Robert Means

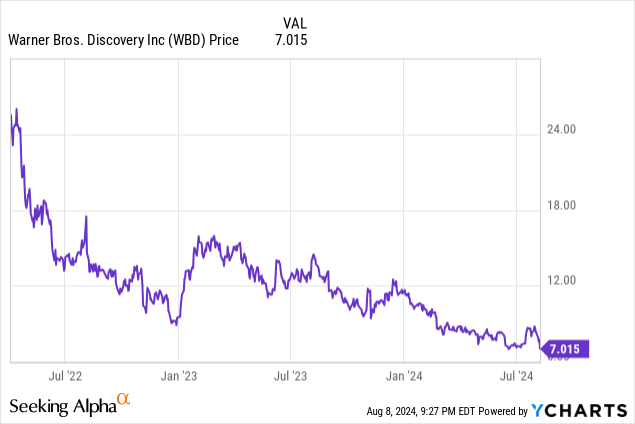

Warner Bros. Discovery (NASDAQ:WBD) has considerably underperformed the market over the previous few quarters. The corporate has skilled main headwinds on many main fronts, from declining linear tv revenues to struggling theater revenues. These headwinds have translated to a sizable income and profitability miss in Warner Bros. Discovery’s newest quarter. In actual fact, WBD took an unlimited $9.1B impairment cost, inflicting the inventory to break down after it reported earnings.

Regardless of these challenges , WBD is well-positioned for development within the coming years. The corporate is efficiently capitalizing on its unparalleled IP, decreasing debt at a formidable fee, and implementing enticing bundling packages. WBD has a lot to sit up for as its most profitable franchises are beginning to acquire momentum.

WBD continues to underperform on account of a linear community enterprise in secular decline.

High-Notch IP

WBD owns among the hottest franchises on the planet in practically all the hottest genres, which embrace heavy-hitters like DC, Harry Potter, Sport of Thrones, and Dune. The corporate is lastly beginning to totally leverage its unbelievable IP with the latest success of Sport of Thrones spinoff Home of the Dragon, Dune, and Harry Potter.

WBD’s upcoming tv and film slate can be probably the most promising it has been in years, with releases like Dune Prophecy, The Penguin, Joker 2, and Superman Legacy scheduled to be launched all throughout the subsequent yr or so. Such a stacked lineup rivals and arguably even surpasses that of Disney (DIS) or Netflix, which is spectacular given the truth that these corporations are valued at an order of magnitude bigger than WBD.

With the declining curiosity in Disney franchises like Marvel and Star Wars, evident in viewership numbers of field workplace numbers, WBD is in a fantastic place to take Disney’s throne because the holder of probably the most helpful IP. In actual fact, among the largest theater releases have been from WBD over the previous yr, from hits like Barbie and Dune raking in billions of {dollars}.

Bundling Technique Comes at a Good Time

WBD is beginning to bundle its streaming service Max with Hulu and Disney+. This bundle will doubtless show to be a successful technique as it’ll doubtless lower churn charges, which have confirmed to be a serious concern for lots of the smaller streamers. Solely Netflix (NFLX) has been capable of preserve its buyer retention charges at an acceptably low degree.

By bundling its content material with that of Hulu and Disney, WBD will make it tougher for patrons to justify cancelling the service given the plethora of content material on the bundle. It would additionally put WBD on a lot firmer footing to compete with the likes of Netflix and even Amazon Prime, which has unparalleled sources at its disposal. Furthermore, this bundling technique helps improve publicity to Max’s premier content material like Sport of Thrones or Home of the Dragon, that are arguably among the finest within the business.

Linear Community Enterprise Stays a Problem

Even though WBD nonetheless makes an enormous chunk of its income from its linear community companies, which boast margins of ~40%, it’s a phase in decline. In actual fact, its personal streaming service has solely accelerated the downturn of its linear enterprise given the general pattern in the direction of streaming. Provided that its streaming margins are solely at about 20%, this pattern is troubling.

WBD is unlikely to see a revitalization of its linear companies as the whole linear community business continues to say no. The NBA rights fiasco will solely serve to speed up the downturn of WBD’s linear enterprise, particularly contemplating how a lot cash the NBA has introduced in for WBD previously. Sadly for WBD, there isn’t a clear approach out of its linear enterprise woes with the rise of newer applied sciences like on-line streaming.

Financials Stay a Giant Burden

WBD nonetheless has an enormous pile of debt, which has hampered the corporate’s means to spend money on its IP. The corporate has needed to be extraordinarily selective by which tasks to speculate massive sources to. This technique shouldn’t be optimum in an surroundings the place buyer churn is increased than ever. A couple of massive tasks yearly will not be sufficient to maintain customers round as long-term clients.

On the flip aspect, WBD has paid again ~13B in debt over the previous few years, decreasing its debt pile by ~25%. Moreover, the corporate has sturdy cashflow that may permit the corporate to proceed paying down debt for the foreseeable future. If WBD can preserve its debt beneath management and proceed investing in high-quality tasks, the corporate may see its shares leap.

Conclusion

WBD seems to be undervalued at its present valuation of ~$19B given its comparatively massive TTM income of ~$40B. As a comparability, Disney and Netflix are valued at ~$156B and ~$270B whereas having TTM revenues of ~$90B and ~$34B respectively. Because of this WBD solely has a P/S ratio of .42 in comparison with Disney’s 1.75 and Netflix’s 8. Nonetheless, WBD continues to lose cash and is being dragged down by a linear community enterprise is speedy decline.

Regardless of the corporate’s unparalleled IP and promising streaming enterprise, WBD needs to be thought-about a maintain at its present ranges, particularly after its underperformance in Q2. The way forward for WBD could relaxation upon the success of some tasks, making it a dangerous play regardless of its promising portfolio of belongings.