Cliff LeSergent/iStock by way of Getty Photographs

Introduction

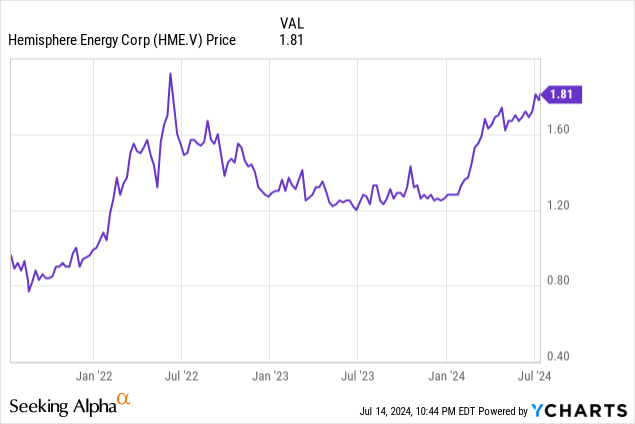

I’ve been following Hemisphere Power (TSXV:HME:CA) (OTCQX:HMENF) for a number of years now, and I’m happy to see the entire return up to now 2.5 years was 68% which handsomely beats the entire return of round 25% for the S&P 500 in the identical time-frame. This small oil producer continues to carry out nicely and because of its strong stability sheet, it is ready to use the overwhelming majority of its money flows to pay dividends and particular dividends, which signify an essential portion of the entire return.

Wanting again at Q1 and utilizing that as a stepping stone for Q2

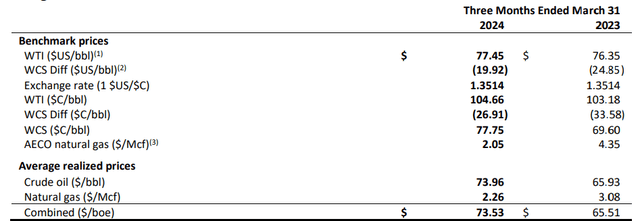

Within the first quarter of this yr, Hemisphere Power produced a complete of three,133 barrels of oil-equivalent per day, with about 99% of the entire oil-equivalent output really consisting of crude oil. The corporate produces heavy oil, which will get offered at a reduction to the WTI oil worth. As you’ll be able to see beneath, the typical WTI worth within the first quarter of the yr was US$77.45 per barrel, and the WCS distinction was slightly below US$20 per barrel, leading to a WCS oil worth of C$77.75 per barrel whereas Hemisphere recorded a realized worth of slightly below C$74 per barrel whereas the typical realized pure fuel worth was simply C$2.26 per Mcf.

HME Investor Relations

This implies two issues. To start with, the corporate’s monetary efficiency relies on the WCS differential. A decrease differential means the corporate realized the next worth for its heavy oil product.

Secondly, the pure fuel worth does not matter in any respect. As you’ll be able to see beneath, the income from the pure fuel gross sales was C$28,000 on a complete income of slightly below C$21M. Which means that pure fuel gross sales contributed lower than 0.15% of the entire income. Negligible. Even when the natgas worth doubles, there will likely be no actual impression on the corporate’s monetary efficiency as a complete.

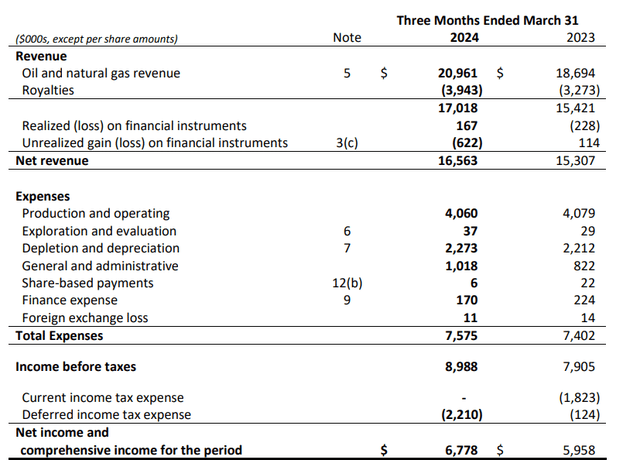

As talked about, the entire income within the first quarter was nearly C$21M and roughly C$17M after caring for the royalty funds. The web income, which additionally takes the impression of the hedge guide into consideration, was roughly C$16.6M.

HME Investor Relations

Because the earnings assertion above exhibits, the entire working price was lower than C$4.1M whereas the entire bills, together with the G&A bills, finance bills, and depletion and depreciation bills have been simply C$7.6M. This resulted in a complete pre-tax earnings of C$9M and a internet revenue of C$6.8M, for an EPS of C$0.07 per share.

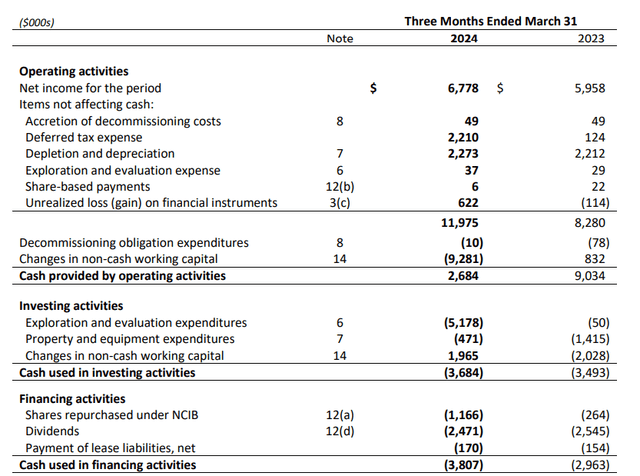

The money movement assertion paints a fair stronger image as Hemisphere is benefiting from current tax swimming pools, which implies it does not have to really pay money taxes. The working money movement earlier than modifications within the working capital place was nearly C$12M with simply C$0.2M in lease funds, leading to an adjusted working money movement of C$11.8M.

HME Investor Relations

The full capex was C$5.6M, and this ends in a C$6.2M internet free money movement consequence. Divided over the present share depend of 97.7M shares, this represents a internet free money movement results of C$0.0635 per share.

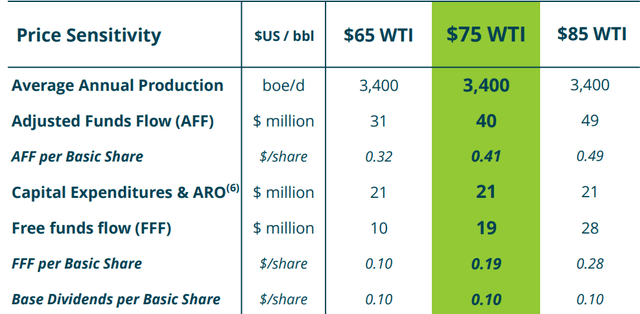

That is barely decrease than the reported internet earnings, as Hemisphere is planning to develop its manufacturing fee to a median of three,400 barrels of oil-equivalent per day. This represents a ten% improve in comparison with the 2023 manufacturing fee. The complete-year capex funds of C$20.8M will enable Hemisphere to finish 13 improvement wells. Contemplating the Q1 manufacturing fee was simply 3,133 boe/day, the typical output within the subsequent three quarters should be round 3,500 boe/day to satisfy the full-year goal.

If the corporate would solely be fascinated by maintaining the manufacturing secure, the entire capex could be considerably decrease. As a comparability: final yr, the entire capex was roughly C$14M for the yr, which is roughly C$3.5M per quarter.

The robust oil worth additionally bodes nicely for the second quarter of the yr. The typical WCS worth was roughly US$65-68/barrel, up by about US$8/barrel in comparison with the primary quarter of this yr. This implies it is fairly possible the corporate will report a considerable improve in its internet realized oil worth, and I feel a C$10/barrel improve is not unrealistic. This might add roughly C$2.85M in income and about C$2.25M after taking the royalty funds into consideration. And as Hemisphere nonetheless does not need to pay any money taxes, this could instantly profit the online free money movement results of the corporate.

The dividend and particular dividends

The corporate presently pays a base dividend of C$0.10 per share, payable in 4 quarterly tranches of C$0.025 per share. However as the corporate has no debt, it additionally pays a particular dividend.

HME Investor Relations

In June, Hemisphere introduced a C$0.03 particular dividend payable later this month. And because the oil worth stays very robust, the money movement ends in the following few quarters must also assist the corporate to declare extra particular dividends, though it’s going to even be fascinating to see how a lot money the corporate is earmarking for its share buyback program.

Funding thesis

I presently don’t have any place in Hemisphere Power anymore, as I needed to take some cash off the desk within the oil sector. Nevertheless, with oil at US$80 and an anticipated manufacturing improve, the corporate continues to be enticing at its present share worth of round C$1.80. At US$80 Oil and assuming a US$15/barrel WCS differential, the Adjusted Funds Movement will likely be round C$44M, leading to C$23M in internet free money movement after taking the C$21M capex program into consideration. This represents C$0.235 per share, which signifies that after the C$0.13 in dividends and particular dividends this yr, there may be loads of money in the stores again inventory. Hemisphere is presently buying and selling at a internet free money movement yield of 11% based mostly on US$75 oil and together with the expansion capex. If I’d assume the sustaining capex is C$15M per yr, the sustaining free money movement yield is presently roughly 14%.

Editor’s Be aware: This text discusses a number of securities that don’t commerce on a serious U.S. change. Please concentrate on the dangers related to these shares.