Yesterday’s Buying and selling Alerts have been very short-term oriented, so – whereas I present a fast replace as properly – at this time, I’d like to indicate you many charts that may show you how to see what’s actually happening with the foremost developments.

Bitcoin Reversal: Has the Tide Turned?

There are numerous them, so let’s begin. First off, the person investor’s darling – .

After a pointy run-up and a failed try to interrupt above $100k, the “new gold” is forming a month-to-month taking pictures star/headstone doji candlestick. Which one in all them is fashioned is irrelevant as each are reversal candlesticks.

We noticed one thing comparable in late 2021, and that was THE prime for a lot of months. Has the tide turned for cryptos? That’s fairly possible.

Cryptos are related to a part of the commodity world as electrical energy is used to mine them. And each: and are nice conductors.

Silver being the most effective, and copper being second-best (however less expensive, which is why it’s used far more typically).

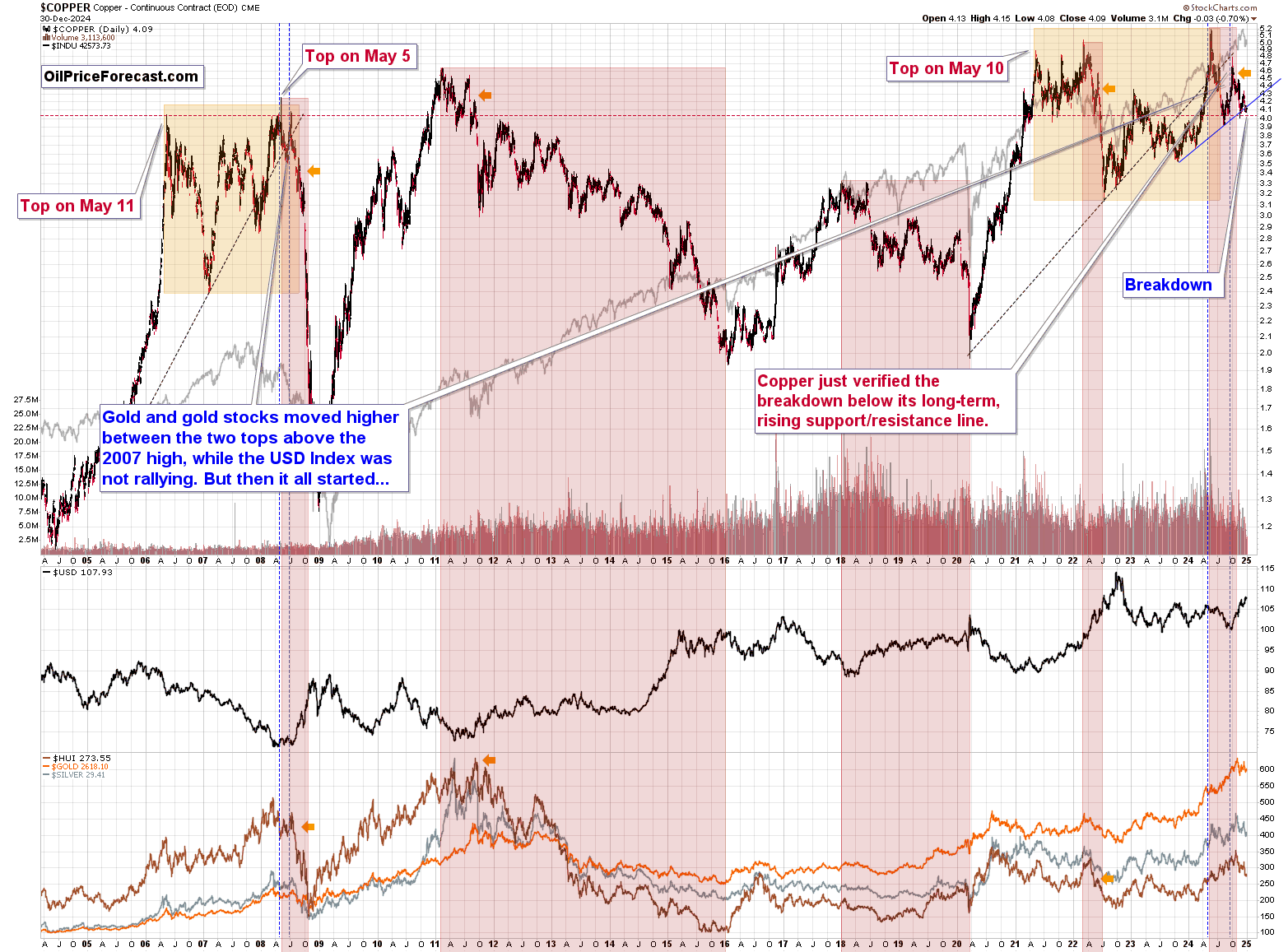

Copper is just not solely after a break a faux breakout above many earlier highs, but it surely’s additionally after a breakdown beneath two rising assist traces – one primarily based on the 2020 and 2022 lows and the opposite primarily based on the late-2023 and 2024 lows.

Please notice that copper “ought to have” soared together with shares as elevated industrial demand ought to have brought on its worth to rally. No additional demand means that perhaps not all was proper with the sturdy financial efficiency.

That’s definitely what the world shares point out.

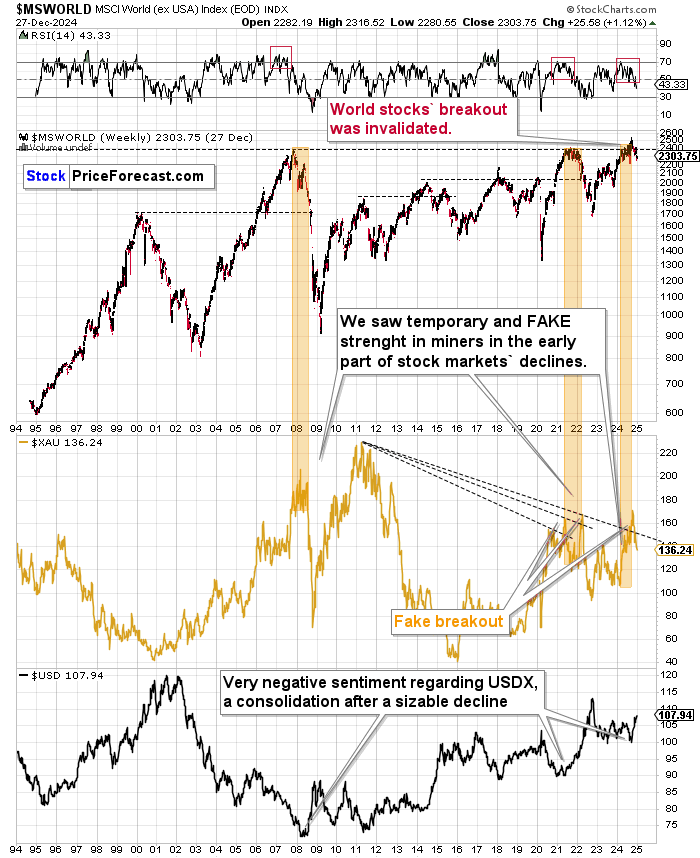

A lot cash has been created since 2020 and all of the world shares have been in a position to do was to maneuver again to their 2008 highs, then barely above it after which they failed and moved again beneath them. All of it occurred in nominal phrases, which signifies that in actual phrases, shares are less expensive than they have been in 2008.

The above-mentioned invalidation is a powerful promote signal, which signifies that shares are prone to decline, identical to copper.

In case you take a look at the decrease a part of the above chart, you’ll see that the XAU Index – proxy for gold and silver shares – simply invalidated its personal transfer to new highs and above the declining dashed resistance line. Once we noticed that in 2022, an enormous decline adopted. Given the significance of the invalidation in world shares, evidently the next decline within the XAU Index (and different proxies for mining shares like and ) will probably be greater than what we noticed in 2022.

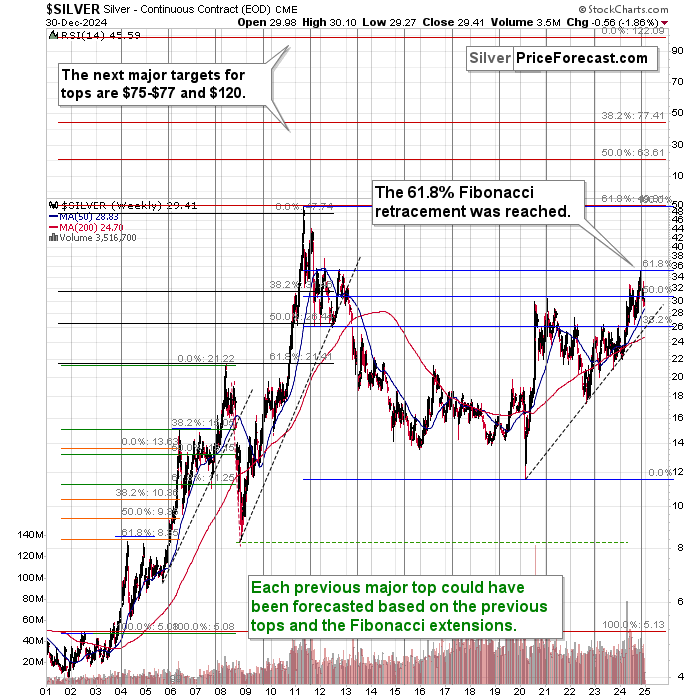

Silver topped at its very long-term cyclical turning level and proper at its 61.8% Fibonacci retracement stage. That is so good from the technical perspective that it’d as properly be on the ebook cowl of a ebook on technical evaluation.

And now, since silver moved again beneath $30 and its earlier highs, the door to additional declines is large open. Sure, I count on silver to be greater in 1-3 years, however within the meantime, I count on its worth to fall, and to fall arduous. That is prone to occur given the analogies in different markets that I featured to date – the one to 2008 and 2022 particularly. That’s when silver declined in a considerable method (and so did mining shares).

Gold Miners Teeter on the Edge

Talking of mining shares, the 2 key ratios of gold shares have lastly offered us with decisive indications. It’s been months since I beforehand featured these two ratios as there was little new to report, however this modified lately.

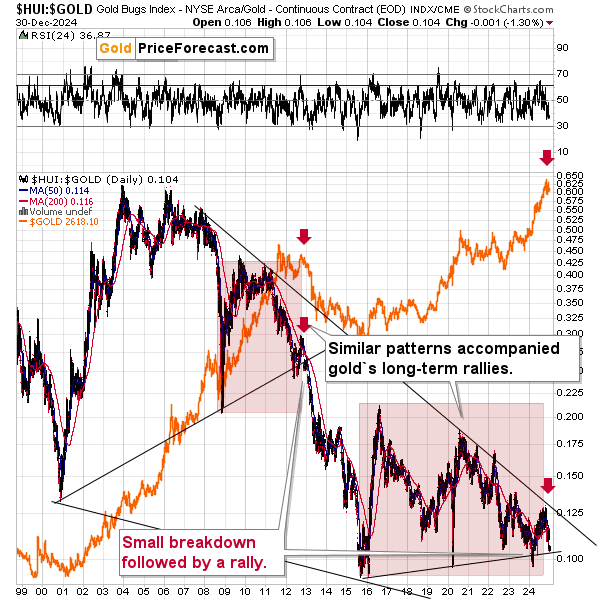

Gold shares (the HUI Index serves as a proxy right here) in comparison with gold lastly topped and resumed their decline. The consolidation took years, so if we see a breakdown beneath the 2015/2016 lows, the next slide might be spectacular. IF the overall inventory market declines in a significant means (bear in mind the world inventory charts? This CAN occur) that’s precisely what might occur to this ratio – and miners’ efficiency as properly.

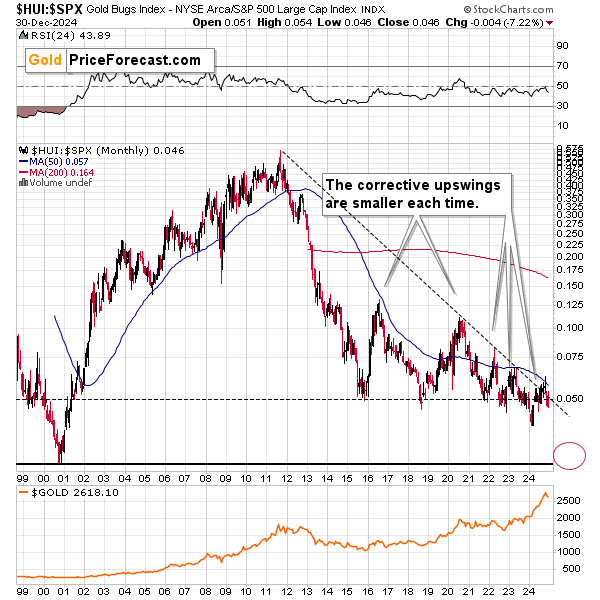

, relative to different shares, have simply invalidated a small breakout above the declining resistance line, they usually simply moved beneath their 2015 low. The earlier breakdowns have been adopted by corrective upswings that every took the ratio to decrease highs. Evidently this time – particularly given the invalidation of the breakdown – the 2015 low will probably be damaged efficiently, resulting in a lot decrease values of mining shares.

What about gold itself?

Nicely, I don’t wish to crush your hopes for brand spanking new highs within the speedy future, but it surely doesn’t seem like it’s within the playing cards.

Ultimately – sure (and a few may take into account gaining passive earnings on their gold within the meantime). Within the following months? Not possible.

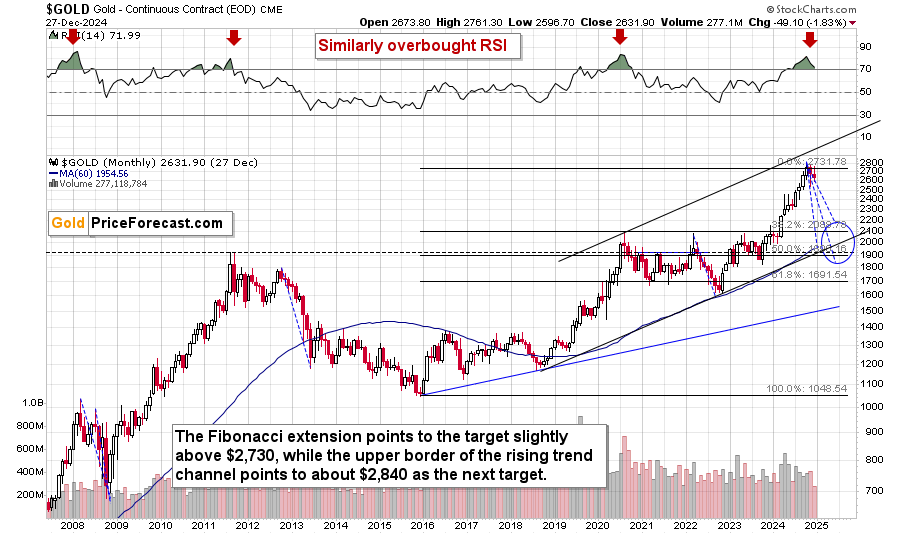

RSI primarily based on month-to-month candlesticks was simply so extraordinarily overbought because it was on the earlier crucial tops. This can be a extremely efficient indication, so it’s no marvel that gold is already declining. The purpose right here is that primarily based on how decrease gold used to say no after such promote alerts, it has far more room to fall.

On a aspect notice, please notice how completely the Fibonacci retracement marked the highest for the latest rally in gold – gold peaked just a bit above the value ranges primarily based on the 1.618 extension of the earlier (2015 – 2020) rally. Extra exactly, it topped between this stage and the higher border of the rising pattern channel.

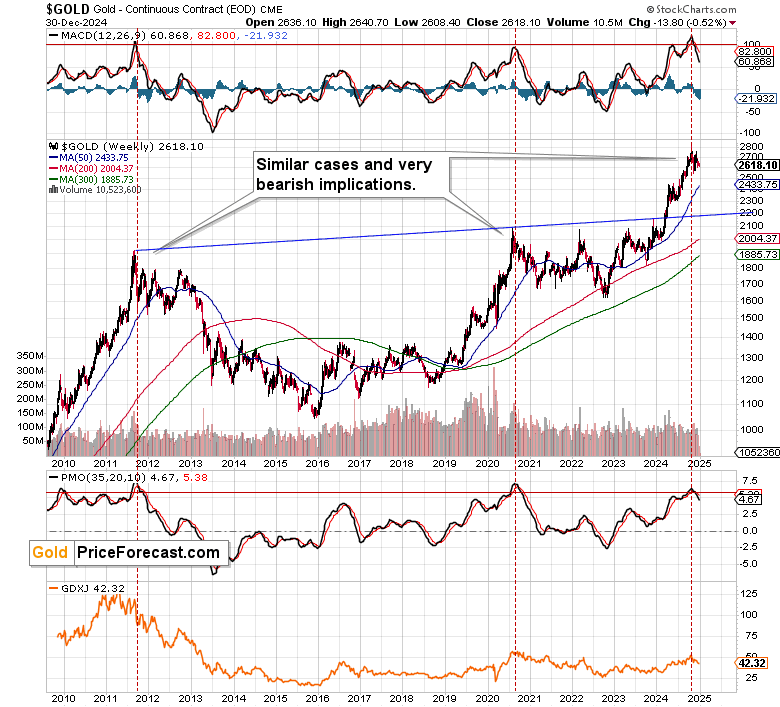

RSI is just not the one indicator pointing to a lot decrease gold costs within the following months. The identical goes for the MACD and PMO primarily based on gold’s weekly worth modifications.

As you may see above, the present state of affairs is similar to what we noticed after the 2011 prime and after the 2020 prime. In each circumstances, gold, silver, and mining shares decline for months after these promote alerts.

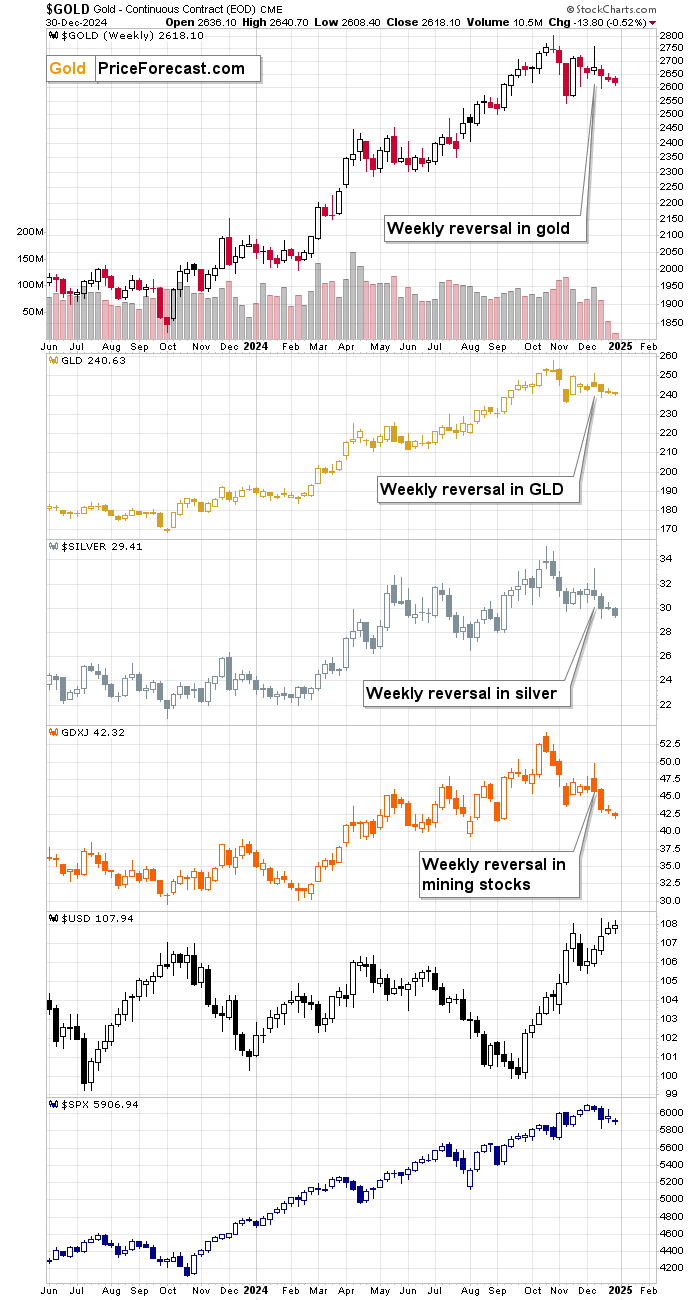

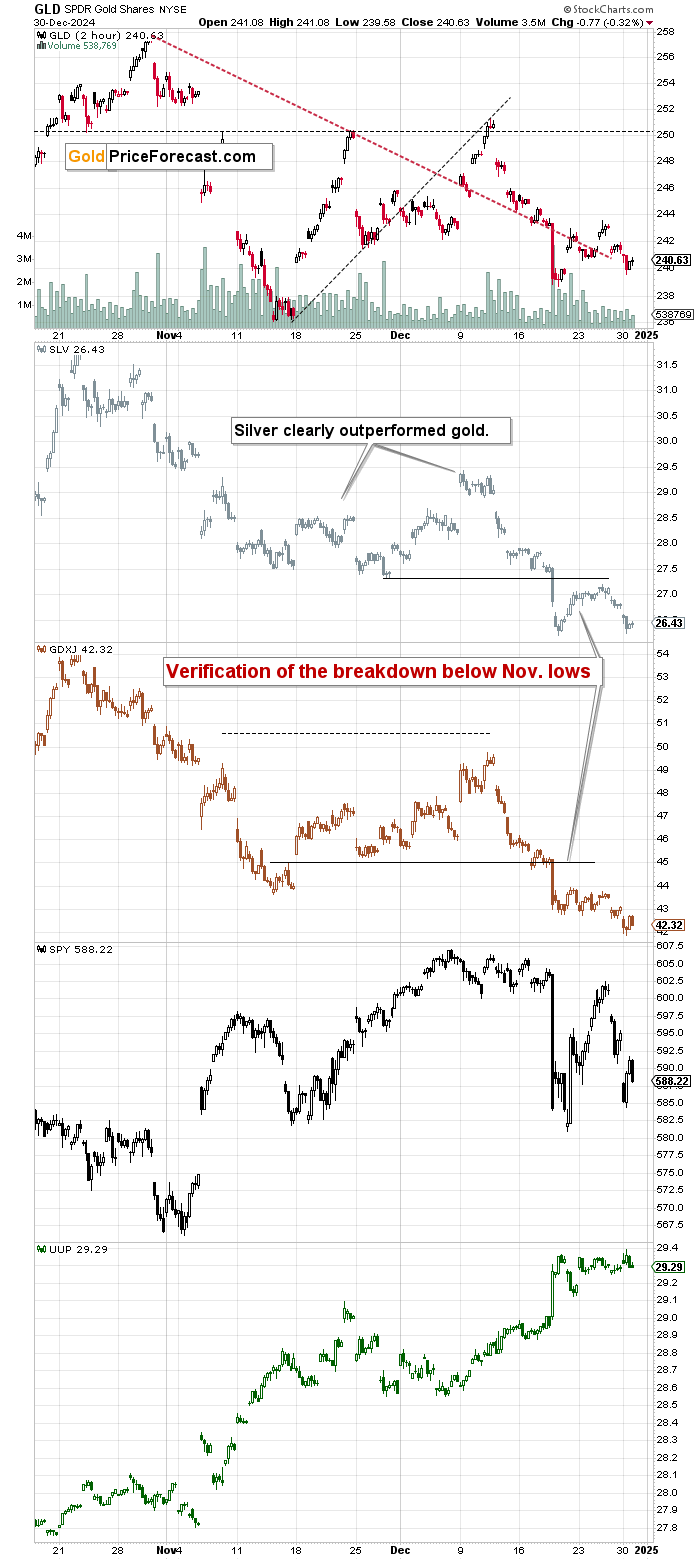

Zooming a bit, do you recall once I wrote concerning the multi-reversal (a reversal in lots of components of the valuable metals sector appeared on the similar time)? It labored, and the costs have been declining since that point.

The decline has been significantly seen in mining shares. No marvel – the additionally declined since that point.

The latter didn’t transfer that a lot decrease, which signifies that when shares fall in a extra significant means, miners will probably really slide.

Zooming even additional, we see how the GDXJ moved decrease after the consolidation, which itself passed off after it broke beneath its November lows. In different phrases, the GDXJ seems ripe for one more downswing.

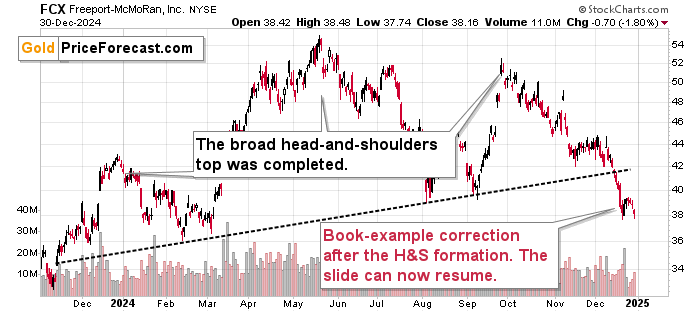

Freeport-McMoran Copper & Gold (NYSE:) declined yesterday as properly, and it seems just like the decline is gaining pace – and my subscribers’ earnings on this inventory (the identical with the opposite that I’m not that includes publicly) are accelerating.

So, the query is – will we see the underside and a reversal at this time? It’s not clear if it’s going to occur at this time, however I proceed to count on it to occur in a matter of days.

That’s gold’s 4-hour chart. It exhibits that gold is on the verge of a short-term breakdown. As soon as it breaks decrease, it might set off a large short-term slide that might, in flip, push miners to our profit-take stage.

I wrote concerning the ’s goal at about 108.8 yesterday, and the present intraday cup-and-handle sample helps one other transfer up, so the above stays up-to-date.

Will the USD Index soar at this time? Or very early subsequent yr?

Maybe Wall Avenue is ready for the yr to shut so earlier than they pull the triggers and promote their shares primarily based on how overvalued they’re? You understand, in order that they’ll money of their yearly performance-based bonuses first.

Both means, the technicals level to huge declines within the upcoming months, and so far as the short-term is anxious, evidently we’ll get one other transfer up within the USDX and one other transfer down within the treasured metals sector shortly. Then a corrective upswing, and a good greater slide.