wavemovies

Introduction & funding thesis

I final wrote about Wix (NASDAQ:WIX) in Could, the place I let my “purchase” ranking on the inventory primarily based on my perception that the corporate will proceed to drive excessive intent customers, each Self Creators and Companions because it builds revolutionary AI-led merchandise to spice up productiveness and general expertise, resulting in the next monetization charge and boosting general ARPS (Common Income per Subscriber). Though the inventory has declined 2.4% because the time of my writing, underperforming the index, it’s up greater than 27% since my preliminary “purchase” ranking, considerably outperforming the index.

Wix is a cloud-based internet improvement platform that lately reported its Q2 FY24 earnings, the place income and earnings grew 12% and 32% YoY, beating estimates. In the course of the quarter, the momentum in its Companions enterprise continued, rising 29% YoY with the rising adoption of Wix Studio and Enterprise Options, whereas it continued to drive sturdy AI-led product innovation.

Though the enterprise could face some headwinds from its Self Creator phase, particularly if macroeconomic situations worsen, I consider that it’s making a sensible transfer to divest a part of the danger by gaining market share in its Companions enterprise. Subsequently, after assessing each the “good” and the “unhealthy,” I consider that Wix continues to stay a “purchase” with an analogous worth goal of $200, which represents an upside of 24% from its present ranges.

The nice: robust development in companions enterprise from the rising adoption of Wix Studio, increasing commerce enterprise & robust profitability

Wix reported its Q2 FY24 earnings, the place income grew 12% YoY to $435.7M, beating estimates. Out of the $435.7M in income, Inventive Options income grew 9% YoY, contributing near 72% of Complete Income, whereas the remaining 28% of the income was pushed by Enterprise Options, which grew 20% YoY. Plus, bookings development additionally accelerated from 10% development in Q1 to fifteen% in Q2, pushed by absorption of the value will increase applied earlier this yr in addition to development from its strategic initiatives that embody gaining market share in its Companions enterprise and constructing AI-led product innovation to drive increased consumer conversion and monetization.

In the course of the quarter, the corporate continued to increase their consumer base with Companions and Self Creators, including 4.7M new customers in Q2 that exhibit robust conversion, ending the quarter with 273M registered customers, whereas their Q1 FY24 cohort stays their strongest non-Covid cohort, producing over $43.4M in cumulative bookings within the first two quarters ending in Q2 FY24. In the meantime, new and current customers continued to buy higher-priced packages and fasten extra enterprise functions, resulting in increased ARPS.

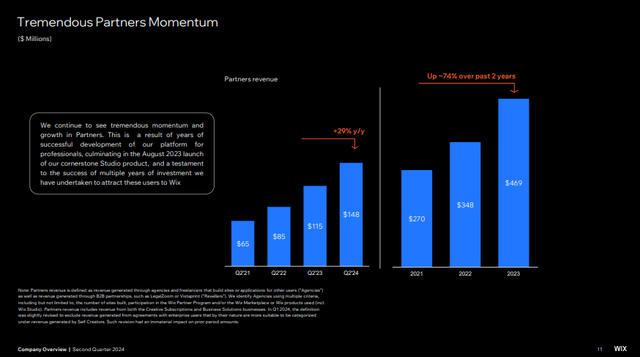

By way of their strategic initiatives, its Companions enterprise grew 29% YoY, making up 34% of Complete Income as Wix onboarded new companies, whereas current Companions continued to deepen their adoption of Wix Studio and Enterprise Options, with Studio package deal bookings rising 20% on a sequential foundation. As the corporate provides new options akin to dynamic no-code design expressions, business-enablement capabilities, and most significantly, their extremely requested Figma plugin, I consider that it ought to proceed to draw new Companions to affix the Wix platform by means of Studio whereas the present cohorts ramp their adoption as they construct extra initiatives on Studio, resulting in increased ARPS.

Q2 FY24 Earnings Slides: Continued momentum within the Companions enterprise

Shifting on to their second strategic precedence, which is AI, the corporate launched 17 AI enterprise assistants throughout a variety of use instances to help their customers and streamline their expertise, the place customers can describe their objectives by means of an AI-chat expertise and AI will act because the “right-hand” individual executing the motion on behalf of the consumer. Moreover, it has additionally launched AI creation capabilities for his or her cellular app builder, the place the know-how can create a branded app primarily based on the consumer’s objectives and aesthetic parameters, in addition to an AI Weblog Generator that may flip related subjects into “near-ready” articles, streamlining the entire workflow course of and bettering the productiveness of their customers.

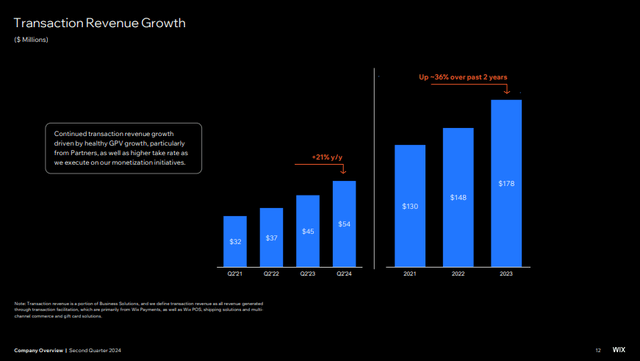

Moreover, Wix additionally noticed an enlargement of their commerce platform, with transaction income rising 21% YoY at a document take charge of 1.68%, as they’ve been efficiently in a position to develop their GPV on account of bigger retailers becoming a member of Wix, notably companions who contributed almost 50% of this quarter’s GPV as they continued to deepen their adoption of commerce enablement instruments throughout supported verticals. In the meantime, the corporate has been including new fee companions and driving increased adoption of Wix Funds in order that they’ll enhance the possession and monetization of the GPV that flows by means of Wix.

Q2 FY24 Earnings Slides: Acceleration in Transaction Income

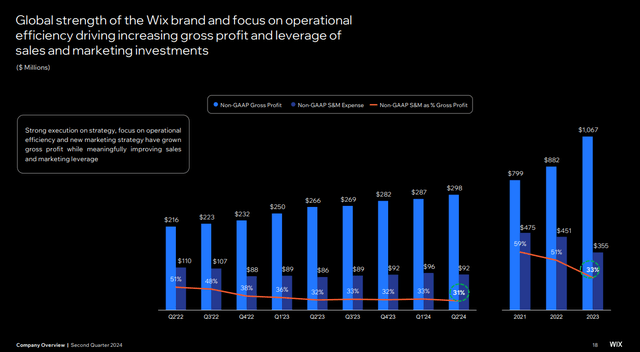

Shifting gears to profitability, Wix generated $90.19M in non-GAAP working earnings, which grew 32% YoY with a margin enlargement of 300 foundation factors on a year-over-year foundation of 21%. This was pushed by a mixture of upper working leverage from increased ARPS, whereas the corporate additionally streamlined its working bills, notably with growing payroll efficiencies from decrease common headcount and decrease promoting bills.

Q2 FY24 Earnings Slides: Increasing profitability

The unhealthy: macroeconomic slowdown and aggressive pressures stay

Though I had beforehand mentioned my concern concerning attainable consumer churn from the brand new pricing mannequin, it seems to be like bookings proceed to stay robust with robust retention charges, particularly amongst its Companions. Nevertheless, I wish to level out that the administration hasn’t explicitly shared their Web Retention Price determine. Within the meantime, macroeconomic pressures persist, with the small enterprise optimism index persevering with to stay at traditionally low ranges. Despite the fact that Wix has made a strategic transfer to divest a few of the threat in its Creator or small enterprise phase to achieve market share with bigger clients, i.e., Companions, I consider that it’s going to see an general slowdown if the economic system materially slows down from its present ranges.

Concurrently, it additionally faces competitors from Shopify (NYSE:SHOP), which has taken an analogous strategy to achieve market share within the enterprise buyer phase, thus rising its GMV and Subscription income whereas unlocking working leverage. In its newest quarterly earnings, Shopify noticed a 22% enhance in GMV, exceeding expectations. On the identical time, Shopify can also be projected to develop 1.8 occasions the expansion charge of Wix, with the next worth a number of on a comparative foundation. Nevertheless, I wish to level out that Wix is the extra worthwhile out of the 2.

Revisiting my valuation: sustaining my worth goal with an upside of 24%

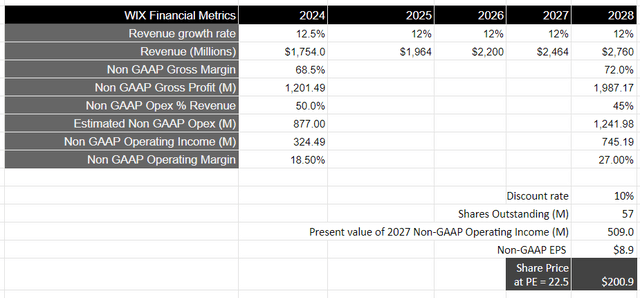

Trying ahead, the administration additional raised the decrease sure of its income steering from the earlier vary of $1.738-1.761B to $1.747-1.761B, which might symbolize a development charge of 12–13% on a year-over-year foundation. Assuming that the corporate can develop in the identical 12% vary over the following 5 years because it continues to execute on its Companions and AI technique to draw high-intent customers and monetize successfully, whereas increasing its Commerce enterprise, it ought to generate a complete of $2.76B in income by FY28.

From a profitability standpoint, the administration has saved its steering for non-GAAP gross margin at 68–69% whereas tightening its expectation for non-GAAP working bills at 50% of Complete Income. This could translate to a non-GAAP working earnings of $324M, at an approximate margin of 18.5%. Assuming that non-GAAP gross margins enhance from their present stage to 72% whereas it streamlines its working bills at 45% of Complete Income per its long-term monetary mannequin, it ought to generate near $745M in non-GAAP working earnings, which might be equal to a gift worth of $509M, when discounted at 10%.

Taking the S&P 500 as a proxy, the place its corporations develop their earnings on common by 8% over a 10-year interval, with a price-to-earnings ratio of 15–18, I consider Wix needs to be buying and selling at 1.5 occasions the a number of, given the expansion charge of its earnings throughout this time period. This may translate to a PE ratio of twenty-two.5, or a worth goal of $201, which represents an upside of 24% from its present ranges.

Creator’s Valuation Mannequin

My remaining verdict and conclusions

I consider that Wix stays attractively priced at its present ranges with adequate upside. Though the corporate could also be liable to seeing its enterprise decelerate, particularly in its Self Creator phase, I consider that it’s de-risking by onboarding bigger Associate shoppers. In the meantime, I’m impressed by the continued momentum within the firm’s Associate enterprise, which is rising at a strong tempo because it expands adoption of Wix Studio and enterprise options, resulting in increased ARPS. Concurrently, the corporate is driving sturdy product innovation because it integrates AI into its options to drive excessive intent customers, who are likely to convert into monetized customers at the next charge, whereas maintaining its working bills underneath verify.

Lastly, the acceleration in its transaction income can also be a brilliant spot and will proceed to develop because it onboards bigger retailers throughout verticals on the platform whereas increasing Wix funds to raised monetize its GPV that flows by means of the platform. Subsequently, after assessing each the “good” and the “unhealthy,” I consider that Wix continues to stay a “purchase” with a worth goal of at the least $200, which represents an upside of 24% from its present ranges.