Alexandros Michailidis

Deutsche Telekom AG (OTCQX:DTEGY) reported constructive working efficiency in Q2 2024, and its valuation is kind of undemanding contemplating its fundamentals a development prospects.

As I’ve lined in earlier articles, I see Deutsche Telekom as one of many finest performs within the European telecommunications sector as the corporate has a lot better development prospects than its friends, primarily on account of its stake in T-Cell US (TMUS). Not surprisingly, its shares have carried out fairly nicely over the previous yr, up by greater than 35% together with dividends and beating its friends by a superb margin, as proven within the subsequent graph.

share value efficiency (Bloomberg)

As the corporate has lately launched its Q2 2024 earnings, on this article, I replace its most up-to-date monetary efficiency and its funding case, to see whether or not it stays an attention-grabbing development choose or not within the European telecoms sector.

Q2 2024 Earnings Evaluation

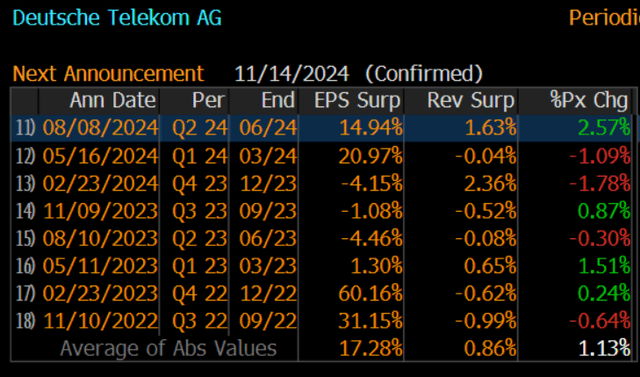

Deutsche Telekom has maintained a constructive working momentum over the previous few quarters, and this pattern was additionally seen in the newest quarter. The corporate was capable of beat market expectations each on the prime and backside strains, resulting in a constructive share value response on the day.

Earnings shock (Bloomberg)

The corporate’s constructive efficiency was supported by most of its working models, with Germany, the U.S. and different European markets performing fairly nicely on an working foundation. That is justified by its technique to put money into growing its infrastructure, particularly within the U.S. the place it presents a bonus over its friends relating to its 5G community. This has led to stronger buyer acquisition over the previous couple of years in comparison with Verizon (VZ) and AT&T (T).

Certainly, its cell internet provides amounted to greater than 2.5 million within the first half of 2024, a small decline in comparison with the identical interval of 2023, with its postpaid buyer base being now above 100 million. This was an vital driver for service income development, which was Deutsche Telekom’s main development engine over the previous few quarters.

In H1 2024, group service income elevated by 4.1% YoY (vs. 3.6% in H1 2023), whereas total income was up by 2.5% YoY, as decrease tools gross sales had a adverse impression on complete revenues. Its EBITDA was up by 6.2% YoY, with the U.S. being sturdy (+7.4% YoY). This efficiency clearly exhibits that T-Cell US working efficiency continues to be wonderful. In Europe, Deutsche Telekom can also be investing in its infrastructure, having elevated by some 3.6 million houses its protection of fiber-to-the-home service, which now reaches over 18 million houses.

Within the U.S., the corporate has lately introduced two joint-ventures to put money into the FTTH community growth, with EQT and KKR, anticipating to succeed in about 10 million houses by the tip of this decade. This can be a nice step for the corporate to take care of a community management place over the approaching years, boding nicely for buyer features and enterprise development over the medium time period.

In Q2 2024, T-Cell US revenues amounted to $19.7 billion, up by 2.9% YoY, and its adjusted EBITDA was $7.8 billion (+9.1% YoY), that are sturdy development figures. In Germany, additionally a key market, its quarterly revenues have been almost $7 billion (up by 3.6% YoY), whereas EBITDA was solely larger by 1% in comparison with the identical quarter of final yr on account of larger wage prices. That is primarily justified by a one-off cost agreed with social companions to compensate for the excessive inflation ranges over the previous few quarters. With out this one-off value, its EBITDA development would have been round 3%, which is far nearer to its reported income development.

In different European markets, income elevated by 6% YoY and EBITDA was up by greater than 8%, to take care of sturdy operation momentum throughout the cell and broadband companies. General, Deutsche Telekom’s revenues amounted to just about $31 billion in Q2 2024, up by 4.3% YoY, and its EBITDA was about $11.8 billion (+7.8% YoY). Its quarterly revenue was near $2.3 billion, up 35% YoY, and its free money circulation improved fairly considerably (+48% YoY) to $5.7 billion.

That is justified by larger earnings and decrease capital expenditures, as Deutsche Telekom offered over the last yr a majority stake in its tower enterprise, plus additionally decrease capex within the U.S.

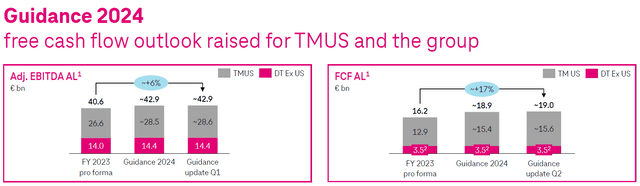

Given this sturdy working efficiency and good momentum within the U.S., which led to an upward revised steering from T-Cell US, Deutsche Telekom additionally mirrored in its accounts the revised steering. It’s now forecasting barely larger EBITDA and free money circulation for the complete yr.

Steering (Deutsche Telekom)

As proven within the earlier graph, Deutsche Telekom’s EBITDA and free money circulation development in 2024 is predicted to be sturdy, which also needs to have a constructive impression on the corporate’s steadiness sheet leverage. Its internet debt on the finish of final June was about $147 billion (together with leases), which results in a internet debt-to-EBITDA ratio of about 2.8x.

This ratio has been steady over the previous few quarters regardless of larger earnings. The corporate has made some small acquisitions and used an important a part of its money circulation era to distribute dividends and repurchase its shares, resulting in barely larger internet debt in current quarters. Nonetheless, in comparison with its friends within the telecom sector, its leverage place is suitable. There isn’t a risk to its funding grade credit standing. Thus, Deutsche Telekom isn’t a lot frightened about debt discount and may proceed to return a big a part of its earnings to shareholders over the approaching years.

Due to this fact, its shareholder remuneration coverage isn’t anticipated to alter a lot within the close to time period each at T-Cell US and on the group stage, each via dividends and share buybacks. Nonetheless, at their present share costs, T-Cell US is at present providing a dividend yield of about 1% and Deutsche Telekom’s yield is barely above 3%. Thus, each shares have a restricted earnings enchantment.

This isn’t anticipated to alter a lot within the quick time period, particularly in the USA. T-Cell US introduced a few months in the past an settlement to purchase nearly all of US Mobile (USM) for about $4.4 billion, which it can finance by debt. This transaction improves T-Cell protection, particularly in additional rural areas, and will increase competitiveness in opposition to AT&T and Verizon, however exhibits that T-Cell’s technique is concentrated on development fairly than returning extra capital to shareholders.

Regardless of that, T-Cell US will maintain an analyst day subsequent September and Deutsche Telekom can have a capital markets day in October. Thus, each firms are anticipated to replace their technique to traders within the quick time period, together with their plans for capital returns. Whereas I don’t anticipate a a lot totally different technique than in comparison with what each firms have been doing recently, they might shock the market and announce a extra aggressive shareholder remuneration coverage, which will surely be nicely obtained by traders.

Relating to its valuation, Deutsche Telekom is at present buying and selling at 12.8x ahead earnings, which is in-line with its historic valuation over the previous 5 years, and can also be fairly near its peer’s common at 12.2x earnings. On condition that Deutsche Telekom is performing fairly nicely and its enterprise outlook is constructive, I now see this valuation as enticing and its shares appear attention-grabbing for development traders. Certainly, in comparison with different European telecom friends with sturdy fundamentals, equivalent to KPN (OTCPK:KKPNY) which I’ve lined in a earlier article, Deutsche Telekom appears to be attractively worth contemplating that KPN is buying and selling at greater than 15x ahead earnings.

Conclusion

Deutsche Telekom has reported a wonderful working efficiency in Q2 2024, sustaining its constructive pattern of the earlier quarters, displaying that its technique to put money into infrastructure is the precise one. Its current bulletins of joint-ventures within the U.S. to broaden its fiber community and the acquisition of US Mobile appear to be good steps to enhance its aggressive place, boding nicely for future development.

Regardless of having stronger development prospects and higher fundamentals than most European friends, Deutsche Telekom is buying and selling in-line with the sector, a valuation that seems to be undemanding and makes it an attention-grabbing development choose within the European telecoms sector.

Editor’s Observe: This text discusses a number of securities that don’t commerce on a significant U.S. trade. Please pay attention to the dangers related to these shares.