The latest sell-off of US share markets – whereas being removed from the worst now we have seen in latest reminiscence – is a well timed reminder that quick time period pull backs is the worth of admission you pay for potential long-term features, based on ETF supplier International X.

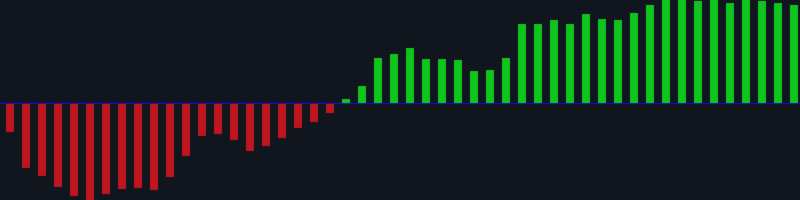

International X Senior Funding Strategist Billy Leung says the present drawdown to this point is considerably smaller than COVID (-34%), the GFC (-16%), and even the 2022 Fed tightening cycle (-24%), in comparison with -9% for the present drop.

“Whereas systematic promoting continues, we imagine that commodity buying and selling advisors (CTAs) are nearing their most quick publicity throughout equities, and that has been a giant purpose why US shares have fallen so sharply in latest days,” Leung stated.

“Nonetheless, we imagine that systematic or computerised promoting is near exhaustion, and this might assist stabilise international share markets. We may even see computerised merchants flip into web consumers if each day strikes stabilise,” Leung added.

Systematic or computerised merchants, mostly often called specialist quantitative buying and selling or CTAs, usually commerce when asset or index costs breach key technical ranges. CTA undertake rules-based buying and selling by which shopping for or promoting happens with out human intervention. A breach of key technical ranges has triggered CTA promoting in US share markets this month, with estimates of US$70 billion to 480 billion in brief S&P publicity.

Based on Leung, the sell-off has been broad-based, however there’s a defensive tilt – client staples, utilities, and healthcare are holding up, whereas know-how firms and small caps are main declines. Furthermore, US equities are attractively priced.

“AI leaders like Nvidia (down 20% up to now month) are struggling as traders take income and reposition their portfolios. The Nvidia GTC AI convention on March 17-21 may very well be an essential sentiment check, with any feedback from CEO Jensen Huang more likely to be very intently watched by international traders. Trump’s America First Speech in April may also be a key occasion for readability on tariffs, commerce coverage and certain financial course,” Leung stated.

“Regardless of the volatility, US equities stay comparatively engaging on a ahead foundation. The S&P 500 trades at a 2026 PE of 18.6x and 2027 PE of 17.0x, barely richer than MSCI World, however supported by larger EPS progress expectations.

“Bonds are seeing inflows, and historical past suggests that when positioning washes out, alternatives will emerge. Taking bits of period within the stomach of the curve (intermediate components) that are extra delicate to progress and US Fed coverage choices could make sense. That is the place we noticed the most important strikes within the US yield curve (1-5 years) quite than the very quick and long run,” Leung stated.

Whereas gold costs have retreated from document highs, this isn’t shocking, when portfolios are offered down – gold can be offered.

“Nonetheless, gold has completed its job very effectively by being rather more resilient than broader fairness markets. We count on gold will respect within the short-term and rise to US$3000/ounce, because the setting may be very optimistic for gold; volatility will contribute to secure haven purchases, whereas geopolitical tailwinds stay within the background,” stated Leung.

“Copper miners will possible see quick time period weak point, however the market sentiment ought to be largely targeted on Chinese language financial resurgence. Copper demand may see a rebound this 12 months, significantly for miners uncovered to infrastructure and industrial demand.”