borchee

As I’ve Discovered Over The Yr, You Cannot Match All the pieces In The Title

An essential ingredient that I overlooked is money. As you will have picked up in my earlier articles, money is a serious facet of how I handle buying and selling. That apart, I’ve additionally famous having money for the investing aspect as properly. I’ve talked about a number of occasions, actually greater than as soon as, that in case you are nonetheless allocating funding cash, you could need to set some apart for the Fall. We’re in mid-August and Fall is correct across the nook. I’ve a ton of open orders proper now, with costs properly beneath the place some shares are buying and selling proper now. I’ve Nvidia (NVDA) bids at a number of costs within the mid to higher 80s, and Amazon (AMZN) at 158 as properly. So immediately, if in case you have been holding again money to take a position, begin placing in bids, take a look at the 3-month charts and see how low your favourite shares had been buying and selling then, and put in opening bids. Use small share quantities, since we have not had an actual correction in a 12 months. If we’re going to have one, it ought to occur subsequent month or mid-October. Let historical past be your information, does the market sell-off at the moment yearly? No, as soon as in an amazing whereas it would not, that is why it may possibly nonetheless occur. If it was a certain factor, everybody could be doing what I’m telling you I’m already doing.

Powell Is Slicing Charges, Why Would The Market Promote Off?

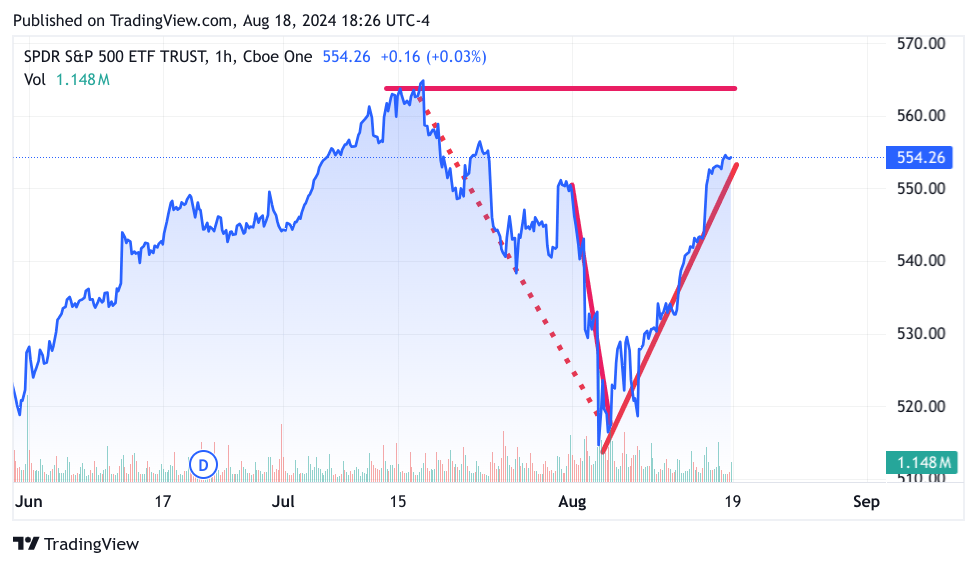

There is not actually a cogent and logical motive as to why the autumn is the worst a part of the 12 months. Maybe it is as a result of most buyers have already allotted all the cash to their funding accounts by now. Maybe this 12 months there will probably be a number of company buybacks that can help the market and the Fall will probably be simply high-quality. Nevertheless, we nonetheless have the controversy of whether or not the Fed easing will probably be sufficient, or maybe the Fed nonetheless would not must ease in any respect. This previous week, we had a number of robust items of macroeconomic information displaying the US financial system is chugging alongside simply high-quality. Regardless of poor numbers from all types of outlets, July Retail gross sales jumped 1%, a lot better than the 0.3% estimate. Additionally reported final Thursday, weekly jobless claims totaled 227,000, a lower of seven,000 from the earlier week and decrease than the estimate for 235,000. A stronger job market means a stronger shopper going ahead. Earlier final week, we had been handled to information (PPI and CPI) displaying that inflation eased barely in July. The final piece of knowledge right here is vital, that inflation is falling and has been for months. Naturally, the Fed, in the event that they really feel assured that the inflation boogeyman is lifeless, can minimize charges. Nevertheless, they do not should, except the financial system is at risk of falling and inflicting jobs to crash. We had that sharp sell-off in early August as a result of we had one piece of employment information that appeared weak, and growth we had been handled to paroxysms of promoting. We then skilled a vertiginous rally that gained again all of the losses in only a few days. Under is the 3-month Chart of the S&P 500 ETF (SPY).

Tradingview

Not often, in response to my admittedly shoddy reminiscence, do I recall such a pointy sell-off and restoration with out extra of those durations of volatility to come back? I believe there will probably be extra conditions the place market individuals will ask if the Fed actually has it proper. That the financial system isn’t about to falter and ship employment over the cliff. Or that the financial system is operating completely properly as it’s and there’s no want to chop in any case. Or maybe, inflation numbers choose up once more. Sadly, we’re nonetheless on the mercy of the Fed and the macroeconomic numbers, that do not at all times cooperate like they did final week.

Let Me Put A Finer Level On It, We Might Have A Sharp Promote-off After The Subsequent FOMC

I may see a build-up to September 18, the final day of the FOMC assembly, financial information has been benign, and inflation remains to be slowly retreating. In precisely one month from now when for my part, Powell will possible announce a .25% minimize. Powell then reasserts the notion of information dependency, which most market commentators are already decrying. Then additional states that they’re possible going to take a really gradual method to cuts, and the market sells off. Then, if there are any less-than-perfect financial numbers, the promoting will speed up and there you will have the correction that we now have managed to keep away from to this point this 12 months. If that occurs, I’ll actually get my NVDA within the 80s or perhaps decrease, in addition to all the opposite magnificent 7 shares that I haven’t got sufficient of. I suppose I’m taking part in armchair psychologist, however I do not see Powell making deep cuts and offering steerage to a loosening of financial circumstances except one thing dire is already happening. If that’s the case, the inventory market is already correcting, and I’ll nonetheless get my 80-dollar NVDA.

Thoughts you within the weeks main as much as the FOMC assembly we may have some euphoric shopping for that takes us up over the earlier excessive of 5669.67. This previous Friday we already reached 5554.25 we’re lower than 116 factors from making a brand new all-time excessive. Does not that trigger a little bit warning in your hearts? It does in mine.

Contemplate This Week As A Costume Rehearsal For 30 Days From Now

I already really feel like we now have gone too far too quick, Simply take a look at that SPY chart above, would not that appear to be too excellent a restoration? I see this week as a little bit of a dry run for September 18, since we now have the Jackson Gap convention. Powell is extensively anticipated to present his blessing to a .25% minimize in September in his tackle at 10 am this Friday. All the pieces he says will probably be overanalyzed, and even his tone and expression will probably be interpreted on whether or not the minimize is perhaps .50%, or how fast a slicing cycle it is going to be. Is he nonetheless involved about inflation? On and on, to me, the possibilities of a sell-off this Friday are fairly good.

So I will probably be organising my buying and selling to reap the benefits of the probability of a buoyant week for shares, at the least within the first 3 days. I will probably be closing lengthy trades, organising brief concepts, and holding money for Friday. Then, relying on how a lot promoting there may be on Friday, maybe beginning to shut out the brief concepts and hedges considerably. If the promoting is admittedly onerous on Friday it would carry by to Monday, so maybe I will probably be disciplined and never go utterly lengthy on Friday. I absolutely anticipate the VIX to interrupt beneath 14 this week, and I’ll certainly get lengthy on the VIX as an excellent hedge. This previous sell-off, the VIX jumped above 65, which is a really excessive stage, and I’m not anticipating to see that any time quickly. Nonetheless, the VIX with a 13-handle is a good stage to start out a hedge. I have already got a Lengthy Placed on Starbucks (SBUX), I believe Mr. Niccol is a superb operator, and if anybody can flip SBUX round it is him. He did not even begin but, and the highway is lengthy, but the inventory jumped greater than 20%. I believe SBUX will retreat this week, and definitely by Friday if I’m right. Going into subsequent month, I’ll make a follow of in search of extra brief concepts, and start to hedge. Definitely, if we get above 5600, I’ll look to hedge the Nasdaq-100 and the S&P 500.

My Trades

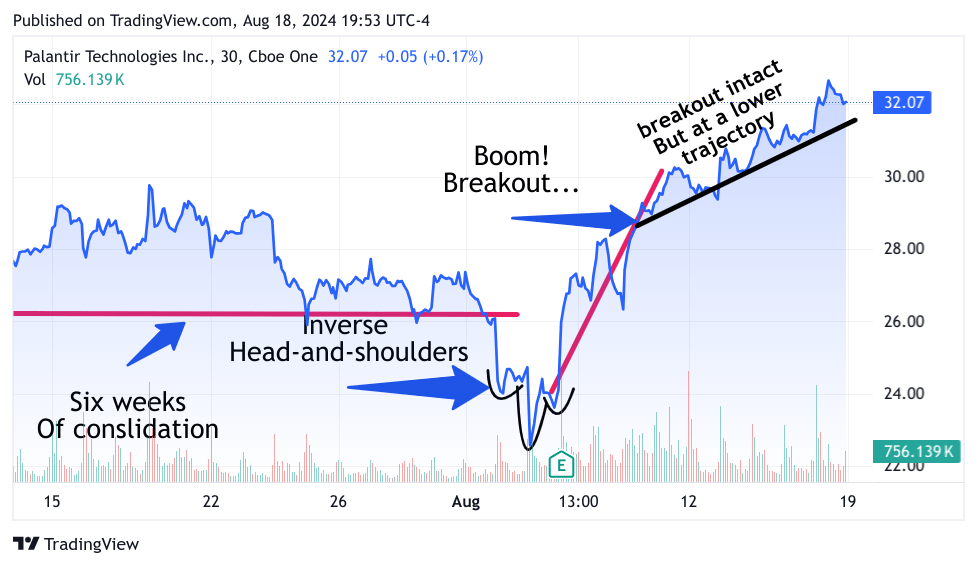

Proper now, moreover SBUX, all trades are on the lengthy aspect. I’m lengthy Name choices on Direxion Every day Semiconductor Bull 3X Shares ETF (SOXL) on the 38 strike. That is an oblique means of taking part within the AI chips, like NVDA, but in addition Broadcom (AVGO), and Micron (MU). I added a bunch of AVGO, and MU fairness to my long-term investing account on this newest sell-off, and I’ve standing orders to purchase at a lot decrease costs in preparation for the Fall’s Falls. Why do I set these costs to this point prematurely? As a result of it is higher for my psychological state to set these purchases up properly forward of time and look forward to the costs to come back to me. One other lengthy Name Choice I did this week is Vertiv Holdings (VRT). It is an AI-adjacent identify that hasn’t recovered as a lot as NVDA and I believe it may enhance this week, as NVDA will get into the excessive 120s. I have been having a number of enjoyable with Palantir (PLTR), it is nearly as if it has simply been found. Take a look at this chart, I first drew it every week in the past this previous Thursday and it simply retains coming. I maintain marking out the breakout extensions (black line is the most recent)

TradingView

How a lot larger can it go? I do not know, however I’ve been trimming my calls and have only a few left. I am on the 29 strike now, I already rolled it up from 27. It retains making 52-week highs, however sooner or later, most likely quickly, it must consolidate. I am prone to shut it out earlier than Friday and maintain the money till Monday. I am additionally Lengthy Name Choices on 2 cybersecurity names SentinelOne (S) as a result of as nice as CrowdStrike (CRWD) is, they may lose some prospects to S. It may not make a lot distinction to CRWD, however it should do S. I’m not throwing shade on CRWD, I added to my long-term holding of CRWD this sell-off. The opposite identify is Rubrik (RBRK). They’re within the candy spot of Ransom hacks. They’re a brand new IPO, and so they bought off onerous lately, I anticipate them to recuperate, actually on the subsequent ransom/hack occasion. Keep in mind to put aside Money, trim your longs however stick with them, and begin creating your hedges and particular person shorts (utilizing choices).

Okay, that’s it, good luck everybody!