Walter Bibikow/DigitalVision through Getty Photographs

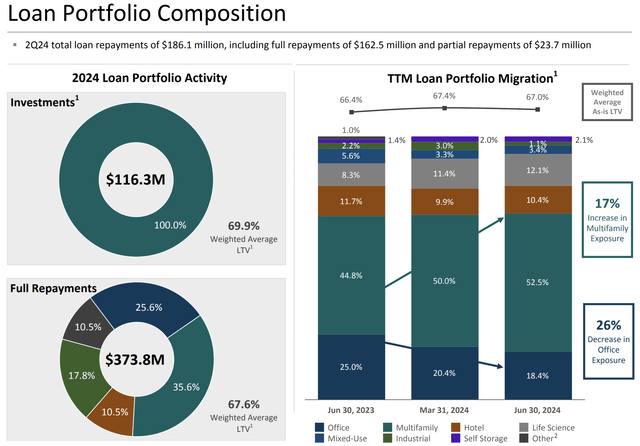

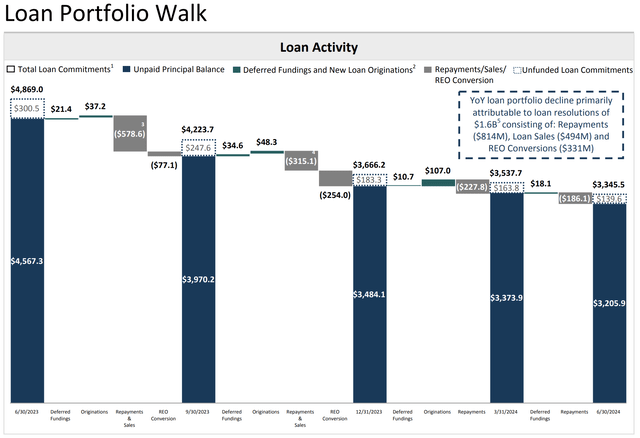

The 26% rally over the past 1 yr of TPG RE Finance Belief’s (NYSE:TRTX) commons to $8.50 must be contextualized towards a guide worth of $11.40 per share as of the finish of its fiscal 2024 second quarter. The mortgage REIT owns debt collateralized by US actual property, with a heavy deal with multifamily properties. Complete mortgage commitments stood at $3.3 billion on the finish of its second quarter with 52.5% allotted to multifamily and an 18.4%% allocation to workplace properties the second largest place. The rally has been constructed on the perceived discount of the inherent danger of TRTX’s mortgage guide because the mREIT pushes via a lower in its workplace allocation. The second quarter noticed $116.3 million in new multifamily mortgage originations towards full repayments of $373.8 million.

TPG RE Finance Belief Fiscal 2024 Second Quarter Supplemental

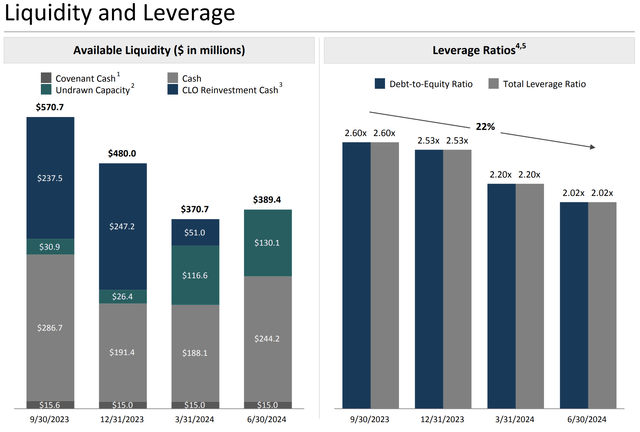

Roughly 1 / 4 of repayments had been workplace loans with TRTX permitting repayments to run forward of investments by $257.5 million, resulting in a surge in money and equivalents and a cloth discount within the mREIT’s leverage ratios. Debt-to-equity is all the way down to 2.02x from 2.6x three quarters in the past, bolstering the protection of the commons and making an especially bullish case for a place within the mREIT’s 6.25% Collection C Preferreds (NYSE:TRTX.PR.C).

TPG RE Finance Belief Fiscal 2024 Second Quarter Supplemental

The preferreds are additionally cumulative, which means any unpaid dividends accrue as a legal responsibility for later reimbursement. The elemental creditworthiness of TRTX and the worth of its commons and preferreds have been boosted by the twin impression of a rise in liquidity and a discount in leverage with cash-on-hand out there for funding of $244.2 million on the finish of the second quarter set to drive future development on fee cuts.

Floating Price Loans And The Discount In Workplace

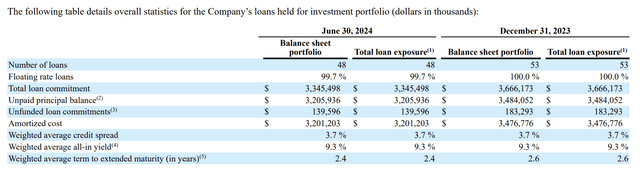

TPG RE Finance Belief Fiscal 2024 Second Quarter Type 10-Q

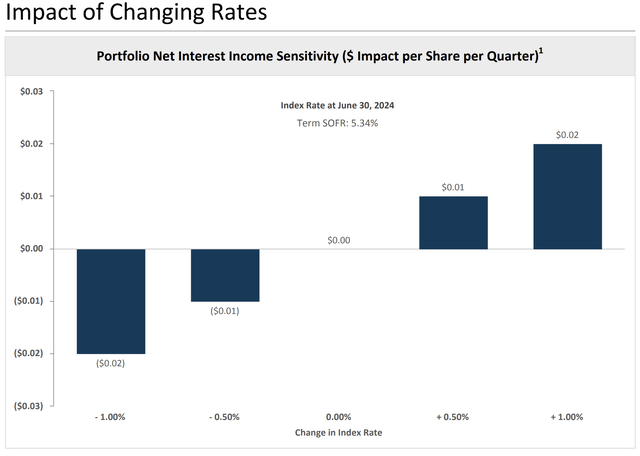

The market is assured of the September 18th FOMC assembly being the primary lower to the Fed funds fee since charges began being hiked in 2022 with the CME FedWatch Device putting the chance of a lower at 100%. The impression of this on TRTX can be multifaceted with the mREIT set to lose $0.01 per share in portfolio web curiosity earnings for each 50 foundation level dip in Time period SOFR which tracks the Fed funds fee. 99.7% of the mREIT loans are floating fee and with a weighted common all-in yield of 9.3%.

TPG RE Finance Belief Fiscal 2024 Second Quarter Supplemental

Therefore, TRTX is about to see a interval of web curiosity earnings dipping within the occasion shopper inflation continues to fall in the direction of the Fed’s 2% goal. The mREIT generated a second-quarter GAAP web earnings of $21 million, round $0.26 per share, an enormous enchancment from a GAAP web lack of $72.7 million a yr in the past. The year-ago interval was affected by a rise in CECL expense of $81.3 million. Distributable earnings of $22.3 million, round $0.28 per share, covers the frequent share dividend of $0.24 per share by 117%, heightening its security as web curiosity earnings is about to face downward stress within the shadow of fee cuts.

TPG RE Finance Belief Fiscal 2024 Second Quarter Supplemental

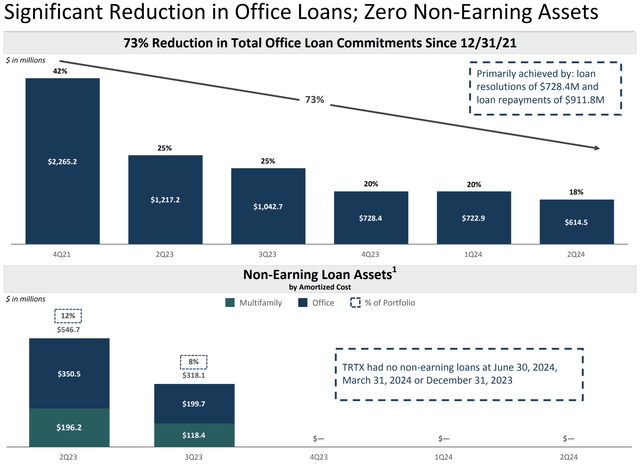

TRTX’s success story over the past three years has been the fabric discount in its workplace loans, an asset class that has quickly fallen out of favor with buyers as work-from-home has grow to be the established order. The mREIT nonetheless holds $614.5 million in workplace loans as of the tip of its second quarter, down from $2.27 billion within the fourth quarter of its fiscal 2021. This fell as a % of whole loans by 200 foundation factors sequentially in the course of the second quarter, with a dip to single digits attainable within the third quarter of fiscal 2025 if the present trajectory is maintained.

Mortgage Portfolio Stroll And Most well-liked Low cost

The mREIT can lean on an growth of its mortgage portfolio to counter the impression of falling charges. TRTX’s mortgage portfolio has been falling for the previous couple of years. A continued dip within the mortgage portfolio when the Fed has pushed via a number of 25 foundation level cuts would seemingly place the frequent share dividend in danger even with the mREIT’s liquidity at a wholesome degree.

TPG RE Finance Belief Fiscal 2024 Second Quarter Supplemental

The mREIT’s technique has been conservative, retaining liquidity and decreasing leverage. This has paid off immensely however there’ll seemingly have to be a change quickly to a extra aggressive stance whereas nonetheless being selective on the forms of loans being originated. I maintain a big place within the preferreds, with fee cuts set to see their worth rise, they’re up $1 since I final lined the mREIT. Nonetheless, at $17.95 per share, they’re buying and selling at a 28% low cost to liquidation worth with an 8.7% yield on value.