• Trump’s commerce battle, inflation information, and final batch of earnings might be in focus this week.

• DoorDash’s imminent inclusion within the S&P 500 is more likely to set off a wave of shopping for that might propel its inventory larger.

• American Eagle’s deteriorating earnings expectations and cautious outlook make it a inventory to promote.

• On the lookout for extra actionable commerce concepts? Subscribe right here to unlock entry to ProPicks AI winners.

U.S. shares completed Friday’s risky buying and selling session within the inexperienced, however the main averages nonetheless suffered their worst weekly decline in a number of months amid a damaging combine of reports associated to President Donald Trump’s commerce battle.

For the week, the 30-stock misplaced 2.4%, the sank 3.1%, and the tech-heavy tumbled 3.5%.

Supply: Investing.com

The week forward is anticipated to be one other eventful one as buyers monitor recent developments about Trump’s tariff choices on imported items from Canada, Mexico and China.

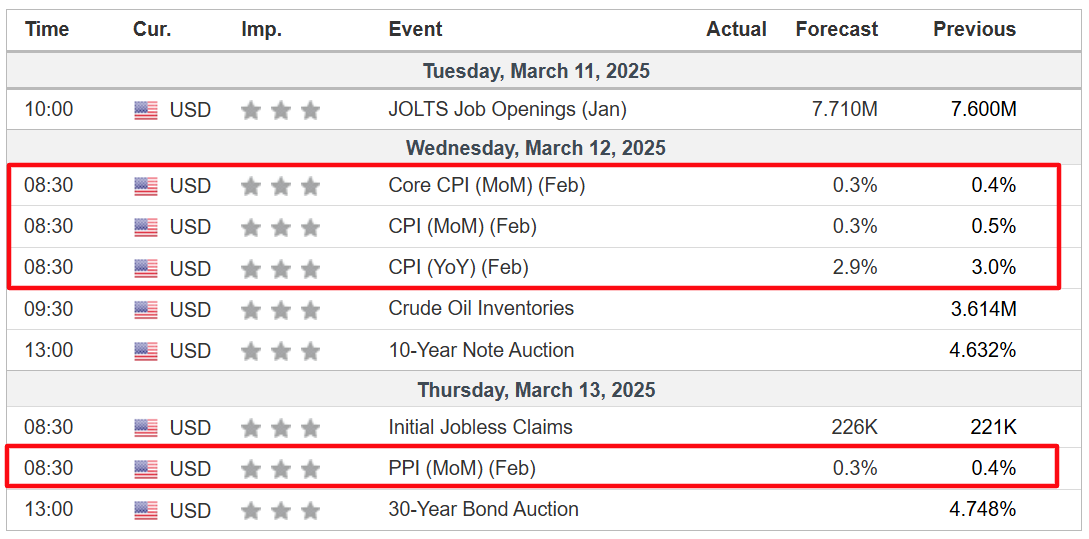

On the financial calendar, most vital might be Wednesday’s U.S. shopper worth inflation report for February, which may spark additional turmoil if it is available in larger than expectations. The CPI information might be accompanied by the discharge of the most recent figures on producer costs, which is able to assist fill out the inflation image.

In the meantime, there might be no Fed audio system on the agenda because the central financial institution goes into its pre-FOMC blackout mode forward of the March 18-19 coverage assembly.

Supply: Investing.com

Odds for Fed price cuts have picked up significantly in latest days, as per the Investing.com , with the U.S. central financial institution now on monitor to chop rates of interest thrice this yr.

And whereas the earnings season is drawing to an in depth, a couple of noteworthy stories loom within the coming week, together with Oracle (NYSE:), Adobe (NASDAQ:), Kohl’s (NYSE:), Greenback Normal (NYSE:), Dick’s Sporting Items (F:), and Ulta Magnificence (NASDAQ:).

No matter which course the market goes, under I spotlight one inventory more likely to be in demand and one other which may see recent draw back. Keep in mind although, my timeframe is only for the week forward, Monday, March 10 – Friday, March 14.

Inventory to Purchase: DoorDash

DoorDash (NASDAQ:) stands out as a compelling purchase this week, as shares of the main on-demand meals supply platform might be added to the important thing S&P 500 index as a part of its quarterly reconstitution.

This announcement, made after Friday’s market shut, alerts a brand new chapter for the corporate, as it would be part of the benchmark index earlier than the beginning of buying and selling on Monday, March 24. Traditionally, such inclusions have typically led to a surge in inventory costs.

Supply: Investing.com

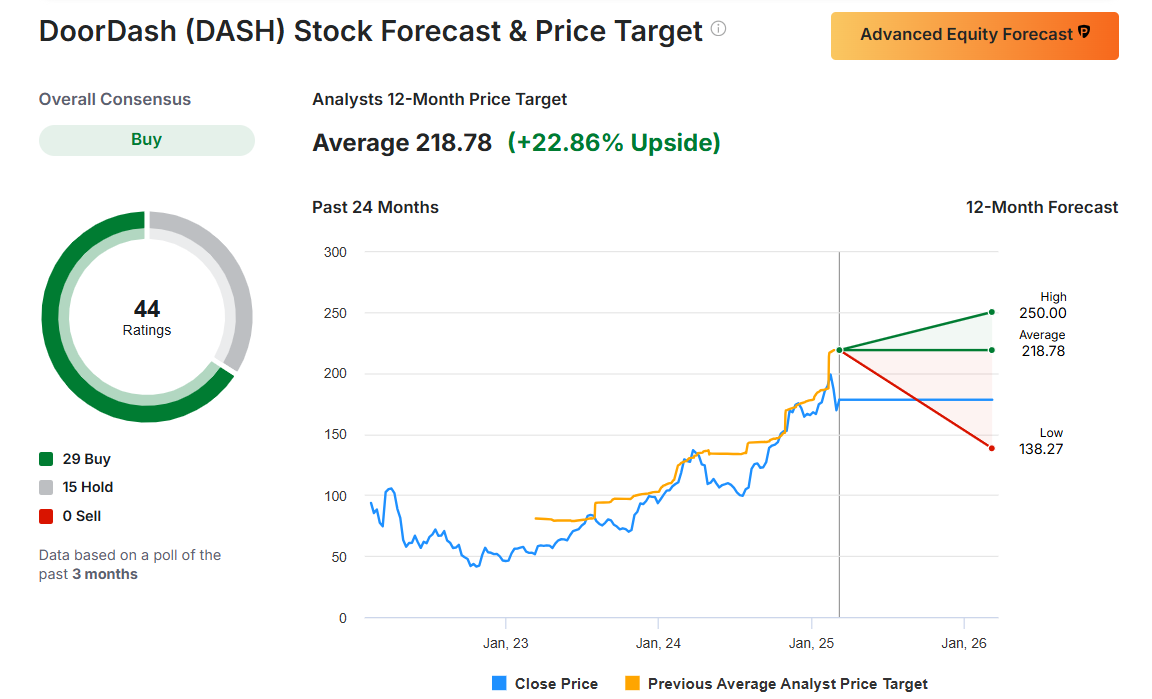

DASH ended Friday’s session at $178.08, the bottom closing worth since January 17. The Palo Alto, California-based on-line meals supply firm has a market cap of $74.8 billion. Shares are up 6.1% thus far in 2025.

The inclusion within the S&P 500 is a testomony to DoorDash’s development and stability. This transfer may result in a considerable enhance in shopping for of DoorDash’s inventory, as index funds and different passive funding autos that monitor the S&P 500 must buy shares to align with the benchmark’s composition.

The corporate has not too long ago demonstrated sturdy operational efficiency, with analysts displaying optimistic worth targets. The newest analyst protection exhibits targets starting from $175.00 to $235.00, with main companies like Truist Securities ($235.00), Barclays ($200.00), and Cantor Fitzgerald ($230.00) all sustaining constructive outlooks.

Supply: Investing.com

The consensus amongst analysts seems bullish, with most sustaining Purchase or Chubby scores, reflecting mounting confidence in DoorDash’s development trajectory and market place.

Moreover, InvestingPro’s AI-powered quantitative mannequin charges DoorDash with a ‘GOOD’ Monetary Well being Rating of two.61, indicating a wholesome profitability outlook and robust steadiness sheet.

You’ll want to try InvestingPro to remain in sync with the market development and what it means to your buying and selling. Subscribe now and place your portfolio one step forward of everybody else!

Inventory to Promote: American Eagle Outfitters

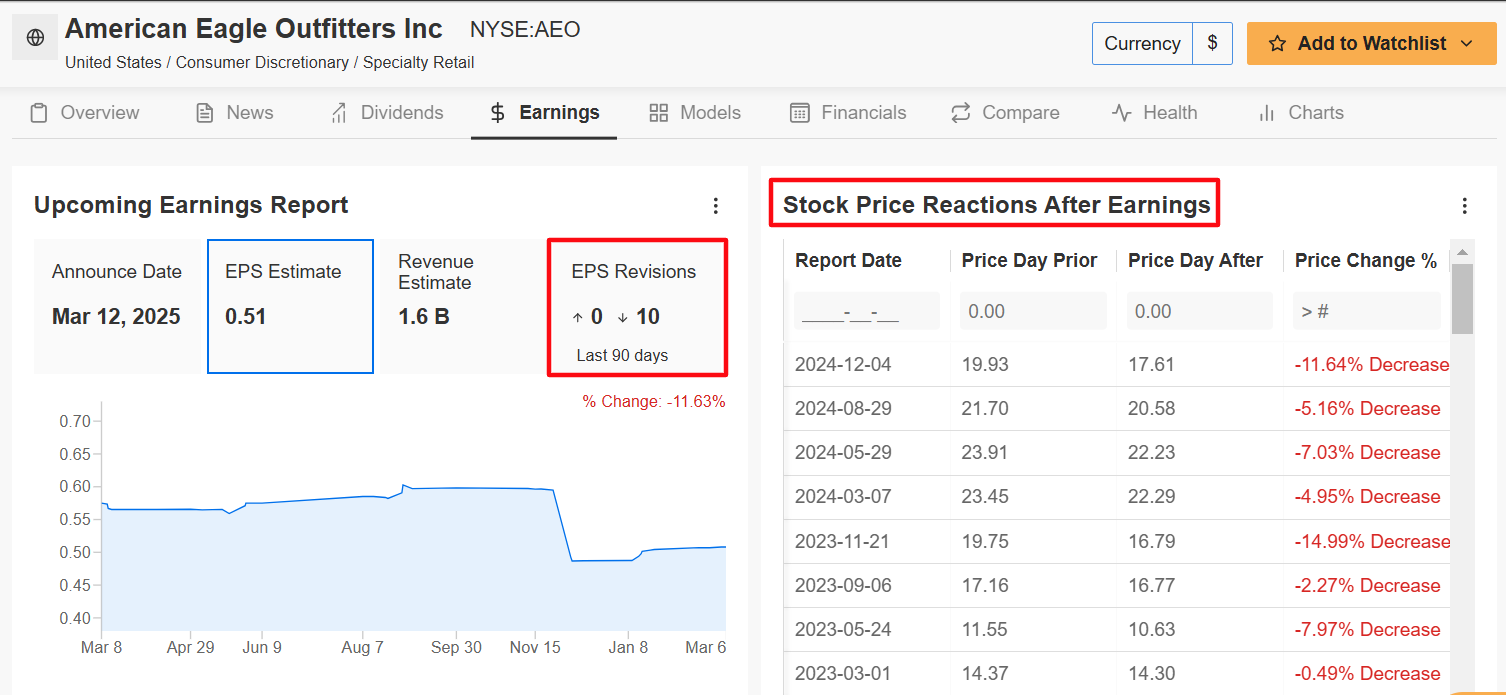

Alternatively, American Eagle (NYSE:), a preferred clothes and accessories retailer, is going through headwinds because it prepares to report its This fall earnings after the market shut on Wednesday at 4:05 PM ET amid a tough retail panorama.

Market individuals count on a large swing in AEO shares following the print, with the choices market pointing to a potential implied transfer of 8.9% in both course. Earnings have been catalysts for outsized swings in shares, with the inventory tumbling over 11% when the corporate final reported earnings in December.

Supply: InvestingPro

Analyst sentiment is overwhelmingly bearish with 10 downward revisions and no upward changes recorded within the weeks main as much as the report. This damaging sentiment means that the market is bracing for a potential disappointment.

American Eagle is anticipated to ship earnings per share of $0.51 for the fourth quarter, declining 16.4% from EPS of $0.61 within the year-ago interval. Income is seen falling 5.9% year-over-year to $1.6 billion.

Trying forward, the outlook for American Eagle seems dim because it struggles with a difficult financial backdrop characterised by elevated inflation and shrinking disposable revenue, resulting in slower shopper demand for discretionary objects, together with clothes purchases.

Because of this, buyers would possibly view American Eagle as a inventory to promote, notably within the face of mounting aggressive pressures and cautious steerage on its future efficiency.

Supply: Investing.com

AEO ended Friday’s session at $12.83, not removed from a latest 52-week low of $11.65. At present valuations, the Pittsburgh-based clothes retailer has a market worth of $2.5 billion. Shares, that are buying and selling under their key transferring averages, are down 23% year-to-date.

Whether or not you are a novice investor or a seasoned dealer, leveraging InvestingPro can unlock a world of funding alternatives whereas minimizing dangers amid the difficult market backdrop.

Subscribe now and immediately unlock entry to a number of market-beating options, together with:

• ProPicks AI: AI-selected inventory winners with confirmed monitor file.

• InvestingPro Truthful Worth: Immediately discover out if a inventory is underpriced or overvalued.

• Superior Inventory Screener: Seek for the perfect shares based mostly on a whole bunch of chosen filters, and standards.

• High Concepts: See what shares billionaire buyers equivalent to Warren Buffett, Michael Burry, and George Soros are shopping for.

Disclosure: On the time of writing, I’m lengthy on the S&P 500, and the by way of the SPDR® S&P 500 ETF (SPY), and the Invesco QQQ Belief ETF (QQQ). I’m additionally lengthy on the Invesco High QQQ ETF (QBIG), Invesco S&P 500 Equal Weight ETF (RSP), and VanEck Vectors Semiconductor ETF (SMH).

I recurrently rebalance my portfolio of particular person shares and ETFs based mostly on ongoing threat evaluation of each the macroeconomic atmosphere and firms’ financials.

The views mentioned on this article are solely the opinion of the creator and shouldn’t be taken as funding recommendation.

Observe Jesse Cohen on X/Twitter @JesseCohenInv for extra inventory market evaluation and perception.