Your help helps us to inform the story

From reproductive rights to local weather change to Massive Tech, The Impartial is on the bottom when the story is growing. Whether or not it is investigating the financials of Elon Musk’s pro-Trump PAC or producing our newest documentary, ‘The A Phrase’, which shines a lightweight on the American ladies combating for reproductive rights, we all know how necessary it’s to parse out the info from the messaging.

At such a crucial second in US historical past, we’d like reporters on the bottom. Your donation permits us to maintain sending journalists to talk to either side of the story.

The Impartial is trusted by Individuals throughout your complete political spectrum. And in contrast to many different high quality information shops, we select to not lock Individuals out of our reporting and evaluation with paywalls. We consider high quality journalism ought to be out there to everybody, paid for by those that can afford it.

Your help makes all of the distinction.

Shut

Learn extra

Automobile makers are stepping up their marketing campaign calling for presidency assist for themselves and their consumers.

The federal government plans to water down calls for for automobile makers to make a share of their vehicles battery-powered after sluggish gross sales and after Vauxhall’s proprietor Stellantis mentioned it might shut down a plant in Luton due to the principles.

No less than 22 per cent of vehicles made in British factories should be battery-powered, and a tenth of vans. Breaking the principles means both shopping for credit from rivals who’re beating these targets – an unpopular possibility – or paying a fantastic of £15,000 per automobile.

However decrease fines might be agreed upon to offer producers and prospects extra time to make the swap.

open picture in gallery

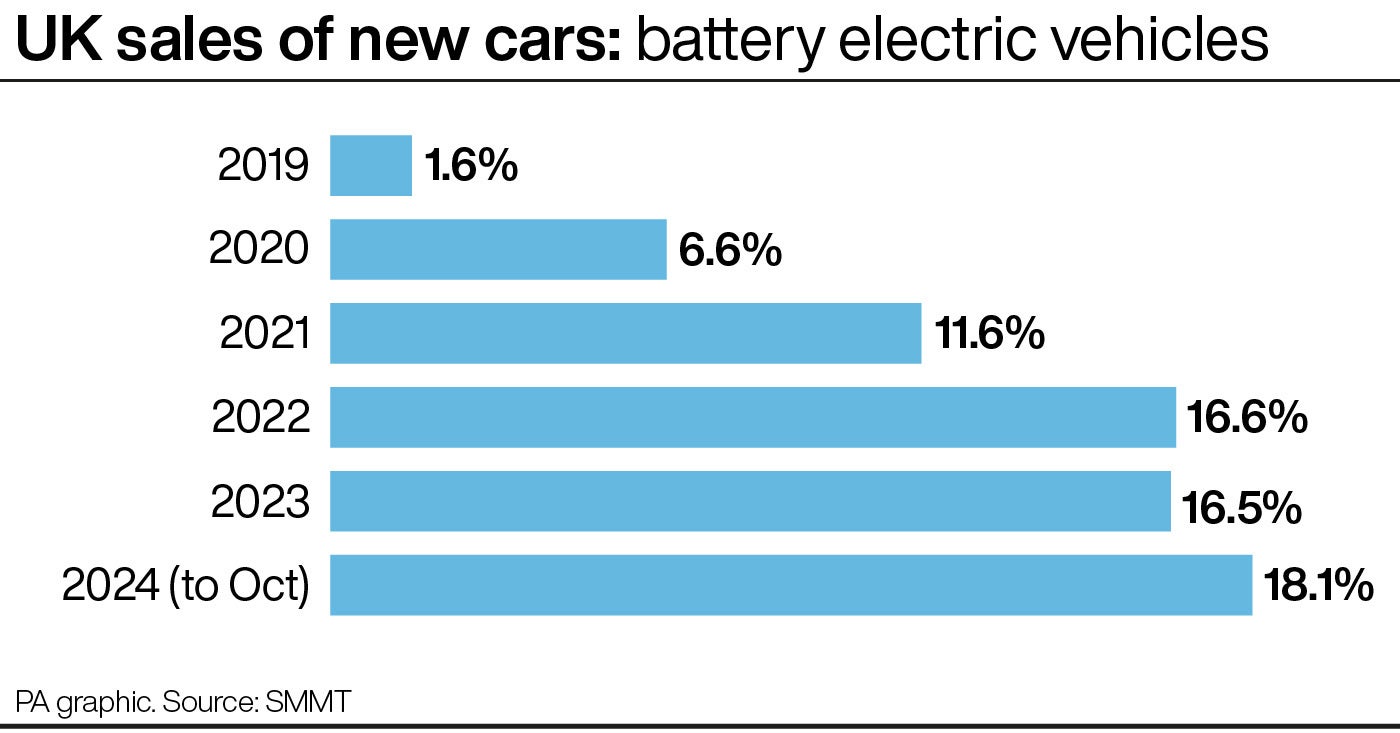

It comes as producers fear about sluggish pickup of the autos that are pricier than petrol fashions however cheaper to run.

The worth hole is slowly declining, however a value of dwelling disaster, low wage development and better borrowing prices are placing strain on consumers.

Ford introduced 800 job cuts within the UK this month and different corporations have warned about job cuts and cutbacks if the sluggish take-up continues.

There are beneficiant incentives for some electrical automobile consumers. Nonetheless, as you will notice beneath, they aren’t as beneficiant as they as soon as have been, and the federal government’s largesse shouldn’t be distributed evenly.

Tax assist now

The most important assist comes for company consumers, which suggests you have to to get your employer to purchase you an electrical automobile as a perk.

This ought to be attainable for many who want a automobile to do their job – for example, these in gross sales who go to shoppers to conduct enterprise. Needing a automobile to commute is probably not sufficient of a cause.

Companies which purchase firm electrical vehicles get a capital allowance, that means the price of the car may be set in opposition to its company tax invoice. This doesn’t work if the automobile is employed.

open picture in gallery

Staff who get to make use of an organization automobile and maintain it for private use may even get a tax profit.

Getting an organization automobile is seen by the federal government as a profit in form and is taxable. Electrical vehicles are rated at simply 2 per cent of their worth per yr, in comparison with as much as 37 per cent for combustion engine autos, and that quantity is then multiplied by an individual’s tax band.

For example, an organization automobile consumer with an electrical automobile price £35,700 with a profit in-kind fee of two per cent and an earnings tax band of 20 per cent pays simply £142.80 a yr in tax to make use of their EV.

A petroleum automobile of the identical value would value £2,550, a diesel £2,641.80 and a hybrid automobile £856.90, in response to vitality agency Octopus.

open picture in gallery

That 2 per cent fee will enhance every year, changing into 9 per cent in 2029, however nonetheless far beneath 19 per cent for hybrid vehicles and as much as 39 per cent for combustion fashions.

As may be seen, these beneficiant allowances are finest for many who work for corporations with an organization automobile scheme or who run a restricted firm.

For those who don’t, what’s on provide is way extra restricted.

The automobile business is lobbying the federal government arduous to develop assist for many who do not need entry to a automobile as a job perk.

Tax assist out there now which is being abolished

Till April 2025, electrical vehicles pays no highway tax. Past that date, they are going to be taxed the identical as petrol and diesel vehicles, albeit at a less expensive fee.

EVs registered from April pays £10 highway tax for the primary yr.

Nonetheless, the £410 surcharge that vehicles price greater than £40,000 should pay for 5 years is waived for electrical vehicles, and can proceed to be.

Electrical vehicles are additionally exempt from the congestion cost in London, though that perk may even finish in 2025.

Different out there assist features a £350 changepoint grant for renters and flat homeowners, which can function till March

Tax assist sooner or later

If EVs proceed to be offered at a sluggish tempo, the federal government could resolve to assist, since EV take-up is central to Britian’s decarbonising plans.

Halving VAT on electrical vehicles to 10 per cent may help in persuading extra drivers to make the swap, the business’s mouthpiece the Society of Motor Producers and Merchants has mentioned.

Assist which has already been abolished

Two years in the past the federal government ended its well-liked £300m grant scheme, which provided a £1,500 low cost on electrical vehicles price lower than £32,000. About half one million consumers had been helped by the scheme.