This text delves into key ideas such because the inevitability of bear markets, the advantages of volatility, and the cyclical nature of market developments.

By greedy these rules, buyers can develop a sound technique to realize long-term success.

Unlock AI-powered Inventory Picks for Underneath $8/Month: Summer time Sale Begins Now!

The inventory market can really feel like a rollercoaster experience, with intervals of exhilarating progress adopted by stomach-churning dips. Whereas these downturns will be nerve-wracking, a historic perspective may help you climate the storm and keep targeted in your long-term funding targets.

This text explores 5 key ideas that each investor ought to perceive to navigate the inventory market’s pure cycles and maximize their possibilities of success. We’ll delve into the inevitability of bear markets, the hyperlink between volatility and better returns, the cyclical nature of market developments, the significance of holding for the long run, and the problem of actively choosing shares that outperform the market.

By greedy these rules, you may achieve a clear-eyed understanding of how the market works and develop a sound funding technique for the longer term. So, listed below are the 5 key ideas to recollect when investing in shares for long-term beneficial properties:

1. Embrace Bear Markets as Stepping Stones

Bear markets, intervals of great value decline, are inevitable. Nevertheless, they are typically shorter than bull markets (progress intervals).

Whereas these downturns will be nerve-wracking, bear in mind: panicking and promoting can lock in losses. A protracted-term perspective helps you climate these storms and capitalize on future alternatives.

2. Volatility Can Create Alternative

If the inventory market () solely skilled regular progress, its returns could be much like these of a deposit account or short-term bond as a result of restricted danger.

Fortunately, the market’s unpredictability and occasional main declines allow it to supply larger returns over the long run. This phenomenon, referred to as the chance premium, is particularly vital throughout sure excessive affect occasions.

3. Every little thing Is Cyclical

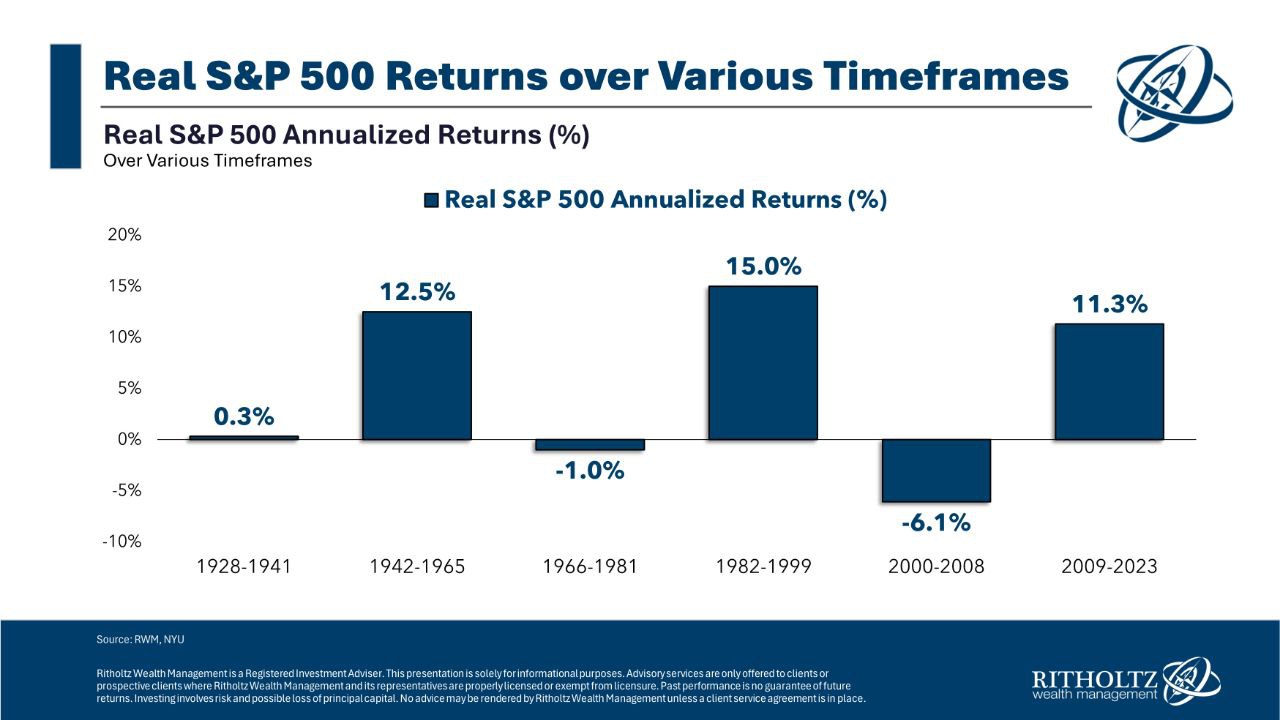

Howard Marks aptly describes market actions as a pendulum, swinging between extremes somewhat than settling within the center. This cyclical nature signifies that after intervals of sturdy efficiency, markets typically expertise downturns, and vice versa.

Throughout bullish phases, valuations soar and investor sentiment is euphoric, driving costs larger. Nevertheless, this exuberance units the stage for decrease future returns as valuations turn out to be stretched. Finally, the market corrects, costs fall, and worry replaces euphoria. This correction paves the way in which for the following cycle of progress.

Understanding this pendulum impact may help buyers navigate market cycles extra successfully, permitting them to anticipate shifts and modify their methods accordingly.

4. Time and Persistence Are Essential

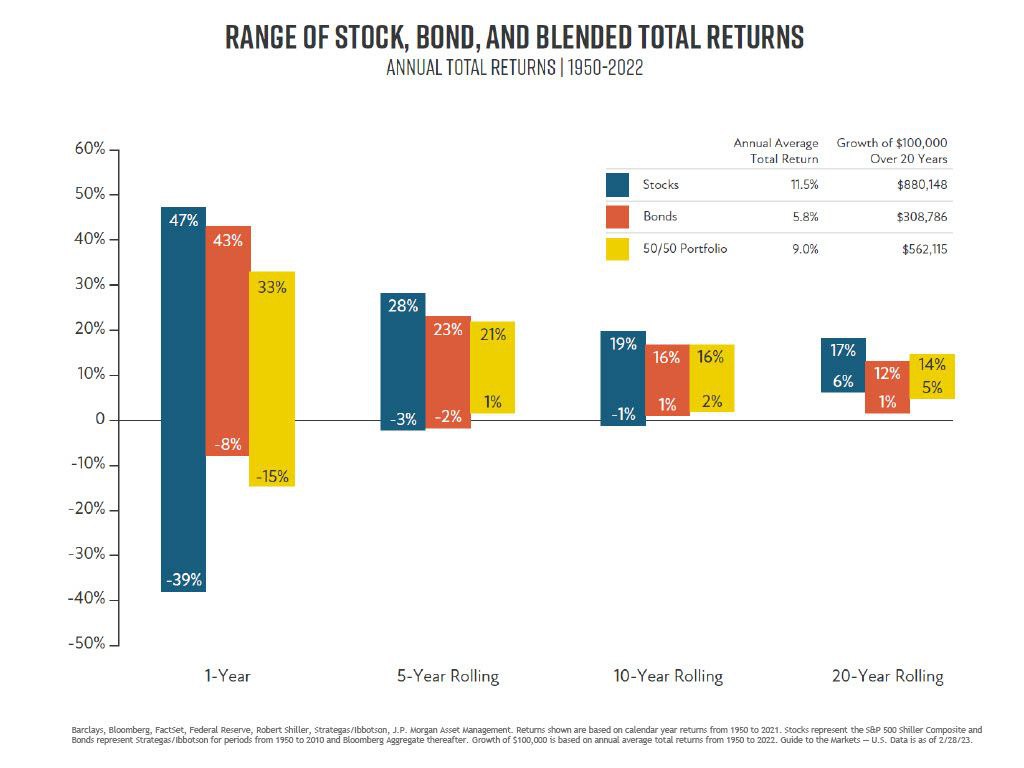

Need to earn a living within the inventory markets? Success requires time and persistence. The longer you maintain shares in your portfolio, the upper your possibilities of making a revenue. Presently, the typical holding interval for shares is simply six months.

This short-term method typically results in monetary losses, as illustrated by the chart under. Most buyers fail to earn a living as a result of they wager in opposition to the percentages.

5. Can You Beat the Market by Inventory Selecting?

Inventory choosing to outperform the market is feasible, but it surely’s a formidable problem. Practically 90 p.c of lively managers fail to beat the market over intervals longer than three years, regardless of getting access to cash, info, and expert groups. So, can particular person buyers do it? Possibly.

This is a device which may assist, out there for a restricted time throughout our summer time promotion.

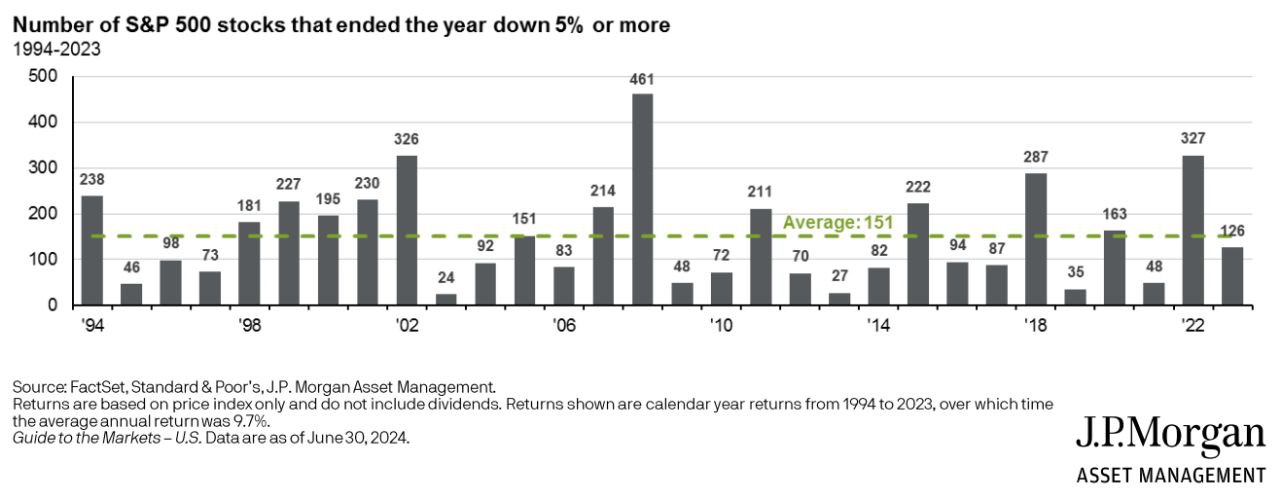

Remember that out of the five hundred firms within the S&P 500, about 151 (30%) usually finish the 12 months with detrimental returns. Just a few considerably outperform the market. What are the possibilities of choosing these 20-30 shares that may yield substantial additional returns? Slim.

As Warren Buffett stated, “Investing is easy, however not simple.” Everybody is aware of what could be the best factor to do, however few do it.

***

This summer time, get unique reductions on our subscriptions, together with annual plans for lower than $8 a month!

Uninterested in watching the large gamers rake in earnings when you’re left on the sidelines?

InvestingPro’s revolutionary AI device, ProPicks, places the facility of Wall Road’s secret weapon – AI-powered inventory choice – at YOUR fingertips!

Do not miss this limited-time provide.

Subscribe to InvestingPro immediately and take your investing sport to the following stage!

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, provide, recommendation, counsel or suggestion to take a position as such it’s not meant to incentivize the acquisition of property in any method. I wish to remind you that any kind of asset, is evaluated from a number of views and is very dangerous and due to this fact, any funding choice and the related danger stays with the investor.