Unlock the Editor’s Digest without spending a dime

Roula Khalaf, Editor of the FT, selects her favorite tales on this weekly e-newsletter.

Within the wake of Brexit, Europe is understandably loath to see Britain have its cake and eat it on the subject of commerce preparations. Within the case of the electrical energy market, such warning dangers leaving each side worse off.

There are good causes to favour a easy buying and selling settlement. On the peak of the 2022 European vitality disaster, electrical energy traded between the UK and European Union helped preserve Europe’s lights on. However Brexit has created inefficiencies that price the UK an estimated £250mn in 2021.

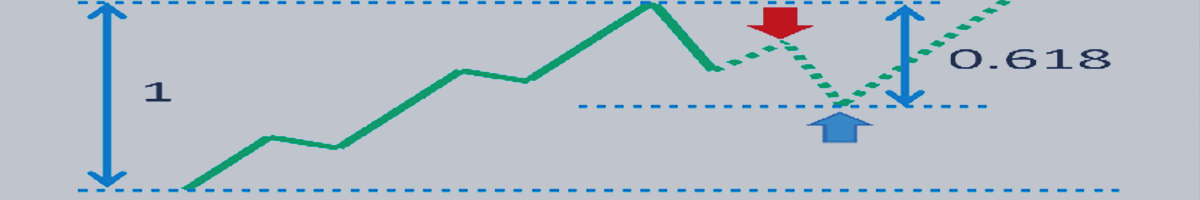

Roughly talking, when the UK was within the EU inside vitality market, a pc algorithm decided probably the most cost-efficient solution to commerce electrical energy. This nonetheless occurs within the EU. However merchants in Britain now use a extra complicated system referred to as “express buying and selling”, the place capability on subsea cables and electrical energy era are auctioned individually — like shopping for a product however reserving supply aside.

An alternate often called “multi-region free quantity coupling” has proved as complicated as its title suggests. A latest European working paper acknowledged this substitute system will not be prepared earlier than June 2026, when the EU-UK Commerce and Cooperation (TCA) Settlement expires and vitality relations should be reviewed.

Renewable vitality raises the stakes. A gaggle of nations across the North Sea — in addition to corporations together with the UK’s Nationwide Grid and Belgium’s Elia Group — need to develop energy buying and selling throughout Europe by an offshore “inexperienced vitality hub”. This might hyperlink wind farms within the North Sea through subsea cables not simply to 1 nation (as at current) however a number of so their output may stream to the place demand, and costs, had been larger.

However the imperfections of post-Brexit electrical energy market preparations are making some potential traders behind the inexperienced vitality hub nervous, owing to the difficulties they create in forecasting attainable revenues. It’s a first-rate instance of the place pragmatism ought to trump politics on this 12 months’s UK-EU “reset” talks.

The temper music will not be encouraging. Brussels is advising member states to not enable the UK deeper entry to the bloc’s electrical energy markets, the Monetary Instances reported in December. That is regardless of an earlier plea by electrical energy corporations and commerce organisations for the rewriting of the “suboptimal” post-Brexit preparations.

After all there’s all the time a lot posturing earlier than negotiations. However some traders consider there are attainable business agreements that would let UK events entry the algorithms that allow smoother commerce, with out overstepping both the UK or EU’s post-Brexit consolation zones.

These ought to at the least be explored by policymakers if each side need traders to stump as much as meet decarbonisation objectives. Ideas matter; protecting the lights on — sustainably — issues extra.