Small-cap shares have had a troublesome time recently, however that would change as rates of interest fall. In fact, regardless that small caps normally have confronted challenges, lots of them nonetheless outperformed the market, with a large variety of them greater than doubling their inventory value yr to this point.

Let’s check out among the excellent performers within the small-cap universe. Something may occur within the coming days as the top of the yr approaches, however for now as of early December, these are among the best-performing small caps of 2024.

Be aware: The shares included on this record have market capitalizations of between $100 million and $2 billion and are traded on main exchanges.

TSS Inc. – up almost 3,700%

TSS Inc (NASDAQ:), or Whole Website Options, offers end-to-end know-how options for knowledge facilities and different know-how environments. The corporate’s built-in platform consists of modular edge providers, knowledge heart providers and configuration providers.

TSS’s inventory has exploded since mid-August, climbing because the market was undoubtedly excited to uncover a knowledge heart inventory that doesn’t get a lot, if any, analyst protection. Notably, the corporate’s income surged 689% yr over yr within the September quarter, suggesting some good causes for this inventory to soar.

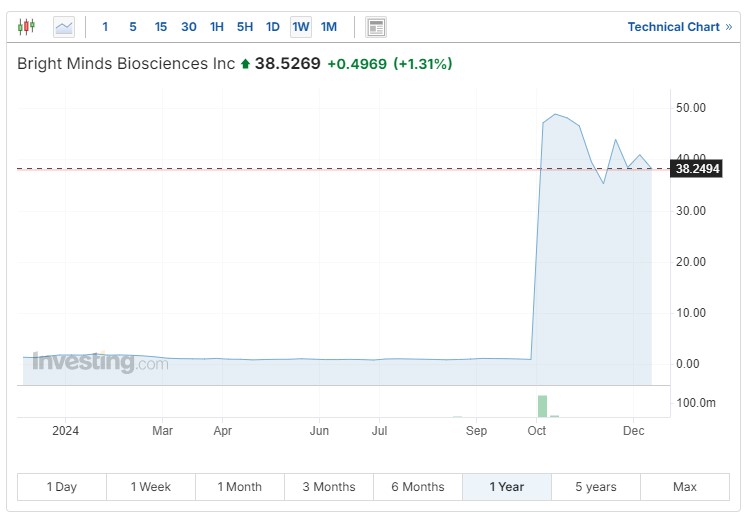

Vibrant Minds Biosciences – up almost 2,600%

Vibrant Minds Biosciences Inc (NASDAQ:) is engaged on remedies for central nervous system issues. The corporate at present has a therapy for uncommon types of epilepsy in Section 2 medical trials. BMB-101 is a extremely selective 5-HT2C agonist appropriate for power dosing with the potential for pro-cognitive results.

After spending a lot of the yr flatlining, shares of biotech firm Vibrant Minds Biosciences surged in late September following the closure of a $35 million non-brokered personal placement. Individuals included Cormorant Asset Administration, RA Capital Administration, Janus Henderson Buyers, Vivo Capital, Schonfeld Strategic Advisors and others.

Monopar Therapeutics – up 1,400% YTD

Monopar Therapeutics Inc (NASDAQ:) is a clinical-stage biotechnology firm growing next-generation, cancer-targeted radiopharmaceuticals. The corporate’s ALXN1840 for Wilson illness met its major endpoint for its Section 3 medical trials. Monopar introduced an settlement with Alexion (NASDAQ:) and AstraZeneca (NASDAQ:) for its late-stage Wilson illness drug candidate in October.

The corporate’s different remedies are within the earlier phases, with MNPR-101 being the furthest alongside. The Section 1 trial is lively and recruiting contributors. MNPR-101 targets superior stable tumors.

Monopar Therapeutics inventory has had an fascinating yr. The shares popped in mid-to-late February earlier than coming into a range-bound interval till October, once they surged in a single day after the Alexion and AstraZeneca announcement earlier than plunging after which starting an up-and-to-the-right march by early December.

Sezzle – up almost 1,100%+ YTD

On the verge of urgent past small-cap standing, buy-now-pay-later firm Sezzle Inc (NASDAQ:) permits shoppers to buy what they want or need at times pay in 4 interest-free installments over six weeks. The corporate additionally lets shoppers make month-to-month installment funds on bigger purchases over three to 48 months.

Sezzle inventory climbed steadily all through a lot of the yr till early November, when it surged from round $205 to method $370 a share. The large hole up got here on the heels of the corporate’s earnings report, wherein it beat earnings-per-share estimates by over 200%, coming in at $2.92 per share versus the 89 cents that had been anticipated. Income additionally shocked to the upside, at $69.7 million versus the $52.6 million that analysts had been searching for.

Dave – up 900%+

Digital banking service Dave Inc (NASDAQ:) affords a cellular app that focuses on money advances. Up to now, the corporate states that it has helped over 6 million members take over 97 million money advances.

Dave’s proprietary AI underwriting mannequin analyzes members’ money circulation fairly than credit score scores to find out their ExtraCash advance eligibility each time they require further money. CashAI considers over 180 knowledge factors, together with earnings, irregular employment, financial institution stability, spending patterns and historical past with the platform.

Shares of Dave have steadily appreciated all year long till they surged in early November.

Honorable mentions

I additionally wished to say a few different fascinating small-cap picks which have skyrocketed this yr, though their market caps are smaller than my self-imposed $100 million ground.

Synergy CHC Corp (NASDAQ:) has soared greater than 4,400% in 2024. The buyer well being firm markets and distributes client merchandise by way of a wide range of distribution channels. Synergy’s manufacturers embody Focus Issue dietary supplements, weight reduction model Flat Tummy, and hand care model Hand MD.

In the meantime, Nexalin Expertise Inc (NASDAQ:) is up 675% after important drama in its inventory value that noticed a number of surges and plummets. The corporate affords a therapy for nervousness and insomnia utilizing a non-invasive, stimulating waveform, delivering its service within the consolation of the affected person’s residence.

Why small caps may outperform going ahead

There’s been loads of discuss small caps coming again as rates of interest fall. The truth is, small caps have outperformed giant caps at totally different instances within the second half of this yr. Moreover, the roared to a brand new document excessive initially of December after President-Elect Donald Trump nominated Scott Bessent as his decide for secretary of the Treasury.

One of many nice advantages of small caps is the potential for sizable returns, however with the potential for nice returns usually comes important threat. That is evident within the sizable rises and falls in among the inventory costs above, regardless that they’re nonetheless up considerably for the yr by early December.

Historical past tells us that small caps sometimes outperform their bigger counterparts when the financial system is recovering, and rates of interest are falling as inflation declines. In fact, buyers are at all times suggested to do their very own due diligence earlier than investing in any inventory, thought or theme.