Pictures By Tang Ming Tung

Funding overview

I wrote about Grocery Outlet Holding (NASDAQ:GO) beforehand (29 Could 2024) with a promote ranking as I used to be very unsure about how same-store-sales [SSS] efficiency was going to be and that the enterprise might miss FY24 steering. Quick-forward to right now, and the share worth has gone down as I had anticipated. I proceed to be destructive about GO, as I count on SSS progress to be poor within the close to time period, provided that the trade-down movement is over and the trade is getting extra aggressive.

2Q24 earnings (introduced on sixth August)

GO reported 2Q24 web gross sales of $1.128 billion, representing 11.7% y/y progress, pushed by 2.9% SSS progress. Gross revenue grew at a lesser price, by 6.9%, to $349.2 million (implying a 30.9% gross margin, which was a 140bps step down from 2Q23). The decrease gross margin offset the optimistic affect from the decrease expense ratio, ensuing within the EBIT margin being compressed 80bps from 3.9% in 2Q23 to three.1% in 2Q24. The excessive tax price (32.5% in 2Q24 vs. 30.7% in 2Q23) brought on web margin to compress as effectively, leading to a web earnings y/y decline of 17% from $24.1 million to $20 million.

SSS to proceed going through headwinds

Could Investing Concepts

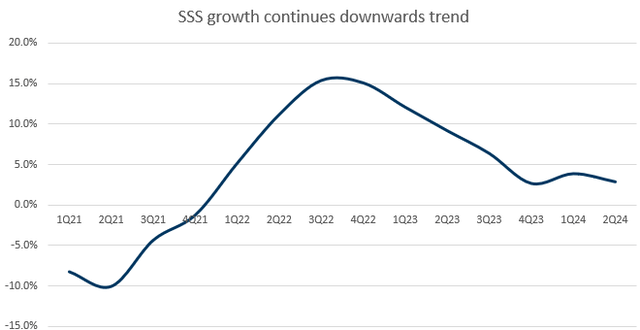

Within the 2Q24 quarter, GO SSS progress got here in at low-single-digit proportion (2.9%), and notably, this was supported by decrease pricing (-2.1% contribution), which attracted shopper site visitors (5.1% contribution).

The earlier bull case for GO was that it benefited from the trade-down motion as inflation was excessive, and that has pushed SSS progress to an elevated degree. Nevertheless, I imagine the macro atmosphere is not in a positive setup for GO, and due to this fact, SSS progress will proceed to slowdown from right here. Two macro-indicators formed my view: (1) On a year-to-date foundation, meals at house inflation is up solely about 1% (not like the previous yr that noticed large inflation); (2) actual wage progress is about 4 to five% on a year-to-date foundation, which suggests customers are more and more with the ability to afford comparatively extra groceries (vs. final yr). With this view in thoughts, I imagine customers won’t be as eager as they had been to purposely commerce down, and this is able to imply site visitors loss for GO.

Certainly, administration famous site visitors slowed in June, and that pattern continued into 3Q24, they usually have guided 3Q24 SSS progress to be ~1.5%, signifying one other quarter of deceleration. The larger implication from this information is that GO is both:

Not seeing improved productiveness within the new shops, and/or GO-matured shops are shedding share as a result of new shops ought to see greater SSS progress due to the productiveness ramp-up (the maturing part).

Both manner, I don’t suppose it is a optimistic scenario for shareholders.

Aggressive atmosphere to drive down margins

With the trade-down movement over, GO is now competing towards incumbents on a degree subject, and it is a very dangerous scenario for GO as rivals are stepping up on promotions. Within the 2Q24 earnings name, GO’s administration famous rising promotional stress all through the quarter and into July from key rivals. Feedback from friends are additionally making a promotional atmosphere. For example, Kroger gave hints of their 1Q25 earnings name on how they view promotions on this atmosphere. On a broader degree, different shopper items corporations are additionally leaning on promotions to draw demand.

The promotional exercise, we did discover an elevated exercise from Could, June, into July. Rivals have been extra aggressive with promotions to show a few of their destructive buyer rely and quantity round. Firm 2Q24 earnings

We’re figuring out new provide sources utilizing more practical promotions and bettering product combine, which is contributing to additional margin enhancements. Kroger 1Q24 earnings

The issue for GO is that it’s comparatively subscale in comparison with different grocery incumbents. On condition that economies of scale are a significant aggressive benefit within the grocery trade (robust bargaining energy to drive down the price of items offered), I don’t see how GO can outcompete massive friends by way of pricing. To present a way of issues, GO LTM income is ~$4.2 billion, whereas Kroger (KR) has $150 billion in income, Walmart has $665 billion, Costco Wholesale has $253 billion, and Albertsons Cos has ~$80 billion. Furthermore, these friends have far more presence (footprint) vs. GO; higher provider relationships to fund promotions (like Kroger is doing); and extra different sources of funding (i.e., promoting income, Costco’s membership income, and so on.) to assist extra aggressive promotions.

As such, I feel GO is caught between selecting to guard SSS progress or its margins. If it chooses to compete aggressively by decreasing costs, margins will collapse (they’re already declining). Whereas, if it chooses to guard margins (by not decreasing costs), SSS progress will fall.

Valuation

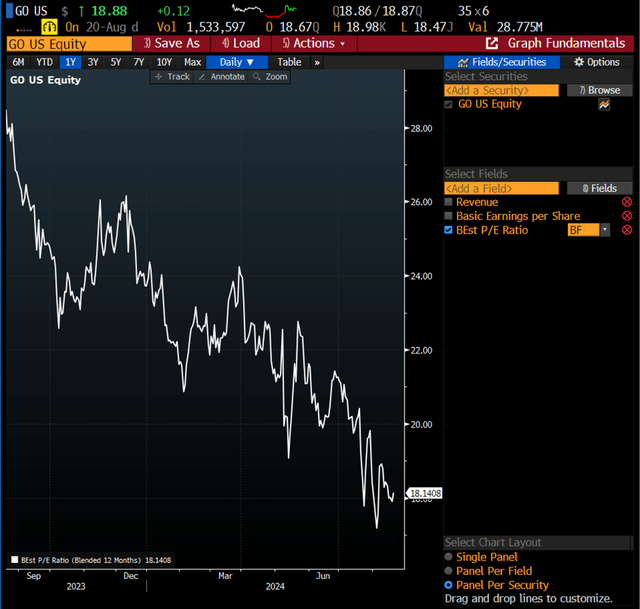

Bloomberg

If GO is to report poor SSS progress as I anticipated over the subsequent few quarters, I imagine valuation goes to see extra stress. Over the previous 12 months, GO’s ahead PE ratio has already seen large derating from ~27x to ~18x right now, and I do suppose there may be lots of room for valuation to fall if the market begins to worth GO like a mature grocery participant. For reference, KR is being valued at ~12x and Albertsons Cos (ACI) is being valued at ~9x.

Threat

Inflation might surge once more, and we may even see one other spherical of trade-down movement that can profit GO. GO can also execute higher than I anticipated concerning the UGO acquisition, giving them a robust anchor level (in route) to additional develop within the area (i.e., open extra shops). This may occasionally assist offset the destructive stress from poor SSS progress.

Conclusion

I give a promote ranking for GO because the commerce down movement is essentially over and the demand atmosphere is getting extra promotional. I count on SSS progress to proceed slowing down from right here, and even when administration decides to guard SSS progress, its revenue margins are in danger given its smaller scale relative to massive incumbents. Furthermore, the valuation has loads of room to fall, particularly contemplating the potential for continued earnings stress.