LordHenriVoton

Direct Line (OTCPK:DIISF) continues to commerce at a reduction to its historic common and its peer group, however this appears to be justified by a weak working efficiency and vital execution threat of its turnaround program.

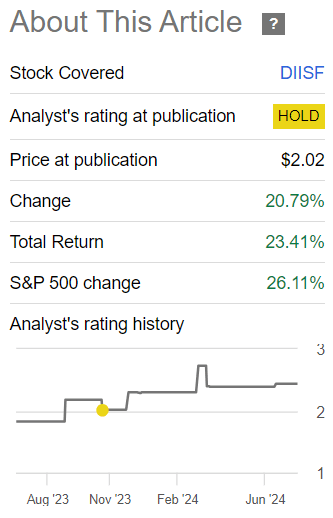

As I’ve coated in earlier articles, Direct Line’s working efficiency was fairly weak as a result of some points within the U.Okay. motor section, which justified its discounted valuation. Regardless of that, its shares are up by greater than 23% together with dividends since my final article, as Ageas (OTCPK:AGESF) proven curiosity in shopping for its competitor, supporting its shares in current months.

Article efficiency (Searching for Alpha)

As I’ve not coated Direct Line for a while and the corporate additionally carried out a capital markets day lately, I believe it’s now time to research its most up-to-date monetary efficiency and technique, to see if its presents worth for long-term buyers within the European insurance coverage sector.

Latest Occasions

A number of months in the past, Ageas made a suggestion to purchase Direct Line for about $3.9 billion, which was rejected by its administration for ‘undervaluing’ it. Ageas was not in a position to have interaction with Direct Line’s administration following the provide and finally didn’t proceed with a agency provide, strolling away from this potential deal.

Whereas an acquisition was not profitable presently, this exhibits that finally Direct Line could also be undervalued following a weak share value efficiency from 2021 to mid-2023. Direct Line’s present market worth is about $3.2 billion, exhibiting that Ageas supplied an honest premium, regardless that on a long-term foundation the corporate could also be value way more.

This occurs as a result of Direct Line is considerably uncovered to the U.Okay. motor section, which has been below stress over the previous few years, first by rising used-car values through the chip scarcity problem, and afterwards by rising restore prices as a result of inflationary surroundings.

These points ought to, a minimum of theoretically, be momentary, and Direct Line’s working efficiency and profitability ought to ‘normalize’ within the close to future, when these pressures subdue. Certainly, its return on tangible fairness (RoTE) ratio, a key measure of profitability within the insurance coverage sector, remained adverse in Fiscal 12 months (FY) 2023 (RoTE of -15%), whereas up to now Direct Line used to report double-digit returns.

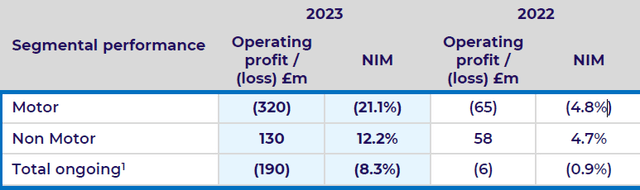

That is defined by a really poor efficiency within the motor section, resulting in an total mixed ratio of 108% in FY 2023 (vs. 101% in FY 2022), which implies the corporate had working losses through the previous two years. Nevertheless, its reported revenue amounted to £223 million in FY 2023, as a result of a achieve of £444 million within the sale of its brokered industrial insurance coverage enterprise.

In different insurance coverage segments, Direct Line was in a position to report an working revenue through the previous two years, however this was not sufficient to offset weak spot within the motor section, as proven within the subsequent desk.

Gross premiums (Direct Line)

Given this weak working efficiency, Direct Line made some strategic actions to enhance its underwriting profitability within the motor section, specifically rising insurance coverage premiums and increasing its own-managed restore community to have a greater management on restore prices, and finally enhance its underwriting profitability in motor.

These measures had a optimistic impact on its gross premium written through the first quarter of fiscal yr 2024, with premiums rising by 18% YoY to £424 million within the final quarter. As the corporate solely studies a buying and selling replace on a quarterly foundation, it’s not potential to know the way its profitability was in Q1, however Direct Line it expects written margins to be above 10%, thus its profitability is anticipated to get well within the first half of the yr.

Certainly, in accordance with analysts’ estimates, its mixed ratio in H1 FY 2024 is anticipated to be round 96%, thus Direct Line ought to report an working revenue once more, after three semi-annual consecutive losses since H2 FY 2022. This exhibits that greater insurance coverage premiums have been forward of claims prices, as inflation and wage stress have declined in current quarters, boding effectively for Direct Line’s underwriting revenue within the close to future.

From a strategic standpoint, Direct Line up to date its enterprise technique lately in its capital markets day, aiming to focus its investments in insurance coverage traces the place it has market place and may ship returns sooner or later, specifically motor, residence, industrial direct, and rescue insurance coverage traces. Different enterprise segments, akin to pet or journey insurance coverage aren’t a part of its ‘core enterprise’ and Direct Line will not make additional investments in these insurance coverage traces.

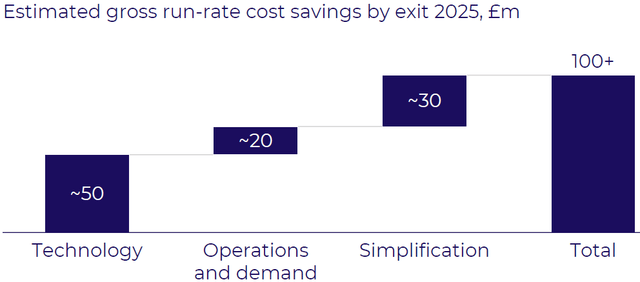

It goals to return to develop by higher technical outcomes, which implies underwriting standards can be key to its future profitability. This implies Direct Line is anticipated to pursue profitability quite than volumes forward, plus it has additionally carried out a value financial savings program to enhance its total profitability over the following couple of years. The corporate is focusing on gross run-rate value financial savings of £100 million by the top of 2025, which must be an vital contributor to a better bottom-line over the medium time period.

Its whole value base was £849 million in 2023, which implies its gross financial savings are anticipated to cut back its annual working bills by about 12%, with the objective of closing the expense ratio hole between Direct Line and its friends of six proportion factors within the final yr. This implies Direct Line is at the moment much less environment friendly than friends and is performing a number of measures to cut back enterprise complexity and making use of machine studying and different technological developments to supply a greater customer support, whereas lowering prices on the similar time.

Price financial savings (Direct LIne )

These efforts to enhance its underwriting income and working effectivity ought to result in a web insurance coverage margin of about 13% by 2026, whereas beforehand was focusing on a minimum of 10%.

Concerning its capital and dividends, Direct Line’s goal is to have a Solvency II ratio of a minimum of 180% and distribute some 60% of its earnings to shareholders. On condition that its Solvency ratio was 197% on the finish of final March, the corporate appears to be effectively capitalized and its dividend payout ratio appears acceptable.

On condition that Direct Line’s earnings are anticipated to get well in FY 2024 to a reported revenue of about £171 million and its Solvency ratio ought to stay round 200% over the approaching quarters, it’s fairly probably that it’s going to resume ‘regular’ dividend funds associated to 2024 earnings.

Certainly, whereas Direct Line resumed dividend funds a few months associated to 2023 earnings, following a dividend suspension within the earlier yr, its dividend was solely £0.04 per share (vs. £0.227 per share associated to 2021 earnings). Based on analysts’ estimates, its dividend associated to FY 2024, anticipated to be paid in Q2 2025, ought to improve to £0.11 per share, resulting in a ahead dividend yield of about 5.8%. That is an attention-grabbing yield, however I believe buyers must be skeptical about this dividend as Direct Line’s turnaround program remains to be ongoing and, in my view, its working efficiency wants to enhance over the approaching quarters for its administration to really feel comfy to extend the dividend a lot. Notice that its anticipated EPS in 2024 is round £0.13, thus a dividend payout ratio of 60% implies a dividend per share of £0.08, thus analysts appear to be fairly aggressive of their dividend estimates and there’s some room for disappointment forward.

Concerning its valuation, Direct Line is at the moment buying and selling at about ebook worth and 10x ahead earnings, an identical valuation once I final coated it. That is at a reduction to its historic common over the previous 5 years of about 1.22x ebook worth, however near its historic common based mostly on earnings, which appears to be justified by the corporate’s current weak working efficiency and far decrease profitability than in comparison with its historical past.

In comparison with its closest friends, together with Admiral Group (OTCPK:AMIGF), Direct Line can be buying and selling at a reduction based mostly on ebook worth (peer group at near 2x ebook worth) and earnings (16x ahead earnings), exhibiting that Direct Line might have vital upside potential if its turnaround program is profitable in enhancing its working and monetary efficiency forward.

Conclusion

Direct Line has improved considerably its working efficiency in current months as a result of its pricing actions and measures to enhance effectivity, however its turnaround program nonetheless has vital execution threat and the way a lot its profitability finally improves over the following few years is kind of unsure. Whereas its shares proceed to commerce at a reduction to its historic common and its peer group, I nonetheless don’t see the risk-return profile engaging sufficient for long-term buyers.

Editor’s Notice: This text discusses a number of securities that don’t commerce on a significant U.S. alternate. Please pay attention to the dangers related to these shares.