Historic tendencies present that bullish methods constantly outperform bearish forecasts.

Understanding market cycles is essential to navigating inevitable corrections and attaining success.

Within the funding world, a well-liked saying goes, “Bearish individuals look smarter, however bullish individuals earn a living.” This adage rings very true once we look at long-term inventory market efficiency.

Historic information, whether or not referencing the or , reveals a constant pattern: over 16 years or extra, the returns have at all times been optimistic.

Regardless of this proof, many buyers unwittingly sabotage their portfolios by heeding the doom prophets who, yr after yr, forecast impending catastrophes.

Whereas these naysayers sometimes hit the mark, their success charge is akin to a damaged clock—appropriate solely twice a day.

These voices of doom resurfaced in the beginning of the present yr, prompting us to replicate on predictions from three distinguished figures on this realm:

1. Jeremy Grantham, who ‘rang the alarm’ on an ‘every thing bubble’

2. Harry Dent (not the one from Batman), who known as the ‘crash of a lifetime in 2024’

3. John Hussman

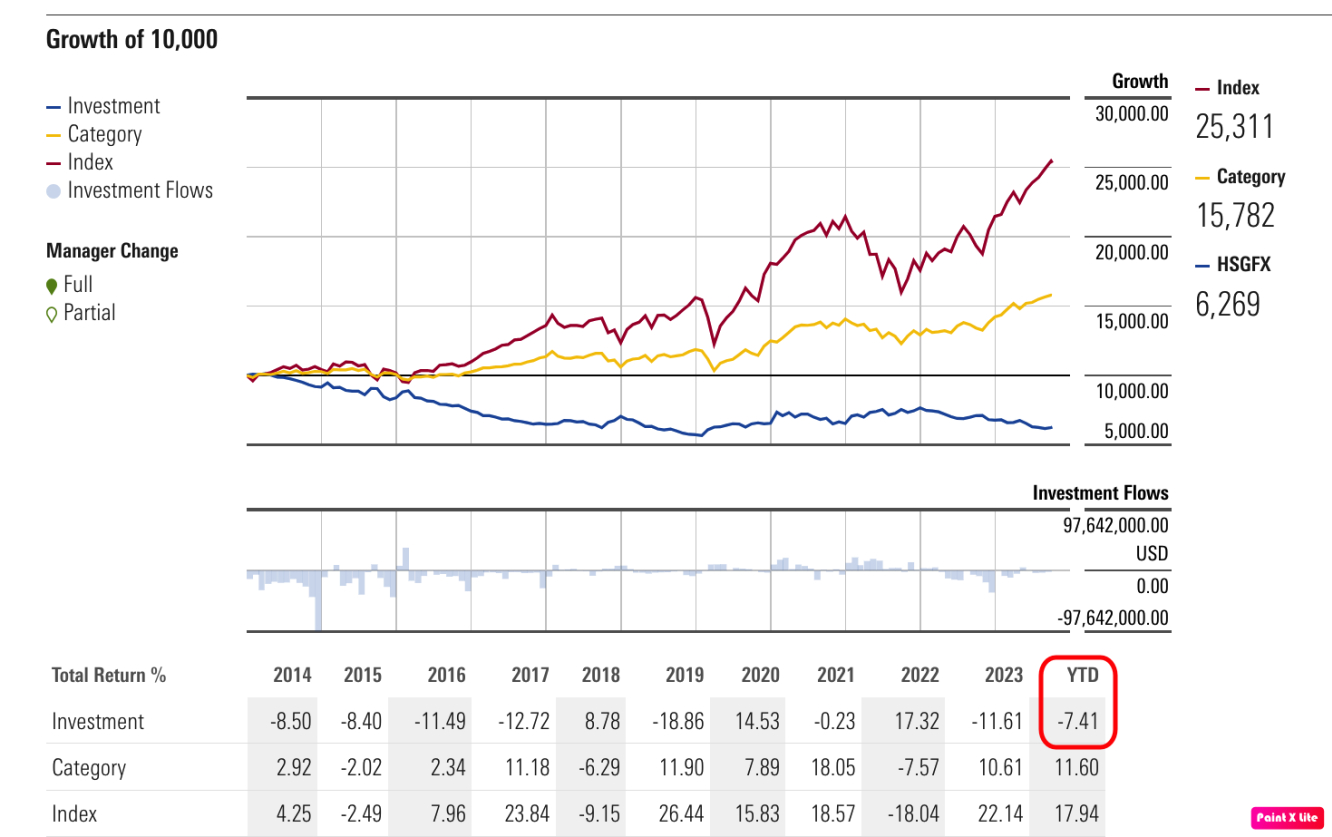

Lastly, think about John Hussman. Over the previous decade, his catastrophic predictions have led to a powerful -38% return.

This yr, whereas the inventory market has gained about 20%, his fund is down 7.41%. Briefly, betting on market collapses has confirmed to be a poor technique for long-term success.

Regardless of Horrible Predictions, Why Do These Prophets Stay Energetic?

The reply lies in human nature and the media’s urge for food for sensationalism. Headlines that stoke concern inevitably draw extra consideration. Think about these two headlines:

“S&P 500 Up 20.5% Since Begin of 12 months—Right here’s Why!”

“S&P 500 Faces 30% Collapse—Right here’s Why!”

It is clear which one grabs your curiosity. The second sells higher, drives extra clicks, and generates greater income, fueling a cycle the place concern reigns supreme.

Sadly, this fixation on pessimism could cause buyers to overlook out on certainly one of historical past’s most profitable bull markets. Those that cling to the predictions of those “specialists” threat dropping sight of their monetary objectives and letting inflation erode their financial savings.

What You Ought to Do As a substitute

It is essential to acknowledge that bear markets happen statistically as soon as each 4 years, making them a norm moderately than an anomaly.

In years like 2022, when markets falter, the doom prophets reclaim credibility, declaring, “I used to be proper!” But when that they had remained constantly bullish, they might have been appropriate three out of 4 years. The logic merely escapes me.

In conclusion, keep away from these characters and their fear-inducing narratives. What actually issues is knowing market historical past, recognizing statistical patterns, and devising a strong funding technique.

Sure, difficult intervals will come up—markets are at present priced greater than typical, and corrections are inevitable.

Nonetheless, in case you fail to harness the market’s pure ebb and circulate, you’ll proceed to fall prey to concern. Embrace the journey, and let time work in your favor.

***

Disclaimer: This text is written for informational functions solely. It isn’t supposed to encourage the acquisition of property in any manner, nor does it represent a solicitation, supply, advice or suggestion to speculate. I wish to remind you that every one property are evaluated from a number of views and are extremely dangerous, so any funding resolution and the related threat is on the investor’s personal threat. We additionally don’t present any funding advisory providers.