jetcityimage

Funding Thesis

Operational excellence, a diversified portfolio, and free money movement development make sure that Occidental Petroleum (NYSE:OXY) stays one in every of Warren Buffett’s prime picks within the power house. Buffett has already bought 255 million shares, making up 29% of the oil and fuel firm’s possession. Buffett continues to construct his stake within the firm, because it seems like a cut price at these ranges.

Since our final protection in January, OXY’s inventory value has elevated from $58 to $62, reflecting a achieve of seven%. Our earlier bullish thesis stays intact, supported by regular progress in monetary efficiency and strategic initiatives. OXY’s long-term potential is bolstered by Buffett’s continued confidence and the corporate’s strategic development efforts.

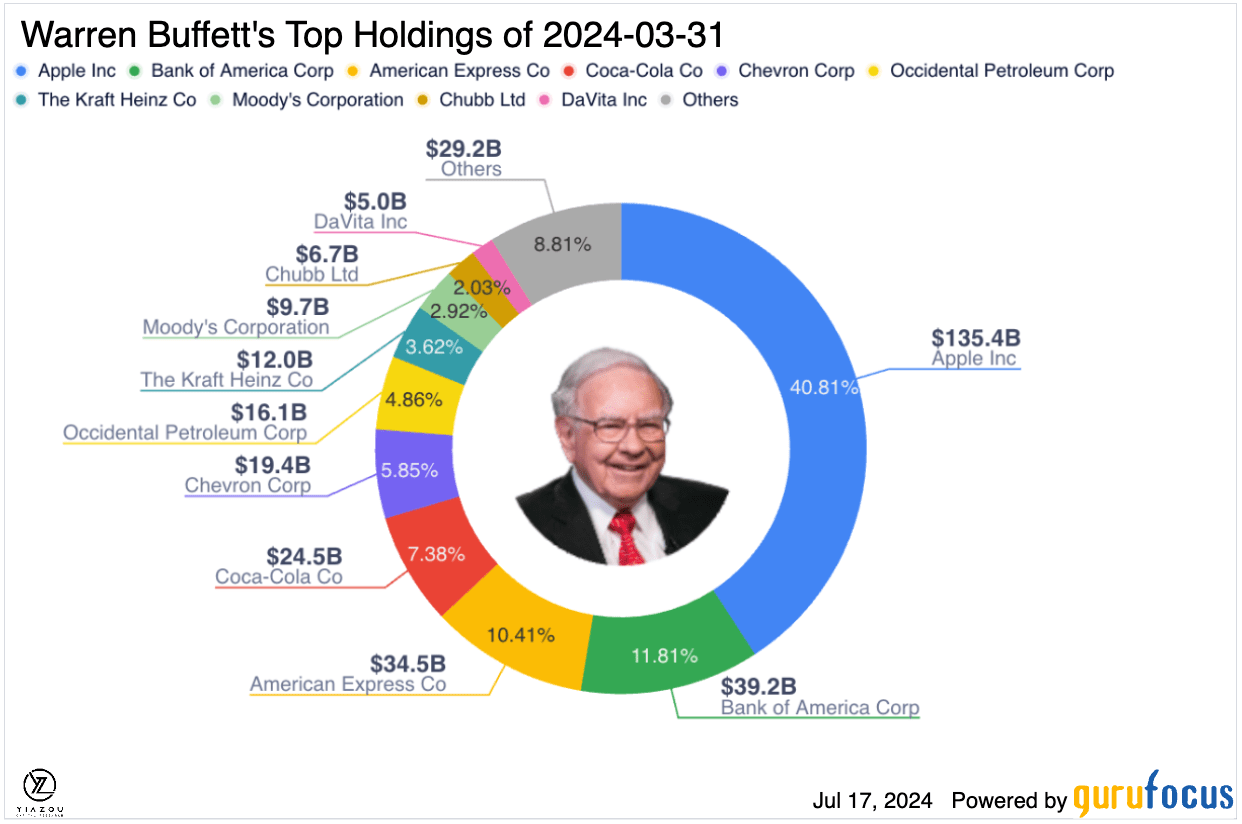

Buffett Boosts Occidental Stake to 29%, Eyes Potential 40% With out Full Management

Warren Buffett continued buying shares of Occidental Petroleum, which appeared to convey its stake up to twenty-eight.8% with almost 255.3 million shares. This makes Occidental Berkshire’s sixth-biggest holding. The frequent shares embrace the warrants to purchase 83.9 million extra at $59.62 every and Berkshire’s 84,897 shares of most well-liked inventory. The warrants’ train and most well-liked redemption might convey Berkshire’s possession above 40%. Although that is attainable, Buffett has publicly proclaimed that he will not take management of the corporate.

Warren Buffett made an enormous funding in Occidental as a result of he had a variety of religion within the administration and the technique that this firm adopted. He began shopping for after studying by means of a transcript of an earnings name and felt that the strategy was properly aligned along with his funding philosophy. He praised Occidental CEO Vicki Hollub for managing properly. The latest improve in stake exhibits continued confidence in efficiency and strategic course for the agency.

GuruFocus

Occidental Thrives With $2 Billion Money Movement and Rising Output

The funding spree is pushed by Buffett’s confidence in Chief Govt Officer Vicki Hollub, a sentiment confirmed by the latest monetary outcomes. The oil and fuel juggernaut benefited from strong operational efficiency, as groups delivered at excessive ranges throughout oil and fuel, OxyChem, midstream, and advertising and marketing segments. Consequently, whole operational money movement totaled $2 billion, and money movement earlier than working capital reached $2.4 billion.

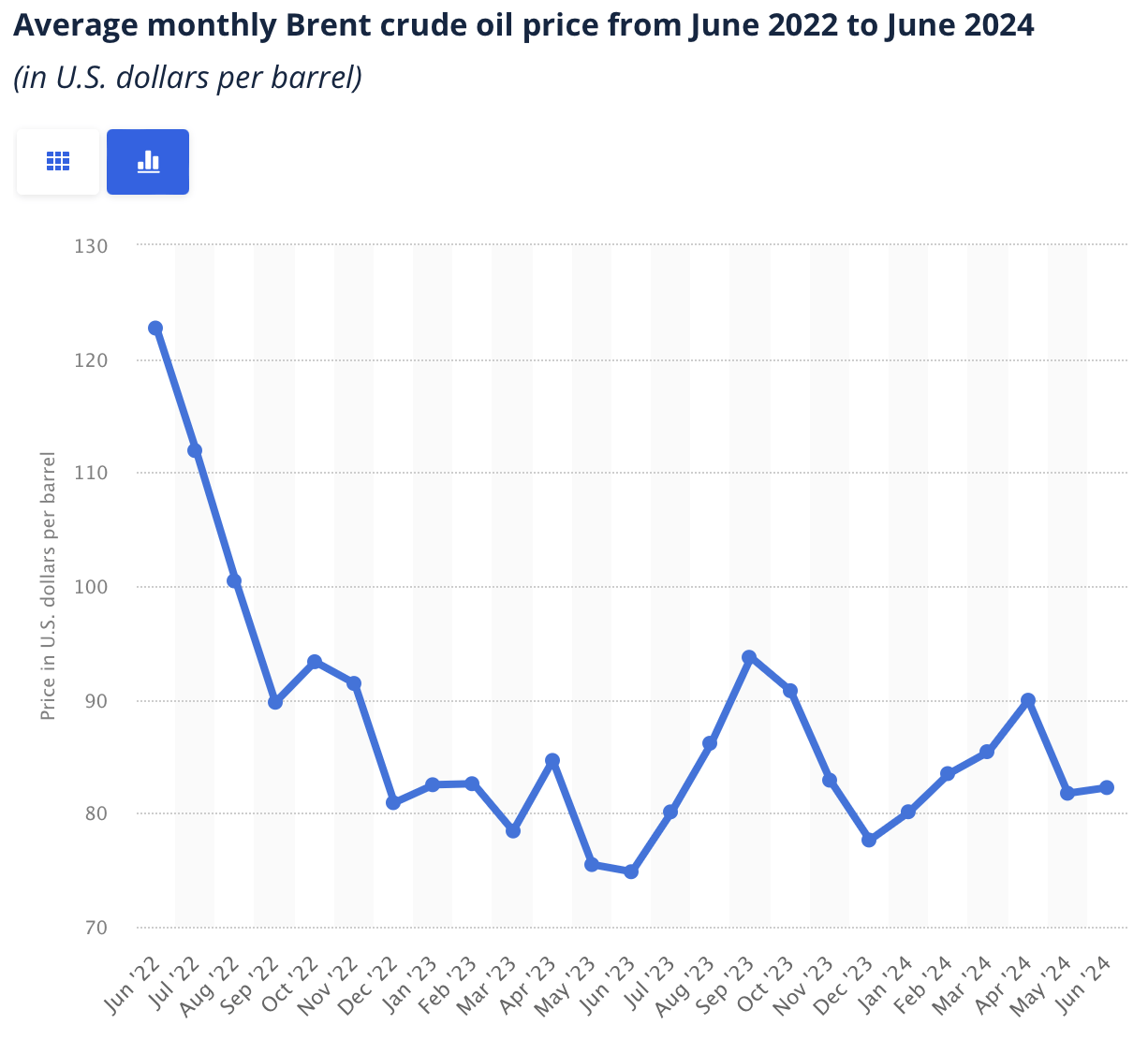

The corporate delivered a web earnings attributed to shareholders of $718 million or $0.75 a share and adjusted earnings of $604 million or $0.63 per diluted share. It generated $1.2 billion in oil and fuel pretax earnings in comparison with $1.6 billion within the fourth quarter. The slight drop was as a consequence of decrease crude oil costs and home crude volumes. Common crude costs had been down by about 4% within the quarter, averaging round $76 a barrel.

Regardless of worries that crude oil may face challenges because of the transfer in the direction of different types of power, the whole elimination of fossil fuels is but to be anticipated within the close to future. The primary enterprise of manufacturing crude oil remains to be strong, notably with the Worldwide Power Company (IEA) predicting that worldwide oil use will rise from 103.2 million barrels a day to 105.6 million by 2030.

The expectation of solely a slight lower in oil demand after 2030 is why Buffett may be very optimistic concerning the oil firm’s future. The corporate has been growing its output, attaining a median of 1.1 million barrels of oil every day within the first quarter, which is near the center of its anticipated vary.

statista

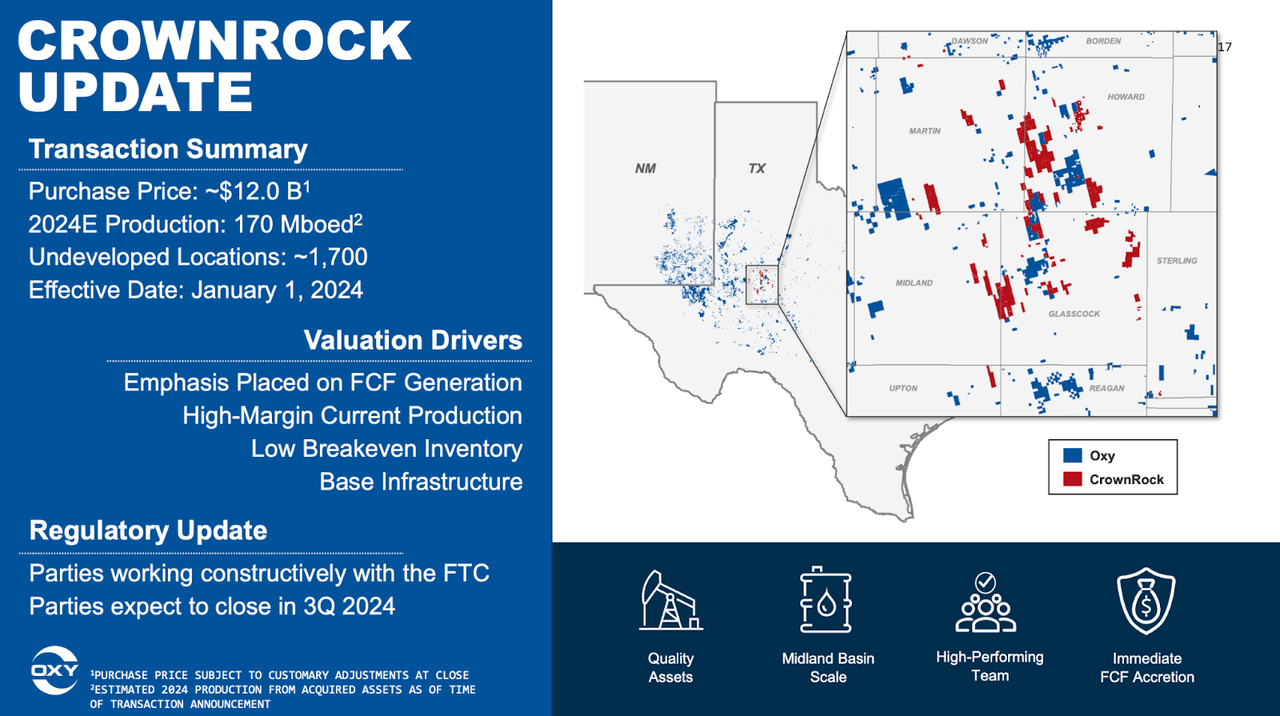

OXY Expands Permian Energy: $12 Billion CrownRock Deal to Enhance Manufacturing and Money Movement

Occidental Petroleum has additionally moved to boost its foothold within the Permian Basin to bolster manufacturing by buying CrownRock for $12 billion. With the acquisition, the corporate will increase its presence into the biggest oilfield. Additionally it is buying a vital low-breakeven and development-ready stock within the Permian Basin by means of CrownRock, which owns over 94,000 web acres of premium pay property and infrastructure.

The deal would strengthen the corporate’s stock ranges by 33% at a break-even value of sub-$40 a barrel. The settlement is predicted to spice up output by 170,000 barrels of oil equal per day by 2024. In the meantime, the CrownRock buyout also needs to see annual free money movement surge by $1 billion when oil pricing stabilizes north of $70 per barrel.

As well as, after finishing the CrownRock buyout deal, OXY expects to divest $4.5 billion to $6 billion. Following the sale, the corporate should pay a portion of its excellent principal debt beneath $15 billion. The agency expects the debt discount to allow its resumption of inventory repurchases below COG’s dedication to returning worth to shareholders.

OXY

Increasing Chemical Enterprise and Carbon Seize for $1 Billion Non-Oil Earnings by 2026

Along with pursuing development within the profitable oil and fuel enterprise, Occidental Petroleum has additionally been diversifying its enterprise empire because it positions itself for the longer term. The corporate has been investing and increasing its chemical enterprise because it continues to construct a carbon seize and storage platform. The investments are anticipated to develop the corporate’s non-oil earnings by over $1 billion by 2026.

OxyChem is the corporate’s chemical enterprise that manufactures vinyl fundamentals and specialty chemical compounds utilized in prescription drugs, water disinfectants, and detergents. The unit generates important money flows which have helped shrug off some volatility within the core oil and fuel enterprise. For example, it earned a pretax earnings of $260 million within the first quarter, which was $10 million above the steerage.

The $10 million improve was pushed primarily by robust demand for the corporate’s polyvinyl chloride and vinyl chloride monomer and decrease ethylene prices. The agency is pouring a variety of sources into rising OxyChem’s manufacturing capabilities. It is updating and broadening its Battleground web site and enhancing a number of crops alongside the Gulf Coast.

In 2023, Occidental Petroleum started the primary funding section for its plant upgrades, which it aimed to finish by 2025. The fruits of those enhancements are beginning to be seen, with the total advantages anticipated by 2025. On the similar time, it should full the Battleground web site by mid-2026. The corporate estimates the investments will lead to one other $300 million to $400 million in earnings over time.

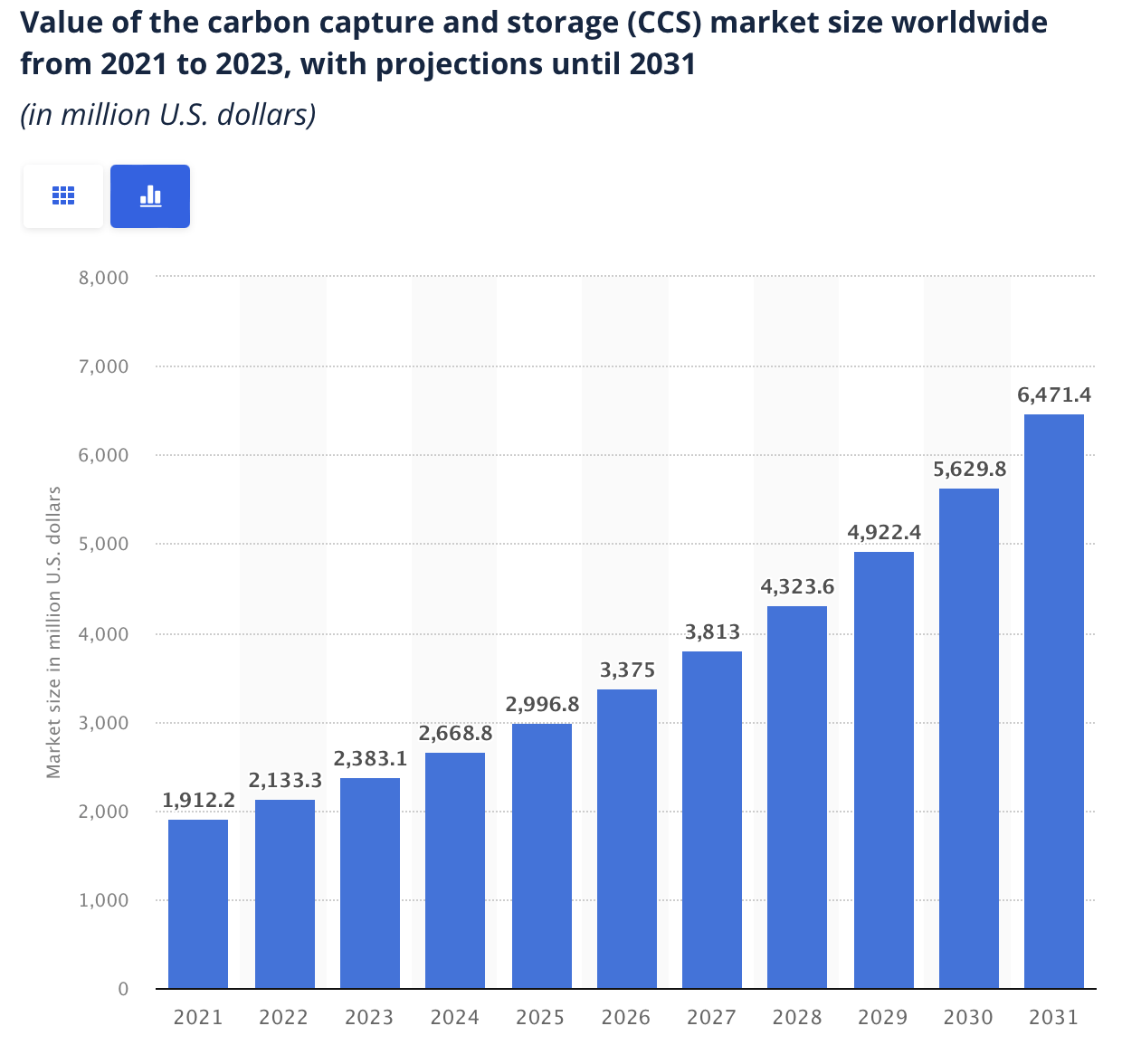

Occidental Targets $4 Trillion market with $600M STRATOS Carbon Seize Plant

As well as, it has positioned itself to profit from the growing drive to take away carbon from the air. This might value $600 million and contain setting up a STRATOS direct air seize (DAC) plant in Texas for Oxy Low Carbon Ventures. The plant can take away as a lot as 500,000 tons of Carbon dioxide yearly and will come on-line earlier than the top of the 12 months.

Whereas it’s within the early levels of commercializing the DAC know-how, it’s properly positioned to generate important worth by the rising push to cut back CO2 emissions to fight world warming. The agency has additionally secured a strategic partnership with BlackRock (BLK), which can assure $550 million in funding in the direction of the event prices of STRATOS.

Since carbon seize and sequestration is predicted to turn out to be a $4 trillion business by 2050, Occidental Petroleum is likely one of the firms well-positioned to profit from its DAC know-how, which it acquired final 12 months following a $1.1 billion acquisition of Carbon Engineering.

Statista

Concluding Ideas

At the same time as the corporate diversifies its enterprise empire, it stays a prime inventory choose within the power sector for passive earnings. In Could, the corporate elevated its quarterly dividend to $0.22 a share, taking its annualized dividend to $0.88, translating to a yield of about 1.4%.

Along with the dividend providing, the inventory has gained about 3.4% 12 months to this point. Whereas underperforming in comparison with the general market’s 19%, it trades at a ahead price-to-earnings a number of of 17, barely above the S&P 500 power sector’s P/E of 13.

Whereas web debt was roughly $19.6 billion within the first quarter, the debt-to-equity ratio had already fallen to 0.67 from a excessive of 1.9 on the shut of the deal in 2019 to purchase Anadarko for $55 billion. This clearly and vividly signifies that the corporate is doing issues proper relating to peeling off increased indebtedness.

If oil costs keep above $70 per barrel, Occidental Petroleum won’t have bother producing heavy revenues and free money flows. The CrownRock acquisition is more likely to improve its capability to extend manufacturing additional whereas strengthening its prospects within the business, with oil output at $40 a barrel.

Along with oil and fuel, two potential catalysts for OxyChem and Oxy Low Carbon Ventures companies will seemingly spur development over a few years as the worldwide financial system shifts towards lower-carbon power. In fact, the corporate pledged that a good portion of money flows would cut back $3.7 billion in debt, however pledged inventory buybacks and better dividends had been aimed toward returning worth to shareholders.