Erik Isakson

Credo Expertise (NASDAQ:CRDO) is a number one participant within the high-performance connectivity market, with speedy enterprise progress pushed by AI and knowledge middle expansions. I anticipate that Credo will considerably develop its complete Ethernet connectivity options within the close to future., doubling its AI associated income by FY25. I’m initiating with a ‘Purchase’ score with a one-year value goal of $35 per share.

Management in Excessive-Velocity Connectivity Market

Credo Expertise is a pure play within the connectivity market, specializing in high-speed connectivity merchandise for knowledge facilities and hyperscalers. For AI computing, it’s mission-critical that knowledge be transferred and delivered to GPUs at excessive speeds inside the knowledge middle, necessitating high-speed Ethernet connectivity options that present substantial bandwidth. Credo presents a number of options designed for Ethernet port speeds starting from 100 gig as much as 1.6 terabits per second, and these options embrace HiWire AECs, Optical PAM4 DSPs, Line Card PHYs, SerDes Chiplets and SerDes IP.

Credo’s progress drivers will be summarized as follows:

The primary issue driving Credo’s progress is the increasing AI market, which has spurred a surge in knowledge middle constructions. When knowledge centre are being constructed, operators must deploy software program, {hardware}, GPUs and connectivity gadgets and wires. Excessive-speed connectivity merchandise, together with copper interconnect cables and optical digital sign processors, are important for connecting these gadgets and {hardware}. As one of many main gamers within the interconnect market, Credo is well-positioned for speedy progress within the close to future. Throughout the This fall FY24 earnings name, the administration disclosed that 75% of the corporate’s whole revenues had been derived from AI workloads, with expectations to double the income by FY25. Credo’s HiWire Lively Electrical Cables (AEC) are designed for knowledge speeds of 100G, 200G, 400G, 800G and rising 1.6T. AECs have already change into a number one resolution for in-rack cable connectivity. As emphasised over the earnings name, AECs supply superior sign integrity, energy and reliability, giving Credo a aggressive benefit available in the market. Lastly, Credo optical digital sign processors (DSPs) are a key constructing block inside optical transceivers which might be utilized in AI clusters, as described of their 10K. The corporate is focusing on its DSP enterprise to succeed in 10% of whole income by FY25, as their PAM4 DSP enterprise ramping up buyer engagement will increase. This rising engagement within the DSP sector might drive further progress for the corporate in FY25.

Outlook and Valuation

The corporate is ready to launch its Q1 FY25 earnings on September 4th, guiding greater than 70% year-over-year income progress. The administration anticipates the income progress accelerating all year long, pushed by an anticipated improve in AI-related income within the second half of FY25.

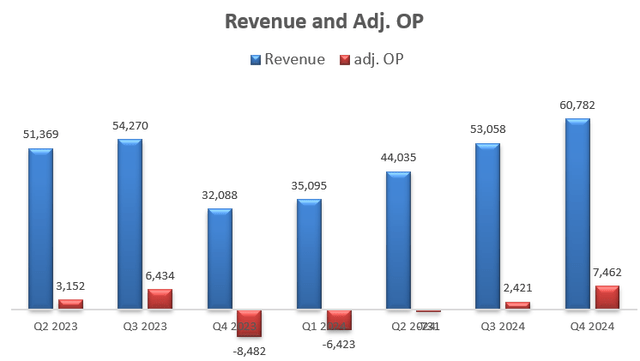

As depicted within the chart under, Credo has skilled strong income progress in latest quarters, accompanied by notable margin enchancment as a consequence of working leverage. Having stated that, Credo continues to be an early-stage progress firm, they usually have to speculate closely in R&D and gross sales & advertising to scale its operations.

Credo Expertise Quarterly Earnings

I’m contemplating the next elements for FY25’s progress:

I estimate that Credo generated $140 million income in AI workloads in FY24. Given the continuing AI investments by hyperscalers and knowledge facilities, I’m assured that the corporate will double its AI-related income by FY25, reaching $280 million. Microsoft (MSFT) is the biggest buyer for Credo, accounting for round 26% of whole income. As reported by the media, Microsoft plans to double new knowledge middle capability this 12 months. With its management within the AI sector by way of Home windows 365, Azure, and its partnership with ChatGPT, Microsoft’s knowledge middle growth is anticipated to drive vital demand for Credo’s connectivity merchandise and cables. I assume Credo’s non-AI income will develop by 10% in FY24, pushed by investments in conventional workloads.

As such, the overall income is estimated to extend by 80% in FY25.

For the normalized income progress from FY26 onwards, I’m contemplating:

Credo stays a comparatively small firm, with income of solely $192 million in FY24. I anticipate AI workloads will proceed to drive the corporate’s progress within the close to future. The AI associated income is anticipated to develop by 60% yearly for Credo in my DCF mannequin, reflecting the corporate’s management in high-speed Ethernet connectivity options. I keep a ten% progress for non-AI revenues. As such, from FY26 to FY30, I calculate the corporate’s income will develop by 50% yearly. After FY30, I anticipate the AI increase to average, because the trade strikes previous knowledge middle growth section. AI is extra more likely to transition into inference stage, with lowered computing necessities for core knowledge facilities. I assume Credo will develop its AI income by 30% from FY31, and non-AI by 10%.

As a small progress firm, Credo is investing closely in R&D prices, allocating greater than 49% of whole income in direction of R&D in FY24. I mannequin 200bps annual margin growth with the next assumptions:

Gross margin: Credo has been increasing their conventional cable and optical enterprise into adjoining markets, together with the 5G communications market. The market growth is leveraging their current expertise, probably producing gross margin growth alternatives. I assume a 50bps margin growth coming from gross earnings. SG&A: I anticipate the corporate will generate 50bps margin growth from the working leverage from SG&A, as the corporate might leverage current gross sales pressure and advertising sources to distribute extra merchandise successfully. R&D: I anticipate 100bps working leverage from R&D bills.

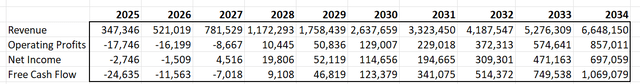

The DCF abstract:

Credo Expertise DCF

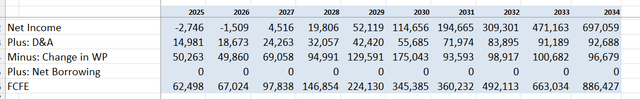

I calculate the free money move from fairness as follows:

Credo Expertise DCF

The price of fairness is estimated to be 17%, assuming risk-free price 3.8% ((US 10Y Treasury)); beta 1.98 (SA); fairness danger premium 7%.

The one-year value goal is calculated to be $35 per share, as per my calculations.

Key Dangers

As mentioned beforehand, Microsoft is the corporate’s largest buyer, representing round 26% of Credo’s revenues. Over the earnings name, the administration disclosed that their second-largest buyer is an AEC hyperscaler, representing 20% of whole income. The third-largest buyer is a number one chiplet firm, making up 15% of whole income. The three largest clients account for greater than 60% of whole income. As such, Credo has vital buyer focus danger. The lack of any of those main clients can be detrimental to the corporate. Credo allotted greater than 11% of whole income in direction of stock-based compensation (SBC). Whereas I feel it is sensible for an early-stage progress firm, the excessive spending on SBC would create headwinds for margin growth. Credo is competing towards Broadcom (AVGO) and Marvell (MRVL). I’ve to acknowledge that each Broadcom and Marvell are fairly giant firms, with substantial R&D and buyer sources. Nevertheless, as a pure play available in the market, Credo’s centered method might present it with a aggressive benefit.

Finish Notice

I favor Credo’s expertise management within the high-speed connectivity market, supported by structural progress drivers from the AI increase and high-performance computing. I’m initiating with a ‘Purchase’ score with a one-year value goal of $35 per share.