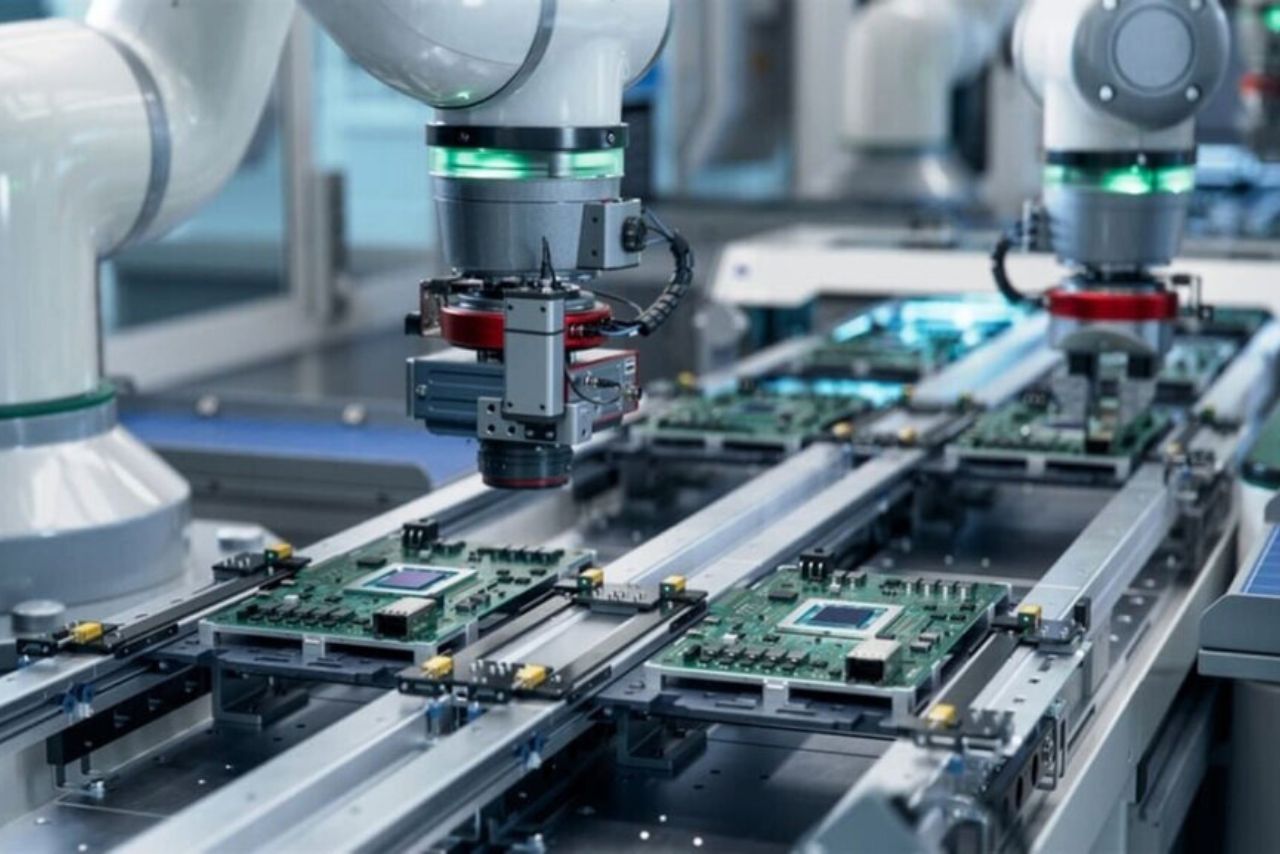

Picture supply: Getty Photographs

On the earth of investing, market corrections can really feel unsettling. Nevertheless, these typically current alternatives to accumulate high quality dividend-paying shares at extra engaging costs. Let’s discover 5 Canadian corporations that match this invoice, and why they appear like an excellent purchase proper now amongst dividend shares.

Highly effective corporations

Whitecap Assets Inc. (TSX:WCP) is a Calgary-based oil and fuel producer. In 2024, it achieved file annual manufacturing, reflecting sturdy operational efficiency. The dividend inventory reported earnings per share of $0.46 for the fourth quarter, surpassing analysts’ expectations of $0.37. As of writing, Whitecap’s inventory traded at $9.01, marking a 14.34% improve from its 52-week low of $7.88. The corporate additionally confirmed a month-to-month dividend of $0.0608 per share, demonstrating its dedication to returning worth to shareholders.

Capital Energy Company, (TSX:CPX) headquartered in Edmonton, is a growth-oriented energy producer. The dividend inventory owns roughly 9,300 megawatts of energy era capability throughout 32 services. Within the fourth quarter of 2024, Capital Energy achieved business operation of its Genesee Repowering venture, enhancing its place for U.S. progress. This growth underscores the corporate’s strategic initiatives to develop and modernize its operations. And with an annual dividend of $2.61, it provides a stellar shopping for alternative.

Earnings stability

Wajax Company (TSX:WJX) is one in every of Canada’s longest-standing and most diversified industrial services and products suppliers. The dividend inventory operates an built-in distribution system, providing gross sales, elements, and companies to a broad vary of consumers in numerous sectors of the Canadian financial system. The corporate’s market capitalization stands at roughly $382.3 million, reflecting its strong presence within the industrial sector. Add in a dividend of $1.40, and it’s a transparent winner.

Cogeco Communications Inc. (TSX:CCA) provides web, video, and cellphone companies in Canada and elements of the USA. The corporate is understood for its sturdy dividend yield, offering traders with a gentle revenue stream. Cogeco’s dedication to increasing its service choices and enhancing the client expertise positions it effectively within the aggressive telecommunications business. Proper now, that dividend sits at a powerful $3.69!

Lastly, Energy Company of Canada (TSX:POW) is a world administration and holding firm specializing in monetary companies in North America, Europe, and Asia. The dividend inventory provides a dividend yield of roughly 5.2%, offering traders with a dependable revenue supply. Energy Company’s diversified portfolio contains pursuits in insurance coverage, asset administration, and sustainable and renewable power corporations, reflecting its strategic strategy to progress and worth creation.

Silly takeaway

Investing throughout a market correction requires cautious consideration. Whereas these dividend shares provide engaging dividends and have demonstrated operational power, it’s important to conduct thorough analysis and assess your danger tolerance. Market circumstances can change quickly, and previous efficiency shouldn’t be indicative of future outcomes. Consulting with a monetary advisor can present personalised steerage tailor-made to your funding objectives.

But all thought of, market corrections, whereas difficult, can unveil alternatives to spend money on strong corporations at extra beneficial costs. These dividend shares every current compelling instances for consideration, due to their sturdy fundamentals and dedication to shareholder returns. As at all times, due diligence and a transparent understanding of your monetary aims are key to creating knowledgeable funding choices.