(Reuters) – Australia’s Macquarie on Tuesday agreed to take a 15% stake in Utilized Digital’s high-performance computing enterprise and make investments as much as $5 billion within the firm’s synthetic intelligence knowledge facilities amid booming AI demand.

Shares of Utilized Digital rose about 20% earlier than the opening bell.

Because the launch of ChatGPT in late 2022, suppliers of computing infrastructure like Utilized Digital have been seeing heavy funding from firms trying to prepare their very own AI fashions and get forward of rivals.

Macquarie’s asset administration arm has agreed to speculate as much as $900 million in an information heart campus that Utilized Digital is growing in North Dakota.

Dallas, Texas-based Utilized Digital additionally has the fitting of first refusal to speculate a further $4.1 billion in future firm knowledge facilities for 30 months, the corporate mentioned.

Utilized Digital Chief Govt Wes Cummins (NYSE:) mentioned the deal gives the corporate with sufficient fairness to assemble knowledge facilities with excessive energy calls for.

The brand new funding will likely be used to repay debt Utilized Digital took on to construct the amenities in North Dakota and can enable it to recuperate over $300 million of its fairness funding in them, the agency mentioned.

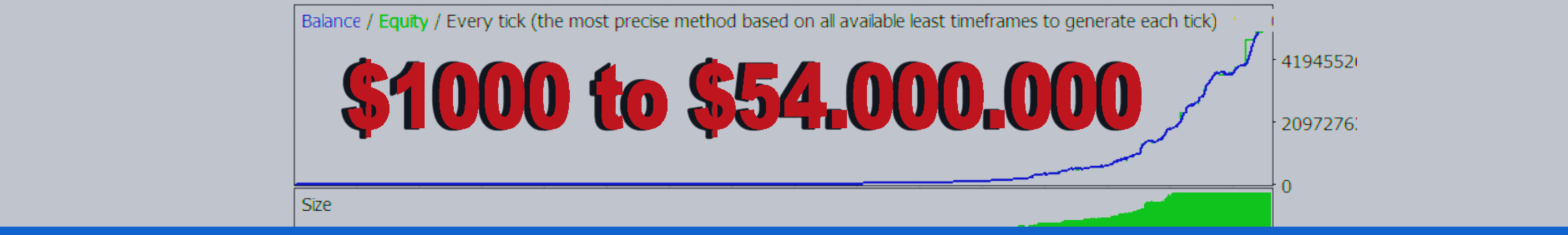

Utilized Digital’s shares have greater than tripled up to now two years as traders guess on AI corporations and knowledge heart suppliers to convey sturdy ranges of progress.

Microsoft (NASDAQ:) mentioned earlier this month it will make investments round $80 billion in AI knowledge facilities in fiscal 2025 to satisfy rising computational wants.

Utilized Digital is ready to report its second-quarter outcomes on Tuesday after the markets shut. (This story has been corrected to say that Macquarie will take a stake in Utilized Digital’s high-performance computing unit, not the entire firm, in paragraph 1; and to take away the reference to valuation of 15% stake in Utilized Digital and Macquarie’s shareholding within the firm)