The current decline is partly because of the failed acquisition of cybersecurity agency Wiz and combined outcomes from YouTube advertisements.

Analysts stay optimistic, citing robust development in AI investments and future income potential.

Unlock AI-powered Inventory Picks for Beneath $8/Month: Summer season Sale Begins Now!

Alphabet’s (NASDAQ:) (NASDAQ:) inventory dropped submit earnings, presenting a possible shopping for alternative because the tech big analyst expectations throughout key monetary metrics within the second quarter report.

The holding firm behind Google reported robust earnings per share of $1.89, beating the consensus estimate of $1.84. Income additionally got here in scorching at $84.74 billion, surpassing forecasts of $84.19 billion and reflecting a 14% year-over-year improve.

Internet earnings additional impressed, reaching $23.6 billion and exceeding expectations of $22.9 billion, representing a 28% leap in comparison with the identical interval in 2023.

Nevertheless, a be aware of warning emerges from YouTube promoting. Whereas nonetheless experiencing a wholesome 13% year-on-year development, it fell wanting analyst expectations, reaching $8.66 billion in comparison with the expected $8.93 billion.

Can Alphabet keep its momentum regardless of this YouTube hiccup? We delve deeper into the corporate’s efficiency and discover the potential impression of YouTube’s promoting miss.

What’s Behind the Pre-Market Decline?

Alphabet’s robust monetary outcomes haven’t been sufficient to stop a pre-market decline of over 3%.

Supply: InvestingPro

Whereas the corporate’s strong efficiency underscores its monetary well being, a number of elements contribute to the inventory’s present dip.

Disappointment with Wiz Acquisition:

The sell-off could also be linked to the collapse of Alphabet’s deal to amass cybersecurity agency Wiz. The $23 billion acquisition, meant to bolster the corporate’s cloud safety, would have been its largest ever.

Nevertheless, the failure to finalize this deal has dampened investor sentiment. Chief Monetary Officer Ruth Porat reassured buyers that Alphabet can nonetheless develop its Cloud enterprise organically however can also be exploring different methods to diversify its portfolio.

AI Investments and Progress Technique:

Regardless of the setback, Alphabet stays dedicated to development, significantly in Synthetic Intelligence (AI). Capital expenditures for the second quarter soared 91.4 % year-on-year to $13.2 billion, reflecting vital investments in knowledge facilities and AI techniques.

CEO Sundar Pichai emphasised that the chance of underinvestment is bigger than the chance of overinvestment, with plans to take a position at the very least $12 billion per quarter till the tip of 2025, even when it impacts revenue margins.

Market Response and Future Outlook:

The market’s response could also be a quick pause in a inventory that has risen over 30 % for the reason that starting of the 12 months. Traders are weighing whether or not this dip represents a short lived adjustment or a possible alternative for continued features.

Analysts Nonetheless Bullish on Alphabet

The present decline within the inventory could possibly be seen as an emotional response and a shopping for alternative for buyers, as analysts proceed to stay bullish on the tech big.

Thomas Monteiro, Chief Analyst at Investing.com, notes,

“Whereas not as explosive as final quarter’s outcomes, these numbers verify that Alphabet continues to be a powerful earnings development machine.”

He emphasizes that past the present figures, the corporate’s underperforming sectors are poised for restoration over the following 12 months.

Monteiro attributes this potential rebound to a number of elements:

“We count on advert development to bounce again as capital prices lower and smaller firms acquire extra money and search sooner development.”

Extra importantly, he highlights that Alphabet is about to see substantial income development as its synthetic intelligence initiatives mature.

Most analysts overlaying Alphabet echo this optimistic sentiment, suggesting that the present dip presents a strategic entry level for buyers.

The corporate’s ongoing investments in AI and its total development technique place it nicely for future features, reinforcing the bullish outlook.

Ought to You Purchase This Dip?

Alphabet’s inventory decline presents a possible shopping for alternative, with a powerful consensus amongst analysts that the corporate stays a strong funding regardless of current setbacks.

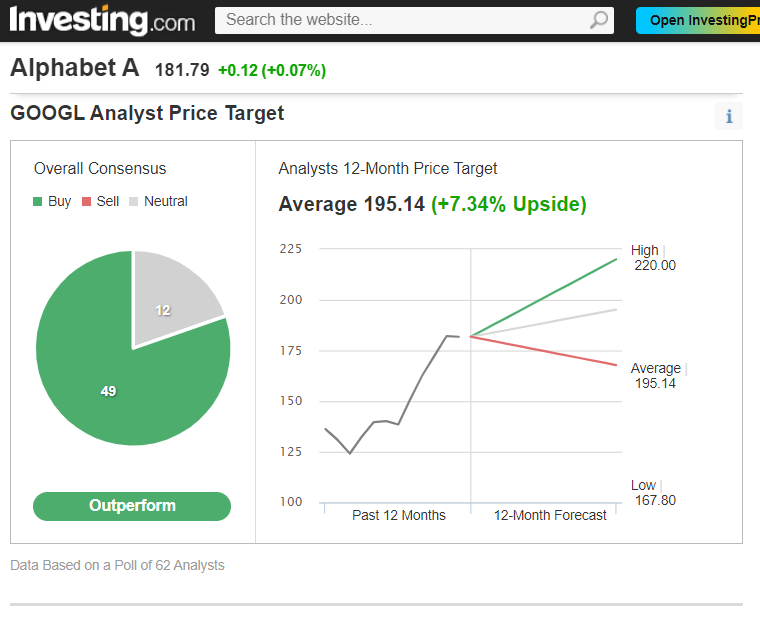

Alphabet holds 49 “Purchase” scores and 12 “Maintain” scores. In response to Investing.com, the common goal value from 62 analysts is $195.14, representing a 7.34 % improve from the shut on July 23.

This goal might rise additional if the present pre-market decline persists. Notably, RBC Capital and UBS have lately raised their value targets for the inventory from $200 to $204 per share, citing Alphabet’s management in AI and its robust efficiency in key development areas.

Regardless of a 30 % improve in its inventory value this 12 months, consultants proceed to view Alphabet as a promising funding. The corporate’s cloud division stays sturdy, producing $10.3 billion in income for the second quarter, up 29 % year-on-year, and reaching document working earnings of $1.2 billion.

Moreover, Waymo, Alphabet’s self-driving automotive unit, has seen income develop from $285 million to $365 million over the previous 12 months, positioning it forward of Tesla (NASDAQ:) within the autonomous automobile race.

Challenges and Dangers Going Forward

Alphabet faces a number of challenges, together with controversies over its new AI-driven search options and considerations from publishers about potential impacts on internet site visitors and promoting revenues.

The corporate additionally contends with antitrust scrutiny in each Europe and the USA. These hurdles signify vital dangers however are a part of the broader challenges confronted by revolutionary tech giants like Alphabet, which intention to not solely generate earnings but additionally drive societal change.

***

This summer season, get unique reductions on our subscriptions, together with annual plans for lower than $8 a month!

Bored with watching the large gamers rake in earnings whilst you’re left on the sidelines?

InvestingPro’s revolutionary AI software, ProPicks, places the ability of Wall Road’s secret weapon – AI-powered inventory choice – at YOUR fingertips!

Do not miss this limited-time supply.

Subscribe to InvestingPro immediately and take your investing recreation to the following stage!

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, supply, recommendation, counsel or suggestion to take a position as such it’s not meant to incentivize the acquisition of belongings in any approach. I want to remind you that any kind of asset, is evaluated from a number of views and is very dangerous and due to this fact, any funding resolution and the related threat stays with the investor.