US and Japanese information in focus as markets wind down for Christmas.

Gold and shares bruised by Fed, however can the US greenback prolong its features?

Threat of volatility amid skinny buying and selling and Treasury auctions.

Sticky inflation is the greenback’s pal

There might be little doubt that 2024 was the 12 months of the , because the tables turned from 2023 when sticky gripped Europe and elsewhere, whereas the boasted progress in its inflation battle. But it surely was different central banks that took the lead in slicing charges in 2024, with stalling progress on taming inflation delaying the Fed’s easing cycle.

Having simply concluded its final coverage choice of 2024, optimism is in brief provide on the Fed. FOMC members are predicting simply two 25-basis-point charge cuts in 2025, main market individuals to cost in fewer reductions for the Fed than another main central financial institution over the following 12 months, aside from the Financial institution of Japan, which is mountaineering .

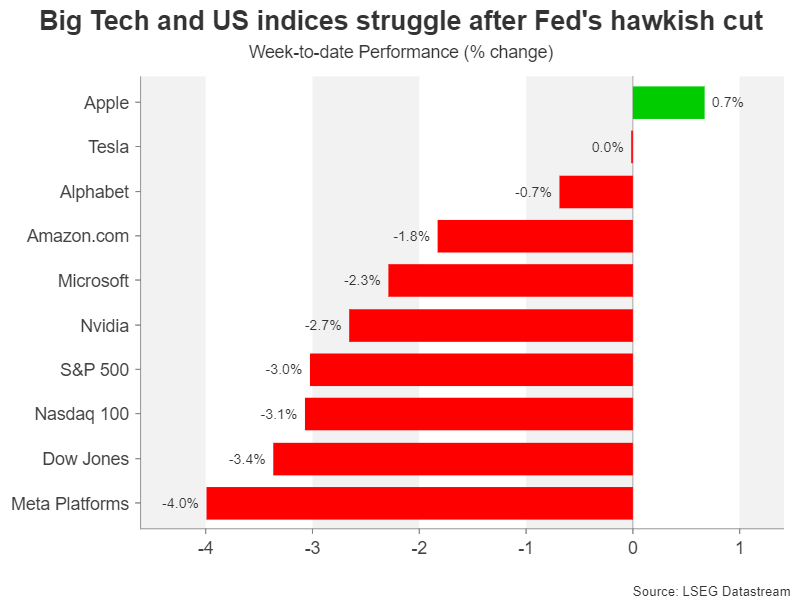

Nonetheless, while this isn’t a completely surprising growth, particularly after Trump’s shock landslide victory on the US presidential election, markets have nonetheless been stunned by the Fed’s hawkishness. Chair Powell strongly hinted in his post-meeting press convention that Fed officers are already serious about what impression Trump’s insurance policies might have on the economic system and on inflation.

Vacation temper sours on charge uncertainty

This actuality examine for the markets has dampened the temper forward of the Christmas break, leaving traders on edge, as charge cuts may flip to charge hikes if the incoming Trump administration doesn’t water down its election pledges on taxes, tariffs and migration.

For now, it’s clear that king greenback isn’t about to lose its crown, though low volumes through the vacation interval may spark some undue volatility, notably in opposition to the , as the majority of financial releases within the coming week can be from Japan and america.

A lightweight US agenda

Beginning with the US, the Convention Board’s client confidence gauge is more likely to entice some consideration on Monday. The index has been rising for the previous two months, whereas certainly one of its sub-gauges – the ‘jobs exhausting to get’ index – has been falling throughout the identical interval. The latter has an in depth constructive correlation with the official unemployment charge, so an extra decline on this measure in December could be indicative of a pickup in jobs development and will additional enhance the dollar.

On Tuesday, sturdy items orders and new residence gross sales for November are due. Sturdy items orders are forecast to have declined by 0.4% m/m following a 0.3% acquire in October. Buyers, although, are inclined to favour the narrower metric of nondefense capital items orders excluding plane, which is much less unstable and is utilized in GDP calculations.

Will the yen steal Christmas?

In Japan, it will likely be enterprise as standard, and though there aren’t many top-tier releases, the info are more likely to be watched as they arrive sizzling on the heels of the Financial institution of Japan’s December coverage choice. Buyers can even be on alert for any potential verbal or precise intervention within the FX market by the BoJ, because the yen’s freefall doesn’t appear to be ending.

The Financial institution signalled at its assembly that it’ll possible wait no less than till March earlier than mountaineering charges once more when it’ll have a greater view of how wage pressures are evolving after the spring pay negotiations have concluded.

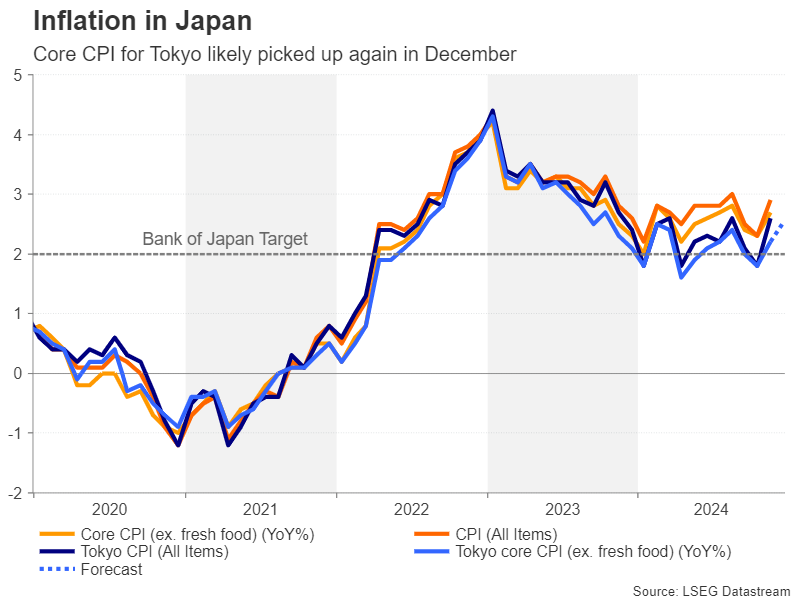

Within the meantime, inflation in Japan continues to hover above the BoJ’s 2.0% goal. The Tokyo CPI estimates for December, that are revealed properly prematurely of the nationwide figures, are out on Friday. In November, Tokyo’s core charge edged as much as 2.2% y/y. An additional acceleration in December would reinforce expectations of a charge improve in March, lifting the yen.

Different information on Friday will embrace the jobless charge, retail gross sales and the preliminary studying for industrial output for November. Forward of all that, producer costs for companies would possibly spur some strikes on Wednesday when buying and selling is predicted to be extraordinarily skinny, whereas the minutes of the BoJ’s October assembly can be eyed on Tuesday for any extra clues on policymakers’ pondering.

Pound and in want of some assist

Elsewhere, each the Financial institution of Canada and Reserve Financial institution of Australia can even be publishing the minutes of their newest coverage conferences on Monday and Tuesday, respectively. In Canada, month-to-month GDP readings for October can be one other point of interest for the Canadian greenback on Monday.

The loonie has plummeted to greater than four-and-a-half 12 months lows in opposition to the US greenback this month and is wanting oversold, therefore, it’s weak to a correction.

Within the UK, there may be a small enhance to the pound on Monday if Q3 GDP development is revised increased within the second estimate.

Rising yields come again to hang-out the markets

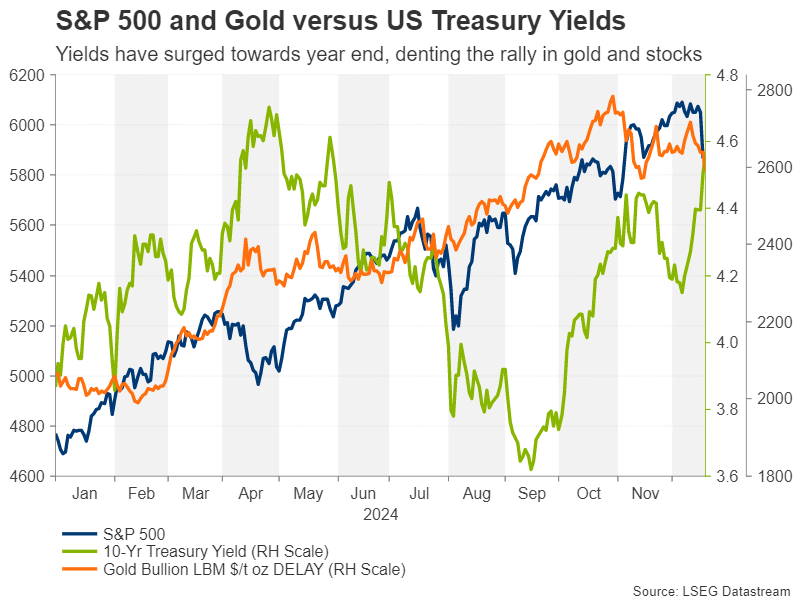

On the entire, if there’s any market turbulence through the festive interval, it’s extra more likely to hit the fairness and bond markets. The Fed’s hawkish stance hasn’t gone down properly on Wall Road and a deepening of the selloff is feasible as Treasury yields proceed to climb. The US Treasury Division is planning on auctioning two-, five- and seven-year notes on Monday, Tuesday and Thursday, respectively, which may add to the upside stress on yields if demand is low.

Gold has additionally taken a tumble over the previous week amid the bounce in yields and the greenback. It will likely be tough for the valuable steel to reclaim the $2,600 stage with the above 4.50%, and a re-test of the $2,530 assist area appears possible.