gyro/iStock by way of Getty Pictures

By Elisa Mazen, Michael Testorf, CFA & Pawel Wroblewski, CFA

Japanese Reforms Begin to Yield Outcomes

Market Overview

Broadening participation despatched worldwide equities larger within the third quarter, with worth and cyclical shares main the best way as monetary circumstances eased throughout most developed markets. The benchmark MSCI All Nation World Ex-U.S. Index superior 8.06%, the MSCI ACWI Ex-U.S. Small Cap Index jumped 9.03%, whereas the MSCI Rising Markets Index added 8.72%.

From a regional standpoint, Asia Ex Japan, North America and rising markets outperformed the index. The UK carried out consistent with the index whereas Europe Ex U.Ok. and Japan underperformed in a interval that noticed foreign money volatility as a rising yen pressured carry commerce buyers who had been quick the foreign money to cowl their losses. Chinese language equities surged to finish the quarter (up 23.49%) following the announcement of aggressive stimulus from Beijing, lifting the efficiency of broader rising markets.

Sharp reversals had been the order of the day within the third quarter, with among the worst-performing markets akin to Hong Kong staging a pointy turnaround after the announcement of enormous stimulus packages from Chinese language officers. Almost a 12 months’s price of buying and selling occurred within the final day of the quarter. This led China-focused segments, like supplies, to make vital strikes larger. Japan’s selection of a brand new Liberal Democratic Celebration head to be prime minister additionally shocked the market, elevating fears that he may not observe the company insurance policies of the earlier administration – one thing that has since been put to relaxation – and led to cash going again into China from Japan from shorter-term gamers available in the market. Yr so far, Japan had been one of many better-performing markets, whereas China had been unquestionably the worst, therefore the robust reversion.

Political drama in France continued with a brand new prime minister floating the concept of further company tax will increase to assist salvage the increasing price range deficit; this saved French shares on their again foot. The 50 foundation level Fed fee reduce rounded issues out on the finish of the quarter. Now markets are nervously anticipating the upcoming U.S. election and what that would imply for worldwide commerce. The U.S. greenback was broadly weaker all through the quarter in opposition to all main currencies.

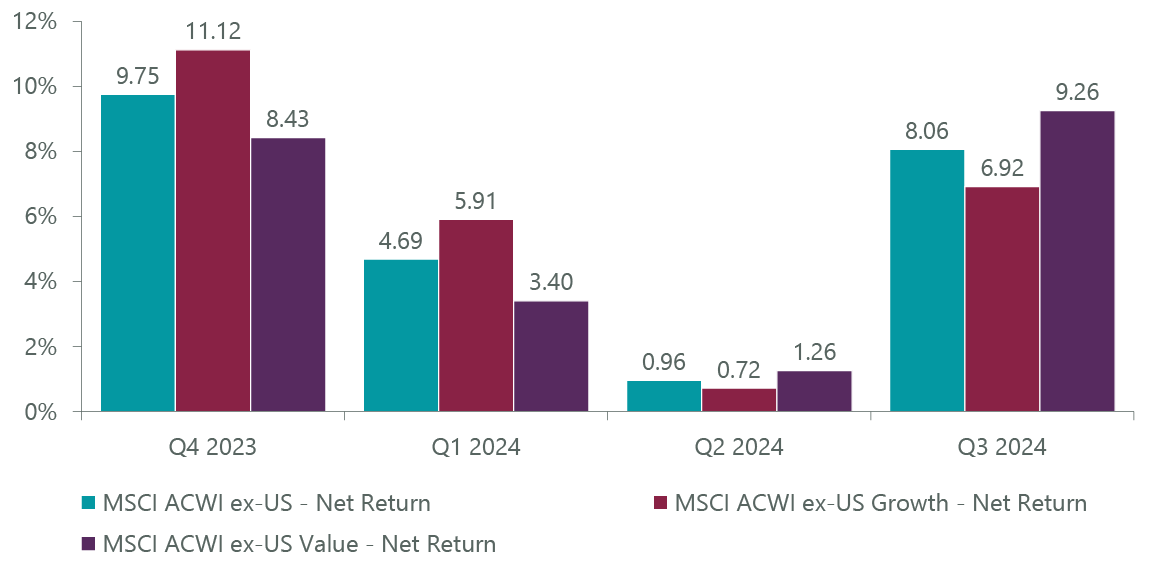

Worldwide development shares rose 6.92% for the quarter however underperformed their worth counterparts by 234 foundation factors as a market rotation away from earlier winners in well being care and expertise ensued.

Exhibit 1: MSCI Progress vs. Worth Efficiency

As of Sept. 30, 2024. Supply: FactSet.

The ClearBridge Worldwide Progress ACWI Ex-US Technique underperformed the benchmark in a third-quarter surroundings favoring worth shares. Our diversified focus past conventional, higher-growth, higher-beta shares helped mitigate the diploma of underperformance and we imagine such an method is well-suited for broadening markets. Efficiency was highlighted by power in each our cyclical holdings within the client discretionary sector in addition to info expertise, though our chubby to the sector neutralized this benefit. Early indicators of wider participation are encouraging for us as lively, bottom-up development managers.

Portfolio holdings that had led in a beforehand slim worldwide market surroundings, together with GLP-1 pharmaceutical developer Novo Nordisk (NVO) and semiconductor gear makers ASML and Tokyo Electron (OTCPK:TOELY), gave again positive factors within the rotation. Whereas Tokyo Electron had been trimmed fairly closely earlier within the 12 months, we capitalized on late-quarter weak point to carry this place to a extra lively weight. We preserve confidence in these franchises as leaders within the secular development market of diabesity remedies, the turnaround of the reminiscence markets in semiconductors and the broadening adoption of Gen AI.

Outcomes had been additionally held again by weak point among the many Technique’s industrial holdings, primarily British pest management supplier Rentokil (RTO), which has seen disappointing development thus removed from its U.S. enlargement technique. Japanese industrial filter and valve maker SMC (OTCPK:SMCAY) detracted as nicely, as a result of ongoing sluggishness within the Chinese language financial system. We exited each shares in favor of better-positioned industrial alternatives.

Portfolio Positioning

We had been lively within the quarter promoting positions the place we really feel development is on the decline, upgrading into new concepts with higher development and valuation assist. At this level we’re satisfied that the Japan transfer to improve profitability, capital allocation and shareholder returns is genuine and added 5 new concepts that replicate this confidence.

Within the secular bucket, we bought Terumo (OTCPK:TRUMF), a Japanese producer of medical gear for blood administration, cardiac and vascular procedures in addition to basic hospital makes use of. Its core cardiovascular and vascular machine enterprise is rising at above-market charges as a result of higher affected person outcomes and improved hospital economics. New product launches in its blood and cell applied sciences enterprise ought to additional bolster Terumo’s development. We see the corporate increasing margins by means of regular development in core markets, new enterprise and extra aggressive M&A that’s doable underneath its new CEO.

Structural development corporations present us the chance to generate alpha from turnarounds and restructurings in addition to broader cyclical drivers. The opposite 4 Japan additions fall into this class – Asics (OTCPK:ASCCF), Tokio Marine (OTCPK:TKOMY), Fujikara, {an electrical} gear maker, and Nippon Sanso Holdings (OTCPK:TYNPF), a supplier of business gases. All stand to profit from each company-specific actions in addition to broader reforms within the Japanese market aimed toward bettering return on fairness and shareholder engagement whereas selling M&A exercise.

Asics is a specialty working shoe designer whose newer administration is dedicated to bringing the enterprise again to industry-like profitability. Along with its iconic trainers, the corporate additionally develops footwear for the sports activities life-style and well being/consolation markets. With higher operational focus, stock administration and a transfer to specialty gross sales channels, we imagine Asics’s well-known high quality will permit it to promote extra merchandise with higher pricing and margins, resulting in vital earnings development.

Tokio Marine is a prime world property and casualty insurer. M&A amongst its smaller rivals previously few years has created larger parity however Tokio Marine stays the biggest insurer by market cap as a result of its bigger abroad portfolio, largely based mostly within the U.S. We see three sources of value appreciation for the corporate going ahead: premium will increase in its home P&C enterprise, the promoting off of cross holdings that would unlock as much as 30% of the corporate’s present worth and bolt-on acquisitions funded by its excessive money technology.

The Financial institution of Japan’s newest Tankan survey confirmed a continued restoration in home demand, rising GDP development and a low danger of deflation returning, circumstances conducive to our growing publicity to the area.

Whereas Beijing’s late-quarter stimulus measures are an excellent begin, ongoing weak point on the earth’s second-largest financial system has brought on us to pare again our direct holdings available in the market over the previous 12 months. We at the moment are evaluating our oblique publicity as nicely, which resulted in a number of exits and trims throughout the quarter, the biggest being the sale of Hong Kong-based life insurer AIA Group (OTCPK:AAGIY). Though AIA’s enterprise has began to enhance, wages and employment, significantly amongst youthful shoppers, have slowed dramatically, creating concern of much less disposable earnings insurance coverage purchases. Authorities stimulus by means of decrease charges may also decrease funding earnings for insurers.

One among our greater gross sales was Nestle (OTCPK:NSRGY), the Swiss packaged meals large, the place development seems to have peaked underneath former CEO Mark Schneider. Nestle’s new CFO has indicated that upward earnings steering shall be pushed out additional than anticipated. We exited the long-held title in favor of French meals and beverage maker Danone (OTCQX:DANOY), a higher-growth concept in client staples.

Outlook

With its September fee reduce, the Federal Reserve joined central banks within the eurozone, the U.Ok., Switzerland and Canada in easing monetary circumstances. The Fed transfer has ramifications nicely past the U.S. and is supportive of broadening participation throughout each developed and rising fairness markets. Mixed with China’s aggressive stimulus measures introduced late within the quarter, we anticipate world financial exercise will stay constructive by means of the top of the 12 months and into 2025.

Regardless of the strongly constructive response by Chinese language equities to Beijing’s financial easing, we imagine extra must be accomplished to restart development. Whereas the measures are focused predominantly on the fairness markets and native authorities budgets, we have to see the creation of long-term demand drivers and client spending, each of which have been troublesome throughout the housing market declines. China is predicted to make further coverage strikes on the finish of October and with the end result of U.S. elections quickly thereafter, we should always know extra concerning the path of its restoration quickly.

We’re inspired by the bettering circumstances throughout our investable universe as they create a extra conducive surroundings for our diversified method to development. Latest efficiency has highlighted the advantages of complementing core secular development positions with opportunistic possession of structural growers and selective publicity to rising development names.

Portfolio Highlights

Through the third quarter, the ClearBridge Worldwide Progress ACWI Ex-US Technique underperformed its MSCI ACWI Ex-U.S. benchmark. On an absolute foundation, the Technique delivered positive factors throughout all 9 sectors during which it was invested (out of 11 complete), with the patron discretionary, financials and client staples sectors the first contributors.

On a relative foundation, general inventory choice contributed to efficiency however was offset by unfavourable sector allocation results. Specifically, inventory choice within the IT and client discretionary sectors and a scarcity of publicity to vitality drove outcomes. Conversely, an chubby to IT, an underweight to financials and inventory choice within the industrials and well being care sectors detracted from efficiency.

On a regional foundation, inventory choice in Japan and the UK supported efficiency whereas inventory choice in rising markets and Europe Ex U.Ok. and an chubby to Europe Ex U.Ok. proved detrimental.

On a person inventory foundation, the biggest contributors to absolute returns within the quarter included Inditex within the client discretionary sector, Haleon (HLN) within the client staples sector, argenx (ARGX) and HOYA (OTCPK:HOCPY) within the well being care sector and London Inventory Change (OTCPK:LDNXF) within the financials sector. The best detractors from absolute returns included positions in Novo Nordisk in well being care, ASML, Tokyo Electron and SK hynix (OTCPK:HXSCF) in IT and Rentokil in industrials.

Along with the transactions talked about above, we added new positions in Prysmian (OTCPK:PRYMF) within the industrials sector, Coupang (CPNG) within the client discretionary sector and repurchased Spotify (SPOT) within the communication providers sector. The Technique additionally exited positions in Antofagasta (OTC:ANFGF) and Givaudan (OTCPK:GVDBF) within the supplies sector, Monday.com (MNDY) and Hexagon (OTCPK:HXGBF) within the IT sector, Daifuku (OTCPK:DFKCY) within the industrials sector and McDonald’s Japan (OTCPK:MDNDF) within the client discretionary sector.

Elisa Mazen, Managing Director, Head of International Progress, Portfolio Supervisor

Michael Testorf, CFA, Managing Director, Portfolio Supervisor

Pawel Wroblewski, CFA, Managing Director, Portfolio Supervisor

Previous efficiency isn’t any assure of future outcomes. Copyright © 2024 ClearBridge Investments. All opinions and knowledge included on this commentary are as of the publication date and are topic to vary. The opinions and views expressed herein are of the writer and should differ from different portfolio managers or the agency as an entire, and usually are not supposed to be a forecast of future occasions, a assure of future outcomes or funding recommendation. This info shouldn’t be used as the only real foundation to make any funding resolution. The statistics have been obtained from sources believed to be dependable, however the accuracy and completeness of this info can’t be assured. Neither ClearBridge Investments, LLC nor its info suppliers are answerable for any damages or losses arising from any use of this info.

Efficiency supply: Inner. Benchmark supply: Morgan Stanley Capital Worldwide. Neither ClearBridge Investments, LLC nor its info suppliers are answerable for any damages or losses arising from any use of this info. Efficiency is preliminary and topic to vary. Neither MSCI nor every other social gathering concerned in or associated to compiling, computing or creating the MSCI knowledge makes any specific or implied warranties or representations with respect to such knowledge (or the outcomes to be obtained by the use thereof), and all such events hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or health for a specific goal with respect to any of such knowledge. With out limiting any of the foregoing, in no occasion shall MSCI, any of its associates or any third social gathering concerned in or associated to compiling, computing or creating the information have any legal responsibility for any direct, oblique, particular, punitive, consequential or every other damages (together with misplaced earnings) even when notified of the potential of such damages. No additional distribution or dissemination of the MSCI knowledge is permitted with out MSCI’s specific written consent. Additional distribution is prohibited.

Click on to enlarge

Unique Submit

Editor’s Word: This text discusses a number of securities that don’t commerce on a serious U.S. alternate. Please concentrate on the dangers related to these shares.