Your assist helps us to inform the story

From reproductive rights to local weather change to Huge Tech, The Impartial is on the bottom when the story is growing. Whether or not it is investigating the financials of Elon Musk’s pro-Trump PAC or producing our newest documentary, ‘The A Phrase’, which shines a lightweight on the American girls preventing for reproductive rights, we all know how necessary it’s to parse out the details from the messaging.

At such a vital second in US historical past, we’d like reporters on the bottom. Your donation permits us to maintain sending journalists to talk to each side of the story.

The Impartial is trusted by People throughout the complete political spectrum. And in contrast to many different high quality information retailers, we select to not lock People out of our reporting and evaluation with paywalls. We imagine high quality journalism needs to be accessible to everybody, paid for by those that can afford it.

Your assist makes all of the distinction.

Shut

Learn extra

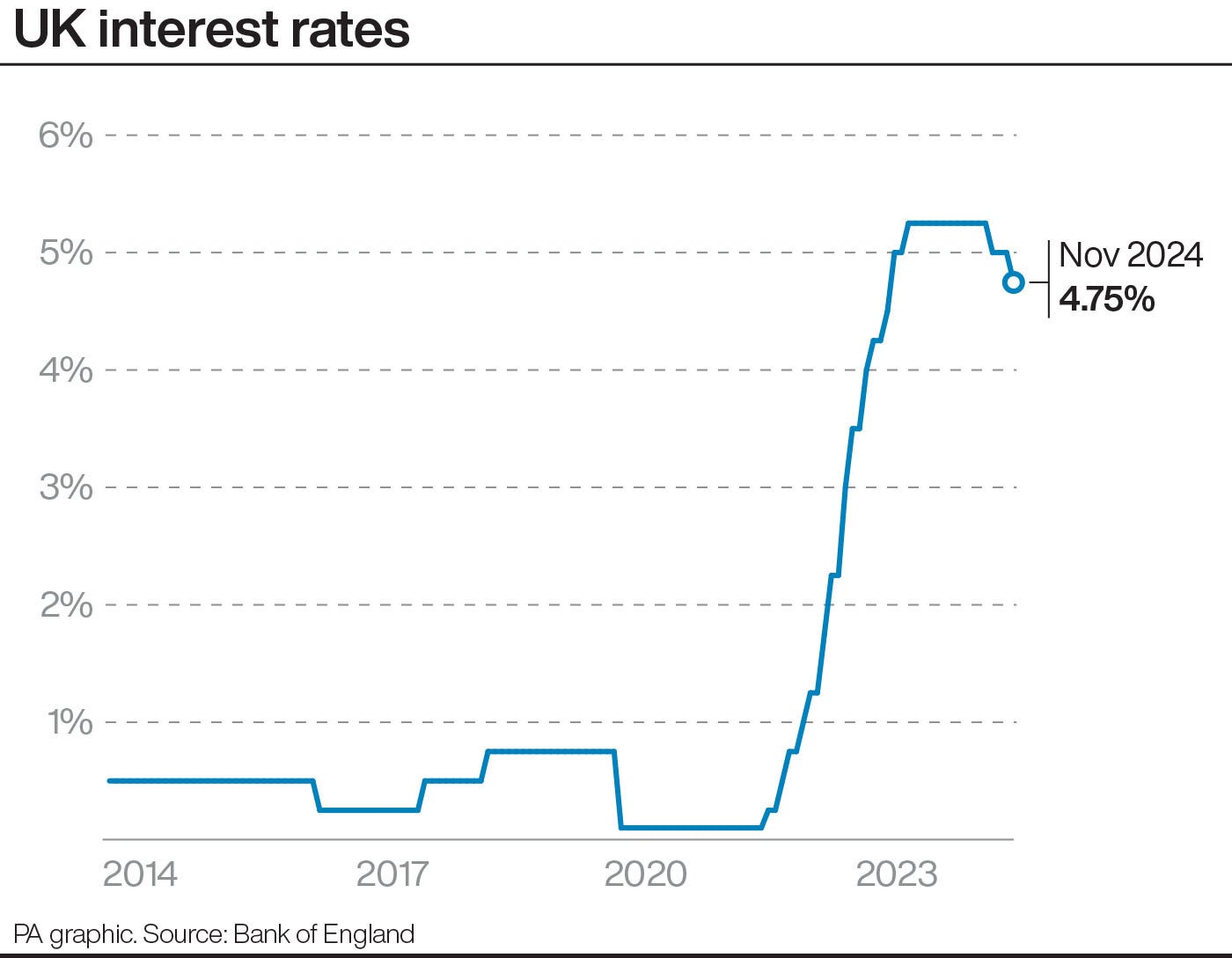

The Financial institution of England held rates of interest regular at 4.75 per cent on Thursday after it was revealed that inflation in November rose to 2.6 per cent, above the central financial institution’s goal.

The transfer retains borrowing prices excessive for mortgage holders and likewise the federal government.

The Workplace for Nationwide Statistics revealed inflation had risen to 2.6 per cent from 2.3 per cent, pushed greater by pricier petrol and clothes.

The central financial institution makes use of greater rates of interest as a device to attempt to tame inflation, forcing households to spend extra on borrowing fairly than pushing up the costs of products.

One other stress on inflation comes from rising wages. Pay packets at the moment are rising at 5.2 per cent, up from 4.9 per cent three months in the past, based on information from the Workplace for Nationwide Statistics launched earlier this week.

Cash market merchants have pushed again their expectation of a charge minimize to Might. Earlier market exercise recommended {that a} minimize may have are available March.

Business lenders like excessive avenue banks and constructing societies use the financial institution base charge as a information on how a lot to cost debtors and the way a lot to reward savers.

Key Factors

The Financial institution of England has held rates of interest regular at 4.75 per cent.

Howard Mustoe19 December 2024 12:01

Merchants are busy unwinding bets of a Financial institution of England charge minimize in February, which might be the following time policymakers meet to set charges.

It’s now evenly balanced after merchants’ bets indicated an 80 per cent probability solely every week in the past.

In the meantime, the pound has regained some floor towards the greenback. Sterling climbed 0.7 per cent to $1.26.

Howard Mustoe19 December 2024 11:53

The FTSE 100 has had a wobble forward of the looming rate of interest choice, due in a bit of beneath an hour. It has slid 1.4 per cent to eight,085.82. The index of 100 largest firms listed in London has been on a downslide for the final month.

Authorities borrowing prices have additionally climbed. The Labour authorities does have some pores and skin on this recreation, because the BoE’s choice will inform how a lot the Treasury should pay to borrow. Yields – the curiosity accessible must you purchase a bond within the secondary market proper now – have risen to 4.604 per cent. Initially of the month they have been nearer to 4.2 per cent.

Howard Mustoe19 December 2024 11:06

Earlier than the large announcement – and to cowl our backs in case charges do go up or down – right here is a superb chart from the Monetary Instances’ Alphaville weblog, charting expectations from the markets on what charges will do within the US and what they really did.

That is for US rates of interest, however you guess that Financial institution of England predictions are equally fallible.

Howard Mustoe19 December 2024 10:44

Wall Avenue had a minor meltdown yesterday after that charge choice, with the S&P500 ending the day down 2.95 per cent. The decelerate in curiosity uncommon cuts was properly flagged, mentioned Russ Mould, funding director at stockbroker AJ Bell

“Markets are usually good at studying the indicators, however the sell-off on Wall Avenue final night time would counsel buyers had began on the Christmas sherry a bit early and have been caught out by the Fed’s announcement about the place charges would possibly go in 2025,” says Mr Mould.

“The prospect of a slowdown in rate of interest cuts was entrance and centre days earlier than the Fed’s newest replace, however buyers appeared to overlook the indicators.

“The US economic system has been holding up properly and Donald Trump’s insurance policies are inflationary, which means the Fed has no purpose to maintain snipping away regularly.

Howard Mustoe19 December 2024 10:10

The Federal Reserve, which is the US central financial institution, determined to chop charges yesterday,. The Fed makes use of a spread, and minimize its vary by 0.25 proportion factors to 4.24-4.5 per cent.

Pushpin Singh, Senior Economist, Centre for Economics and Enterprise Analysis mentioned: “The Federal Reserve (the Fed) opted to chop rates of interest for the third consecutive assembly, by 25 foundation factors, yesterday night. The choice was accompanied by the Federal Open Market Committee’s (FOMC) publication of its newest projections.

The Fed mentioned it expects the US economic system to develop by greater than anticipated and that inflation might also be greater than thought. Fee cuts could not come as thick and quick as beforehand thought.

“ The central financial institution now expects solely 50 foundation factors price of cuts subsequent yr, down from the 100 foundation factors in its final projection, signalling a hawkish stance on financial coverage and underscoring considerations of lingering inflationary stress extra broadly.”

Howard Mustoe19 December 2024 09:34

Most Metropolis-watchers are satisfied rates of interest can be held at 4.75 per cent at this time, however what about after that?

Analysts at funding financial institution Goldman Sachs mentioned that the Financial institution is prone to minimize rates of interest each three months, “given firmer near-term inflation numbers and uncertainty across the impression of the employer nationwide insurance coverage hike”.

Nomura analysts assume charges will settle in the long run at about 3-3.5 per cent.

Howard Mustoe19 December 2024 08:45

Charges have been on a merry journey because the monetary disaster, when borrowing was near free for some debtors, together with varied governments.

The report excessive was 17 per cent in November 1979, which remained the speed till July 1980.

The report low was 0.1 per cent in March 2020 within the wake of Covid.

From 1719 to 1822 charges have been mounted at 5 per cent.

Howard Mustoe19 December 2024 08:10

If you’re simply becoming a member of us, we’re counting all the way down to midday, to see which manner the Financial institution of England will go on rates of interest. Centre for Economics and Enterprise Analysis Senior Economist Charlie Cornes thinks they are going to be held at 4.75 per cent.

Mr Cornes mentioned: “CPI inflation within the UK rose for a second consecutive month in November, to 2.6 per cent, pushed by greater costs for motor fuels and clothes. In the meantime, core and providers inflation, each indicators fastidiously monitored by the Financial institution of England (BoE) as measures of underlying value stress, stay elevated, at 3.5 per cent and 5.0 per cent respectively. He mentioned current wage development information are “all indicators are pointing in the direction of the BoE holding off on slicing rates of interest.” “As an alternative, Cebr maintains that the following charge minimize can be in Q1 2025.”

Howard Mustoe19 December 2024 07:06

Increased inflation pushed the pound down, which aided valuations for FTSE 100 firms, a lot of which earn on {dollars} and euros, being large multinationals.

“A weaker pound following the newest UK inflation figures gave a lift to the FTSE 100 and its bounty of greenback earners. The UK index rose 0.2 per cent to eight,208, led by Shell and BP, with Ashtead among the many massive US-focused gamers giving assist,” says Russ Mould, funding director at inventory dealer AJ Bell.

“UK inflation at an eight-month excessive sounds dramatic but the annual 2.6 per cent charge is bang in keeping with expectations and core inflation, which excludes meals and power, at 3.5 per cent got here in decrease than the three.6 per cent consensus determine.

“As such, we haven’t had what the market would describe as an ‘inflation shock’. That explains why shares in curiosity rate-sensitive sectors like housebuilding haven’t retreated on the newest figures.

Howard Mustoe19 December 2024 06:05