Secure income in monetary markets are shaped from benefits. One in all these benefits could also be selecting the perfect time to commerce. Markets are always altering, however there’s a course of that continues to be unchanged from the very starting of inventory buying and selling: small ranges are adopted by massive ranges, massive ranges are adopted by small ranges. This apparent cycle is essential to us! That is as a result of speculators want value adjustments to earn a living. The larger the adjustments, the larger the potential for revenue. If there isn’t any value change or it’s small, the speculator will get caught in place. The prospect of triggering a cease will increase, however there isn’t any revenue potential. Makes an attempt to commerce on flat days have ruined an enormous variety of merchants. On the identical time, patterns that bear in mind solely volatility with out route work wonders.

Take a look at the every day chart of gold. The “ATR 1” indicator has been added to the chart. We use a easy volatility sample: “ATR 1” drops for two days or extra, after which development begins. The subsequent day is prone to have an excellent potential for a powerful transfer. We now have examined this – this sample alone already permits us to persistently make a revenue. In any other case, it may be significantly improved. Let’s attempt to take solely these days that weren’t shock days (closing above the utmost or under the minimal). They’re marked on the chart with a gold star.

All the things is nice. However for the comfort of buying and selling and variability, we wish to have a versatile, customizable one (perhaps the cycles are higher seen on decrease timeframes?) the instrument. And fortuitously, MetaTrader 5 has a fantastic possibility in its arsenal. Simply take the “ATR 30” and construct a transferring common SMA 75 primarily based on its information.

The ensuing instrument alerts a possible spike in volatility by crossing its common from backside to prime. We might additionally just like the blue line to remain under the yellow line for some time. This fashion we will filter out low-quality transactions.

The ultimate aspect will likely be a versatile development indicator. You should use transferring averages or all types of various stochastics with an extended interval. There are numerous variations. We are going to use a multifunctional development indicator with four-level smoothing “FourAverage”. As with methods of this sort, the flexibleness of configuration permits for higher outcomes. And as you realize, income are by no means superfluous.

The mixed use of our volatility indicator and development indicator will permit us to find out the entry into the market. We are going to enter a commerce within the route of the development indicator in the meanwhile of a surge in volatility (the blue one crosses the yellow one from the underside up or when the yellow line turns up). If the image we’re buying and selling on has a historic orientation, then we commerce solely in its route.

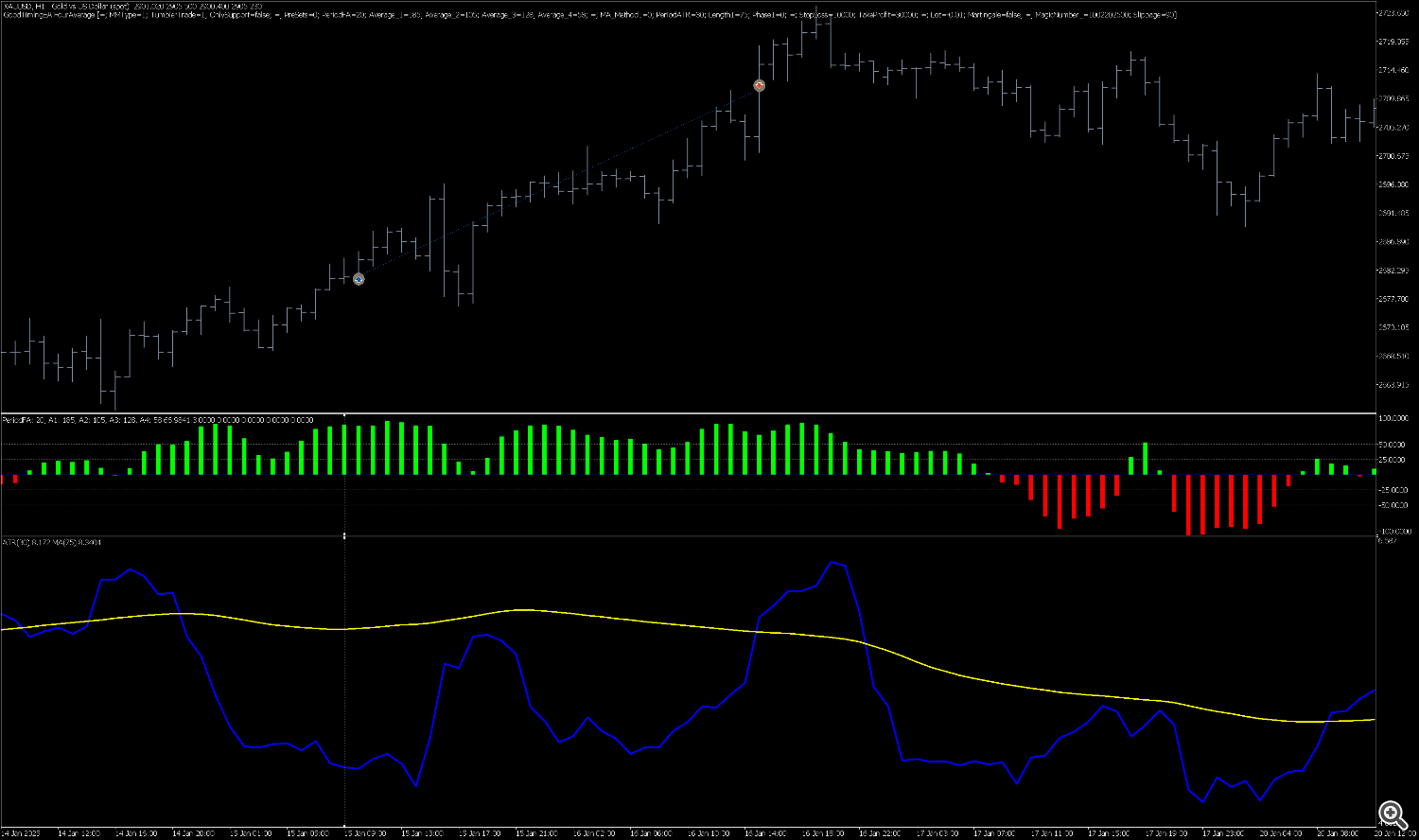

The figures under present a gold chart with the “FourAverage” indicator with buy-only settings. Gold is an asset that has a historic upward development (not less than on the stage of inflation). Based mostly on these two causes, it’s logical to simply accept purchase alerts solely.

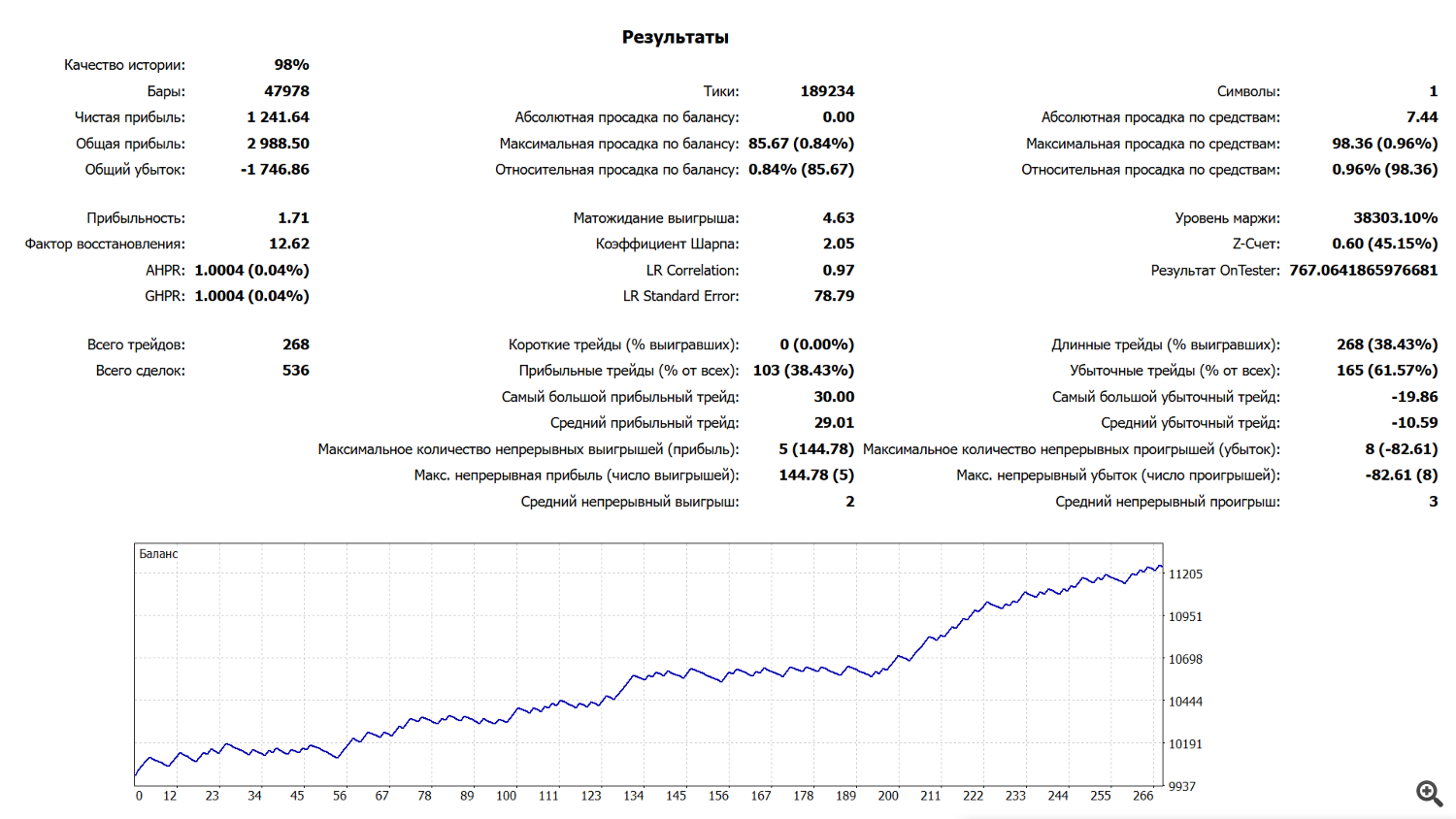

Within the subsequent article, we’ll check our entry technique utilizing the only methods to exit a place. Within the meantime, we have now chosen the parameters to get a ready-made system and make it possible for we’re heading in the right direction and our idea is worthwhile.

The principles of the buying and selling system “Good time”

Image: Gold (XAUUSD)

Route: BUY

Timeframe: H1

FourAverage parameters: PeriodFA = 20, Average_1 = 185 , Average_2 = 105 , Average_3 = 128 , Average_4 = 58

ATR Parameters: ATR 30 MA 75

Entry Guidelines: The yellow line turns up. FourAverage > 0

Exit Guidelines: Cease Loss 10,000 factors, Take Revenue 30,000 factors

Consequently, we have now a transparent entry on the surge in volatility and within the route of the prevailing development. That is how the offers look on the chart.

We examined this set within the technique tester and received a powerful consequence. The result’s good each when it comes to revenue and restoration issue. Two easy however logical guidelines shift the chances to our facet.

You should use the system as it’s or add your individual filters or guidelines. Within the following articles, we’ll attempt to enhance the system and obtain actually spectacular outcomes.