DNY59

We beforehand coated Novo Nordisk (NVO) (OTCPK:NONOF) inventory in April 2024, discussing why we had maintained our Purchase score then, attributed to the a number of expansions in its manufacturing/fill end capacities, with the continuing shortages nonetheless implying immense client demand.

We believed that these capex would ultimately be accretive to its prime/backside strains, particularly for the reason that Pfizer’s (PFE) CEO, Albert Bourla, had estimated an weight problems market dimension of up $150B.

Since then, NVO has charted new heights earlier than dramatically pulling again because the market rotated from high-growth shares. Even so, the bulls proceed to defend its 2024 backside with the easing provide points more likely to set off sturdy FQ3’24 numbers, as noticed within the administration’s raised FY2024 steering.

With the rivals nonetheless a couple of years away from US FDA approval, we imagine that NVO together with Eli Lilly and Firm (LLY) are nonetheless poised to get pleasure from a two horse race within the weight problems/diabetes market.

The GLP-1 Funding Thesis Stays Strong For Opportunistic Buyers

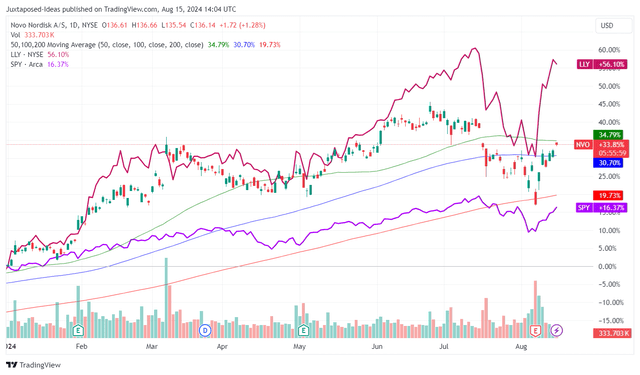

NVO YTD Inventory Worth

TradingView

NVO has had a risky YTD efficiency certainly, attributed to the market rotation from high-growth shares since late June 2024 and the next bullish assist noticed by early August 2024.

This volatility is partly attributed to the earlier Semaglutide shortages for the reason that begin of the 12 months, with it additionally contributing to the pharmaceutical firm’s slower gross sales progress for Wegovy (weight reduction) at 11.65B DKK in FQ2’24 (+24.3% QoQ/ +55.1% YoY) and Ozempic (diabetes) at 28.87B DKK (+3.8% QoQ/ +30.6% YoY)

That is in comparison with the therapies’ historic progress recorded in FQ2’23 at +543% YoY and +59% YoY, respectively.

When in comparison with NVO’s direct competitor, LLY’s latest efficiency with Mounjaro (diabetes) recording sturdy +71.1% QoQ/ +215.5% YoY gross sales progress and Zepbound (weight reduction) at +138.4% QoQ in FQ2’24, we will perceive why the market might have been dissatisfied with the previous’s latest efficiency.

On the identical time, LLY has had better success in Worldwide progress for Mounjaro gross sales, with it rising by +136.6% QoQ/ +1,058.1% YoY, in comparison with NVO’s Ozempic at +10.4% QoQ/ +9.5% YoY in the identical Q2’24 quarter.

Except for the availability points, maybe a part of the headwinds might also be attributed to “sufferers receiving tirzepatide (Mounjaro) had been considerably extra more likely to obtain weight reduction,” in comparison with semaglutide (Ozempic), with “on-treatment adjustments in weight had been bigger for sufferers receiving tirzepatide at 3 months.”

Then again, readers should notice that NVO’s next-gen candidate, CagriSema, already provides a -15.6% of weight reduction by Week 32, properly exceeding Wegovy at -7% at Week 13/ -15.2% at Week 68 and LLY’s Mounjaro at -15.7% at Week 72, by the inherent advantage of pace.

With CagriSema’s first Part 3 outcomes for REDEFINE 1 anticipated in H2’24, we imagine that we may even see NVO emerge stronger forward, considerably aided by the continuing capability growth of its API services and fill-finish networks, a few of that are already “up and operating.”

On the identical time, readers should notice that these headwinds are attributed to the earlier provide points, with NVO’s FQ3’24 doubtlessly bringing forth a strong sequential progress, since Ozempic/ Wegovy are not in scarcity.

Most significantly, the administration has already raised their FY2024 web gross sales progress steering to +25% YoY and working revenue progress at +25% YoY on the midpoint, up from the unique steering of +22% YoY and +25% YoY supplied within the FQ4’23 earnings name, respectively, lending power to its high-growth funding thesis.

Lastly, NVO has highlighted exemplary market share good points in North America for Ozempic at 56% in FQ2’24 (in line QoQ/ +1 factors YoY) and globally at 46.6% (-0.6 factors QoQ/ +1.6 YoY), together with the rise in its international diabetes worth market share to 34.1% (+0.1 factors QoQ/ +1.4 YoY).

Whereas LLY has raised their FY2024 income steering to +34.8% YoY progress, up from the unique variety of +20.1% YoY, together with the continuing ramp up of its international presence with the goal to enter extra markets in 2025, we imagine that NVO stays properly positioned to compete transferring ahead.

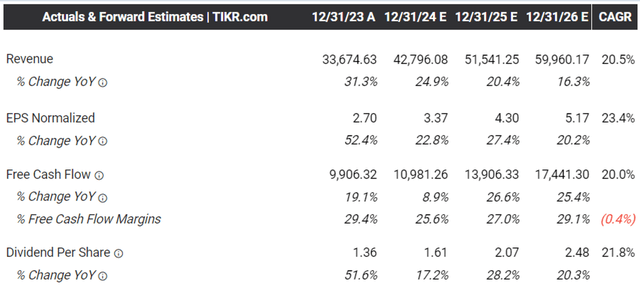

The Consensus Ahead Estimates (in $)

TIKR Terminal

The identical optimism has additionally been noticed within the consensus raised ahead estimates, with NVO anticipated to generate an accelerated prime/ bottom-line progress at a CAGR of +20.5%/ +23.4% by means of FY2026, respectively.

That is in comparison with the earlier estimates of +11.1%/ +11.5% and its historic progress of +8%/ +8.5% between FY2016 and FY2022, respectively.

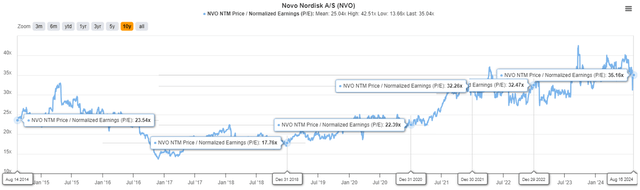

NVO Valuations

TIKR Terminal

The latest market vast pullback has additionally moderated NVO’s FWD P/E valuations to 35.16x, down from the latest peak of 40.17x in June 2024 and nearer to its 1Y imply of 36.09x.

Even when in comparison with its direct weight problems/ diabetes remedy pharmaceutical peer, LLY at FWD P/E valuations of 58.71x with the projected adj EPS progress at a CAGR of +65.4% by means of FY2026, it’s plain that NVO is the worth purchase at present ranges.

So, Is NVO Inventory A Purchase, Promote, or Maintain?

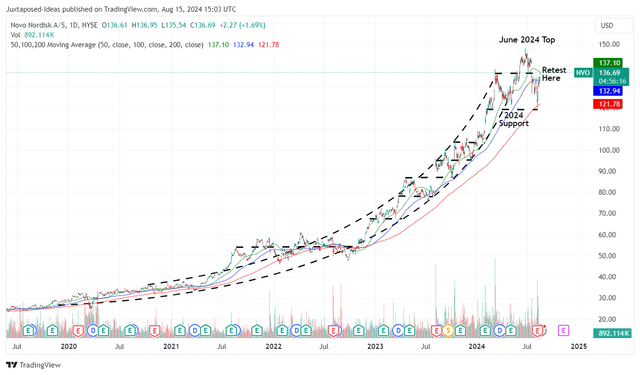

NVO 5Y Inventory Worth

TIKR Terminal

For now, NVO has traded sideways for the reason that begin of 2024, with it presently buying and selling close to to its 100-day transferring averages after the drastic correction from the June 2024 prime and the next bounce from the bullish assist at $120s.

For context, we had supplied a good worth estimate of $98.90 in our final article, primarily based on the FY2023 adj EPS of $2.70 and the earlier FWD P/E valuations of 36.63x. That is on prime of the long-term worth goal of $186.00, primarily based on the consensus FY2026 adj EPS estimates of $5.08.

Primarily based on NVO’s raised FY2024 adj EPS steering to roughly $3.37 (+25% YoY) and the identical P/E valuations of 36.63x (close to to its 1Y imply of 36.09x), we’re taking a look at an up to date truthful worth estimate of $123.40, implying a minimal premium of +9.3% at present ranges.

Primarily based on the consensus raised FY2026 adj EPS estimates of $5.17, there stays a wonderful upside potential of +40.3% to our up to date long-term worth goal of $189.30 as properly, because of the latest pullback from the June 2024 peak of $146.90.

Whereas minimal, the 1.07% in ahead dividend yields permit long-term shareholders to DRIP and accumulate extra shares on a quarterly foundation as properly.

Because of nonetheless engaging complete return prospects by means of capital appreciation and dividend revenue, we’re reiterating our Purchase score for the NVO inventory right here.

Threat Warning

Readers should notice that NVO’s prospects are tightly linked to its GLP-1, Insulin, and Weight problems therapies, which comprise 93.7% of its H1’24 gross sales (+1.8 factors YoY).

With its uncommon illness phase underperforming expectations with declining gross sales at -3.7% YoY in H1’24, it goes with out saying that any market share losses in its progress segments might doubtlessly influence its future prime/ bottom-line progress.

That is particularly since NVO has underperformed towards its direct peer in H1’24, with it remaining to be seen if the improved Ozempic/ Wegovy provide might enhance its H2’24 efficiency.

Because of this, buyers might need to monitor its near-term efficiency, significantly in China, since Wegovy has been just lately permitted in China albeit with accelerated patent expiry in lower than two years, in comparison with 2031 within the EU/ Japan and 2032 within the US.