Your assist helps us to inform the story

From reproductive rights to local weather change to Large Tech, The Impartial is on the bottom when the story is growing. Whether or not it is investigating the financials of Elon Musk’s pro-Trump PAC or producing our newest documentary, ‘The A Phrase’, which shines a light-weight on the American girls combating for reproductive rights, we all know how essential it’s to parse out the details from the messaging.

At such a essential second in US historical past, we want reporters on the bottom. Your donation permits us to maintain sending journalists to talk to either side of the story.

The Impartial is trusted by People throughout your entire political spectrum. And in contrast to many different high quality information shops, we select to not lock People out of our reporting and evaluation with paywalls. We consider high quality journalism needs to be obtainable to everybody, paid for by those that can afford it.

Your assist makes all of the distinction.

Learn extra

Rates of interest have been held at 4.5 per cent by the Financial institution of England (BoE) throughout mounting international uncertainty and rising commerce tensions sparked by Donald Trump.

That was the extent reached in February when the Financial Coverage Committee (MPC) made its first reduce since November final 12 months, in so doing bringing the speed all the way down to its lowest degree since mid-2023. March’s resolution noticed the MPC members vote 8-1 in favour of sustaining the 4.5 per cent fee – with one vote for one more 0.25 share factors reduce.

Whereas the rate of interest is predicted to fall additional this 12 months, solely two extra cuts are anticipated in 2025 because the BoE tries to keep up a lid on inflation, whereas prices rise for companies and the broader financial outlook stays unsure.

A good portion of that uncertainty is because of Donald Trump’s commerce tariffs being positioned – and altered or withdrawn at brief discover – which has created unrest in industries and will see the price of promoting their items to the USA rise considerably. Whereas the UK has but to implement any retaliatory tariffs, an escalating commerce conflict might considerably hit financial progress in addition to customers’ spending energy.

The UK rate of interest stays above the eurozone fee, which the European Central Financial institution reduce to 2.5 per cent earlier this month, whereas on Wednesday, America’s Federal Reserve opted to pause its personal cuts, leaving borrowing charges at 4.25-4.5 per cent.

The BoE utilises the rate of interest as one of many methods to try to regulate inflation, with a goal fee of two per cent.

Andrew Bailey, governor of the Financial institution of England, stated: “There’s a whole lot of financial uncertainty for the time being. We nonetheless suppose that rates of interest are on a regularly declining path, however we have held them at 4.5 per cent at this time.

“We’ll be wanting very intently at how the worldwide and home economies are evolving at every of our six-weekly rate-setting conferences. No matter occurs, it is our job to ensure that inflation stays low and steady.”

Inflation’s influence

When the BoE made the Financial institution Price reduce final month, inflation had been on the decline. Nevertheless, a mid-February report confirmed Shopper Costs Index (CPI) inflation rose to three per cent in January, from 2.5 per cent in December.

With inflation subsequently rising once more – and, importantly, rising by greater than anticipated – rates of interest have been at all times unlikely to be reduce this time round.

open picture in gallery

Decrease rates of interest can be utilized to encourage companies to renew investing as the price of borrowing is decrease, which may give the broader economic system a lift.

Nevertheless, it could actually additionally result in rising costs as funding in additional jobs or salaries imply individuals have, and spend, more cash; subsequently the reverse can also be seen as true in that if demand is decrease, it could actually assist cut back these potential value rises – or in different phrases, it could actually assist stem inflation.

The BoE have acknowledged they’ll take a cautious method to lowering the rate of interest in order to not see a pointy spike in inflation, as was seen a few years in the past.

Mortgages, financial savings and companies

Rates of interest are a double-edged sword for households. On the one hand, the upper it’s, the higher it’s for these with cash in financial savings accounts as they earn the next return on their money.

Reverse facet of the see-saw to savers sit householders. Mortgages can naturally change into dearer when curiosity repayments must go up primarily based on an rising rate of interest.

Fastened-term offers negate the should be involved over modifications, however after a fast improve in prices over the previous two years many owners would have been hoping for greater cuts this time round.

“Whereas the central financial institution has prevented including gas to the hearth, the federal government should now take decisive motion. Merely ready for rates of interest to chill inflation just isn’t a plan. Savers want consistency and assist to revive confidence of their monetary future,” stated Lily Megson, coverage director at My Pension Professional.

“With the chancellor’s spring assertion quick approaching, we will solely hope for a renewed give attention to guaranteeing individuals can save sufficient for a safe monetary future.”

David Hollingworth, affiliate director at L&C Mortgages, famous that because the maintain had been anticipated, it ought to trigger “barely a ripple within the mortgage market” this time round.

For companies, whereas no change to rates of interest means short-term continuity by way of borrowing prices, the looming spring assertion subsequent week is an even bigger issue forward of elevated labour prices coming into play – particularly set in opposition to the backdrop of commerce tariffs.

“Tariffs imply costs and prices will inevitably go up and this can be a lose-lose situation for customers, companies, and financial progress. Extra tariffs are additionally on the agenda for the beginning of subsequent month which can add contemporary uncertainty into the combo,” stated William Bain, head of commerce coverage on the British Chambers of Commerce (BCC).

Outlook for 2025

Most analysts are nonetheless anticipating two additional charges cuts in 2025, which outdoors of mortgages and financial savings accounts can nonetheless have an effect on all the things out of your weekly store to vitality payments.

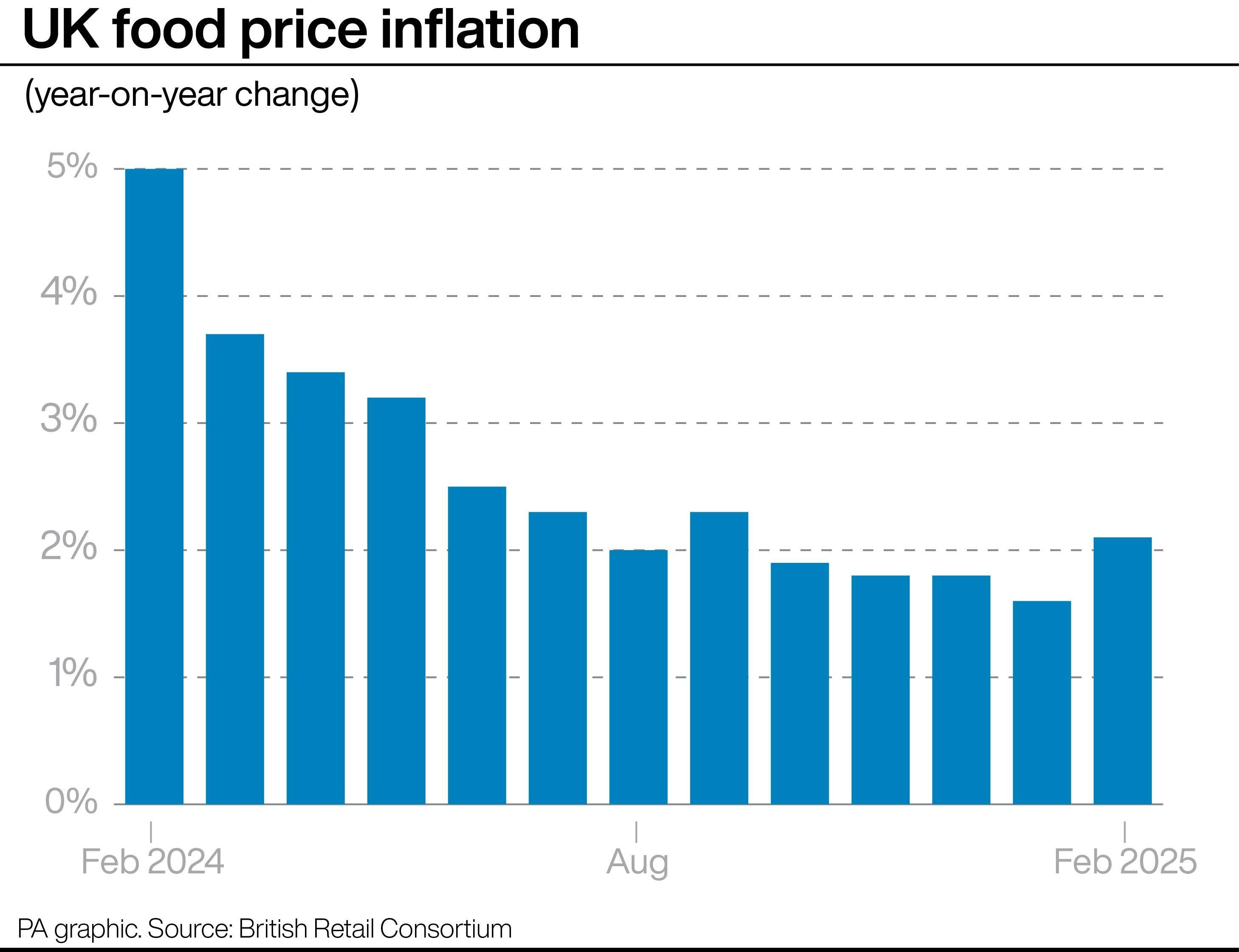

Whereas the goal is to decrease inflation to 2 per cent, it’s not often a straight-line trajectory and the recommendation is to anticipate a bumpy journey, significantly by way of meals value inflation later in 2025, which is predicted to rise.

open picture in gallery

“It has been a turbulent few weeks, each economically and politically, so a cautious method appears justified whereas the info stays so unsure,” stated Victor Trokoudes, CEO of Plum.

“The BoE has a lot to think about. Inflation is now forecast to extend additional to three.7 per cent attributable to larger vitality prices and controlled costs. Fuel and electrical, water and broadband prices in addition to council tax are all attributable to considerably rise in April, which provides inflationary stress in addition to usually damaging individuals’s day-to-day funds. These inflationary worries ought to possible ease considerably later within the 12 months, however till then the BoE might want to stay vigilant to rising costs.

“Added into the combo are political components. Further public spending is required on defence attributable to current international developments, and employment tax will increase are coming into impact shortly as properly. And that’s earlier than you take note of the looming risk of elevated tariffs underneath the brand new Trump administration within the USA, although there are hopes that the UK’s commerce steadiness with the USA places it in a greater place than others to keep away from a heavy influence right here.”

It additionally stays to be seen how these incoming further enterprise prices in April translate to companies and other people’s pockets, so whereas a decreasing rate of interest throughout the 12 months is predicted, it’s very a lot wait-and-see territory as to when that can occur – although economists at The Pantheon say it might be Might and November this 12 months.

It stays tough nonetheless, should you’re trying to remortgage, transfer your cash or in any other case handle your funds, to know when the precise greatest second to take action will likely be, with Rachel Reeves’s spring assertion subsequent week the subsequent large date to mark within the calendar for brand spanking new info.