Cathie Wooden is certainly one of its main exponents by bringing to market a number of ETFs which can be very fashionable.

The shares we’ll have a look at are Lilium, Origin Supplies, and Aeva Applied sciences.

In search of actionable commerce concepts to navigate the present market volatility? Unlock entry to InvestingPro’s AI-selected inventory winners for beneath $9 a month!

Disruptive innovation reshapes industries by utilizing cutting-edge know-how to overtake present markets or create solely new ones. Because of this, it alters market dynamics and trade constructions, sometimes involving a excessive degree of threat and the exploration of recent applied sciences.

Cathie Wooden stands out as a number one determine on this space, primarily by her collection of ETFs generally known as the ARKs, which give attention to investing in disruptive firms. These ETFs have gained immense reputation, with some boasting spectacular returns throughout sure durations.

They’re as follows:

ETF ARK Innovation (NYSE:)

ETF Genomic Revolution (NYSE:)

ETF Fintech Innovation (NYSE:)

ETF Subsequent Era Web (NYSE:)

ETF Autonomous Expertise & Robotics (NYSE:)

These ETFs have even prolonged their attain to Europe and are listed on distinguished exchanges, together with Germany’s Deutsche Bӧrse Xetra, the London Inventory Trade, Amsterdam’s CBOE, Italy’s Borsa, and Switzerland’s SIX Swiss Trade, with a fee charge of 0.75%.

Some notable disruptive firms embody Tesla (NASDAQ:), Nvidia (NASDAQ:), Roku (NASDAQ:), Baidu (NASDAQ:), Zillow (NASDAQ:), Teladoc Well being (NYSE:), et cetera.

Now, let’s dive into a number of disruptive shares that provide important upside potential out there, albeit with appreciable threat. It’s a sector appropriate just for aggressive traders with a well-diversified portfolio.

1. Lilium

Lilium (NASDAQ:) is a German aerospace firm listed on Nasdaq that develops the Lilium Jet, an electric-powered aerial automobile able to flight.

The corporate is revolutionizing the city mobility sector with its idea of electrical air cabs by providing quick, zero-emission transportation whereas serving to cities keep free from congestion.

It just lately raised $114 million to assist its operations and preliminary flight assessments. It has additionally accomplished the primary part of integration testing for the Lilium Jet’s electrical energy system—an important step towards flight situation approval.

With additional cash than debt on its stability sheet, Lilium enjoys monetary flexibility as it really works to certify its product. This money place might be essential, given the capital-intensive nature of the aerospace trade and the continued improvement part.

Lilium will report its outcomes for the quarter on November 19.

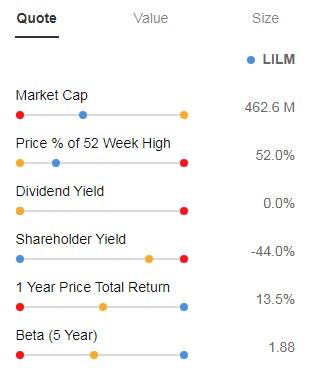

Its Beta of 1.88 displays its shares transferring in the identical course because the market however with significantly extra volatility.

Supply: InvestingPro

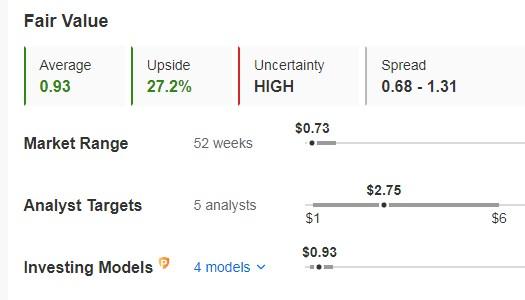

Lilium’s shares are undervalued on a basic foundation. Particularly, its truthful worth is, at the start of the week, 27.2% above the share worth, precisely at $0.93.

The market estimates a median potential of round $2.75 for these shares.

Supply: InvestingPro

2. Origin Supplies

Origin Supplies (NASDAQ:) goals to facilitate the worldwide shift towards sustainable supplies by changing petroleum-based supplies with decarbonized options. The corporate is dedicated to decreasing carbon emissions and producing supplies with decrease environmental affect.

A yr after it introduced its breakthrough in creating a course of for 100% recyclable plastic bottle parts, the corporate has secured a Memorandum of Understanding (MOU) for 2 years of manufacturing and expects this settlement to generate $100 million in income beginning in early 2025.

The corporate’s CEO, Wealthy Riley, demonstrated his confidence within the firm’s potential by buying a further 300,000 shares.

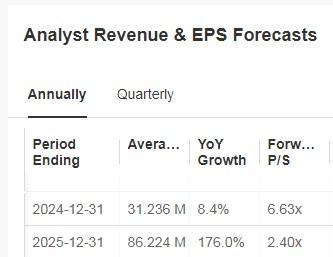

On November 7, it presents its quarterly accounts. Earnings are anticipated to extend by 8.4% this yr and 176% by 2025.

Supply: InvestingPro

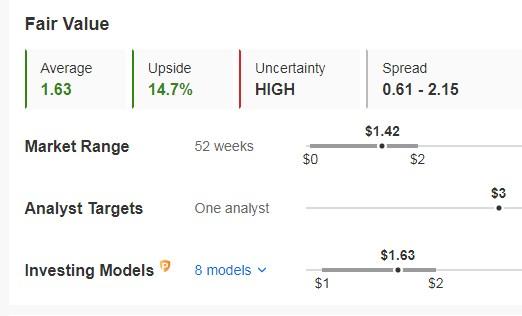

Origin’s shares are basically undervalued, with a good worth 15% above the present share worth of $1.63 on the week’s begin.

The market estimates a median potential of round $3 for its shares.

Supply: InvestingPro

3. Aeva Applied sciences

Aeva Applied sciences (NYSE:) is a US-based firm that designs, manufactures, and sells LiDAR sensing programs and sensing software program options.

The corporate provides options which can be extra environment friendly and cost-effective than options, which may facilitate mass adoption, positioning itself to drive disruptive change.

Aeva just lately introduced that its know-how shall be utilized by a serious European automaker to validate its automated automobile programs. It expects its know-how to allow fast differentiation between static and dynamic objects, like pedestrians or autos. Moreover, its know-how has been chosen by a number one U.S. nationwide protection safety group and for Germany’s automated prepare program.

Supply: InvestingPro

It can launch its earnings report for the quarter on November 7. The corporate maintained a stable money place, with a complete of $285.2 million on the finish of the quarter.

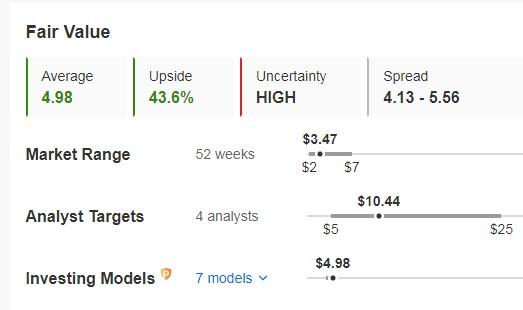

Its shares are buying and selling 43.6% (at the start of the week) beneath its truthful worth or worth to fundamentals, which might be at $4.98.

The potential assigned by the market could be at $10.44.

Supply: InvestingPro

***

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, supply, recommendation, counsel or suggestion to speculate as such it isn’t supposed to incentivize the acquisition of property in any manner. I wish to remind you that any sort of asset, is evaluated from a number of views and is extremely dangerous and due to this fact, any funding resolution and the related threat stays with the investor.