Tom Werner/DigitalVision by way of Getty Photos

Funding motion

I advisable a maintain ranking for Darden Eating places (NYSE:DRI) after I wrote about it in April this yr, as I used to be frightened concerning the impacts of inflation on DRI retailer site visitors and its value base. Primarily based on my present outlook and evaluation, I like to recommend a promote ranking. My key replace to my thesis is that I anticipate DRI to lose share within the close to time period as a result of promotional atmosphere throughout the business. Administration has voiced their intention to give attention to worthwhile development; therefore, I don’t suppose they’re going to have interaction in aggressive advertising to guard their market share. Alongside that is the poor shopper spending atmosphere, which ought to additional drag down general demand.

Overview

Trying on the state of the present shopper spending atmosphere, I’m turning pessimistic concerning the DRI demand outlook over the following couple of quarters. On the core of my perception is that buyers are slicing again on spending throughout each staples and discretionary merchandise. I’ve written about my views on the present macro atmosphere on this publish, and I’m reiterating among the factors for readers of this publish:

To start with, on the macro degree, shopper spending stays very pressured. A number of indicators and proof are pointing to this: (1) shopper sentiment ticked down in July to its lowest level in 2024; (2) main retailers are slicing costs to draw shopper demand; (3) customers are slicing again on primary items demand like groceries; (4) discretionary spending is being held again. Evidently, that is positively not an atmosphere the place I anticipate customers to spend extra on discretionary gadgets. Secondly, the comp base is barely harder for FY24, as 2023 had the 53rd week and the US has a compressed vacation calendar in 2024. Writer’s work on Academy Sports activities And Outside

This impression is felt strongly in away-from-home eating as nicely, the place customers usually tend to in the reduction of on eating in eating places. I also needs to level out that meals away from dwelling inflation is monitoring greater than general headline inflation; as such, customers are feeling extra stress from that finish.

Given the demand backdrop, I see a really excessive chance of elevated promotions by restaurant gamers with a purpose to proceed capturing demand, and we are able to already see this occurring with the quick meals gamers and step by step occurring with the informal eating gamers (DRI’s fundamental rivals). As an illustration, Chili’s not too long ago slashed the value of its Massive Smasher burger, which was launched in early 2024, by 15% to $10.99 if it was bought within the “3 for Me” meal combo. One other instance can be Applebee’s launching the $1 Margaritas and 50 cent mozzarella sticks. Whereas I discussed that informal diners are the primary rivals for DRI, one mustn’t overlook the truth that the reductions and promotions provided by quick meals gamers might lead to a bit of DRI’s prospects buying and selling down.

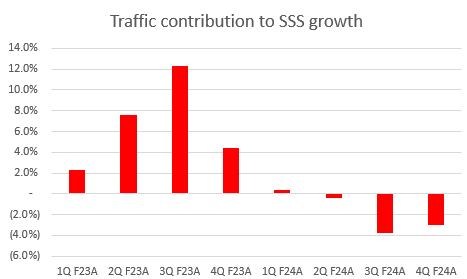

Writer’s work

In mild of this promotional atmosphere, I’m very frightened that DRI goes to lose a big share within the close to time period. The latest outcomes that confirmed site visitors declining additional validate my view that DRI is going through a pinch from the promotional atmosphere. The hope is that DRI can even step up on promotions to retain its market share, however I’ve little expectations for DRI to be aggressive on this entrance, as administration has at all times communicated their intention to realize worthwhile development. Even within the latest earnings name, they reiterated this level. Alternatively, friends which have reported lackluster development like Brinker Worldwide (EAT), Bloomin’ Manufacturers (BLMN), and BJ’s Eating places (BJRI) are very prone to step up on promotions to win again share (EAT income grew 3.4%; BLMN income fell by 4%; BJRI income fell by 1.2% within the newest quarter).

And simply bear in mind, we do have levers to drag. We do have extra advertising to drag if we need to, however our focus is on worthwhile gross sales development. 4Q24 earnings

Valuation has room to compress

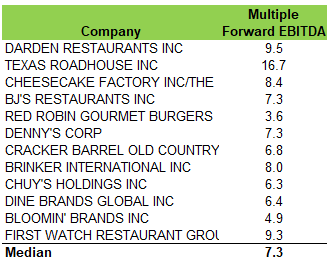

Writer’s work

DRI at the moment trades at a premium to the business, and that is granted as a result of it has proven higher development than friends over the previous few quarters. Nonetheless, I feel this dynamic is about to vary when rivals are stepping up on promotion whereas DRI is caught with producing worthwhile development. That is very possible going to impression DRI gross sales within the coming quarters, which I anticipate to result in a valuation compression from 9.5x to 7.3x. Whereas DRI has traded all the way down to its -1 normal deviation, from a historic perspective, there’s nonetheless room for valuation to fall, because it did go to ~8x in early 2017.

Danger

Since I’m downgrading to a promote ranking, I ought to contact extra on the potential upside danger.

The upside danger right here is that inflation is certainly coming down, not less than on a headline foundation, and if this development continues, stress on shopper spending will ease incrementally as we transfer by the yr, which ought to drive general business demand.

One other danger is that administration might flip aggressive on promotions, regardless of what they sign to the market, and so they do have some room to play with given Olive Backyard (the largest revenue driver for DRI) restaurant degree margins are nonetheless trending above pre-covid (2019) ranges at 21.9% as of FY24 vs. 20.6% in FY19. This might assist the present valuation a number of that DRI is buying and selling at.

Lastly, DRI nonetheless has a robust steadiness sheet (<1x leverage ratio with $200 million of money available and $1 billion availability in credit score amenities) that it could actually use to assist share value efficiency (they did purchase again 8% of shares over the past 3 years).

Ultimate ideas

My advice is to downgrade from a maintain to a promote ranking, because the near-term demand outlook is bleak. Inflationary pressures are resulting in diminished shopper spending, significantly in discretionary classes like restaurant eating. As well as, DRI’s give attention to worthwhile development retains them from participating in aggressive promotions, not like rivals, possible leading to market share losses within the near-term. As this stuff occur, I see the potential for DRI’s valuation to compress all the way down to the business’s degree.