With 2025 approaching, the panorama for SMBs is present process transformative modifications pushed by advances in know-how, shifts in shopper expectations, and evolving regulatory frameworks.

It’s a precedence for an organization to maintain a pulse on the trade traits that affect these it serves. How will AI brokers remodel monetary providers? What does a shift in tipping construction imply for the small companies it serves? Between conversations with

companions, prospects, buyers, and the Fintech neighborhood, we consistently synthesize what we study, utilizing contemporary insights to adapt rapidly and strategically.

The under traits spotlight how Fintech and embedded finance are reshaping monetary accessibility and empowering small companies globally.

Predictions for SMBs

Platform options will see elevated demand as SMBs will transfer to built-in instruments and functions.

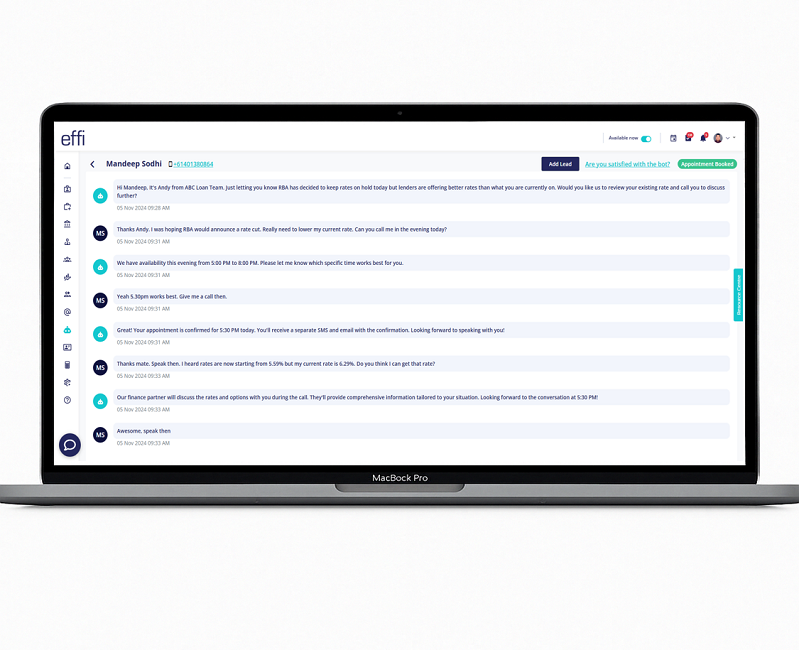

With the launch of autonomous AI brokers on the horizon, AI brokers will quickly turn into part of our every day lives. Savvy small companies will rapidly uncover new

functions for AI brokers, seeing a lift in effectivity as they have interaction brokers for all the things from customer support to knowledge analytics.

Nonetheless, for SMBs, which means that having a single unified view of their knowledge will turn into extra vital than ever. Immediately,

SMBs use 7-8 completely different software program functions to run their companies, leading to knowledge being siloed throughout a number of programs (for instance, an e mail advertising platform, accounting software program, and CRM device). For AI brokers to make sense of a enterprise’s knowledge

and act on that info, SMBs will more and more look to vertical apps or software program platforms that may serve a number of wants and home related efficiency knowledge inside a single answer. With a single pane of glass view of the enterprise, AI brokers will likely be

in a position to make sensible suggestions and assist them full vital duties.

In response to new tax on tip insurance policies, SMBs will regulate their pricing buildings.

Already, there’s a rising expectation for shoppers to go away ideas for on a regular basis providers, together with salons, cafes, bars, and eating places. If a coverage eliminating taxes on ideas have been to get permitted, workers would possibly be capable of take house extra pay with out enterprise

house owners having to boost worker wages. In consequence, this might most probably change the way in which that SMBs value their providers. For instance, we could start seeing obligatory ideas for providers or, in an much more drastic state of affairs, lower-priced providers and better obligatory

ideas.

Nonetheless, if prospects suppose there’s much less tax burden on small enterprise workers, this may occasionally additionally backfire and trigger prospects to tip much less. Small companies must be able to adapt to those modifications and inform their employees what this really means to them

from a tax perspective.

Predictions for Fintech

Favorable market circumstances will lead to elevated M&A and IPO exercise.

The previous two years noticed a large dip in IPO and M&A exercise because of regulatory pressures and broader macro considerations. With the regulatory cloud clearing and the economic system proving extra resilient than anticipated, we count on M&A exercise and IPO markets to choose up.

As well as, previously couple of years, there was quite a lot of non-public capital raised for debt funding, albeit at the next hurdle fee than that which was raised in 2020 or 2021. With the quantity of dry powder obtainable, we count on debt capital markets

exercise to stay sturdy in 2025. With spreads throughout numerous devices persevering with to tighten, we count on issuers to make use of favorable market circumstances to entry markets and even pull ahead their funding plans.

Banks will proceed to lag behind Fintech in innovation however will leverage acquisitions and partnerships to remain aggressive.

It’s unlikely that banks will catch as much as Fintech within the close to future from an innovation perspective. Banks have been round for much longer, utilizing quite a lot of legacy providers and infrastructure. They’re additionally far more regulated total, in order that they will be unable

to disrupt the market the way in which that Fintech has. Nonetheless, we’ve seen banks and Fintech partnering far more carefully, which is accelerating entry and innovation.

As Fintechs begin nibbling on the lending pie sometimes owned by banks, we gained’t be stunned if banks use their monetary muscle to make strategic Fintech acquisitions or minority stakes. This permits them to faucet into the trendy tech stack and new demographics

whereas instantly competing with different Fintech companies, relatively than shedding to them in mixture. This might be a optimistic path for small companies, a traditionally underserved inhabitants, to get extra entry to capital and monetary providers.

2025 will deliver elevated, albeit cautious, funding in Fintech.

Converging with our expectations of enhancing M&A exercise and IPO markets, we count on to see a lift in investments in Fintech. As Fintech VCs are in a position to exit their legacy positions through both technique (i.e., not simply reliant on illiquid secondary markets)

and enhance DPI ratios, it creates a tailwind for the Fintech sector.

General, there will likely be extra funding in Fintech the place there’s the appropriate product and innovation. It’s already beginning to decide up—however buyers are approaching cautiously since they’ve been burned previously. The monetary providers trade continues to be ripe

for disruption, and loads of alternatives for funding within the Fintech house to excel.