The Federal Reserve has formally began its rate-cutting cycle. On September 18, the central financial institution made a extra aggressive transfer than anticipated, slashing the important thing funds price by half a p.c. This hawkish determination is projected to alleviate some strain on shoppers, probably resulting in decrease bank card and mortgage charges. Whereas most consultants had predicted a price reduce, the consensus anticipated a extra modest quarter-percent discount.

The bigger reduce exhibits that the Fed is upbeat on inflation. The speed of value will increase fell to 2.5% in August, and the Fed clearly believes that it’ll quickly hit the two% goal. The speed reduce was the primary since March of 2020, and places the funds price within the vary of 4.75% to five.0%.

With this shift in Fed coverage, buyers are naturally asking, what’s subsequent? Wells Fargo analyst Donald Fandetti presents a transparent suggestion: take into account transferring into REITs and specialty finance sectors, which traditionally carry out nicely in rate-cutting cycles, whereas additionally offering the added incentive of excessive dividend yields.

“After underperforming via the speed hike cycle, we now see a good threat/reward for the shares, together with double-digit div yields. Traditionally, the shares do nicely when the Fed is slicing charges. Company MBS spreads are nonetheless vast and banks might begin shopping for after large hits from mark-to-mkt,” Fandetti opined.

Moving into specifics, Fandetti recommends two such shares which are paying out dividend yields north of 12%. And he’s not alone in his optimism – in accordance with the TipRanks database, each names are rated as Robust Buys by the analyst consensus. Let’s take a better look.

Annaly Capital Administration (NLY)

The primary Wells Fargo choose is Annaly Capital Administration, a REIT with a major give attention to residential actual property and mortgage-backed securities. The corporate has been notably profitable in buying these belongings, and has constructed up a complete portfolio value $75 billion. The agency has almost $11 billion in everlasting capital, and $6.3 billion in whole belongings out there for financing. In its final monetary launch, Annaly acknowledged that $66 billion of its whole portfolio was held within the ‘extremely liquid’ Company phase.

The Company enterprise makes up 58% of Annaly’s capital allocation, with the rest divided between mortgage servicing rights (22%) and residential credit score (20%). The corporate follows a diversified capital administration technique, designed to create sturdy, long-term risk-adjusted returns throughout various financial and rate of interest cycles. At its coronary heart, the technique pairs short-term, floating-rate credit score securities with the belongings that populate the long-term, fixed-rate company portfolio.

Story continues

Annaly additionally focuses on attracting buyers, by prioritizing capital return. The corporate has a long-standing dividend cost coverage, with a cost report going again to the Nineties and a historical past of adjusting the cost when vital. Of word, Annaly didn’t halt the dividend in the course of the pandemic disaster. The corporate’s most up-to-date declaration, made on September 10, was for a 65-cent cost per widespread share, to be despatched out on October 31. This marks the seventh quarter in a row with the dividend at this price. The annualized cost of $2.60 per widespread share provides a ahead yield of 12.8%.

The corporate’s dividend is supported by the earnings out there for distribution, or EAD. Within the final reported quarter, 2Q24, this metric got here to 68 cents per share, 4 cents higher than had been anticipated – and greater than sufficient to cowl the 65-cent widespread share dividend cost.

Checking in with Fandetti, we discover the Wells Fargo analyst upbeat on Annaly based mostly on the corporate’s historical past and its prospects for improved worth going ahead. He writes, “We use NLY as a case examine how its inventory value and dividend reacted throughout prior Fed price cycles, given the lengthy historical past as a public firm. Though it didn’t occur instantly because the Fed lowered rates of interest from 2000-2002 the inventory value and dividend elevated… NLY did decrease their dividend earlier in 2024 given the speed atmosphere, however mgt appears to be signaling that the present dividend is sustainable… When it comes to NLY’s rate of interest sensitivity, for each -15bps MBS unfold change, this is able to enhance ebook worth by +6.2%.”

Together with this, the analyst bumps up Annaly’s ranking from Equal Weight (i.e. Impartial) to Chubby (i.e. Purchase), and units a $23 value goal that means an 11.5% upside for the approaching 12 months. With the annualized dividend, this inventory’s one-year return can method 24%. (To look at Fandetti’s observe report, click on right here)

General, NLY shares get a Robust Purchase consensus ranking from the Road, based mostly on 8 opinions that embody 6 Buys and a couple of Holds. (See NLY inventory forecast)

AGNC Funding (AGNC)

Now we’ll flip our eyes to AGNC Funding, one other REIT with a give attention to mortgage-backed securities. AGNC is an internally managed agency, and its portfolio is valued at $66 billion. Greater than $59 billion of that – over 90% – is invested in Company MBSs, and 96% of the portfolio is invested in 30-year fixed-rate devices. AGNC additionally has important investments in internet TBA mortgage positions, CRTs, and non-agency devices.

A have a look at the present dividend exhibits that the inventory stays a sound alternative for buyers looking for a gradual return. AGNC pays out its dividend month-to-month, at a price of 12 cents per widespread share. This provides one vital benefit, as many buyers search to make use of dividend shares for an revenue stream – and this dividend, with its month-to-month cost, will match higher with most billing schedules. As well as, the dividend annualizes to $1.44 per widespread share, a determine that provides a ahead yield of 13.9%.

On the monetary aspect, AGNC final reported for 2Q24, and in that quarter the corporate had non-GAAP EPS of $0.53. Whereas this missed the forecast by a penny, it gives full protection of the dividend’s quarterly price.

After we flip once more to analyst Fandetti, we discover that he likes this firm’s prospects going ahead, saying of AGNC, “We imagine the speed atmosphere may very well be a pleasant tailwind to AGNC’s ebook worth… On AGNC’s sensitivity, for each -10bps MBS unfold change, this is able to enhance ebook worth by +5%…”

The highest-rated analyst can also be bullish on the dividend, and provides to his feedback, “And the dividend yield is enticing in our view… We imagine the dividend is comparatively safe at these ranges as returns are within the mid-teens for brand new company MBS investments. AGNC’s earnings report confirmed its core earnings of 53c, which is nicely above the quarterly 36c dividend.”

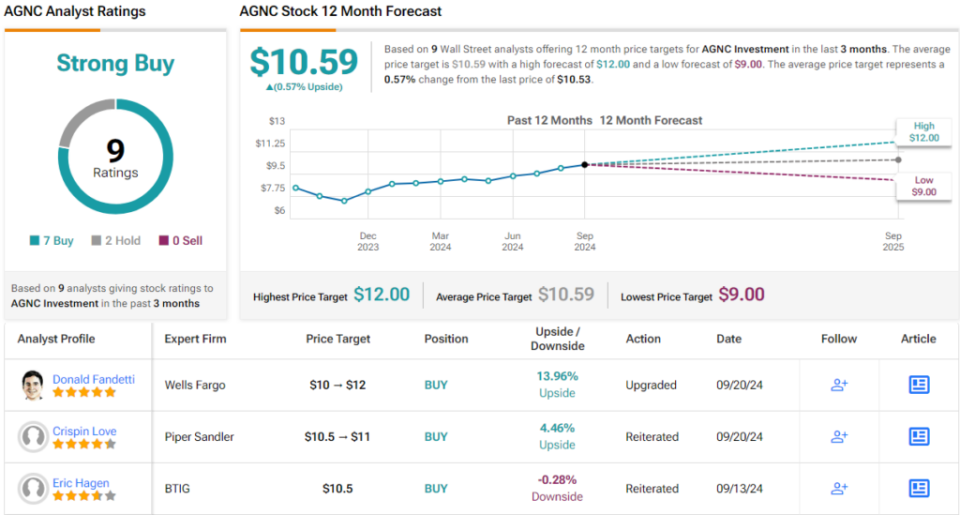

Taken collectively, these feedback help Fandetti’s improve of AGNC from Equal Weight (i.e. Impartial) to Chubby (i.e. Purchase), whereas his value goal of $12 signifies potential for a one-year upside of ~14%. The mixed upside/dividend return potential on this inventory for the 12 months forward involves ~28%.

From the Road as an entire, AGNC will get a Robust Purchase consensus ranking, a stance based mostly on 9 opinions that break right down to 7 Buys and a couple of Holds. (See AGNC inventory forecast)

To search out good concepts for shares buying and selling at enticing valuations, go to TipRanks’ Finest Shares to Purchase, a software that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analyst. The content material is meant for use for informational functions solely. It is vitally vital to do your individual evaluation earlier than making any funding.