This week is anticipated to be comparatively quiet. Essentially the most notable information launch would be the Report on Friday, January 3. Early within the week, we’ll get some housing information, whereas persevering with jobless claims on January 2 will seemingly draw consideration. Final week’s claims spiked to 1.91 million, although these figures are sometimes revised downward. If claims unexpectedly improve, it might sign a possible slowdown within the labor market, however the broader information suggests continued energy.

The December jobs report from the BLS gained’t arrive till January 10, making this week’s ISM information—anticipated at 48.2, barely down from 48.4—one of many few key indicators for now.

Equities and Market Efficiency

Final Friday, fairness markets opened sharply decrease however managed a modest rebound by the shut. The noticed a notable late-day rally, gaining about 30-40 foundation factors within the remaining quarter-hour, pushed by a $2 billion purchase imbalance. Regardless of this, market breadth was weak: solely 48 shares superior, whereas 452 declined, and three have been unchanged.

Main contributors to losses included tech giants like Nvidia (NASDAQ:), Tesla (NASDAQ:), Microsoft (NASDAQ:), Apple (NASDAQ:), and Amazon (NASDAQ:). The Bloomberg 500 index mirrored this weak point, emphasizing the difficult day for equities.

S&P 500 Futures and Financing Developments

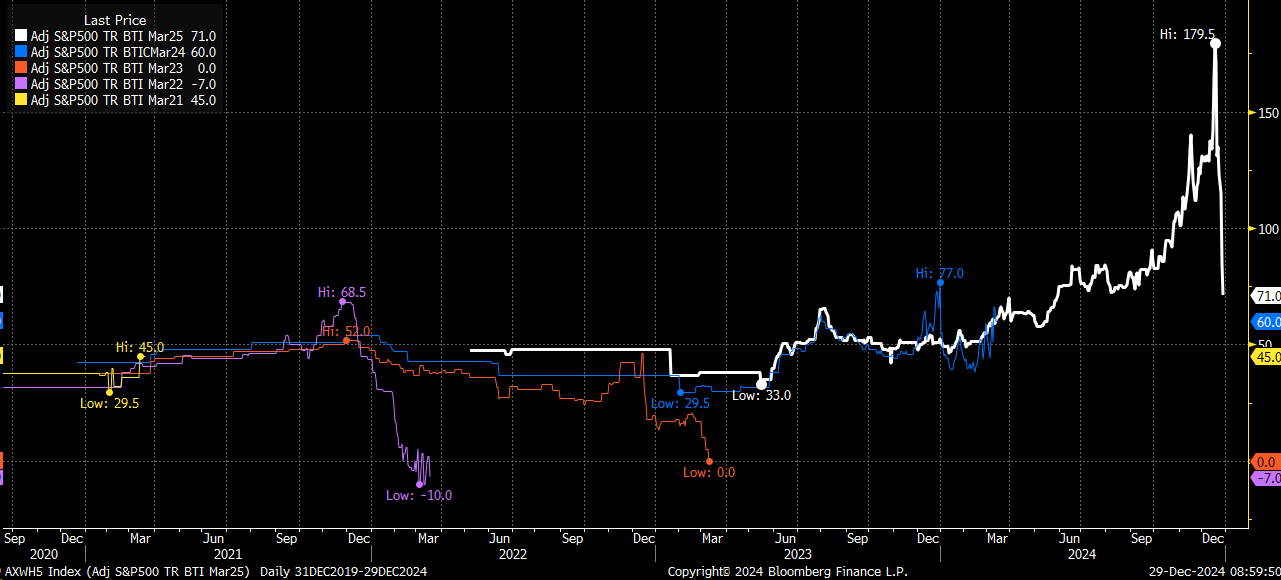

One noteworthy pattern has been the sharp decline in BTIC whole return futures contracts for March 2025. These contracts, that are used to measure fairness financing prices, have fallen from a excessive of 179.5 to only 71 as of Friday’s shut. Traditionally, such contracts commerce inside tighter ranges, suggesting that this yr’s motion is extra excessive.

This might point out end-of-year deleveraging or decreased demand for margin and leverage. If this pattern persists, it could replicate broader market dynamics, similar to tightening liquidity or changes in seller stability sheets. We’ll have extra readability when FINRA margin stability information is launched in mid-January.

Curiosity Charges and the Yield Curve

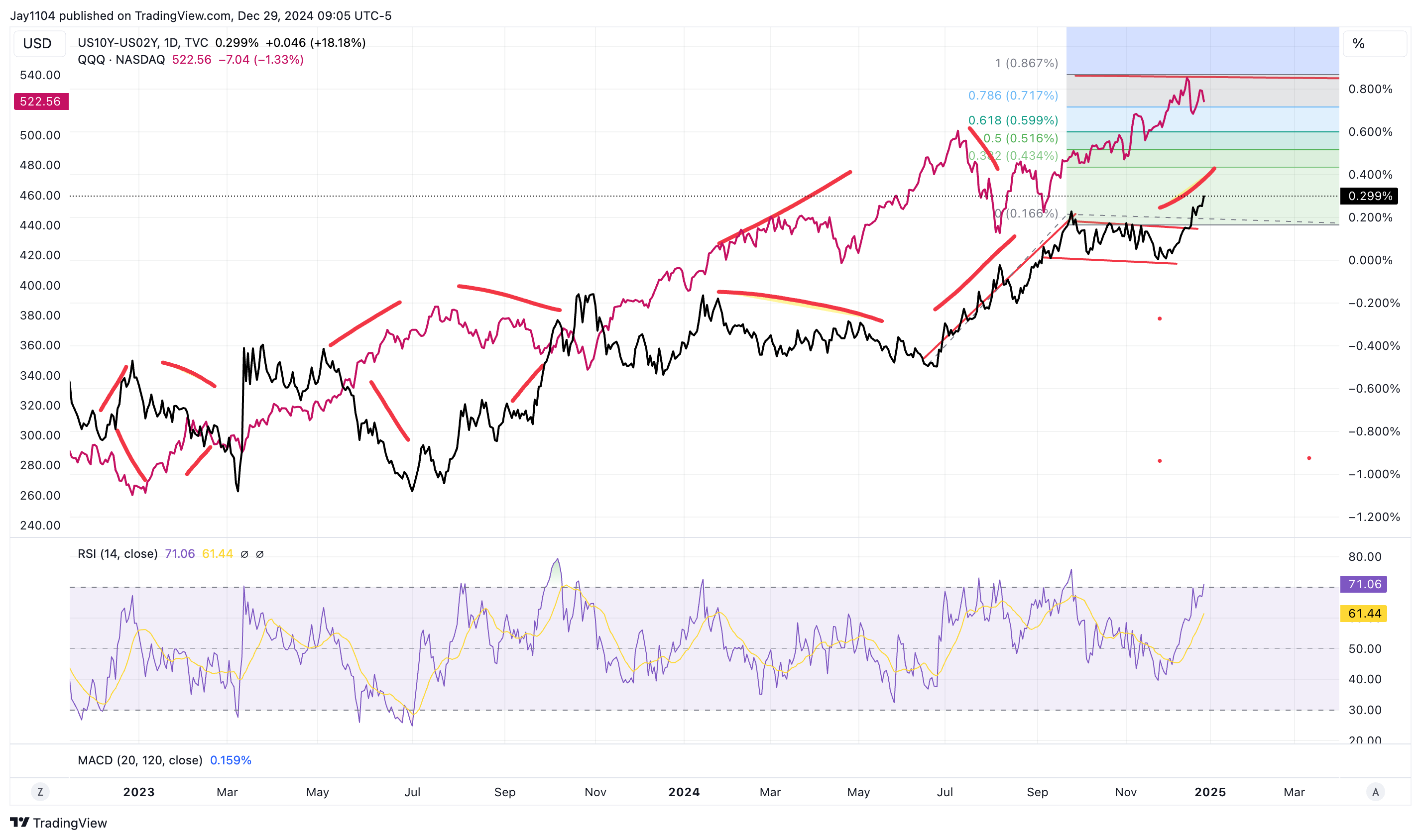

The yield hit its highest stage since November 2023, closing at 4.82%. In contrast to late 2023, when yields have been falling, they’re now rising, probably heading again above 5%. A steepening yield curve, particularly within the 30-year minus and minus 3-month spreads, is unfolding quickly.

This bear steepener—the place longer-term yields rise sooner than short-term ones—can weigh on equities. Traditionally, equities wrestle during times of steepening, particularly when charges on the again finish of the curve cleared the path increased.

Key Market Alerts and Historic Parallels

Ahead-looking contracts, such because the 3-month Treasury invoice vs. 18-month ahead contracts, recommend charges might rise by about 20 foundation factors over the subsequent 18 months. Equally, 12-month ahead contracts indicate a 50% probability of a price hike inside the subsequent yr. This may increasingly clarify the decreased demand for leverage, as fairness financing prices are unlikely to lower.

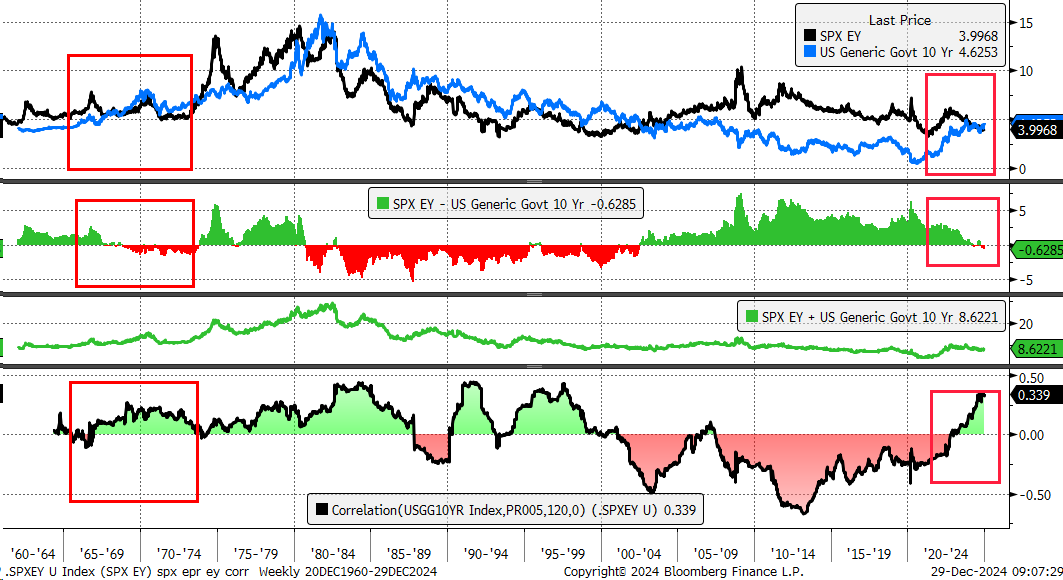

Drawing parallels to the Sixties, rising charges and a deepening yield curve contributed to unfavourable fairness threat premiums and vital market challenges throughout that period.

We might see related dynamics unfold within the coming months if these developments persist.

Last Ideas

Have an amazing Sunday, and we’ll see you on Monday!

Key Phrases:

1. ISM Manufacturing PMI Diffusion Index: Tracks month-to-month modifications in manufacturing sector output, with particular sensitivity to enter prices, new orders, and employment indices. A studying beneath 50 implies contraction, impacting GDP projections.

2. Persevering with Claims vs. Revisions: Persevering with unemployment claims present a lagging labor market indicator, with upward revisions providing insights into structural shifts in employment circumstances.

3. TICS (S&P 500 Complete (EPA:) Return Futures): A proxy for fairness financing prices priced in foundation factors above or beneath the Federal Funds Charge. Their sharp declines usually replicate year-end deleveraging or tightening of liquidity circumstances in fairness markets.

4.FINRA Reg T Margin Balances: Represents investor leverage developments; declining balances sometimes sign a discount in speculative positioning or compelled deleveraging by brokers.

5. Lengthy-Finish Treasury Yields: The 30-year yield-breaking resistance ranges (e.g., 4.82%) suggests structural modifications in inflation expectations, progress forecasts, and time period premium dynamics.

6. Bear Steepener Dynamics: Fast will increase in long-term yields relative to short-term charges, usually brought on by rising time period premiums or shifts in actual yield expectations, exerting stress on duration-heavy property like tech equities.

7. Ahead Curve Dynamics (18-Month Ahead 3-Month Charges): Market-implied price hikes priced into ahead curves recommend increased expectations for financial coverage tightening relative to the spot curve.

8. Fairness Gamma Publicity (GEX): The late-session rally attributed to buy-side gamma results close to crucial strike ranges ($59.50) highlights the function of seller hedging dynamics in short-term value motion.

9. Supplier Repo Exercise and Stability Sheet Constraints: Declines in dealer-reported fairness repo exercise sign decreased threat urge for food and liquidity constraints, usually tied to year-end regulatory pressures or capital reserve changes.

10. Yield Curve Bear Flattening vs. Historic ERP Dynamics: Evaluating the unfavourable fairness threat premium through the Sixties stagflationary atmosphere to present dynamics underscores the dangers of tightening monetary circumstances in a high-rate regime.

Unique Publish