The RSI (Kernel Optimized) indicator integrates Kernel Density Estimation (KDE) with the Relative Power Index (RSI), making a probability-based framework to find out how carefully the present RSI stage aligns with traditionally vital pivot factors. By using KDE, discrete historic pivot values are remodeled right into a clean likelihood distribution, enabling extra refined development evaluation than conventional RSI alone.

Core Idea: Kernel Density Estimation (KDE)

KDE is a non-parametric methodology used to estimate the likelihood density perform of a dataset. As a substitute of counting on discrete bins as in histograms, KDE applies a steady kernel perform over every information level to supply a clean curve that represents likelihood density at each stage of the variable being studied.

Common KDE Components:

Step-by-Step Logic

Accumulating RSI Pivot Knowledge: The method begins by figuring out historic highs and lows in RSI information. These turning factors are recorded as separate units of RSI values: one set for pivot highs and one other for pivot lows.

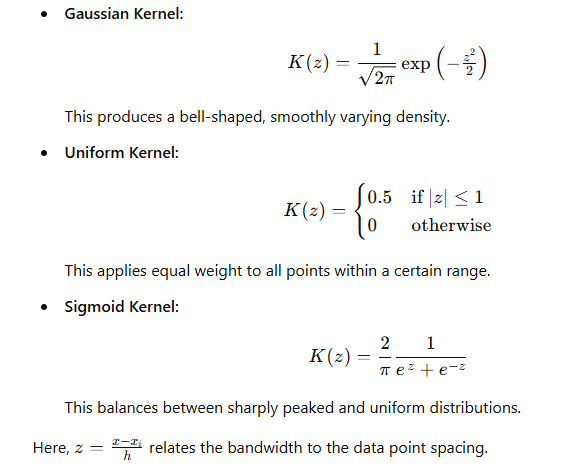

Deciding on a Kernel Operate: A number of kernel choices could also be accessible, akin to Gaussian, Uniform, and Sigmoid. Every kernel defines how affect diminishes as the space from a knowledge level will increase.

Adjusting the Bandwidth (h): The bandwidth controls how vast and clean the likelihood curve is:

A smaller bandwidth highlights finer particulars and is extra delicate to particular person information factors. A bigger bandwidth creates a smoother, extra generalized likelihood distribution.

Establishing the Chance Distribution: After selecting the kernel and bandwidth, KDE is utilized to the units of pivot RSI values. The result’s a steady likelihood distribution, indicating how seemingly the present RSI is to be close to traditionally vital pivot ranges.

Evaluating Chances: Two main strategies can be utilized:

Nearest Mode: Focuses on the likelihood density on the level closest to the present RSI worth. Sum Mode: Integrates possibilities over a spread, offering a cumulative sense of how strongly the present RSI matches historic pivot patterns.

A user-defined threshold determines when the likelihood is taken into account excessive sufficient to recommend that the present RSI carefully resembles earlier pivot circumstances.

Producing Market Alerts: By evaluating the present RSI’s likelihood distribution to historic pivot distributions:

A excessive likelihood of similarity to historic low pivots could sign a bullish alternative. A excessive likelihood of similarity to historic excessive pivots could point out a bearish state of affairs.

The edge might be adjusted:

A better threshold leads to fewer however extra dependable indicators. A decrease threshold produces extra indicators however could embody extra noise. Advantages of Kernel Optimization

Clean Knowledge Illustration: KDE transforms discrete pivot information right into a steady, simply interpretable likelihood curve.

Chance-Primarily based Evaluation: Quantifying the probability of present circumstances matching historic pivot factors provides depth and robustness to RSI-based evaluation.

Flexibility and Adaptability: Customers can choose the kernel perform, modify bandwidth, and select likelihood analysis modes to tailor the indicator to varied market circumstances.

Knowledgeable Choice-Making: Chance-driven insights assist merchants distinguish between random market fluctuations and real pivot-like habits, bettering confidence in entry and exit selections.

Conclusion

By integrating KDE with RSI, the kernel-optimized logic supplies a probability-based evaluation of the place the present RSI stands relative to historic pivot distributions. By way of kernel choice, bandwidth tuning, and threshold changes, merchants achieve a extra nuanced, statistically knowledgeable device for figuring out potential turning factors available in the market.

Obtain the RSI (Kernel Optimized) Indicator with Scanner utilizing the Kernel Optimized Logic above with built-in Scanner of forex pairs, time frames right here:

– for MT4: RSI Kernel Optimized with Scanner for MT4

– for MT5: RSI Kernel Optimized with Scanner for MT5