Shares in Donald Trump’s media firm rise as Wall Avenue is buoyed

Shares in Donald Trump’s media firm have surged to their highest level since mid-June within the opening minutes of buying and selling on Wall Avenue, as traders guess that the tried assassination of the previous president will enhance his possibilities of re-election.

The share worth of Trump Media and Know-how Group soared as excessive as $46.27 on Monday morning in New York – earlier than dropping again to $39. That was a steep 27% improve, though not fairly the $50 mark that had been indicated in pre-market buying and selling.

The idea that merchants seemed to be following was that the assassination try makes Trump’s election extra doubtless in November, and that that will by some means improve earnings considerably from Fact Social, his rival community to X, previously Twitter.

But it surely was not simply Trump-specific property that gained floor. US markets additionally rose extra broadly, and the Dow Jones industrial common rose to a brand new file excessive.

Bob Savage, head of markets technique and insights at BNY Mellon, an funding financial institution, mentioned:

The narrative for the day rests on the “Trump Commerce” with many traders assuming the weekend occasions add to the previous president being re-elected. The logic being that the possibilities of tax minimize extensions and better commerce tariffs – resulting in even increased US fiscal deficits, even alongside potential progress headwinds and intense political stress on the Federal Reserve to ease as inflation continues to subside close to time period. Some additionally suspect a doable withdrawal of US help for Ukraine would additionally up fiscal pressures in Europe, who might then have to choose up the funding for the warfare.

You possibly can proceed to comply with our dwell protection from around the globe:

Within the US, Trump says RNC speech will probably be ‘rather a lot completely different’ since taking pictures at Pennsylvania rally

Within the UK, Starmer faces take a look at of Labour self-discipline after SNP proposes vote on ending two-child profit cap

In our Europe protection, Estonia PM Kaja Kallas resigns to take up EU overseas coverage function

In our protection of the Israel-Gaza warfare, Unrwa HQ ‘changed into a battlefield’ in heavy combating, says company chief

Share

Key occasions

US inventory indices achieve after Donald Trump assassination try

US inventory markets have risen on the opening bell on Monday, in a transfer some analysts mentioned was associated to elevated expectations of a presidential election victory by Donald Trump after the tried assassination on Saturday.

Listed here are the opening snaps, by way of Reuters:

S&P 500 UP 23.71 POINTS, OR 0.42%, AT 5,639.06

NASDAQ UP 92.11 POINTS, OR 0.50%, AT 18,490.56

DOW JONES UP 281.17 POINTS, OR 0.70%, AT 40,282.07

The assassination try, and Trump’s defiant response, have prompted some individuals to say {that a} Republican victory is extra doubtless.

Chris Zaccarelli, chief funding officer for Impartial Advisor Alliance, mentioned:

In a Republican administration, you’ll see a decrease tax coverage, decrease regulatory coverage… that’s usually good for shares. We’re seeing a few of that when it comes to ahead trying expectations from traders at this level.

Share

Up to date at 09.38 EDT

What’s going to China do to attempt to hit its 5% annual progress goal, given the slowdown revealed right now?

Duncan Wrigley, chief China+ economist at Pantheon Macroeconomics, a consultancy, mentioned:

President Xi Jinping right now delivered a piece report on the Third Plenum on deepening reform and selling modernisation, with particulars but to be launched. The main focus will in all probability be on selling high-tech and manufacturing as the trail to increased productiveness and sustained progress in the long term.

Measures to encourage private-sector and overseas enterprise funding are doubtless, however sweeping reforms to create a consumption-driven progress mannequin, similar to family residency reform or constructing a common welfare system, are unlikely.

Share

The FTSE 100 is down by 0.3% in London. Burberry aside, a few of the largest fallers are miners, who’ve been hit by considerations over the Chinese language financial system.

Mining firm Antofagasta, whose speciality is copper, fell by 4.1%, whereas Anglo American fell by 2.1%.

China is struggling to maintain up the pace of its financial system, because the property business and consumption sluggish.

Lynn Son, chief economist for Higher China at ING, an funding financial institution, mentioned:

The drag from the property market ought to come as no shock. The precise drag on GDP progress will doubtless persist for an prolonged time frame, as even when costs backside out, there’s nonetheless a excessive degree of inventories that must be digested earlier than new funding takes place.

And that has hit consumption:

A detrimental wealth impact from falling property and inventory costs, in addition to low wage progress amid numerous industries’ price chopping, is dragging consumption and inflicting a pivot from big-ticket purchases towards a primary “eat drink and play” theme consumption.

Nevertheless, there was nonetheless demand from business, which might assist the Chinese language financial system climate the hunch in spending:

We continued to see sturdy progress in hi-tech manufacturing (8.8% YoY) and pc and digital gear manufacturing (11.3% YoY), which ought to stay a significant space for progress as China prioritises its transition towards increased finish manufacturing and establishing technological self-sufficiency.

Share

Larry Elliott

Stress on Beijing to take steps to enhance Chinese language shopper confidence has intensified after information that weak retail spending dragged down the expansion charge of the world’s second largest financial system.

With falling home costs nonetheless performing as a drag on exercise, official figures confirmed the Chinese language financial system increasing at an annual charge of 4.7% within the second quarter – a lot weaker than the 5.1% anticipated by the monetary markets.

Annual retail gross sales progress slowed from 3.2% to 2% within the three months ending in June – the weakest in 18 months – and fell barely in June alone.

You possibly can learn the total report right here:

Share

We’ve got had some financial updates on business in Europe and the US.

In Europe, industrial manufacturing knowledge revealed this morning confirmed that output fell by 0.6% throughout Might – lower than the 0.8% anticipated by economists. Output over the course of the earlier 12 months was additionally revised up barely, though it was nonetheless down by 2.9%.

Within the US, the New York Federal Reserve’s manufacturing survey confirmed exercise slowing barely – though it was higher than anticipated.

Share

Goldman Sachs doubles earnings to $3bn

Goldman Sachs made earnings of $3bn within the second quarter of 2024, greater than double final 12 months due to sturdy bond buying and selling earnings.

The Wall Avenue financial institution’s revenues had been $12.7bn for the second quarter of 2024, 17% increased than the second quarter of 2023, however 10% decrease than the bumper first quarter of 2024 when it benefited from a surge in debt points and a few main mergers and acquisitions.

Goldman’s share worth is up by almost 1 / 4 to this point in 2024, as traders seem to welcome a return to specializing in the funding banking that made it among the best recognized names in US finance. Goldman had made a quick foray into shopper banking.

The financial institution’s sturdy share worth efficiency has benefited its bankers, whose shared bonus pot elevated by 20% this 12 months.

David Solomon, Goldman’s chief govt, mentioned:

We’re happy with our strong second quarter outcomes and our total efficiency within the first half of the 12 months, reflecting sturdy year-on-year progress in each international banking and markets and asset and wealth administration.

Share

Financial institution of England policymaker says rates of interest must be minimize

Richard Partington

The Financial institution of England must “cease squeezing residing requirements” and minimize rates of interest, a senior policymaker has mentioned.

Swati Dhingra, a member of the central financial institution’s financial coverage committee (MPC), mentioned official borrowing prices must be minimize at its subsequent assembly on 1 August to ease stress on households and companies.

Dhingra instructed the Relaxation is Cash podcast:

Now’s the time to begin normalising [interest rates], in order that we will then lastly cease squeezing residing requirements the best way we’ve got been to try to get inflation down. We’re weighing on residing requirements and that price doesn’t must be paid.

Whether or not the Financial institution cuts borrowing prices in August for the primary time because the Covid pandemic is regarded as on a knife-edge, with Metropolis traders pricing in a 50/50 probability of a minimize from the present degree of 5.25%.

You possibly can learn the total report right here:

Share

Up to date at 07.47 EDT

Shares in retail expertise firm Ocado have slumped by 11% after an funding dealer downgraded its expectations.

Ocado fell by 11.3% on Monday, making it the most important faller on the FTSE 250 index. Solely Burberry – now down 17% after dishing out with its chief govt – has executed worse right now.

Ocado makes use of robots working round grids to attempt to make grocery store deliveries extra environment friendly and due to this fact worthwhile. Nevertheless, after surging in worth through the coronavirus pandemic lockdowns, traders have grown cautious of its anticipated money wants.

Reuters experiences that Bernstein, a US brokerage, has mentioned the corporate’s shares will “underperform”, in comparison with a earlier score of “outperform”. It expects the share worth to maneuver in direction of 260p – a stark minimize from its earlier goal of 1000p.

The report means that Ocado ought to “think about its choices” to go personal in a grocery deal and scale back money burn. That may be a significant blow to the London Inventory Trade, on condition that Ocado is without doubt one of the few outstanding UK tech corporations.

The dealer mentioned:

Liquidity problem is actual and vital with each current debt refinancing and a necessity for additional cash quickly.

Share

UK authorities’s NatWest stake falls under 20%

The UK authorities’s stake in NatWest has fallen under 20% for the primary time because the financial institution was bailed out through the monetary disaster.

NatWest, previously Royal Financial institution of Scotland, mentioned that the federal government now owns 19.97% of its shares, after promoting off 81m. The federal government had owned 38% in Might, earlier than a programme of share gross sales.

Paul Thwaite, NatWest’s chief govt, mentioned:

Returning NatWest Group to full personal possession stays a key ambition and we imagine it’s in the very best pursuits of each the financial institution and all our shareholders.

Share

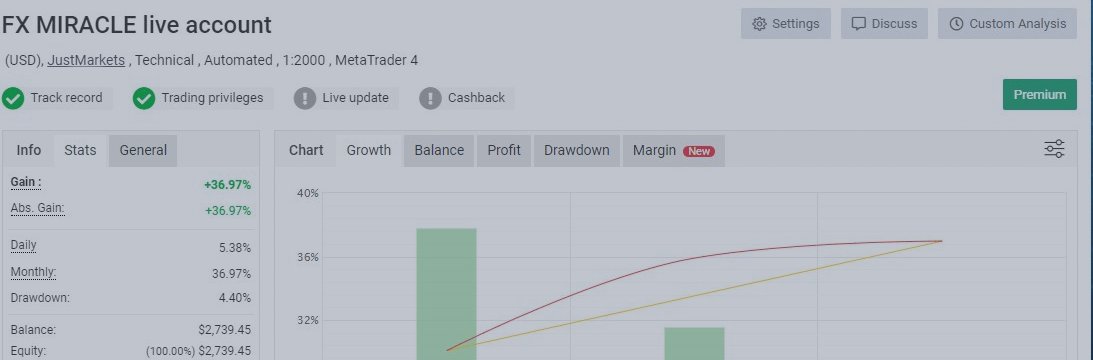

Trump set for paper achieve of $2bn as shares in media firm surge

Let’s take a more in-depth have a look at the numbers for Donald Trump’s media firm: he may very well be in line for a paper achieve of $2bn due to the hovering valuation after the failed assassination try over the weekend.

Trump Media and Know-how Group’s shares began buying and selling at $57.25 on 26 March, when it merged with a particular objective acquisition firm (Spac). It soared on its first day to a excessive of $79.38 – briefly valuing it at greater than $10bn. It has not hit these heights since then.

Spacs turned a sensation through the monetary market bubble through the coronavirus pandemic lockdowns. A shell firm lists on the inventory market, raises a load of money, after which seems for a corporation to merge with – providing a faster path to a list.

Trump’s firm – whose inventory market ticker bears his initials, DJT – jumped on the Spac bandwagon, and benefited from the “meme inventory” craze as many political supporters purchased in.

But the monetary actuality dealing with the corporate has been fairly tough, because the Fact Social community has struggled to draw the customers to justify its lofty valuation. In April the corporate’s share worth dropped as little as $22.55.

It has by no means recovered to its opening worth on 26 March, and by Friday it was at $30.89.

In pre-market buying and selling (which occurs off the primary inventory change) the worth of DJT shares rose by as a lot as 70%, though that surge has weakened considerably in latest minutes. Google Finance suggests the share worth is up 53% at $47.29.

DJT was value $5.87bn on the shut on Friday, and Trump himself owns 60%, based on Refinitiv.

If that 53% achieve is replicated when US markets open, then the notional worth of Trump’s fortune would rise by about $2bn.

Nevertheless, Trump is prevented from cashing out on his fortune till September, underneath phrases that forestall him promoting shares. The US presidential election doesn’t happen till November.

Share

Up to date at 06.06 EDT

The response to the Trump assassination try on conventional monetary markets has been pretty muted – particularly in contrast with the Trump Media & Know-how Group share worth surge.

The US greenback is sort of flat towards a trade-weighted basket of currencies, whereas US futures costs counsel US benchmark inventory indices will achieve about 0.5% once they open later.

US Treasury bond yields have tended to rise when the prospect of Donald Trump profitable again the presidency seems to extend. That’s on the idea that his financial insurance policies would improve inflation and add to authorities debt.

The value of benchmark 10-year Treasury bonds fell in worth on Monday. The yield on these bonds (which strikes inversely to costs) rose by 0.02 share factors to 4.206.

Share

Share worth of Trump’s Fact Social firm rises 70% pre-market

The share worth of Donald Trump’s media firm has surged in pre-market buying and selling after the tried assassination of the US presidential candidate.

Demand for shares in Trump Media & Know-how Group (TMTG), the proprietor of the X rival Fact Social, appeared to soar on Monday. The share worth rose 70% in buying and selling forward of the opening of New York’s Nasdaq inventory change.

Merchants seem like speculating that the assassination try makes a Trump victory within the November presidential election extra doubtless, and that that will profit TMTG, regardless of its monetary struggles to this point.

Share

Up to date at 04.46 EDT

Bitcoin leap linked to Trump assassination try by analysts

The value of bitcoin has jumped 10% in a transfer that some analysts have linked to the tried assassination of Donald Trump on Saturday.

The value of 1 bitcoin rose above $63,000 on Monday, and was up 9% over the day, based on Refinitiv.

The cryptocurrency – which tends to be extra unstable than many conventional property – had slumped from above $70,000 in early June to under $54,000 in early July. Its file excessive was in March, when it hit 73,803.

The idea is that the Trump’s defiance after the assassination try makes him extra prone to win, and that he’ll then be extra prone to ease rules on bitcoin, as he has courted crypto advocates, together with in a June assembly with crypto “miners” (homeowners of computer systems that make the calculations essential to the decentralised cryptocurrency’s functioning). Many cryptocurrency advocates have hyperlinks to libertarian politics.

The value of #Bitcoin is up almost 10%(!) following the assault on Donald #Trump. As the percentages of Trump profitable the US elections rise, so does Bitcoin, underscoring that it’s extremely prone to shifts within the political panorama. This makes the work of traders tougher, as… pic.twitter.com/Z8HLrEMEVw

— jeroen blokland (@jsblokland) July 15, 2024

Rania Gule, market analyst at XS.com, a web-based buying and selling platform, mentioned that bitcoin had gained after Joe Biden’s poor efficiency in a debate towards Trump earlier this month:

I imagine that US political information is driving features in cryptocurrencies as a result of it’s a “speculation-driven” space.

If re-elected, Trump might search much less stringent regulatory insurance policies in direction of cryptocurrencies, probably enhancing regulatory situations and inspiring extra investments.

His insurance policies in direction of worldwide relations and overseas commerce even have a big influence available on the market, as tensions or stability in worldwide relations might result in fluctuations in cryptocurrency markets.

You possibly can comply with extra information on US politics as Trump prepares to simply accept the Republican get together’s nomination as US president:

Share

Recruiter Robert Walters warns of slower restoration in jobs market

Recruiter Robert Walters has additionally warned that it doesn’t count on the roles market to choose up no less than till subsequent 12 months, after a slowdown in hiring the world over.

UK revenues for the London-listed firm had been down 18%, whereas Asia Pacific revenues had been down 15%.

Toby Fowlston, chief govt, mentioned:

Price earnings for the primary half of 2024 continued to replicate the rebasing in market situations relative to the post-pandemic peak. This era of market adjustment is now longer in length than beforehand anticipated, with macroeconomic turbulence and political uncertainty restraining shopper and candidate confidence in sure geographies.

Our near-term planning now assumes that any materials enchancment in confidence ranges will probably be gradual, and certain not happen earlier than 2025.

Share

Burberry’s struggles and the surprisingly weak Chinese language financial figures are placing luxurious and vogue shares throughout Europe underneath stress.

Watch firm Swatch Group additionally reported a steep fall in gross sales within the first half of its monetary 12 months. JP Morgan analysts mentioned that Swatch has one of many highest exposures to China amongst its European rivals, based on Reuters. they wrote:

We expect the sector will doubtless come underneath stress very first thing this morning, and notably Richemont, the obvious read-across.

Cartier proprietor Richemont fell 2.6% and Louis Vuitton proprietor LVMH was down 1.7%.

Share

As may be anticipated after such a brutal set of stories on Monday morning, Burberry’s share worth has slumped.

The style firm is down 11% in early buying and selling.

It has been a fairly torrid 12 months. You possibly can see right now’s hunch within the very backside proper of the under chart, but it surely has been one-way visitors for a lot of 2024. Shares are down 45% for the 12 months.

Share

It seems like these Chinese language GDP knowledge might have set the temper for Monday on inventory markets, with Europe’s indices falling on the opening bell.

London’s FTSE 100 and Spain’s Ibex are each down 0.4% in early buying and selling, so it doesn’t appear to be a response to the soccer no less than.

Listed here are the opening snaps, by way of Reuters:

EUROPE’S STOXX 600 DOWN 0.3%

GERMANY’S DAX DOWN 0.2%

BRITAIN’S FTSE 100 DOWN 0.4%

FRANCE’S CAC 40 DOWN 0.5%, SPAIN’S IBEX DOWN 0.4%

EURO STOXX INDEX DOWN 0.4%; EURO ZONE BLUE CHIPS DOWN 0.4%

Share

Burberry replaces boss as loss anticipated; Chinese language retail weak point slows progress

Good morning, and welcome to our dwell protection of enterprise, economics and monetary markets.

All change on the high of British vogue: Burberry has introduced the departure of chief govt Jonathan Akeroyd after it was pressured to cancel its dividend after a hunch in gross sales.

Akeroyd has left the FTSE 100 firm “with rapid impact by mutual settlement with the board”, Burberry mentioned on Monday morning. Burberry has appointed American Joshua Schulman, a former Michael Kors boss, to interchange him.

Gerry Murphy, Burberry’s chair mentioned the efficiency was “disappointing”. He mentioned:

We moved rapidly with our artistic transition in a luxurious market that’s proving more difficult than anticipated. The weak point we highlighted coming into full 12 months 2025 has deepened and if the present pattern persists by way of our second quarter, we count on to report an working loss for our first half. In gentle of present buying and selling, we’ve got determined to droop dividend funds in respect of full 12 months 2025.

The information revealed by Burberry in its accompanying buying and selling replace don’t make for fairly studying for shareholders: comparable retailer gross sales are down by 21% to £458m within the 13 weeks to 29 June.

Within the Asia Pacific area gross sales are down by 23%. Revenues throughout your complete monetary 12 months might drop by 30%. Burberry mentioned:

We’re working towards a backdrop of slowing luxurious demand with all key areas impacted by macroeconomic uncertainty and contributing to the sector slowdown.

Chinese language GDP grows by 4.7%, under 5.1% forecast

Buberry’s struggles have been put into context by Chinese language GDP figures earlier this morning: progress slowed to 4.7% year-on-year within the second quarter, down from 5.3% within the first quarter and under the 5.1% anticipated by economists polled by Reuters.

China’s Communist get together leaders are assembly for his or her “third plenum” this week, the discussion board that takes place about each 5 years at which they set out their long-term insurance policies on the financial system. The federal government is aiming for five% progress in 2024, which can be a difficult goal if the weak point persists.

The figures had been “hampered primarily by weak shopper spending and demand”, mentioned analysts at Deutsche Financial institution led by Jim Reid. They added:

Different knowledge confirmed that China’s retail gross sales slowed to +2.0% y/y in June (v/s +3.4% anticipated and the worst since December 2022) after advancing +3.7% in Might, thus highlighting that the world’s second largest financial system is struggling to spice up consumption. Including to the detrimental sentiment, China’s dwelling costs fell once more in June, declining -0.67% on the month with current dwelling costs declining -0.85%.

The agenda

Share