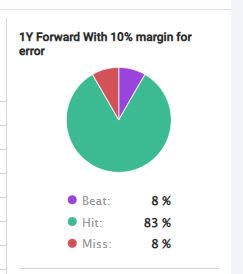

The pie chart under compiles Visa Inc precise EPS efficiency versus Road estimates for the interval 2013 via 2023.

fastgraphs.com

Precise versus Road solely missed one time prior to now 11 years.

Administration Is Shareholder-Pleasant

As aligned with the continuing part, I contemplate shareholder-friendly administration to be demonstrated by the flexibility to supply clear, clear investor communications. Visa administration does this, together with detailed monetary and working statistics.

Such communications keep away from perennial one-off bills and / or monetary changes to the revenue assertion. Sometimes, Visa administration affords quarterly earnings studies with none hair on it.

Administration routinely supplies well timed investor updates and useful investor convention shows. Visa administration participates in Road and investor occasions each quarter.

Money dividends, if declared, are raised constantly. Over the previous 5 years, the Visa board of director raised the money dividend per share by 16 p.c each year.

Visa’s Current Newsfeed

In latest weeks, Visa has discovered itself within the humorous papers over a number of points.

On June 25, a decide appeared able to reject a $30 billion swipe payment settlement by Visa and Mastercard. In March, the expectation was the settlement can be accepted.

On July 10, Visa disclosed that it’s going to launch ~$2.7B from its sequence B and sequence C convertible taking part most popular inventory in reference to the third obligatory launch evaluation on June 21, 2024. The web consequence can be barely dilutive to present Visa frequent “A” stockholders. I discovered the discharge considerably complicated and needed to learn it greater than as soon as. Buyers hate sophisticated tales. This was considered one of them.

On the identical day, a Financial institution of America analyst downgraded each Visa and Mastercard inventory to “impartial” on account of considerations about aforementioned regulatory points, moderating development to worth added “companies” income streams, and “restricted upside” to valuation multiples and ahead earnings estimates.

Commentary

The anticipated V / MC swipe payment settlement rejection is prone to delay practically 20 years of litigation on this problem. I can’t predict the end result, however based mostly upon present public data, I’d not dismiss the inventory over it. Duopolies are likely to discover a method to come out alright. I want to hear your views on this within the remark part under.

The conversion of the sequence B and C inventory had been well-communicated. Nonetheless, it’s not simple to grasp with out understanding the historic context. Backside line: I count on “A” share dilution to be a comparatively minor problem. For years, Visa administration has been repurchasing over 2 p.c each year of complete diluted shares excellent.

The BoA analyst that downgraded the inventory to “impartial” lowered his goal value from $305 to $297; not earthshaking. In the meantime, on June 25, Evercore ISI Group lowered their goal value from $335 to $330. Again on Might 13 Piper Sandler initiated protection at $322. These are the three most up-to-date brokerage studies I discovered. These estimates common to a $316 value goal, representing a 19 p.c upside from a latest $265 bid.

My Truthful Worth Estimate

As of March 31, 2024, my Visa Inc. Truthful Worth Estimate was $313.

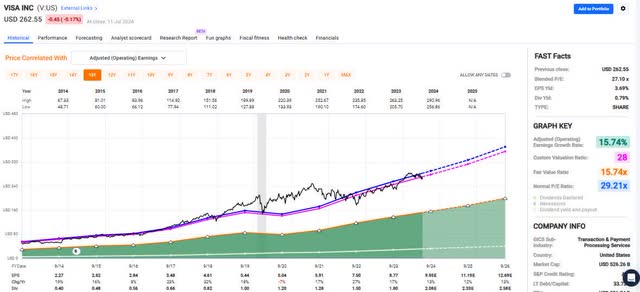

At core, this was based mostly upon 28x the corporate’s FY2025 present $11.19 Road EPS consensus. The next FAST Graph illustrates the long-term relationship between V price-and-earnings.

fastgraphs.com

V has a long-term PE 29.2x on annualized 15.7% EPS development. I diminished my FVE by one flip (to 28x or the pink line on the chart) to compensate for decelerating earnings development.

Working the identical 10-year valuation train utilizing present 2025 Road estimates and modestly diminished historic multiples for P / OCF and P / FCF yields greater value targets: about $340 per share.

Subsequently, I consider my $313 FVE isn’t aggressive. For those who settle for it, an investor wishing to start out or increase a place in V inventory might contemplate doing so with a good issue of security.

As with all place, I encourage traders to construct a place slowly over time, search to purchase in periods of soppy value efficiency, and by no means chase a inventory.

Please do your individual cautious due diligence earlier than making any funding determination. This text isn’t a advice to purchase or promote any inventory. Good luck with all of your 2024 investments.